Roughly two years into the era of mutual fund-to-ETF conversion as a pathway to ETF industry entry, we’ve learned two things. The first is that the future of this trend looks promising, with many more funds coming to market this way. The second is that the early years of conversion haven’t exactly been easy for providers.

Maybe the best way to explain the disparity between outlook and recent history is that the first is centered on end user – investors want ETFs, but the latter tells a tale about distribution challenges – the hardest nut for providers to crack.

As a quick dive into that rosy future, consider that we’ve now seen nearly 40 mutual funds become ETFs in the past two years from big and not-so-big names like Dimensional, Franklin Templeton, Bridgeway and Goldman Sachs, to the tune of about $70 billion in assets now sitting in these strategies. There are another 20 or so conversion plans in the regulatory pipeline from firms like Alliance Bernstein and JP Morgan.

This is a trend that is still in its early days, and it makes sense because ETFs make good – often fiduciary – sense for many investors. They are excellent vehicles for market access and tax management, among other things.

Bloomberg Intelligence’s “U.S. ETF 2023 Themes” report projected ETFs to continue “marching toward fund structure dominance,” crossing 50% of total fund assets in the U.S. by the end of 2027. Today, they are just shy of 30% — a level that, in itself, represents 2x growth in just about a decade.

“ETFs’ growing dominance is supported by steady inflows and increased interest in the structure from legacy mutual fund companies that are seeking to retain customers,” Bloomberg’s report said.

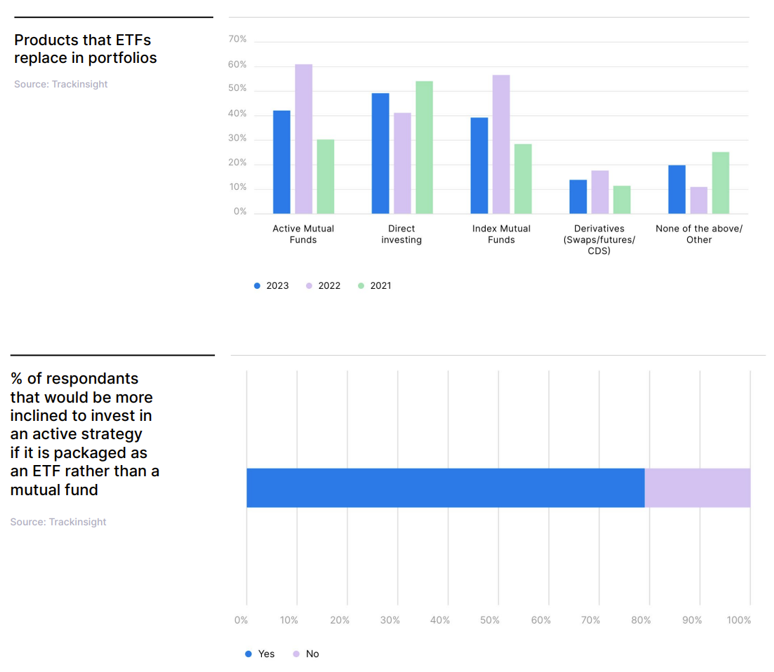

Trackinsight’s Global ETF Survey 2023 (of over 500 professional investors putting to work nearly $1 trillion in assets) found that “in the Americas, a notable 80% of respondents stated they would be more inclined to invest in an active strategy if packaged as an ETF rather than a mutual fund, supporting the trend of Mutual Funds to ETF conversion.”

“This overwhelming interest in an ETF wrapper is likely due to most ETFs’ lower expense ratios relative to mutual funds. The greater transparency of ETFs and the improved tax efficiency are also likely reasons for the appeal of an ETF wrapper,” the survey said.

In fact, about 2/3 of those surveyed in the Americas, according to the survey, 61% said they’ve already replaced active mutual funds with ETFs, and over half have replaced index mutual funds with ETFs.

A Challenging First Round

A look at how MF-to-ETF conversions have fared thus far can be a little humbling to providers. We’ve seen nearly 40 conversions from 19 different providers since the first one took place in early 2021, and asset growth has not immediately followed most of these conversions. Quite the contrary. Most have seen no growth at all, if not lost a few assets in the process.

Things like market environment – ‘is this a good strategy for right now?’ – as well as fund performance play a role in the uptake of a new ETF, even one just recently converted from a mutual fund with existing track record. A new ETF, even a converted one, needs to have what we call the “necessary conditions” for success:

- The product has to be right.

- The capital support needs to be there.

- The infrastructure must be in place.

In many cases, converted strategies aren’t especially innovating in either access or cost – they aren’t solving an investor problem that hasn’t already been solved.

Some of these funds didn’t have a particularly high active share, or high turnover, or complexity – traits that would benefit from the ETF structure. Many weren’t even that unique, barely more than me-too products of well-established ETFs. It’s understandable why many failed to find a new following of investors.

That can be especially true if the original mutual fund didn’t come into a conversion with sizeable assets. Capital support – as in seed or, in a conversion case, a strong asset base – can make all the difference in attracting inflows from a broader audience.

And then there’s the issue of infrastructure, which in the case of conversions means understanding the operational complexities of a wrapper that trades intraday in-kind (choose your partners wisely) and cracking the ETF distribution challenge. The ETF market is crowded and highly competitive – distribution, as in sales and marketing, can be difficult but critical.

If nothing else, ETFs have a competing disadvantage with mutual funds when it comes to platforms’ willingness to support their growth. In the mutual fund world, commissions rule. Platforms – like Wells Fargo and the like – are incentivized to offer (distro) commission-paying products like mutual funds. In an ETF wrapper, however, these same strategies look a lot less appealing because there’s no such thing as commission sales in ETFs, which can mean that distribution and growth support disappear.

The good news is that many conversions haven’t seen immediate asset growth, but some have, and quite notably too. Look at Dimensional with its initial lineup of 7 MF-to-ETF conversions. These strategies have attracted more than $10 billion in new asset flows since converting (in two installments) in mid to late 2021, according to Morningstar data.

Their secret? Dimensional knows who its clients are and how to get in front of them with a product offering that’s competitive and makes a lot of sense.

As Morningstar put it, “Part of the reason that Dimensional has proven more successful likely rests with the tight connection to its advisor-dominated client base. Its ETFs also have lower fees than many actively managed funds, and most are among the most diversified in their respective category, meaning they’re more appealing to a wider range of investors than many other ETFs and mutual funds available.”

Other firms like Neuberger Berman, for example, have also done well. Their converted MF-to-ETF commodity strategy has grown some 35% since its conversion in October 2022.

What we know today is that the early days of MF-to-ETF conversions have been a little tougher than many anticipated, but no one is questioning whether ETFs are the future. This is a wrapper that solves investor problems in terms of access, cost, and tax efficiency. And if you follow the money, you know that investors have been voting with their dollars in favor of the ETF structure vs. mutual funds.

We are just reminded, once again, that this is a tough business, with no guarantees. We love to throw around the notion that the bar to entry is low, but the bar to success is high in the ETF industry. So far, MF-to-ETF conversions have just proven that little piece of wisdom to be true.

Disclosure

All investments involve risk, including possible loss of principal.

The material provided here is for informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

The value of investments and the income from them can go down as well as up and investors may not get back the amounts originally invested, and can be affected by changes in interest rates, in exchange rates, general market conditions, political, social and economic developments and other variable factors. Investment involves risks including but not limited to, possible delays in payments and loss of income or capital. Neither Toroso nor any of its affiliates guarantees any rate of return or the return of capital invested. This commentary material is available for informational purposes only and nothing herein constitutes an offer to sell or a solicitation of an offer to buy any security and nothing herein should be construed as such. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested, and nothing herein should be construed as a guarantee of any specific outcome or profit. While we have gathered the information presented herein from sources that we believe to be reliable, we cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed herein are our opinions and are current only as of the date of distribution, and are subject to change without notice. We disclaim any obligation to provide revised opinions in the event of changed circumstances.

The information in this material is confidential and proprietary and may not be used other than by the intended user. Neither Toroso or its affiliates or any of their officers or employees of Toroso accepts any liability whatsoever for any loss arising from any use of this material or its contents. This material may not be reproduced, distributed or published without prior written permission from Toroso. Distribution of this material may be restricted in certain jurisdictions. Any persons coming into possession of this material should seek advice for details of and observe such restrictions (if any).