The ETF Nerds NFTs are live. (You can read their origin story here: We Are Diving into NFTs – An Intro)

As a total novice in the space, if I were to summarize this NFT experiment in a simple statement, it would be this: Crypto is fun! But if you think it’s easy, try accessing it.

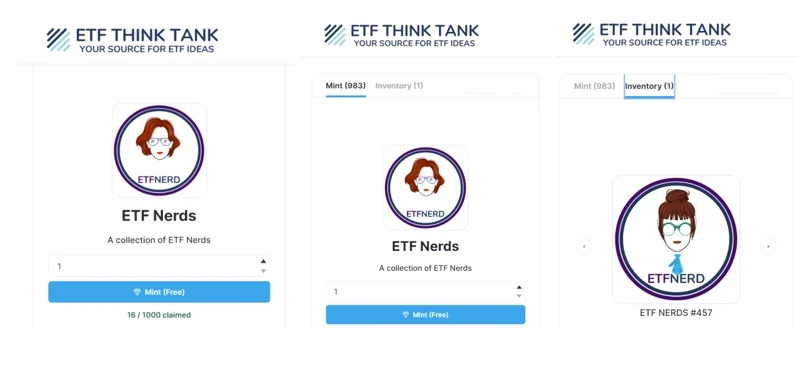

To begin at the end, check out the final product here: www.etfthinktank.com/etfnerds/. This is where the ETF Nerd NFTs can be found, all 1,000 of them.

How We Got Here

A lot of work went on under the hood to get us to this clean interface where, today, you can access our NFTs. They are recorded on the Ethereum blockchain, and are accessed through OpenSea, which is an NFT marketplace. These “venue” choices were based on the fact that these are some of the most popular, most widely used applications in the NFT space.

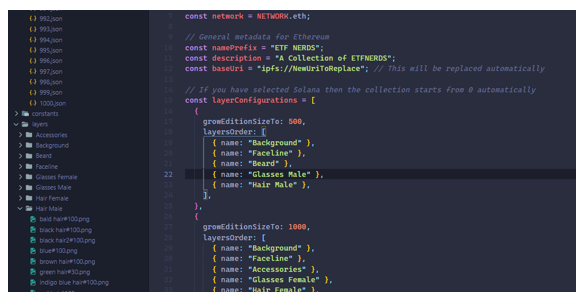

Here’s a glimpse at some of the computer code and metadata – programs we had to write – defining the traits in each ETF Nerd, and the overall process of locking that Nerd onto the blockchain (the smart contract.) It takes an expert to do it – don’t try it at home.

What Your NFT Is Made Of

The only common feature among all ETF Nerds in the collection is the white background and circle outline. NFTs are about originality, so none of the ETF Nerds are the same, each built with unique metadata that’s randomized at minting.

To make it even more interesting, we wanted to play with the concept of rarity. Rarity, in this context, refers to a layer that rarely appears in an NFT, making that NFT even more valuable. In our collection of 1,000 ETF Nerds, we selected three layers to be rare. That’s established by deploying these layers at a below-average rate, in this case, only 10% of the time per trait. They are:

- The glasses with the ETF Think Tank logo on the lenses

- The red lipstick for female Nerds

- The red tie for male Nerds

In practice, this rarity feature means that if you get a female Nerd with ETF Think Tank logo-glasses and red lips (like our collection’s poster NFT), or the male counterpart with that cool red tie, well, you’re just lucky.

This combination of randomization and rarity of features means two things. First, you don’t have any control over the NFT you get. The outcome of the minting process is an ETF Nerd like no other before. The surprise is part of the fun, and it’s also fuel for a trading opportunity, which is the second point. If you don’t like what you get, or if you want an NFT someone else got, you can trade or buy it from them. It’s easy: go ahead and make them an offer they can’t refuse. OpenSea is a marketplace, so peer-to-peer transactions are welcomed.

Interacting with NFTs doesn’t end at minting. It can go on in trading. And, for starters, it can live forever as your headshot or image in your Twitter account. Michael Venuto already figured that one out. The many applications of NFTs are still being explored.

How To Get To An NFT

To access our NFTs you need Ethereum. You may also need a healthy dose of perseverance.

Even though we are not selling the NFTs – we are sharing them for free – you are going to incur a cost known as the “gas fee” in the Ethereum blockchain. This fee, which is paid to crypto miners for making your transaction happen, fluctuates depending on traffic, for lack of a better word.

Consider that on Day 1 of minting our NFTs, we saw that fee range anywhere from $3 and $45 at different times of the day. This fluctuation is best described as surge pricing, much like the one you’d see in any on-demand type of service. To the extent that it’s possible, the only advice we can offer here is, avoid rush hour if you can.

If you don’t already have Ethereum, you need to get it.

For that, you can either on-ramp onto an exchange or onto a broker that will sell it to you, and then have that crypto moved into a digital wallet such as MetaMask (that’s a popular choice), or you need a “friend” who will send some directly to your wallet peer to peer.

This part of the experiment is personal because it depends on the route you choose, so I’ll share mine.

This was my first trip into crypto world, so I started out by reading a lot about the pros and cons of exchange access vs. broker access, and by talking to my colleagues who’ve traveled these roads before.

In the end, I opted to access crypto through an exchange because I wanted to be able to move my Ethereum around – this purchase wasn’t just about an investment for me, it was about utility. I needed it to get an NFT.

The most popular exchange, and the one said to have the easiest onboarding experience, Coinbase, was also among the most expensive at first glance. Having lived in the ETF world this long, everything about “high fee” was a deal breaker.

And yet, I went with Coinbase anyway because simplicity for first-time users was more important to me than cost given my inexperience in the space. You could say fear of getting lost had me willing to pay top dollar for a flashlight.

These kinds of moments can get you philosophical. I found myself thinking about how human emotion does drive investing decisions in ways that numbers on a page can’t quite understand.

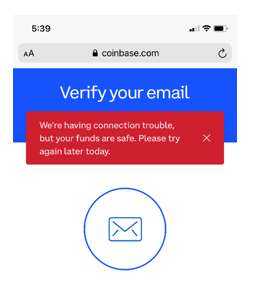

I started setting up my account – name, password, identity confirmations to satisfy the Bank Secrecy Act and Anti-Money Laundering regulations (there’s no anonymity in crypto, just so we’re clear) – and that’s when I hit the first hitch: a required email verification. The email never came. I tried again. Crickets.

Back to the drawing board I went, choosing the exchange Gemini as my next stop. Here, fees were described as convoluted by some reviewers, and not easily findable on their platform, which you could argue may be worse than high fees – they’re unclear.

Still, against my better judgment, I took the plunge. Name, password, email, address, social security number, bank account, verification code (this time it came through) – the many steps on my path to crypto access, now traveled for the second time in an evening.

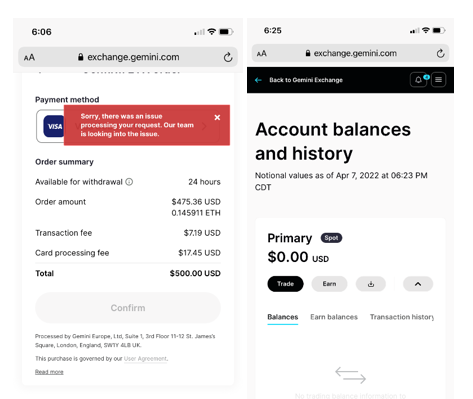

I finally arrived at the Ethereum price quote. I punched in the amount I wanted to buy ($500) and hit confirm. Then came the error message. In bright red, of course, to kill any joy as fast as possible.

Perseverance, folks. I hit refresh. Check bank account balance again. Since I used my debit account, the transaction was sitting there as “processing.” Money is gone, or is it? Gemini doesn’t seem to have it. I read FAQs. Refresh again. Still zero dollars showing up in my Gemini account. Something went wrong, but I’m not sure what.

Being a Gen-Xer, I do the only thing that makes sense: I look for a phone number to call. There isn’t one.

But there’s a support link where you can submit, through a series of pre-filled statements, what your issue is. I leave with a commitment that someone will look into your problem as soon as possible. About 90 minutes in, I call it a night, emptyhanded.

Now it’s day 2. A note from support didn’t immediately come the next day, but a welcome email did, letting me know my Gemini account was active (even though the $500 never made it from my bank account into Gemini.) I went through the steps again and easily bought some Ethereum.

An initial $500 deposit plus the $7 Gemini gives you as a reward for opening the account meant I was in possession of $479.83 worth of Ethereum. Do the math. All in all, it cost me over 5% right out of the gate.

Got The Ethereum, Next Comes The Wallet

With Ethereum at hand, I now needed a digital wallet to put it in and transact with. Downloading and setting up one is easy.

It took a couple simple steps to set up a MetaMask wallet. Security steps were interesting. For example, after you create a complex password that you’re reminded to remember at all costs – the App will not help you if you forget – you’re encouraged to “write down” a safe “Secret Recovery Phrase” that is unique to you. That phrase consists of several random words you must remember and recite in the exact same order when asked. Fascinating.

Wallet is ready, but it’s empty. Figuring out how to have some of my Gemini-custodied Ethereum brought to wallet wasn’t as easy. There was no clear path on either side to make that connection that I could find. When I eventually found what looked like a real possibility in Gemini, and tried to transfer 0.05 Ethereum to my wallet, some fine print popped up alerting me that my available balance was in fact not completed yet: “…your crypto purchase is subject to a holding period of up to 5 business days.”

Could this really be a T+5?

By now, I confess I’m getting tired. So, I try a shortcut, which in hindsight is probably where I should have started to begin with, which is by buying Ethereum directly through MetaMask via Apple Pay. That was so easy. Another $150 later, I made sure I’d have just enough Ethereum in my wallet to pay for gas.

At that point, it’s a quick process. Go back to www.etfthinktank.com/etfnerds, hit the “Connect Wallet” button, scan the QR code that appears, which immediately triggers a new application on your phone asking you to connect your wallet. Next, back on the website, hit “Mint” which you should consider carefully but quickly. This is a decision where the terms change every 30 seconds. At first, my gas fee was quoted at roughly $45. Before I hit go, gas had already jumped to $54. Think fast, and act faster.

What came next was just totally cool. Meet my one-of-a-kind ETF Nerd #457:

The Immediate Takeaway

The entire process of creating and acquiring an NFT was more complex than I had anticipated.

To some extent, these kinds of adoption hurdles are just bumps on the road in the path to innovation. We should even expect them in nascent technologies and applications. That much I get. But in that initial moment when even acquiring Ethereum seemed impossible to accomplish, I was struck by the irony of the narrative around crypto assets.

Crypto is said to be the ultimate democratizer, the solution for the underserved and the unbanked, the gateway to access. You first have to figure out how to get to it.

Whether it’s on-ramping through an exchange or a broker, or trying to get someone to send you some, or buying (another) round of crypto through the wallet directly once you know better (my recommended route for the purpose of acquiring NFTs, by the way), the lesson here is that being your own bank is no easy task. There’s no one to call for support.

DeFi may disrupt, displace and improve a lot of what we know as TradFi today – it seems to have already killed TradPhoneLines – but actual decentralization is not easy. Especially for an impatient Gen-Xer.

The NFTs, however, are indeed really fun. I can’t wait to figure out what to do with #457. We hope you will mint your own ETF Nerd and drop us a line to share with us your experience.

Disclosure

All investments involve risk, including possible loss of principal.

This material is provided for informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

The value of investments and the income from them can go down as well as up and investors may not get back the amounts originally invested, and can be affected by changes in interest rates, in exchange rates, general market conditions, political, social and economic developments and other variable factors. Investment involves risks including but not limited to, possible delays in payments and loss of income or capital. Neither Toroso nor any of its affiliates guarantees any rate of return or the return of capital invested. This commentary material is available for informational purposes only and nothing herein constitutes an offer to sell or a solicitation of an offer to buy any security and nothing herein should be construed as such. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested, and nothing herein should be construed as a guarantee of any specific outcome or profit. While we have gathered the information presented herein from sources that we believe to be reliable, we cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed herein are our opinions and are current only as of the date of distribution, and are subject to change without notice. We disclaim any obligation to provide revised opinions in the event of changed circumstances.

The information in this material is confidential and proprietary and may not be used other than by the intended user. Neither Toroso or its affiliates or any of their officers or employees of Toroso accepts any liability whatsoever for any loss arising from any use of this material or its contents. This material may not be reproduced, distributed or published without prior written permission from Toroso. Distribution of this material may be restricted in certain jurisdictions. Any persons coming into possession of this material should seek advice for details of and observe such restrictions (if any).