This week is sure to bring more questions than answers, and no one is complacent anymore. Plugging the holes in the dam may be the desired answer for many, but not the long-term solution. Arguably, capitalism requires dynamic moments, some failures, and unfortunately, sometimes feelings of chaos. Regulatory policies are not designed to guarantee a smooth ride for economic conditions. These policies cannot truly protect the integrity of the financial system and can even contribute to flaws in the system. The fact is that as much as investors, employers, and employees want regulation to protect the overall financial system from vulnerability, sometimes hurricanes cannot be avoided (remember Jamie Dimon’s warning?). The question is: what do we do when we are faced with a hurricane? Hunker down and do nothing, or reposition for the rebound? Remember, capitalism remains the best system. Don’t believe me? Check out this article, “Ten Reasons Why Capitalism Is Morally Superior.”

ETF Think Tank Weekend: FinTwit/What’s the Solution for 2023 Crisis?

If you are like most ETF Think Tank Members, you should be looking for information and opportunities. To this point, while much can be said about reporting in traditional media channels, we continue to find Twitter Spaces a tremendous source for insight and active ideas. This was especially the case this past Saturday, during a 12-hour marathon session hosted by Mario Nawfal, which featured guest speakers Mark Cuban, Bill Ackman, Brian Sullivan and Marc Cohodes. The originally scheduled 12-hour period eventually carried over to Sunday. Listeners were treated to a constant, open-mic atmosphere, where participants shared robust, constructive debates and discussions. Perhaps not the best way to spend a weekend but given the historic and fearful period for hundreds of thousands of folks, it was a poignant share of information. It was also a great example of how the FinTwit community has provided constructive, in- depth information for millions of people. Links to the recording can be found here or in the highlighted names. A word of warning: as much as these discussions are helpful and unfiltered, they contain hidden agendas. Not all the information is accurate, and negative sentiment tends to be emphasized to attract attention. Nevertheless, as much as CNBC, Bloomberg, CNN etc. are traditionally solid sources of information, we continue to believe that Spaces, YouTube and other FinTwit platforms remain very helpful as primary sources of information. For our members, we will be hosting a special Happy Hour this Thursday, with the Portfolio Managers at Davis Advisors. Davis Advisors, led by Chris Davis, has a long history investing in the financial sector, so we are sure to get constructive insights.

Structural Facts: The Problem and Risk Was Evident

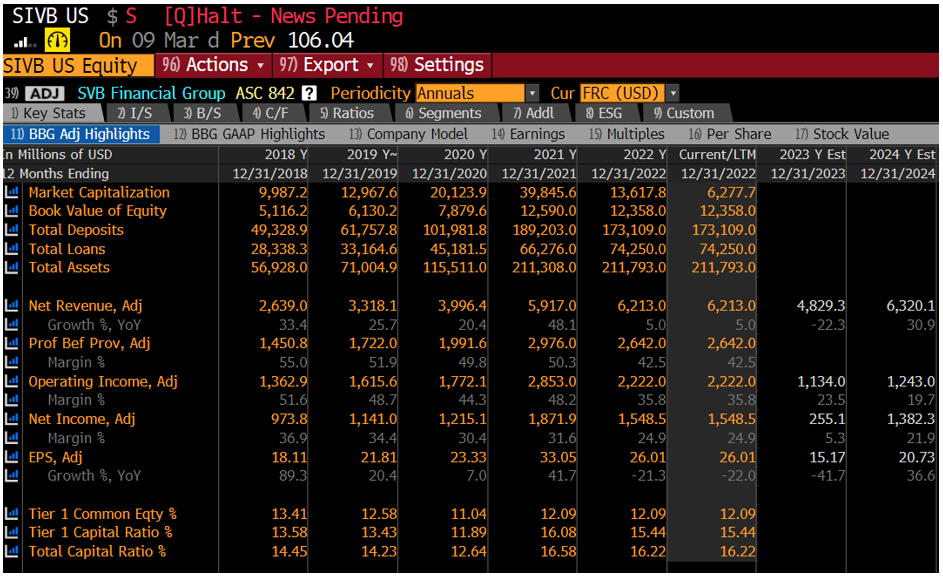

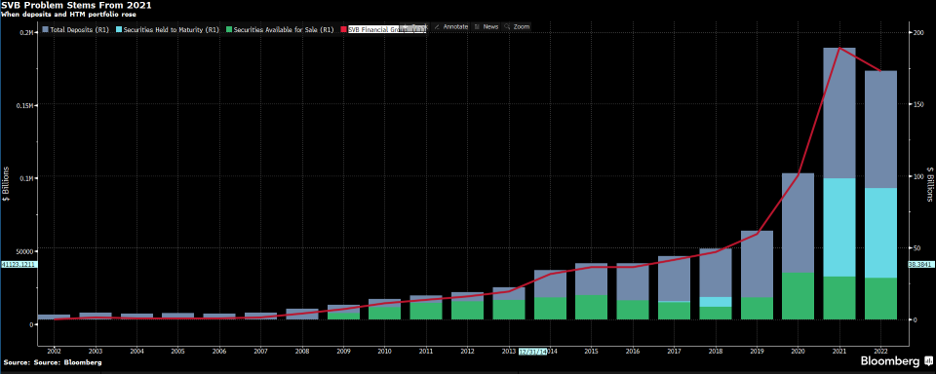

In hindsight, it’s clear 2022 was a tough year for most investors. It is equally clear to bankers that interest rates had been rising. It is unclear how the management at Silicon Valley Bank (SVB) were not aware of their mismatch of risk, but as of February 2023, most people felt there was little reason to be concerned (check out the “Capital Ratios”). Regardless, SVB’s failure is arguably a symptom of too much easy money coming from rapid and excessive growth. This can be seen in the below chart, which illustrates how ballooning deposits (mostly from VC/PE money) led to a higher stock price (line in red), and the mismanagement of matching securities Held-for-Maturity (HFM) and the difference in accounting for bonds which were Held-for-Sale (HFS). HFM is priced at cost, not Mark-to-Market (MTM). The change from HFM to HFS in a rising rate environment was inevitably going to lead to a collapse of billions in value, and failure in capital ratios for this bank, which was 16th largest bank in the United States. The action against Silicon Valley Bank (SIVB) also reflects a willingness for the Fed to move to protect the system and make an example of weak risk management controls.

As per a Reuters article, the rumblings of a warning of a Moody’s Investors Service credit downgrade led to the run on the bank of some $42 billion within 24 hours, which is why the FDIC had no choice but to step in and take over. Of course, this is not to suggest that Moody’s is the cause of the run on the bank. The fact is that deposits were leaving in advance of Thursday and Friday. Moreover, the cause is less important than the outcome. The 48 hours leading up to the collapse is a reminder of how mobile banking makes it very easy to move money. No bank can survive a run on 25% of their assets, and arguably this outcome weakens the fundamental base of the financial system.

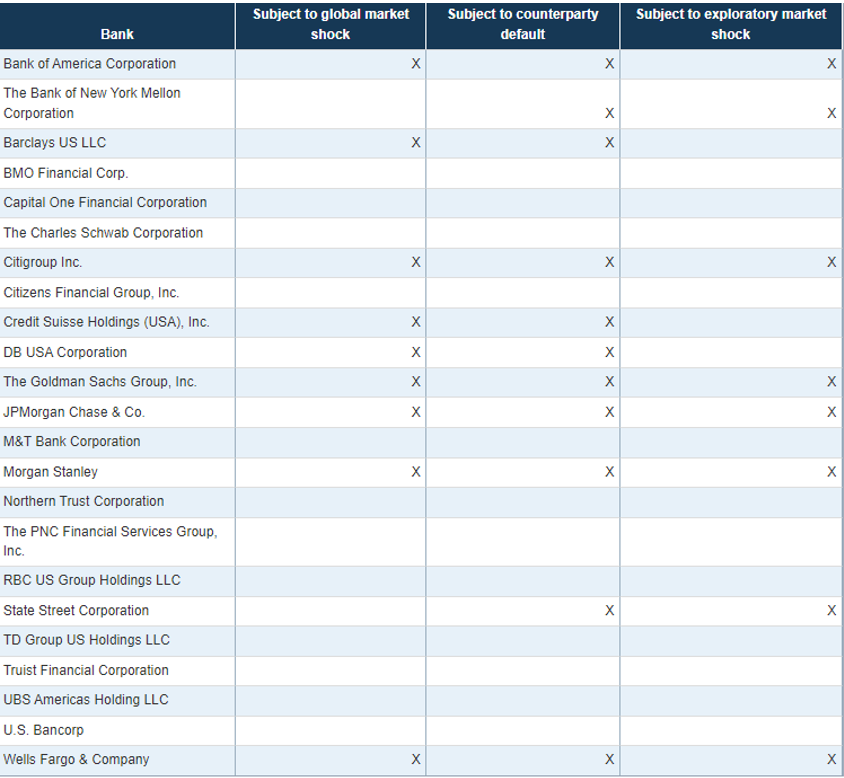

Ironically, as recent as February 9, 2023, the Board of Governors of the Federal Reserve System released its “hypothetical” scenarios for its annual 2023 bank stress test on 23 large banks. No, SVB was not on the list. Apparently, as a “regional” bank, the federal reserve let SVB work through a different set of accounting rules, aka HTM and HFS (details about the Dodd Frank 2023 stress test.) It’s possible some blame should fall on the Federal Reserve for allowing easier accounting rules for regional banks, but again, blame is less important than the outcome. Today, we can expect the cost of money to increase on everyone in the banking system.

Contagion Risk Now Reduced, But…..

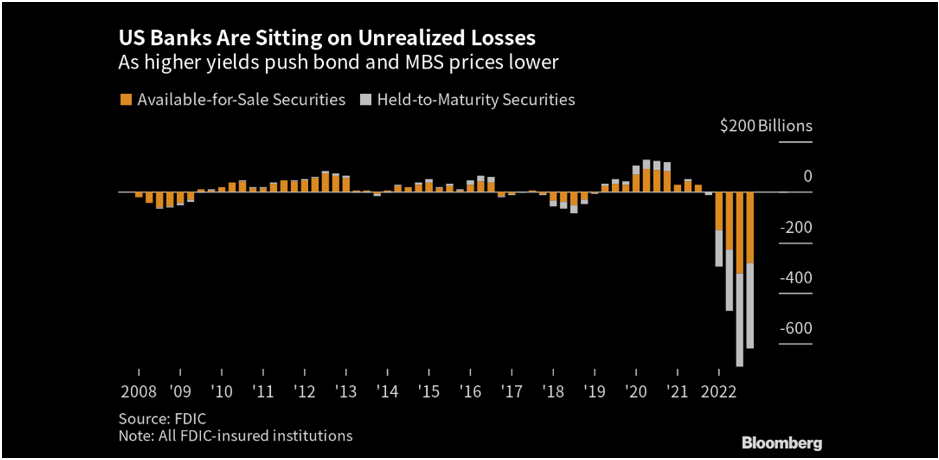

As we write this piece on Sunday night, March 12, 2023, it is clear that questions about a contagion effect run a balance between agendas associated with (1) businesses that need to have access to their deposits for payroll and growth, no matter which bank holds them, (2) questions about the centralization of the banking system, and (3) the fallout caused by cross collateralization and counter party risk between different banks. The contagion effect will also lead to a restructuring of the rules of banking, or risks to the system in the further centralization of a few large banks. Higher costs of capital for regional banks will impair their ability to compete. Then again, when one looks at how the US banking system accumulated $620 billion of unrealized losses over these past two years in the form of Held-for-Sale Securities (HFS) and Held-to-Maturity Securities (HTM), it is clear that the system was at risk and needs to be re-evaluated. Ironically, this is part of the underlying premise behind DeFi/Bitcoin. True – no one will bail out Bitcoin, but it is also true that further centralization of a financial system can be non-competitive, as well as dangerously in the hands of a few.

Summary

The financial sector will not be the same after this past week, but change was inevitable. Change is also disruptive, but we are glad that capitalism can adapt and thrive. As much as the initial reaction may feel like chaos given the macro uncertainty that will come from the outgrowth of the Federal Reserve action, we think the Bank Term Funding Program (BTFP) was the best outcome. Inflation, stagflation, deflation and/or a recession are all better outcomes than a 1930s depression, where hundreds of thousands of companies cannot make payroll and individuals can’t access their money. We do not claim to be experts on what has happened, so like everyone we are learning together. Hope you will join us this Thursday for what is sure to be a special Happy Hour. The buzzword? How about Bank (Central Bank, Federal Reserve Bank, SV Bank)!

Disclosure

All investments involve risk, including possible loss of principal.

The material provided here is for informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

The value of investments and the income from them can go down as well as up and investors may not get back the amounts originally invested, and can be affected by changes in interest rates, in exchange rates, general market conditions, political, social and economic developments and other variable factors. Investment involves risks including but not limited to, possible delays in payments and loss of income or capital. Neither Toroso nor any of its affiliates guarantees any rate of return or the return of capital invested. This commentary material is available for informational purposes only and nothing herein constitutes an offer to sell or a solicitation of an offer to buy any security and nothing herein should be construed as such. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested, and nothing herein should be construed as a guarantee of any specific outcome or profit. While we have gathered the information presented herein from sources that we believe to be reliable, we cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed herein are our opinions and are current only as of the date of distribution, and are subject to change without notice. We disclaim any obligation to provide revised opinions in the event of changed circumstances.

The information in this material is confidential and proprietary and may not be used other than by the intended user. Neither Toroso or its affiliates or any of their officers or employees of Toroso accepts any liability whatsoever for any loss arising from any use of this material or its contents. This material may not be reproduced, distributed or published without prior written permission from Toroso. Distribution of this material may be restricted in certain jurisdictions. Any persons coming into possession of this material should seek advice for details of and observe such restrictions (if any).