Broad Market Commentary

Despite economic uncertainties and the war hitting the 500-day milestone, hope for better times ahead has led to the stock market rebounding in 2023. Investor confidence and the optimism that surrounds market conditions may surprise many in the bear camp, as well as those who have been through market cycles before. Point of fact, it is usually easier to make a rational case to reduce short term equity risk in the face of near term known risk, but stocks tend to move higher in the long term. Ironically, it is the bond market with higher interest rates that has been hurt more during this period than the US Equity market.

Hidden Gems

The Russia -Ukraine War sadly continues with little evidence of a truce. While people do not die from cyber-security, nor does such technology lead to an assault of people’s homes, there can be no question that cyber-security is ubiquitous and an unending global invasion.

The invasion and bombing of people’s homes is terrible and far worse than the penetration and invasion by technology companies at the core virtual infrastructure of a company. Yet, in this week’s ETF Think Tank blog, we decided to review two sectors that are mostly under-owned by investors. To be honest, the world simply does not feel like a safer place and unfortunately military spending by the US needs to continue to rise. In fact, the U.S. budget for defense is now set at $857.9 billion (See Summary of Fiscal Year End 2023 National Defense Act here). As our relationship with North Korea, and separately China, continues to be precarious, there is talk of such spending reaching the trillion dollar level.

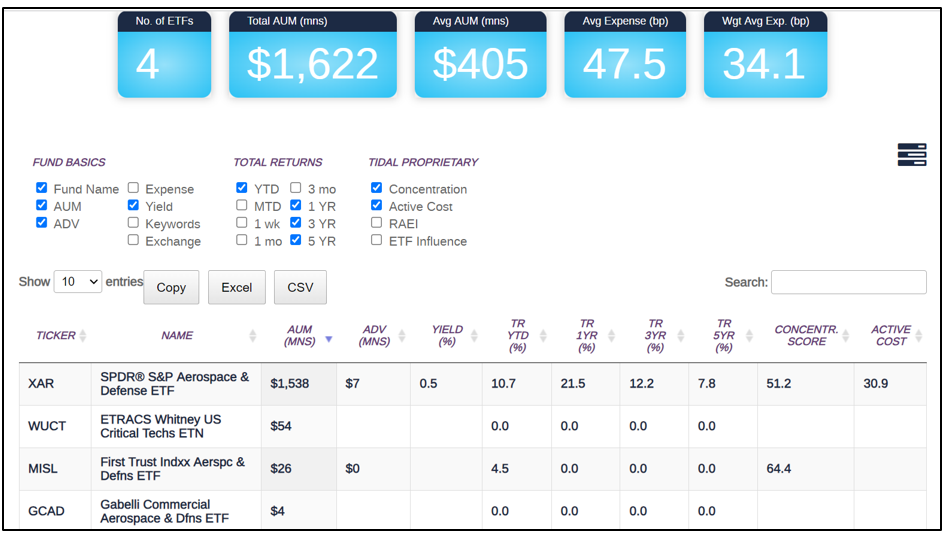

However, investors appear to be ignoring ETFs in the industry – probably because stock performance has been uninspiring. Note, there are only 4 ETFs that provide targeted exposure to the defense industry and only the SPDR S&P Aerospace & Defense ETF (XAR) has achieved AUM mindshare.

Hidden Gems: ETFs Worth a Second Look

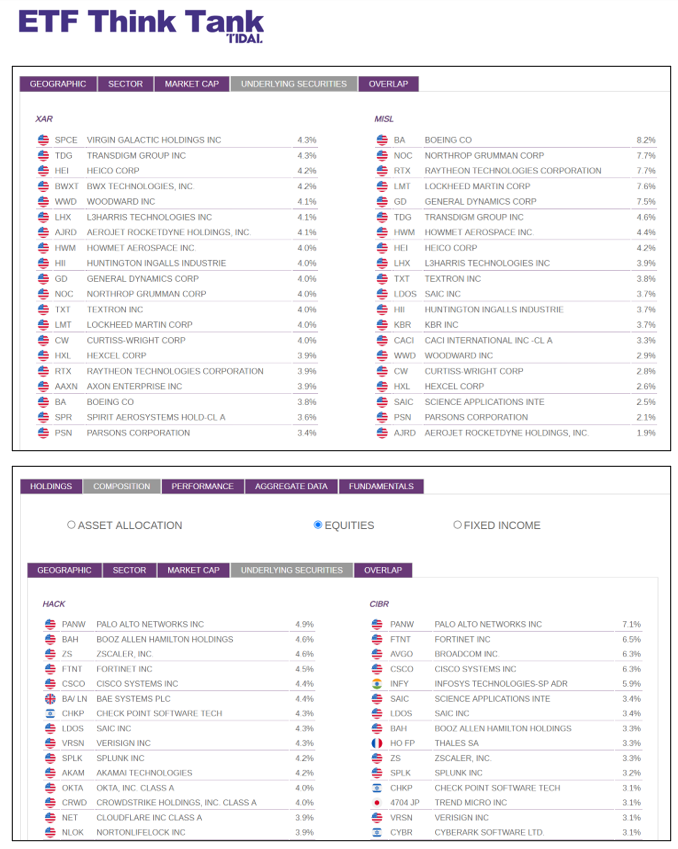

A second look, however, is worth some time since the overlap between the dominant fund SPDR S&P Aerospace & Defense ETF (XAR) (launched 2011) and the newer fund launched by First Trust Index (MISL) on October 25, 2022 has a 64% overlap. As structure matters, we would also highlight that MISL also offers a 2024 return on equity of 17.9% and a PE multiple that is also below that of the S&P 500. This is not the case for XAR. Most sector strategies are managed pursuant to quantitative analysis, so these funds will be overlooked as their performance has been underwhelming. However, conditions do change, and steady industries supported by huge budgets can provide value to investors when breadth is narrow. Put differently, thematic portfolios tend to lean towards growth and overlook boring long term value opportunities that are out of favor. We think this could be a mistake.

Tank Shared Insights: From the Tank Battle Ground

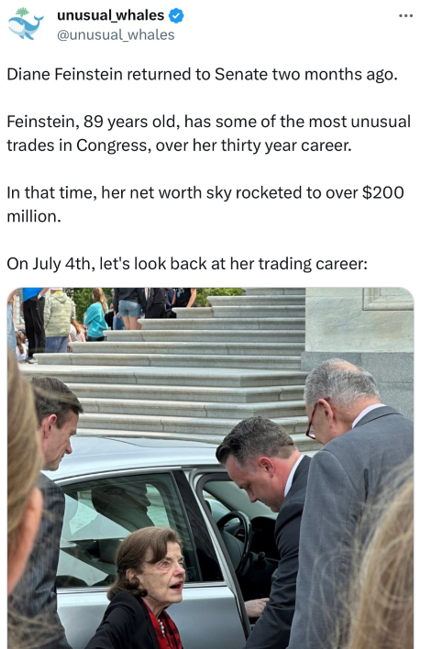

Participation in Tank 1:1 meetings slowed down during the Fourth of July weekend, but due diligence continued on social media. A favorite Twitter post was from ‘@unusual-whales’ which highlighted how the 89-year old representative Diana Feinstein has accumulated a net worth of $200 million trading stocks. Exactly how her process has worked over her 30-year tenure in Congress remains a mystery, but congrats to her for building a nice retirement package. Glad she isn’t just relying on her pension from the government. Enjoy reading the entire Unusual Whales thread here .

Speaking of social media, those reading this blog know how committed we are in the Tank to our outreach on social media, aka Twitter, YouTube, LinkedIn and yes – now Threads. To this point, clearly Threads is set up well to rival Twitter. As a feeder, Instagram has some 1.6 billion users so Threads getting to 100 million users is no surprise. Moreover, if Twitter has 237 million users, the question is how many are bots and/or duplicates? The social media battle for mindshare is an ongoing struggle around insights that we think are important.

Summary

Thematic investors tend to look to growth ETF opportunities or funds with a “Hack Moment”, but the hidden gems can also be those ETFs which, at their core, are just “steady Eddie.” The terrible reality is that the world will not be a safer place in the future and the Aerospace and Defense industry might, unfortunately, benefit from these risks. If you don’t believe us – as a subtle reminder, just check your spam filter.

Most importantly, we are sad that the war continues. Please know that the intent of this piece is not to capitalize on the death and destruction that is taking place in the Ukraine, but rather to help fund the necessary strength of our US military. We know Congress is under pressure to reduce the budget and the US spends more than the next 10 largest countries combined.[i] To this point, just know that we will be monitoring with profound new rigor how Congress invests both as citizens with their own money, as well as our country’s money.[ii]

[ii] https://www.cbo.gov/budget-options/58632

Disclosure

All investments involve risk, including possible loss of principal.

The material provided here is for informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

The value of investments and the income from them can go down as well as up and investors may not get back the amounts originally invested, and can be affected by changes in interest rates, in exchange rates, general market conditions, political, social and economic developments and other variable factors. Investment involves risks including but not limited to, possible delays in payments and loss of income or capital. Neither Toroso nor any of its affiliates guarantees any rate of return or the return of capital invested. This commentary material is available for informational purposes only and nothing herein constitutes an offer to sell or a solicitation of an offer to buy any security and nothing herein should be construed as such. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested, and nothing herein should be construed as a guarantee of any specific outcome or profit. While we have gathered the information presented herein from sources that we believe to be reliable, we cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed herein are our opinions and are current only as of the date of distribution, and are subject to change without notice. We disclaim any obligation to provide revised opinions in the event of changed circumstances.

The information in this material is confidential and proprietary and may not be used other than by the intended user. Neither Toroso or its affiliates or any of their officers or employees of Toroso accepts any liability whatsoever for any loss arising from any use of this material or its contents. This material may not be reproduced, distributed or published without prior written permission from Toroso. Distribution of this material may be restricted in certain jurisdictions. Any persons coming into possession of this material should seek advice for details of and observe such restrictions (if any).