Many U.S. investors may be feeling a little more optimistic about markets this year, but inflation – and its impact on investment portfolios over time – is still topic du jour in most circles because it’s proving to be stubbornly sticky.

Earlier this month, at the ETF Exchange conference in Miami, inflation was a hot issue in both panels and hallway conversations, with many advisors telling us that inflation remains their clients’ top concern this year.

The State Street Global Advisors ETF Impact Survey, released this month, which set out to understand how investors were dealing with market volatility, reinforces that notion. The Survey found that 74% of investors who currently work with an advisor rank inflation as a top concern – a level that has remained largely steady since last summer and remains elevated relative to pre-pandemic levels.

How high, for how long, is the question we are all asking (and for good reason). If you recall, not long ago, Bank of America made news when it pointed out that, historically, once inflation rises above 5% in a developed economy, it takes 10 years for it to get back down to 2%. Ten whole years.

“Inflation has two main drivers: easy monetary policy and supply disruptions,” ETF Think Tank co-founder and CIO of Toroso Investments, Michael Venuto, noted. “The hawkishness of the Fed suggests they are done debasing our currency, but the damage from Covid and stimulus will persist and recur in waves of the next few years.”

What does this mean in terms of a real impact? In a recent conversation with the team at FolioBeyond, Dean Smith, Chief Strategist, offered this perspective: at 5% inflation, it’d take 15 years to see your inflation-adjusted real wealth drop by half. At 2% inflation, it’d take 36 years to lose half of your real wealth. We are looking at a current inflation rate that’s more than twice as erosive as the Fed’s target. (You can watch that full conversation here.)

This sticky inflation also means interest rates should continue to go up as the Fed attempts to bring that reading down, and that has its own challenging implications.

The Advisor Benefit

In this environment, two things have proven true. The first is that diversification remains an investor’s best friend, and ETFs are a great tool of choice for implementing that diversification.

The second is that most advisors are delivering on their value proposition, helping investors navigate this difficult terrain.

Consider two standout findings in the State Street survey:

- Roughly 60% of investors said ETFs “have improved the overall performance of their portfolio” and more than half of all surveyed said ETFs “made them a better investor.”

According to Brie Williams, head of Practice Management at State Street Global Advisors, most investors surveyed found ETFs to be better diversified products that offer liquidity, lower cost and tax efficiency, transparency, and ease of access, providing for better risk mitigation in volatile markets.

- More than 80% of investors working with a financial advisor said their advisor “helped them remain confident in this period of rising inflation and market volatility” and worked with them on understanding the impact this environment could have on their long-term goals.

“The characteristics of ETF have allowed investors to better position their portfolios in partnership with financial advisors,” Williams told us. “This survey amplified what the right financial advisor can do, not only to help an individual build a portfolio, but to give structure and guidance they may need to make the difficult choices.”

As she put it, if behavioral research shows that personal biases and emotions can sometimes prevent investors from making tough (but necessary) investment decisions, periods of market stress can “amplify the value of advice.”

Diversifying With ETFs

With good advice in hand, ETFs can make the job of accessing diversification easier because of the liquidity, tradability and ease of access of this investment tool, as well as the vast number of funds delivering “other” paths of returns – be it alternative, thematic, tactical or something else.

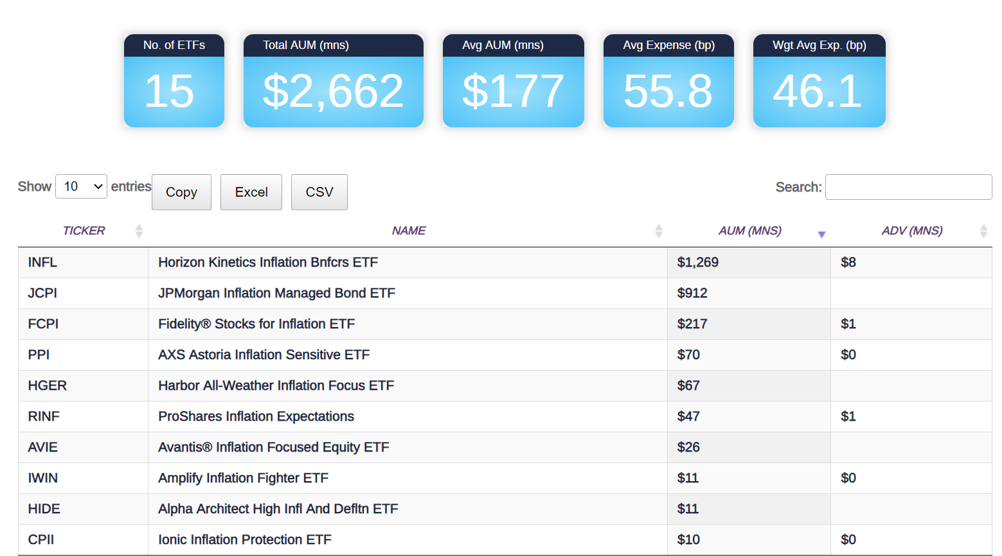

For example, one category of ETFs that looms large in this inflation conversation is the batch of inflation-focused ETFs that have come to market in the past year or so, designed specifically for this current environment. Below, consider the 10 largest inflation ETFs ranked by assets under management:

This list, while not exhaustive, tells us that inflation fighting is not a one size fits all affair – and neither is diversification. Different providers go at this challenge in different ways, and each would have a different impact on a portfolio allocation.

Some of these inflation-focused ETFs look exclusively for inflation beneficiaries – companies that may deliver capital growth in an inflationary environment, such as mining stocks, producers, or real estate. Some ETFs invest instead in derivatives contracts, bonds and TIPs. There are ETFs in this segment that opt for a commodity, real-asset-type of portfolio, and there are some that opt for an asset allocation approach, blending different asset classes, including crypto assets, in pursuit of inflation protection.

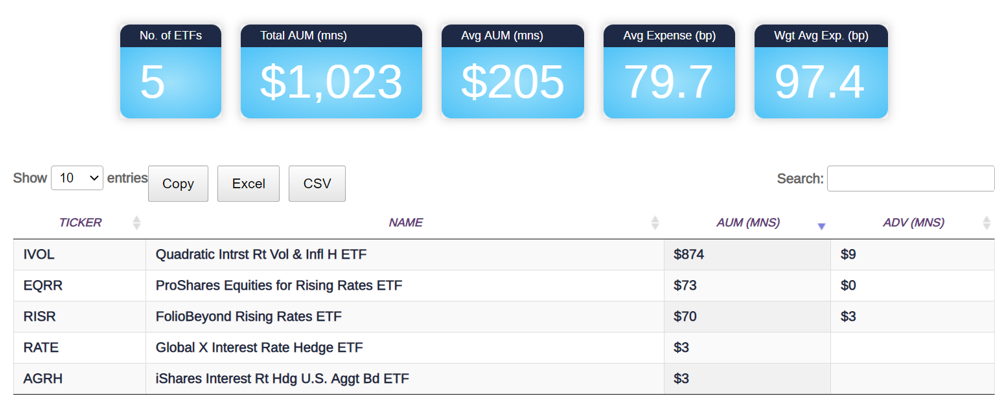

There are also a number of ETFs that set out to navigate this inflationary environment from a rising rate perspective. They include:

The Due Diligence Homework

A look at these Funds is a reminder that ETF solutions abound, and due diligence is key to understanding how any given strategy interacts with the other positions in your portfolio. Are they providing that differentiated return stream, or protection, or income, or uncorrelated results you are seeking? It’s allocation that drives returns, so getting the mix right is crucial.

While this is no small task in an ETF market that keeps welcoming more funds every day, slicing, and dicing these categories in new and novel ways, we are seeing that good financial advice supported by good financial tools (ETFs) are powering investors to face an inflationary period head on, and with confidence to boot.

Disclosures

All investments involve risk, including possible loss of principal.

This material is provided for informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

The value of investments and the income from them can go down as well as up and investors may not get back the amounts originally invested, and can be affected by changes in interest rates, in exchange rates, general market conditions, political, social and economic developments and other variable factors. Investment involves risks including but not limited to, possible delays in payments and loss of income or capital. Neither Toroso nor any of its affiliates guarantees any rate of return or the return of capital invested. This commentary material is available for informational purposes only and nothing herein constitutes an offer to sell or a solicitation of an offer to buy any security and nothing herein should be construed as such. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested, and nothing herein should be construed as a guarantee of any specific outcome or profit. While we have gathered the information presented herein from sources that we believe to be reliable, we cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed herein are our opinions and are current only as of the date of distribution, and are subject to change without notice. We disclaim any obligation to provide revised opinions in the event of changed circumstances.

The information in this material is confidential and proprietary and may not be used other than by the intended user. Neither Toroso or its affiliates or any of their officers or employees of Toroso accepts any liability whatsoever for any loss arising from any use of this material or its contents. This material may not be reproduced, distributed or published without prior written permission from Toroso. Distribution of this material may be restricted in certain jurisdictions. Any persons coming into possession of this material should seek advice for details of and observe such restrictions (if any).