Broad Market

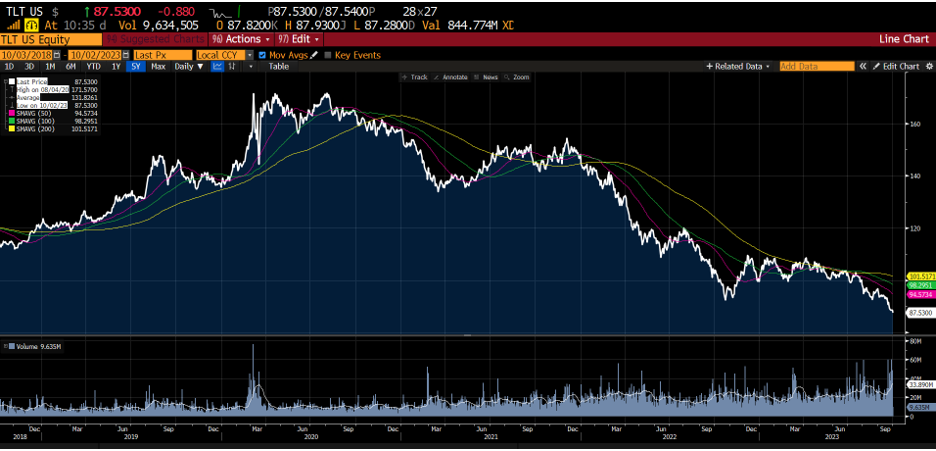

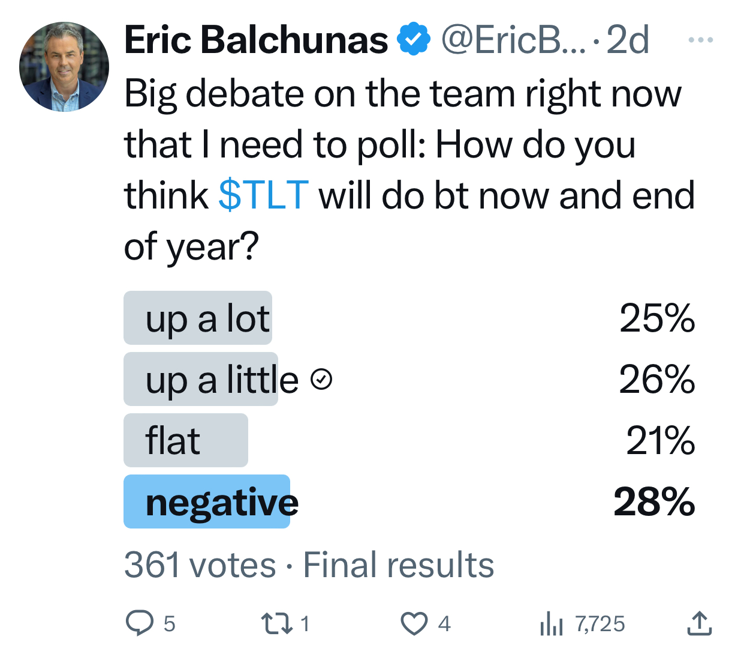

Sometimes it helps to go back to basics when the world looks upside down. Meaning that if the “risk free return” measured by the US Treasury continues to move higher as the value goes, we either need economic growth above the 4-6% level or we run the risk of stagflation. We use the iShares 20+ Year Treasury Bond ETF (TLT), which has incessantly been trading lower since it peaked at $171.57 on August 4, 2020, as a benchmark to measure this painful reality both out of convenience and because of its long-time utility. Others might argue that there are better benchmarks, and they may be right, but TLT is investible, and its performance works with model building. How much higher bond yields will go is anyone’s guess, but plainly speaking, the disruption caused by this consistent trend is critical to capital market assumptions that are disturbing to professional investors and certainly will have a meaningful impact on people’s daily lives sometime soon. To that point, we highlight a quick poll on X (formerly Twitter) taken by Eric Balchunas on September 28, in which 28.5% of 361 participants voted very narrowly in favor of lower price (higher rates).

While short-term thinking about long-term interest rates creates challenges around long-term planning, the simple truth is we don’t know how or when this bubble will run out of air. Past bubbles have been periods of time where headline boredom and selling exhaustion have signaled a bottom. However, this may not be the case for the Treasury market since its input reflects so many different economic variables and outcomes. Moreover, headline risks may just be beginning and will now unfortunately be measured in trillions of dollars. CNBC’s Robert Frank reported “stock market losses wiped out $9 trillion from Americans’ wealth.”

Short-term thinking does not solve long-term problems and arguably an X poll is unscientific, but it can be a constructive way to measure current sentiment. Moreover, we note that the poll’s choice of options skewed towards incremental thinking. Eric, hope you will run a second poll using the same audience with the question, “How do you think $TLT’s price will trade during Q4?” Poll Options: Up 5-10%, +- 5% or Down 5-10%. We may be wrong, but our thinking is that framing the poll with numbers creates a context. Thereafter, of course, the next question would be a poll around 2024. The plain truth is we need the price to stabilize!!!

To be clear, we know this exercise is highly unscientific and arbitrary. However, arguably to a large degree, such an audience poll is probably equally as accurate as when the media cites a poll of economists or Wall Street strategists. All polls should be viewed with skepticism. The fact, however, remains that TLT and the Treasury’s various maturities generally reflect how investors are subjectively reviewing the “risk free return” after inflation.[i]

Moving from September into October almost always brings negative sentiment. Most people view October as a month where markets correct, but the September Effect offers little inspiration for the fourth quarter and almost always brings rational, bear-minded thinking. The reasoning for weakness may have something to do with mutual fund fiscal year-end tax harvesting.

Hidden Gems: Memorable Articles that Explain ETF Construction

In the ETF Think Tank, we have been long time advocates for Saba Capital’s activism efforts in the Closed-End Fund category both through their ETF, the Saba Closed-End Funds ETF (CEFS), and through their SMAs and Hedge Funds. CEFS is a fully transparent actively managed ETF that carries a yield of 9.6% (SEC Yield). The fourth quarter is usually a good time to buy closed-end funds because of seasonal weakness led by year-end tax selling and a lack of buyers in the space. The fund has been around for over 5 years (Inception March 2018). The investment thesis behind Saba is straight forward. Closed-end funds most often trade at a discount and under circumstances where this discount widens to greater than 10-12%, Saba can play an activist role to encourage a fund manager to repurchase shares or perhaps even close the fund outright. The strategy, admittedly, takes patience, and the closed-end fund space carries very hefty fees and leverage. However, CEFS also brings an unusual twist to its short stance on the Treasury. Through SWAPS it is 40.55% short the 5 years (35.66%) and 10 years Treasury (3.89%). The hedge has existed since inception (March 17, 2017) and mostly been in place to offset some of the negative carry that comes from direct leverage in the closed-end funds, but the strategy is actively managed. See Fund details here.

Real Life Tank Battle Ground Stories

We find that our Tank Members have a dedicated period each week to research, so understanding some of the basics behind ETFs is not something that we focus on. Nevertheless, we were recently asked to provide constructive sources of information around the ETF basics.

- https://www.ssga.com/us/en/intermediary/etfs/resources/education/how-etfs-are-created-and-redeemed

- Elisabeth Kashner https://insight.factset.com/the-heartbeat-of-etf-tax-efficiency-part-two-knowing-the-players-#:~:text=ETF%20rebalances%20are%20often%20accompanied,outflow%20on%20the%20rebalance%20day.

- https://www.etf.com/publications/etfr/anatomy-etf-trade

Summary

Bottom line, all roads lead to what happens with the Treasury. To this point, while some may be concerned about yields and others about inflation, the debt clock has always been a visual KPI that has haunted me. Afterall, if there is no plan to address this issue, how does the problem ever get solved? A well-known lesson that everyone knows to be a fact – “problems only compound when they are ignored.”

[i] ETF Nerd readers – we acknowledge that TLT rolls its duration and in fact is not a maturity of 20 years. The actual duration is 17.45 years with a weighted average maturity of 25.49 years. (See iShares June 30, 2023 Fact Sheet) To be clear, there is no guarantee of return when investing in TLT and arguably most investors in TLT are not doing the math behind the risk free rate behind this security. Nevertheless, the actual holdings of Treasury on a derivative basis with the market place using an efficient market theory use such a metric. For a true definition of how risk free is measured see Wikipedia’s definition. Here is the link.

Disclosure

All investments involve risk, including possible loss of principal.

The material provided here is for informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

The value of investments and the income from them can go down as well as up and investors may not get back the amounts originally invested, and can be affected by changes in interest rates, in exchange rates, general market conditions, political, social and economic developments and other variable factors. Investment involves risks including but not limited to, possible delays in payments and loss of income or capital. Neither Toroso nor any of its affiliates guarantees any rate of return or the return of capital invested. This commentary material is available for informational purposes only and nothing herein constitutes an offer to sell or a solicitation of an offer to buy any security and nothing herein should be construed as such. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested, and nothing herein should be construed as a guarantee of any specific outcome or profit. While we have gathered the information presented herein from sources that we believe to be reliable, we cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed herein are our opinions and are current only as of the date of distribution, and are subject to change without notice. We disclaim any obligation to provide revised opinions in the event of changed circumstances.

The information in this material is confidential and proprietary and may not be used other than by the intended user. Neither Toroso or its affiliates or any of their officers or employees of Toroso accepts any liability whatsoever for any loss arising from any use of this material or its contents. This material may not be reproduced, distributed or published without prior written permission from Toroso. Distribution of this material may be restricted in certain jurisdictions. Any persons coming into possession of this material should seek advice for details of and observe such restrictions (if any).