Broad Market Commentary

We publish a great deal of content at the ETF Think Tank, and we are proud that this research provides educational insights and actionable thoughts to financial advisors and their clients. As we reflect on the beginning of 2023, we are reminded that it began with significant doubts about the foundation of the traditional 60/40 portfolio model. In 2022, both bonds and stocks suffered significant declines as concerns about rates going parabolic put all past assumptions in question. The Federal Reserve’s ability to implement a soft landing was also put into question. Fortunately, late in 2023, these concerns proved to be less fatal as data restored confidence in the Federal Reserve’s capability to pull off a soft landing. As such, regardless of whether one was bullish or bearish, this was a surprisingly exciting year with much drama and plenty of opportunity for investors. To this point, for those who follow our work closely, we remained highly focused on the bond market as a signal of market health and breadth, as well as a core investment vehicle – aka $TLT and credit spreads. This was made especially clear in our piece from October 4th: “Signals From $TLT.”

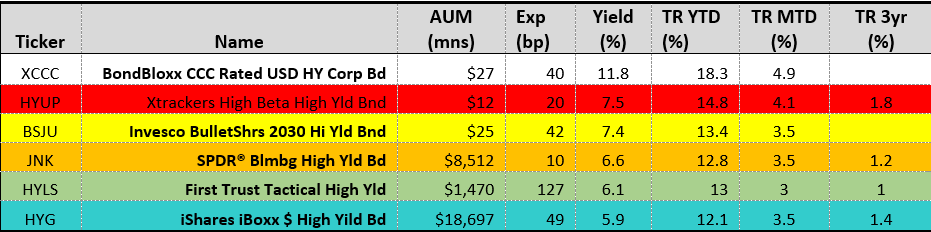

As structure matters, we highlight 6 high-yield bonds in our first chart. We see they each have different degrees of sensitivity to interest rates, credit spreads, and duration. We maintain the focus that bigger is not always best for a portfolio. Further discussion about this will follow in the “Hidden Gems” section, but simply put, readers should note that ETFs can effectively showcase innovation and market opportunities.

In reflection of 2023, we also thought we would highlight a couple of pieces where we offered constructive views. Think Tank writing, of course, is a bit like therapy as it unwraps truths to draw insights out. It is also frequently incomplete, so please know that we welcome engagement and feedback from readers about what we write. The truth is that many of our pieces have created internal debate and deeper discussions among our members. A case for bulls or bears is often best fleshed out in a conversation.

Here are a few pieces worth reviewing from the Structure Mattes series:

- During the bank crisis on March 15th, we wrote that we expected the Fed would aggressively backstop the regional banks. “No More Complacency Around the Banking System.” Note that, ironically, in the previous article we also wrote about people needing to pay attention to their Apple allocation. This is ironic because Apple, with its fortress balance sheet, started offering High Yield savings accounts in April, which competed against banks. Apple quickly gathered $10 billion and then it was discovered that the partnership with Goldman was not so lucrative (probably mostly for Goldman). We will see if Apple finds another large partner. (see Link)

- We tried to keep our favorable biases balanced around Bitcoin, and internally Cinthia ruled the roost and kept us honest, especially when we wrote about the comparison of the common culture between the Berkshire Shareholder community and Bitcoin HOLDer community.

- We have always emphasized themes in the ETF Think Tank and we had discussed the importance of considering defense spending and defense ETFs. We wrote Thematic Investors Should Look at Defense Spending. Since the piece was written on July 12, 2023, the SPDR S&P Aerospace & Defense ETF (XAR) is up 35.44% versus a remarkable 27.84%. Unfortunately, because the world does not seem to be headed towards increased safety, an expanded US defense budget seems like a necessity.

- Across the board, we have frequently highlighted opportunities in the emerging markets and emphasized being focused on India through the Columbia India Consumer ETF (INCO). In our Think Tank Exchange with Jay McAndrew, we even highlighted how institutions were diversifying away from China or at least isolated such exposure through EM-Ex China (XCEM).

- We are rarely openly negative around an asset class or an issuer, but on August 30th we wrote an article called “The Vanguard Bubble (VNQ)” and called for a shrinkage in the share count as a measure of weakness in the group. VNQ today has 379.899 million shares outstanding, down from 392 million at the beginning of the year. Outflows for the year 2023 were about $1.839 billion in VNQ and it would appear that the outflows in the mutual fund were similar, but surprisingly VNQ bounced back ahead of SPY, up 8.81% versus 6.19%. This is especially impressive beta if you are in the camp that this kind of real estate is part of an allocation in alternatives.

- Beginning September 20th, we started really highlighting small caps, starting with a piece called “Small Cap Zingers” followed by a two Think Tank Exchanges:

- Most recently, in our last December Tank piece, we wrote that financials are the sector to watch in 2024 and active management is the place to be in this area. We will see if we are correct on this call which will be measured by the expectations around alpha coming from the Davis Select Financial ETF ($DFNL). No pressure Davis Fund family! As a reminder, we hosted a number of Think Tank Exchanges with Davis Advisors Peter Sackmann and Dodd Kittsley:

- What did we get wrong? For years we have highlighted alternatives to the expensive Hedge Fund wrapper, and 2023 was no different. The challenge seems to be that benign, unsexy returns, are not exciting to investors when markets are dynamic and exciting. In such periods, with so many opportunities appearing exciting and potentially lucrative in the short-term, people need more convincing, especially since the down years have been short lived. We are not complaining about being wrong and certainly not looking for another lost decade in returns. We more than made up for it in other ways. However, we will remain stubborn in our conviction that ultimately, we believe a safe portion of investors assets should be in hedge fund alternatives which are uncorrelated to everything else. Diversification is about risk management and is critical to investors and financial advisors who want to have a safe bucket for when things go bad. We also seem to be wrong about family offices shifting more aggressively into ETFs as more than just a beta play. To this point, we highlighted family office allocation trends between UBS and Goldman Sachs. Perhaps firms like JP Morgan, with their massive private bank, will change this now that they have found so much success in the ETF industry. JPM was slow to get started in the ETF industry, but now has $132 billion AUM across 64 ETFs.

In 2023 We Stepped Out of Our Comfort Zone During the Think Tank Happy Hour

In the Fourth Quarter of 2023, with Michael Gayed’s leadership and experience in social media, we remodeled our ETF Think Tank Happy Hour in a significant manner. Those who have attended since 2020 probably noticed that it is now a little less intimate, as the “Brady Bunch” view is no longer offered. Don’t think we don’t miss seeing your faces every Thursday at 5pm! We are reviewing this show, but in a crowded field for mindshare, we felt we needed to upgrade to attract a broader audience and not be minimized to being just a “FEW.” This upgrade follows some great shows with individuals such as Dan Niles, Lyn Alden, Lawrence Lepard, Ethan Powell, Peter Atwater, Michael Howell, and most recently Lakshman Achuthan. Change is not always easy, but as an ETF Think Tank that is expected to foster innovation and analyze market dynamics, it is a requirement. We even took on the risk of chaos by having three guests talk about volatility all at once. Check out the episode called “Exploring the World of Options” with guests Jay Pestrichelli, Meb Faber and Sylvia Jablonski. The Happy Hour is a special platform for us as thought leaders to explore with our members the journey the market is delivering to us every week. We hope this new platform really gathers momentum! To explore the change, feel free to check out the link and enjoy the recordings. We know we have greater social reach than most any other in the ETF industry and look forward to proving this value in 2024!

Of course, the ETF Think Tank Year in review is more than just the Structure Matters series. Our Research director Cinthia Murphy proved that the “Woman Factor” was very real through her wonderful research articles and interview series called Wavemakers. Our favorite pieces to highlight include: How an ETF is Born, Could JEPI Get To Big To Be Effective, and How To Trade ETFs: A Quick Guide For Financial Advisors. There are about 20 or so great articles to choose from and a similar amount of Wavemaker interviews, so others may have a different set of “favorites.” Just know, everyone wants to talk to Cinthia! Check out the series on our YouTube channel if you want to learn from brave ETF Entrepreneurs.

Of Course, when it comes to research and content, no one can forget about Mike Venuto and David Dziekanski. If you ever missed a Happy Hour feel free to listen and read Mike’s summary, which we call Get Think Tanked Distilled. Mike is omnipresent! Anyone struggling to determine an outlook for markets in 2024 should review David’s quarterly pieces (See Q3 report called “The Problem with Treasury Bonds Is The Issuer, Not the Economy.” It is always crammed with wonderful graphs, charts, and insights. No one takes complex ETFs apart like David!

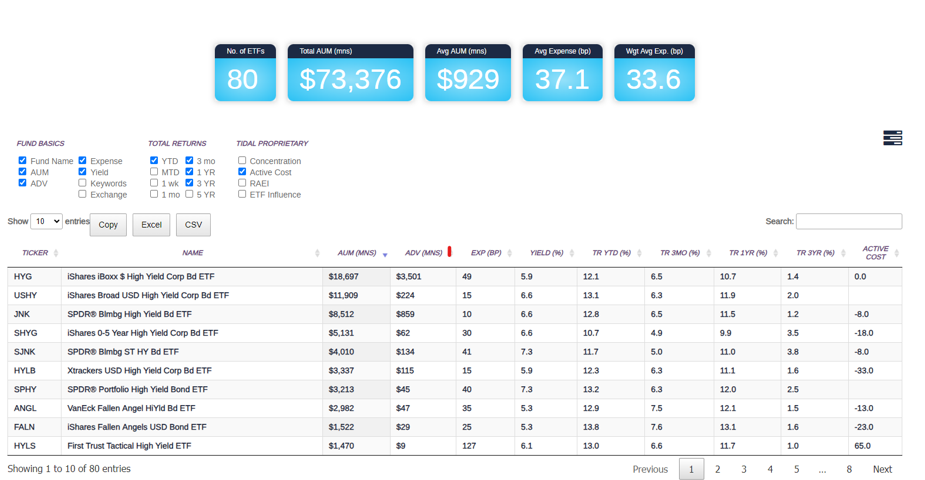

Hidden Gems

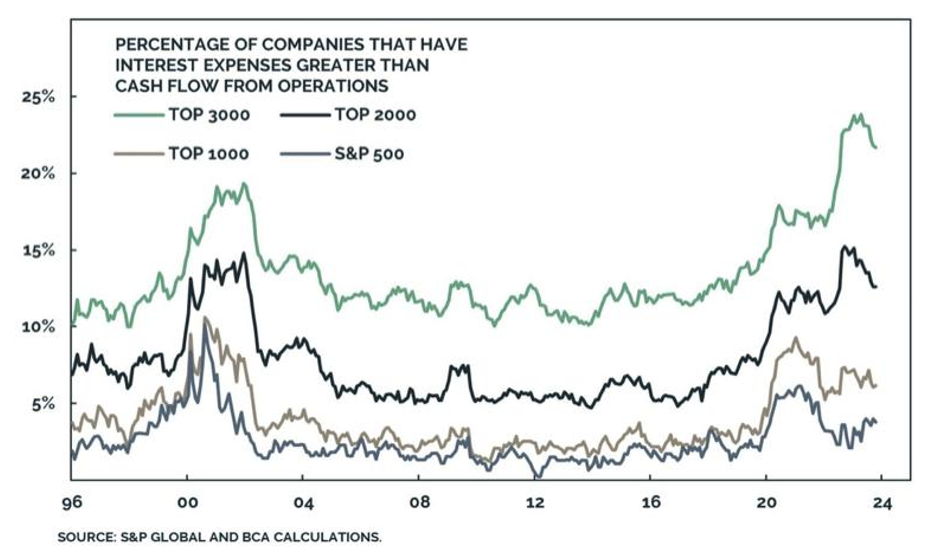

As of the date of this summary, there are currently 80 high-yield ETFs with AUM of about $73.376 billion. As is typically the case, the top 10 Funds represent about 82.8% of the AUM, or about $60.78 billion. Out of these top 10 AUM funds, only iShares Fallen Angels USD Bond ETF (FALN), with $1.522 billion in AUM was listed in the top 10 performers in 2023, and now the yield is only 5.3%. Curious is the fact that BondBlox CCC-Rated USD High Yield Corporate Bond ETF (XCCC) YTD performance was 18.3% and it still has a yield of 11.8% versus the iShares iBoxx High Yield Corporate Bond ETF (HYG) and SPDR Bloomberg High Yield Bond ETF (JNK) that yield 5.9% and 6.6%, respectively. Is this a danger sign or an opportunity? When you consider that the percentage of companies that have interest expense greater than their cashflow from operation, you must wonder if this spread is appropriately wide. Drilling deeper, we find that the fund owns about 231 positions, with 35.87% between 5-7 years and 64% shorter than 5 years, which puts it more in line with HYG than JNK in terms of duration.

Clearly, those laughing at us about ETFs being beautiful should also review the image from April to July 2023. Seriously, how beautiful would it have been to buy XCCC when it traded in line with HYG? Stay tuned, maybe beautiful will become handsome again in 2024! We expect volatility to come back in 2024!!

As proud ETF Nerds, we at the ETF Think Tank sincerely believe that ETFs are beautiful. As a blank canvas, ETFs reflect market sentiment and opportunity in real time and as a pure, liquid, and transparent expression for investors. We may not always like the price, but it is honest and accurate because of the ecosystem that polices it. Yes, ETFs are highly regulated. However, more to the point, the integrity of the ecosystem is preserved and maintained by its culture that is made up of competitive people with real grit that take pride in following the regulatory framework. See Cinthia Murphy’s piece titled The 10 Commandments of ETFs for an additional perspective. All this may sound corny, but it is honest and part of why the ETF industry works so well. All this is to say thanks to the hidden gems who are like fierce watch dogs of integrity around the ecosystem. You know who you are!! Usually they are the loudest and most consistent voices on X, formerly Twitter!

Lastly, but most importantly, it’s time to recognize a few hidden gems who make the Tank run smoothly! The work in the Tank is achieved with tremendous coordination among many people in marketing, compliance, social media and technology to make the turnaround of what we do extremely fast.

Dear Linda Venuto, Thank you for working tirelessly to create wonderful adverstisements for our shows and sponsors. You make catchy phrases seem easy and have made me laugh many times with your images!

Dear Ryan Fitzgerald, you wear a lot of hats! Thanks for rolling up your sleeves and making some wonderful shorts for our videos! I know that probably means you have to listen to an hour long video several times. For years, Ryan has been the keeper of our ETF KPI Research and in 2023 he stepped into the role officially as the author. Followers of this piece can easily identify the Open/Close ratio, great historic analogies, and even trends in who is winning the ETF World Cup which runs simulataneously with Soccer World Cup.

Dear Greta Burgdorf and Thomas Newberg, Thank you for your edits and keeping us compliant. I still have not met you face to face over these past 2 years working together, but that will change in 2024!

Dear Margaret Burgdorf, maintaining an abundance of ETF data along with all that you do at Tidal is nearly impossible to imagine. It is amazing that your hair doesn’t look like David Dziekanski’s (Sorry pal)!

Summary

It is tough to sum up 2023 since so much was accomplished in just 1 year. It will be challenging to top it all in 2024, but we hope our members appreciate that every day we are trying to add value. We respect your interest and allocation of time to our research and hope that we are pushing the envelope as a Think Tank should. Please do share feedback and always feel free to call us out on anything you disagree with. As a Think Tank we want engagement, even if we are on the other side of a discussion!

Happy new year!! Let’s all battle together in our Tank!!

P.S. Sorry for the rambling!!!

Disclosure

All investments involve risk, including possible loss of principal.

The material provided here is for informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third-party providers is obtained from what are considered reliable sources. However, its accuracy, completeness, or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

The value of investments and the income from them can go down as well as up and investors may not get back the amounts originally invested, and can be affected by changes in interest rates, exchange rates, general market conditions, political, social, and economic developments, and other variable factors. Investment involves risks including but not limited to, possible delays in payments and loss of income or capital. Neither Tidal nor any of its affiliates guarantees any rate of return or the return of capital invested. This commentary material is available for informational purposes only and nothing herein constitutes an offer to sell or a solicitation of an offer to buy any security and nothing herein should be construed as such. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested, and nothing herein should be construed as a guarantee of any specific outcome or profit. While we have gathered the information presented herein from sources that we believe to be reliable, we cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed herein are our opinions and are current only as of the date of distribution, and are subject to change without notice. We disclaim any obligation to provide revised opinions in the event of changed circumstances.

The information in this material is confidential and proprietary and may not be used other than by the intended user. Neither Tidal nor its affiliates or any of their officers or employees of Tidal accepts any liability whatsoever for any loss arising from any use of this material or its contents. This material may not be reproduced, distributed, or published without prior written permission from Tidal. Distribution of this material may be restricted in certain jurisdictions. Any persons coming into possession of this material should seek advice for details of and observe such restrictions (if any).