All Eyeballs Descending on Omaha for The Berkshire Annual Meeting

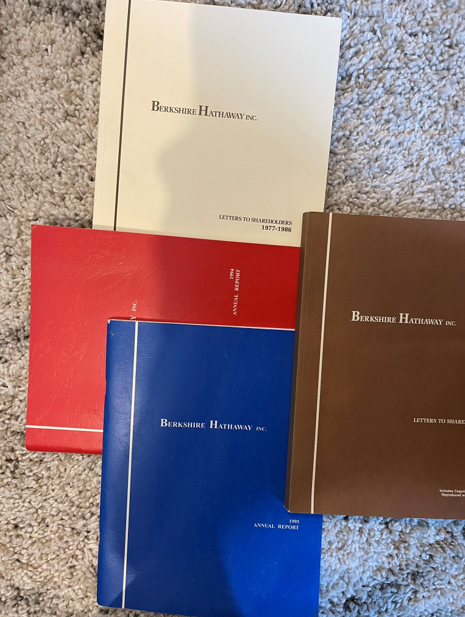

On May 6th, some 30,000 Buffettiers will gather in Omaha (Rural America) for the Berkshire Hathaway annual shareholder meeting. This is a weekend that many long-term shareholders look forward to and cherish each year. The event is as much about the success of their leadership and their personal investments as it is about a lifestyle and philosophy. It is also about a sense of community and the power of an ecosystem. Last year, our Director of Research, Cinthia Murphy, attended the event and wrote about her experience. Read that report here: What We Learned From Buffett and Munger at BRK 2022. Of course, anyone who has listened to Mr. Buffett or Mr. Munger over the years should appreciate that the foundational success of this genius is from pure focus on old-school fundamental values, and not as an early adopter or technologist. Additionally, the company’s leadership has consistently pushback against gold as a “store of value” investment because its use case does not align with their values around fundamental investing. All this is to say that asking Mr. Buffett or Mr. Munger about Bitcoin as a technology or store of value is just silly. Rather, we would suggest a better line of questioning that focuses on the common core principles. There is zero probability that Mr. Buffett or Mr. Munger will embrace Bitcoin investment directly, but let’s not forget that the basic tenants and philosophy are in fact shared among the two communities.

Here are some points to consider regarding the intersection of Berkshire Hathaway’s principles and Bitcoin:

- Financial and Fiscal Discipline: Berkshire has always been disciplined with its use of cash and issuance of shares. The limitation of the number of Bitcoin at 21 million is aligned with Berkshire’s belief in buybacks and reducing the denominator on its value creation.

- Rural America: Check out the video by Peter McCormack, What Bitcoin Did.

- Trust and Decentralization: When they acquire a company, Berkshire issues a value proposition that the company will maintain its independence and not be consolidated. This philosophy fosters trust from entrepreneurs and transparency for investors, and is a core principle of Bitcoin, aka DEFI.

- Brand awareness: The importance and value of a brand ecosystem (Coca Cola, American Express, Apple and Bitcoin) is about changing the lives of billions of people.

- Store of Value: Aren’t stocks a long-term store of value? Berkshire (BRK) is the ultimate example.

More Questions for the Oracle of Omaha¹

We think there are at least 12 other common principles between these two communities but believe we should ask a few more questions about Berkshire’s leadership before we can be sure about our views.

- We can’t find a year where Berkshire paid a dividend. If dividend distribution is not an important premise behind shareholder retention, then why does it matter that Bitcoin doesn’t pay a dividend or earn cash flow? According to Motley Fool, Berkshire earns about $6 billion from dividend income each year.²

- What is the “use case” for having a $344³ billion portfolio of stocks beyond future capital appreciation? Does this not suggest that there is no real use case for owning shares in Berkshire stock beyond a thesis that the Board of Directors will skillfully invest to create retained earnings that later can be market-to-market at a multiple of the firm’s book value, or other stock price metrics? Maybe there is a breakup value, but let’s be truthful – no one hopes for that day! (Truth – most people should be grateful that Berkshire was created as a store of value led by so much pure genius.) Regardless, what is the use case for owning stocks as a derivative beyond a Board of Directors and Management team that creates greater value than yesterday’s investment? Obviously this presents questions about the stock portfolio which includes a large concentrated position of 907 million shares in Apple stock, worth some $150 billion (AP $169). How did Berkshire vote its shares on Tim Cook’s compensation package? Was Berkshire the reason why Mr. Cook’s pay was reduced by 40%, or did he really volunteer for a pay reduction? (Both Mr. Buffett and Mr. Munger are each paid only $100,000.)

- Technology Impacts on Business? As someone who admits to not knowing much about technology, how are you confident that Apple’s technology is right for the future, won’t be disrupted, or will benefit from AI or blockchain? Mr. Buffett – please talk to us about these technology trends! How do you feel they will impact the industries you are currently invested in and operating businesses in? What is your cap expenditure on AI and Blockchain?

- Berkshire Digital Asset Investment Platform Exposure. We know you made an exception in investing in NU Holdings ($500 million) as a banking and onramp platform. Congrats on being open-minded. What made this emerging market opportunity worth the risk? It seems that NU Holdings trades at 7x to revenues with about 80 million in members vs Coinbase at 5x. Does this reflect regulatory challenges in the US market, or just a value opportunity?

- DEFI vs Centralized Management Style. We admire your openness as the CEO of Berkshire and your noted decentralized style of management. Often, when you buy a company, you transfer value in the form of Berkshire shares to the founder and bet that the alignment of incentives works to everyone’s benefit. It is enjoyable to meet all the CEOs of companies owned by Berkshire. How do you manage the continued alignment of interests? Are those who sell to you allowed to diversify? We appreciate that this is a legitimate securities transaction, but how is this different from a token deal where BRK is paying for a business that is out of the pockets of a Buffeter? Assuming so, is this not a deal based upon TRUST by both parties at the risk of shareholders?

Maybe a thesis that Berkshire Hathaway and Bitcoin have more in common than just the B in the name sounds crazy to some folks. Of course, what we are proposing may be controversial on both ends, but disagreement is okay. Afterall, we are the ETF Think Tank, and our community is used to us being on the cutting edge. Part of our value proposition is to engage our community with research, tools, and shared insights that both expand and enrich our membership. Speaking of communities, we look forward to seeing so many of our ETF Nerd members at the Inside ETFs Conference. Do reach out before you sign up to learn about other benefits and join us this Thursday for our Event Highlight Happy Hour!

¹ https://en.wikipedia.org/wiki/Warren_Buffett

² The Motley Fool https://www.fool.com/investing/2023/01/17/warren-buffett-48-billion-dividend-income-6-stocks/

³ The Motley Fool https://www.fool.com/investing/2023/04/21/76-warren-buffett-portfolio-invested-in-5-stocks/

Disclosure

All investments involve risk, including possible loss of principal.

The material provided here is for informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

The value of investments and the income from them can go down as well as up and investors may not get back the amounts originally invested, and can be affected by changes in interest rates, in exchange rates, general market conditions, political, social and economic developments and other variable factors. Investment involves risks including but not limited to, possible delays in payments and loss of income or capital. Neither Toroso nor any of its affiliates guarantees any rate of return or the return of capital invested. This commentary material is available for informational purposes only and nothing herein constitutes an offer to sell or a solicitation of an offer to buy any security and nothing herein should be construed as such. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested, and nothing herein should be construed as a guarantee of any specific outcome or profit. While we have gathered the information presented herein from sources that we believe to be reliable, we cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed herein are our opinions and are current only as of the date of distribution, and are subject to change without notice. We disclaim any obligation to provide revised opinions in the event of changed circumstances.

The information in this material is confidential and proprietary and may not be used other than by the intended user. Neither Toroso or its affiliates or any of their officers or employees of Toroso accepts any liability whatsoever for any loss arising from any use of this material or its contents. This material may not be reproduced, distributed or published without prior written permission from Toroso. Distribution of this material may be restricted in certain jurisdictions. Any persons coming into possession of this material should seek advice for details of and observe such restrictions (if any).