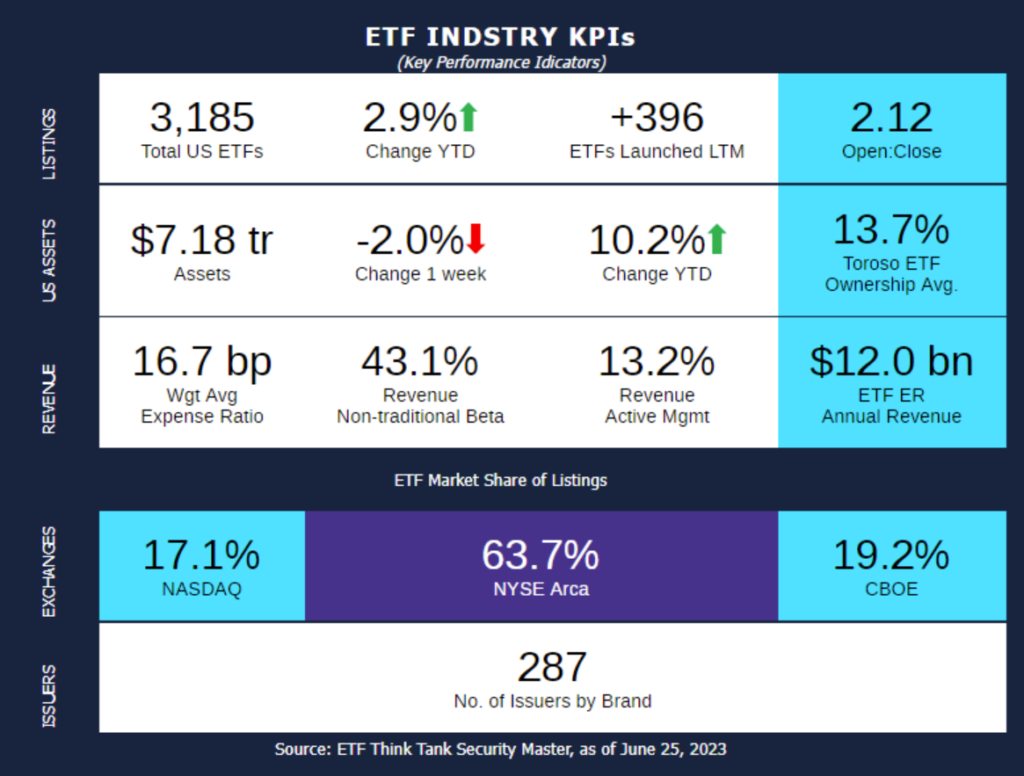

Week of June 19, 2023 KPI Summary

- This week, the industry experienced 8 ETF launches and 3 closures, shifting the 1-year Open-to-Close ratio to 2.12 and total US ETFs to 3,185.

- Schools are out and summer has begun in the U.S once again. Many Americans will take a vacation during the summer months, so let’s look at the 5 non-leverage Travel and Leisure ETFs. This topic is an update from a previous KPI article on 6/27/2022.

- The category has $571 Million across the 5 funds, with a large majority ($400 Million) in Invesco’s PEJ which was launched in 2005. The remaining 4 funds (AWAY, BEDZ, CRUZ, JRNY) are all from different Issuers and have been launched in the last 3.5 years.

- Last year at this time, the category constituted $1.39 Billion with PEJ managing $1.1 Billion. Additionally, it was made up of 6 funds, the extra one SonicShares Airlines, Hotels, Cruise Lines ETF (TRYP) closed in July 2022.

- Although the category is down 58% from this time last year, the funds are up 12% YTD on average in AUM. Defiance Hotel Airline and Cruise ETF (CRUZ) leads the pack at +25.3% YTD and +17.3% over 3-months.

- The average expense ratio of the category shifted from 69 bps to 67.8 bps.

- The category has $571 Million across the 5 funds, with a large majority ($400 Million) in Invesco’s PEJ which was launched in 2005. The remaining 4 funds (AWAY, BEDZ, CRUZ, JRNY) are all from different Issuers and have been launched in the last 3.5 years.

- While Summer 2022 still had families tepid on travelling with Covid lingering, this summer will finally feel like Covid is a thing of the past for most. PEJ and CRUZ are hoping that to be true because they’ve been pummeled -63% and -49% respectively since our last report on Travel and Leisure ETFs one year ago. The third largest of the category, CRUZ, rose 13% during that time alternatively.

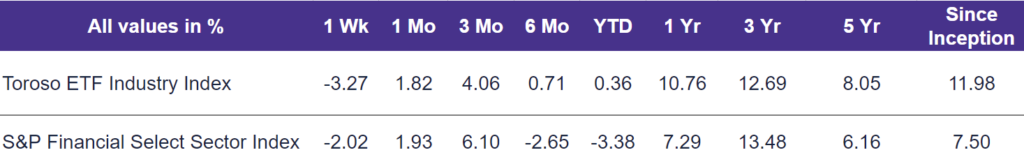

- Both indexes experienced a large decrease week. Toroso ETF Industry Index was down -3.27% while the S&P Financial Select Sector Index led at -2.02%.

ETF Launches

PIMCO Ultra Short Government Active ETF (ticker: BILZ)

PIMCO Multisector Bond Active ETF (ticker: PYLD)

Global X 1-3 Month T-Bill ETF (ticker: CLIP)

Future Fund Long/Short ETF (ticker: FFLS)

Direxion HCM Tactical Enhanced U.S. Equity Strategy ETF (ticker: HCMT)

Clouty Tune ETF (ticker: TUNE)

VictoryShares Free Cash Flow ETF (ticker: VFLO)

FT Cboe Vest U.S. Equity Moderate Buffer ETF – June (ticker: GJUN)

ETF Closures

LifeGoal Conservative Wealth Builder ETF (ticker: SAVN)

LifeGoal Home Down Payment Investment ETF (ticker: HOM)

LifeGoal Wealth Builder ETF (ticker: WLTH)

Fund/Ticker Changes

Fidelity® Disruptors Fund (ticker: FGDFX)

became Fidelity Disruptors ETF (ticker: FDIF)

TETF.Index Performance vs. S&P Financial Select Sector Index

(as of June 23, 2023)

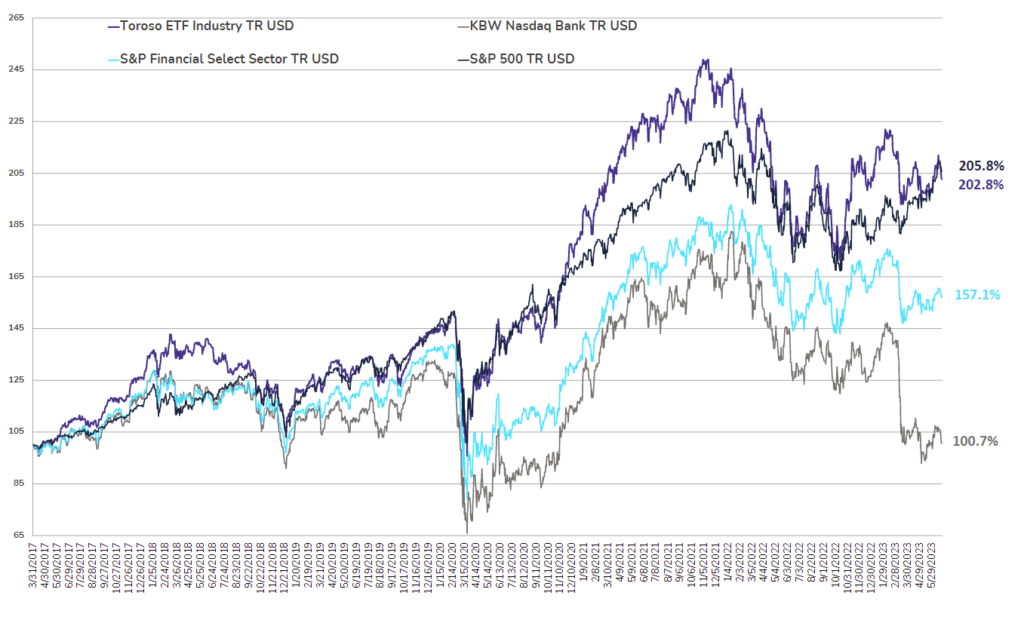

TETF.Index Performance vs. Other Leading Financial Indices

(March 31, 2017 through June 23, 2023)

Why Follow the ETF Industry KPIs

The team at Toroso Investments began tracking the ETF Industry Key Performance Indicators (KPI’s) in the early 2000’s and have been consistently reporting on, and analyzing these metrics ever since. The table above was the impetus for the creation of the TETF.Index, the index that tracks the ETF industry. Each week, we will share the statistics we believe to be the most useful for identifying industry trends, in addition to the performance of the TEFT.Index.

DISCLAIMER

Past performance is no guarantee of future returns. This article is for informational and educational purposes only; is not intended to constitute legal, tax, accounting or investment advice; and does not constitute an offer to sell or a solicitation of an offer to buy any security or service. Furthermore, the Indexes shown above are not investable. While Toroso has gathered the information presented from sources that it believes to be reliable, Toroso cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed are Toroso’s opinions and do not reflect the opinions of any affiliates or related persons. All opinions are current only as of the date of initial publication and are subject to change without notice. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested.