Broad Market

We believe that acquisitions can transform a company and accelerate growth, but they carry execution risk and KPIs are not always easy to measure. Moreover, a large price tag carries higher execution risk. Cisco’s $28 billion acquisition is risky, and management will be expected to transform the business to a subscription model and deliver growth in 2025/2026.

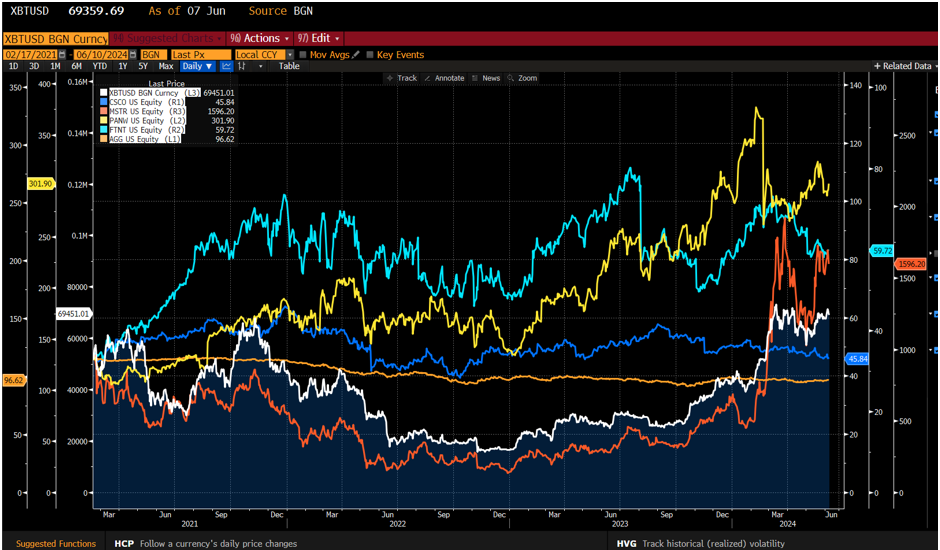

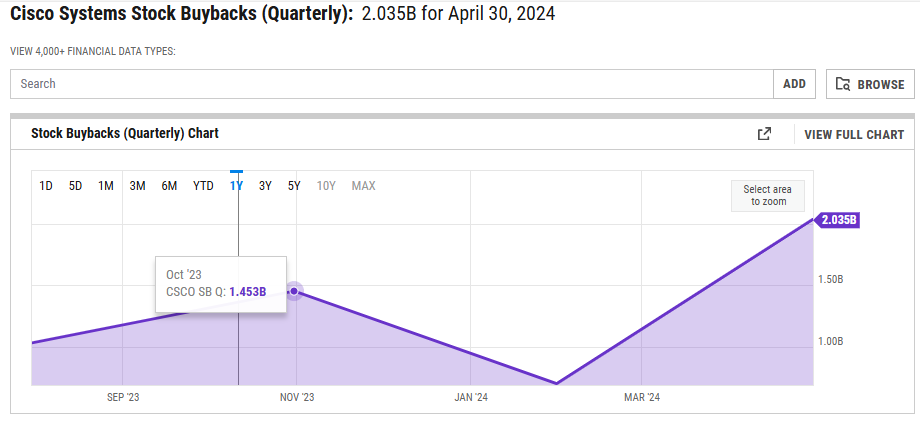

On February 17, 2021, when Bitcoin was priced at about $52,000, we published an article on the ETF Think Tank website, suggesting that Cisco should diversify its treasury strategy by buying Bitcoin. Unfortunately, three years later, Cisco’s stock continues to trade like a zombie company despite having a huge footprint in so many exciting areas like cyber security, AI and Blockchain. Worse, however, is that despite billions in buybacks, this management team has now spent an additional $28 billion on Splunk, and most recently even announced $1 billion in AI venture capital investments without building any confidence. Maybe Bitcoin isn’t the right answer for every company’s treasury, but why is a shrinking share count a better solution for a company whose management does not seem to demonstrate an ability to capitalize on obvious trends in technology? Moreover, Cisco shareholders and critics of the Bitcoin idea should review the chart above and ask themselves why management’s April 2024 decision in to aggressively buy back shares is the right tactical bet knowing the execution risks are so high (see Ycharts for detail). Cisco has a long history of making tuck-in and/or product acquisitions to drive sales, but this acquisition feels more like management looking to buy some time. The deal was 6x revenues, a 30% premium over the stock price, and a huge premium over Cisco’s PE. Free cashflow was expected to be $420 million on a go forward basis on $28 billion. What else needs to be said? Skeptics of Bitcoin and value shareholders need to look closely at this price tag.

We appreciate management’s confidence, but investors and analysts do not seem to agree. Despite initial confidence in the 2026 timeframe to execute on an accretive deal (See CNBC interview March 18, 2024), management seemed to back pedal and failed to convince their investor audience that business momentum is building after two events with analysts (see June 5 interview with Chuck Robbins). Why is business execution risk and concentration risk better than diversification risk in a company’s treasury strategy? Some might say career risk is better played through acquisitions and buybacks than out-of-the-box thinking, but when 21 analysts have you rated as “sell” and only 8 have you as “buy,” maybe you need to do something different.

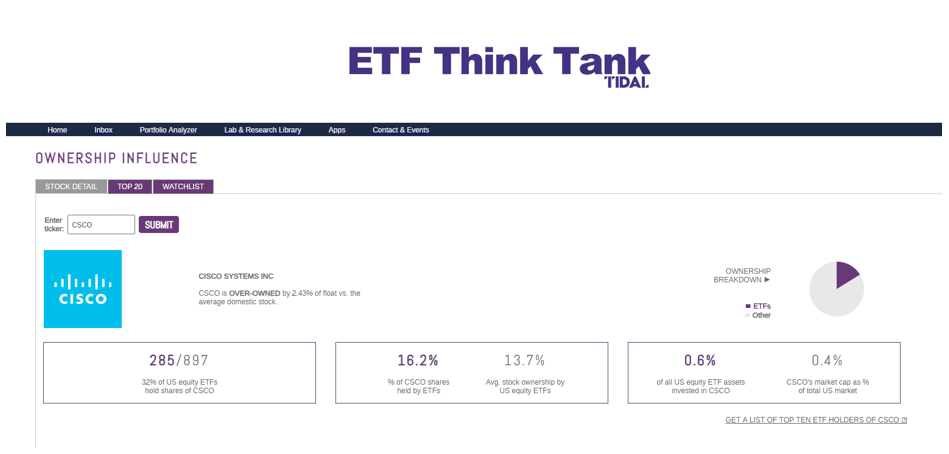

Readers of this article may be wondering how to avoid Cisco in a portfolio. To be clear, this is not our intention. As ETF nerds, we aren’t claiming to be stock pickers. Those looking for exposure to this stock can look at thematic ETFs such as the Dow Jones US Telecommunications ETF (IYZ = 15.83%), the Amplify Cybersecurity ETF (HACK = 7.35%), the First Trust NASDAQ Cybersecurity ETF (CIBR = 6.2%) and the iShares MSCI USA Value Factor ETF (VLUE = 5.51%). Feel free to reach out directly to us to learn more about our opinions, but right now we are highlighting the obvious. As a value play in cyber security and telco, growth and disruptive portfolios may be underwhelmed in 2024 by this holding. We would also highlight that, to our surprise, Cisco is owned 16.2% by ETFs, which may be a statement that active managers are avoiding the stock.

Hidden Gems

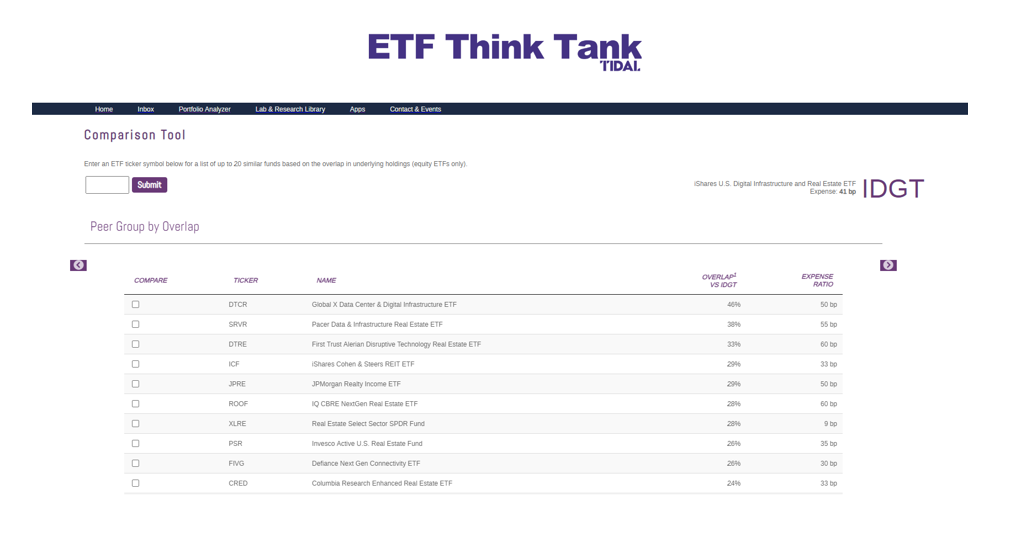

Is the new iShares US Digital Infrastructure and Real Estate ETF (IDGT), which in December 2023 converted from the iShares North American Tech-Multimedia ETF (IGN)[i], a hidden gem that will remain orphaned by investors? We have admired Blackrock-iShares for their determination with this ETF which has had various iterations since its launch in 2001 and which still only has $41 million in AUM.

Much has been written about the long-term global implications around AI. Recently, several companies in the Bitcoin mining space have announced Hyperscaler deals where they expand their infrastructure towards AI (See CoinDesk commentary “Bitcoin Miners Are Set for a Coiled Spring Rally”). Nevertheless, the change by iShares is interesting since it highlights how structure can change in an ETF with an index replacement and a ticker change. However, we would highlight that this change will not likely incorporate AI, unless some of the REIT digital centers pivot like some of the Bitcoin miners have done.

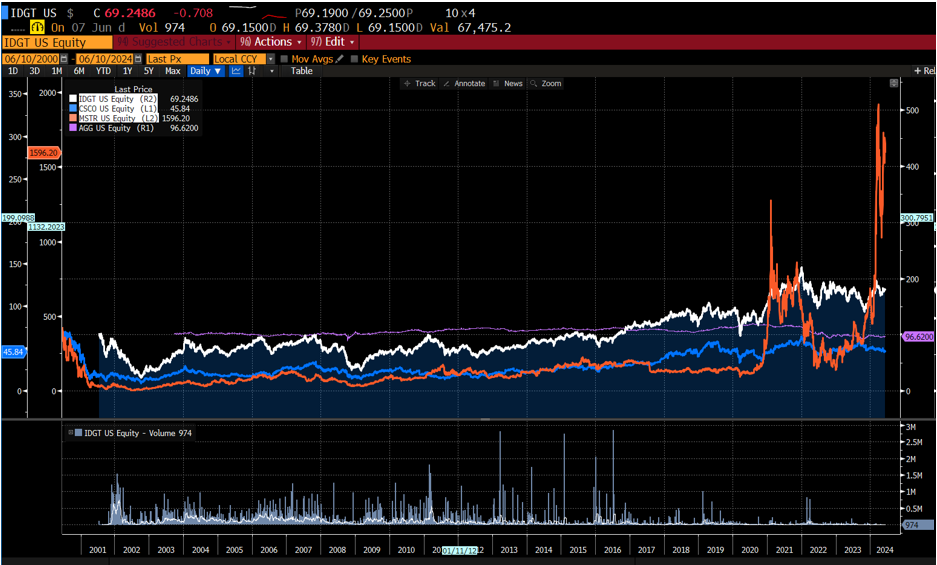

Circling back to our underlying premise around Cisco investing in Bitcoin, we would highlight how it has performed versus IDGT ETF, the iShares Core US Aggregate Bond ETF (AGG), and even MicroStrategy (MSTR). Although we admit the MSTR example is an extreme case of Treasury Management, we would also highlight that Michael Saylor openly admitted during the MicroStrategy World 2024 Conference that the decision to buy Bitcoin was in part made based upon his experience in reviewing the risks of acquisitions and 30 years of running a small software company that was floundering as a “zombie” company (His words). Watch the full video MicroStrategy Video here.

Summary

We are not suggesting that Cisco should have invested $28 billion in Bitcoin, nor are we suggesting that management should stop buying back stock. However, we ask that companies like Cisco review their treasury policy and include Bitcoin. A measured allocation is no different than a venture capital investment which we would argue is aligned with a technology firm’s culture. It is reasonable to argue that bonds can carry credit risk or the risk of decreasing purchasing power. Hard money investments like bitcoin and gold have a different set of risks, but fiduciaries on boards who are approving constant buybacks of shares should also be considering management’s ability to execute and concentrate risk. Is Cisco management’s assessment of such risk better than Mr. Market’s? Are incentives aligned? Cross your fingers that Splunk does not go kerplunk![ii]

Believers in cryptology and Blockchain often reference that DeFi solutions are best implemented when “trust is replaced by truth.” Cisco’s management had better deliver on their vision in 2025-2026 as measured by the price of bitcoin. Mr. Market is watching.

We highlight IDGT in the “Hidden Gems section” of this report for two reasons. First, normally we look at ETFs as a benchmark or KPI to measure a stock’s performance in a sector. However, given that this ETF has been reworked a number of times with swapping indexes this might not be the case. Second, we believe investors often look at past performance of an ETF and do not always read through the disclosures that point to how past performance was driven by different indexes.

[i] https://www.miaxglobal.com/sites/default/files/alert-files/IGN_Symbol_Name_Change___53726.pdf

[ii] https://www.merriam-webster.com/dictionary/kerplunk#:~:text=k%C9%99(r)%CB%88pl%C9%99%C5%8Bk,fell%20kerplunk%20at%20his%20feet

Disclosure

All investments involve risk, including possible loss of principal.

The material provided here is for informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third-party providers is obtained from what are considered reliable sources. However, its accuracy, completeness, or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

The value of investments and the income from them can go down as well as up and investors may not get back the amounts originally invested, and can be affected by changes in interest rates, exchange rates, general market conditions, political, social, and economic developments, and other variable factors. Investment involves risks including but not limited to, possible delays in payments and loss of income or capital. Neither Tidal nor any of its affiliates guarantees any rate of return or the return of capital invested. This commentary material is available for informational purposes only and nothing herein constitutes an offer to sell or a solicitation of an offer to buy any security and nothing herein should be construed as such. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested, and nothing herein should be construed as a guarantee of any specific outcome or profit. While we have gathered the information presented herein from sources that we believe to be reliable, we cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed herein are our opinions and are current only as of the date of distribution, and are subject to change without notice. We disclaim any obligation to provide revised opinions in the event of changed circumstances.

The information in this material is confidential and proprietary and may not be used other than by the intended user. Neither Tidal nor its affiliates or any of their officers or employees of Tidal accepts any liability whatsoever for any loss arising from any use of this material or its contents. This material may not be reproduced, distributed, or published without prior written permission from Tidal. Distribution of this material may be restricted in certain jurisdictions. Any persons coming into possession of this material should seek advice for details of and observe such restrictions (if any).