Broad Markets

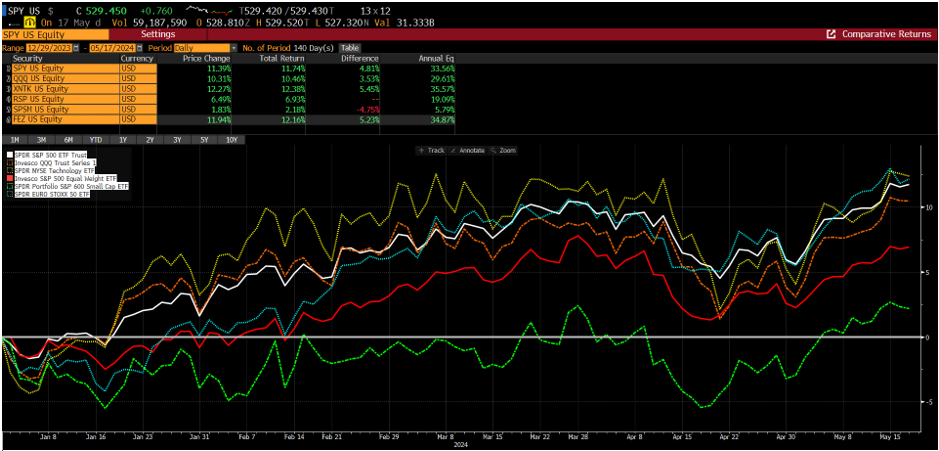

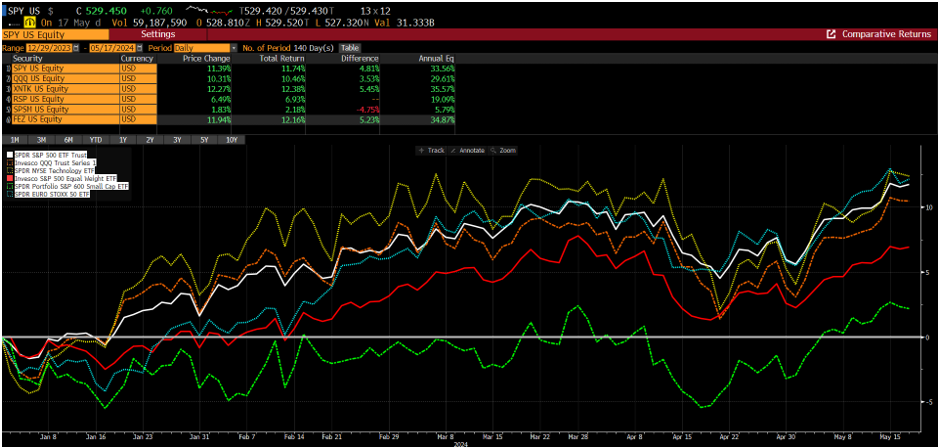

Following a great 2023 where the S&P 500 was up 24.8%, are equity returns poised to repeat this? Are conditions that awesome in the US, or is this just because such returns are needed to keep up with inflation? Such unsustainable expectations are, of course, unrealistic and arguably even dangerous for investors as they can lead to unfavorable risk conditions. The problem, however, is that an overly conservative investment approach can also feel risky, as our threshold for the standard cost of living is constantly being challenged across the board. As of May 17th, as measured by the S&P 500 and the QQQ, US markets are running at a healthy clip up 11.74% YTD, with 10.46% led by technology stocks. Breadth remains narrow as reflected by the performance of the SPDR Portfolio 600 Small Cap ETF (SPSM) and the Invesco Equally weighted US ETF (RSP) which are up 2.18% and 6.93%, respectively. Of course, this means that investors may need to seek more diversification in the second half of 2024, as multiples in the international markets play catch up, or small caps finally have their catch up rally in the US. This possibility is also shown by the fact that breadth in technology, as reflected by the SPDR NYSE Technology ETF (XNTK), has outperformed the Technology Select Sector SPDR Fund (XLK) which is dominated by Apple and Microsoft, both of which are equally weighted at about 22% in XLK. We think this is particularly good news as it offers a sliver of hope that equity markets could be broadening. In addition, we would highlight that technology and innovation has been best reflected by XNTK in these past 12 months, with 12-month returns of 53.44% vs XLK with 40.3%. We see this as good news since it demonstrates positive breadth in the sector as well as hope for the benefits of diversification. Face it! There are many people today who are rightfully skeptical that diversification simply isn’t paying off.

Inflation: 2% Targeted Inflation will be Achieved Even if we Have to Lie

Real estate is not affordable regardless of whether you are renting or owning, but circumstances are leading people to make major shifts on where they live. According to a new report by Redfin, as of April 2024, asking rents across 33 major metro areas rose in the past year, and renters are leaving expensive cities. The fact is that eliminating shelter as part of the statistic is silly, and structure matters in terms of quality of life! Here is the link to the study. Feel free to shop and move to the sunbelt where rents are declining accordingly!

Truth is – managing a strategy around inflationary risks and quality of life in terms of standard living may be best served by identifying where rents are stable rather than buying TIPs, ETFs, or ETFs with “inflation” in the name. However, since we are the ETF Think Tank, we cannot advise people on where they should live!

Hidden Gems: Massive Dispersion of Outcomes

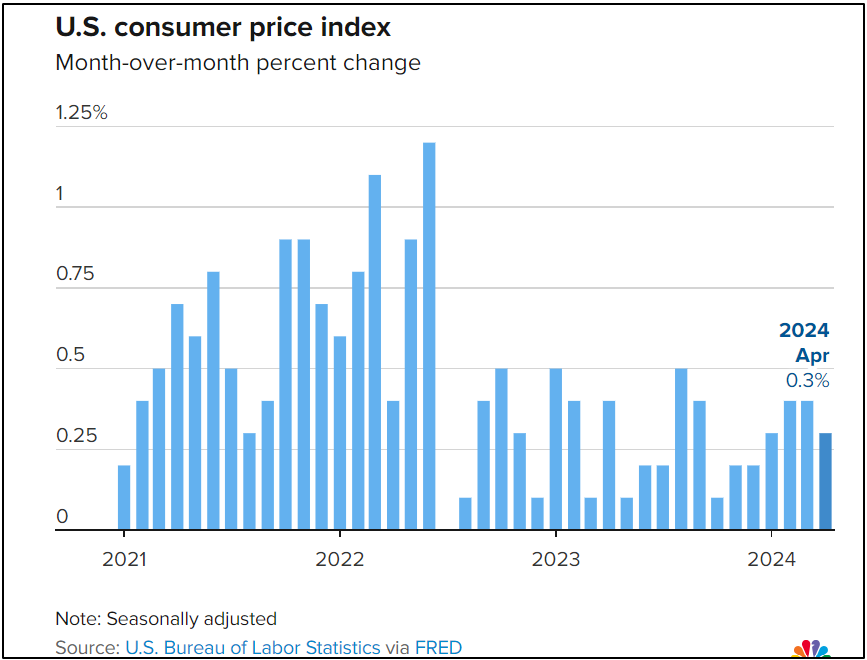

Arguably, the Fed will eventually reach their 2% target simply because they will eliminate or adjust anything that has a price that is increasing. A skeptic would say “Let’s ignore shelter, food and transportation and focus on technology that leads to efficiencies.” We should also ignore the implications around the new China tariffs which will make manufacturing imports more expensive.[i]

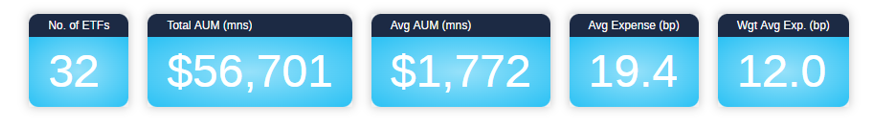

There are 15 different ETFs with the word inflation in them, but the dispersion of outcomes is quite distinctive. As we often say, the biggest funds may not have the best outcomes relative to the investor’s strategy. In total, there are 32 funds with $56.7 billion in AUM and varying durational targets. Fee and size are not necessarily going to be the best choice of screen in this category!

Summary

Inflation is likely not going away for quite some time. Rather, it will be redefined and characterized differently. To this point, we have been hosting a series of meetings each week trying to address this issue with advisors. As is frequently the case, innovative actively managed solutions that are more aligned with current market circumstances are not always recognized by investors. Regardless, investors and consumers will likely need to adjust their standard of living to new conditions or adjust to a new town or city. Moreover, it is probably best not to tell a client that they need to move in order to maintain their lifestyle!

[i] Biden’s China Tariffs Are the End of an Era for Cheap Chinese Goods – The New York Times (nytimes.com)

Disclosure

All investments involve risk, including possible loss of principal.

The material provided here is for informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third-party providers is obtained from what are considered reliable sources. However, its accuracy, completeness, or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

The value of investments and the income from them can go down as well as up and investors may not get back the amounts originally invested, and can be affected by changes in interest rates, exchange rates, general market conditions, political, social, and economic developments, and other variable factors. Investment involves risks including but not limited to, possible delays in payments and loss of income or capital. Neither Tidal nor any of its affiliates guarantees any rate of return or the return of capital invested. This commentary material is available for informational purposes only and nothing herein constitutes an offer to sell or a solicitation of an offer to buy any security and nothing herein should be construed as such. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested, and nothing herein should be construed as a guarantee of any specific outcome or profit. While we have gathered the information presented herein from sources that we believe to be reliable, we cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed herein are our opinions and are current only as of the date of distribution, and are subject to change without notice. We disclaim any obligation to provide revised opinions in the event of changed circumstances.

The information in this material is confidential and proprietary and may not be used other than by the intended user. Neither Tidal nor its affiliates or any of their officers or employees of Tidal accepts any liability whatsoever for any loss arising from any use of this material or its contents. This material may not be reproduced, distributed, or published without prior written permission from Tidal. Distribution of this material may be restricted in certain jurisdictions. Any persons coming into possession of this material should seek advice for details of and observe such restrictions (if any).