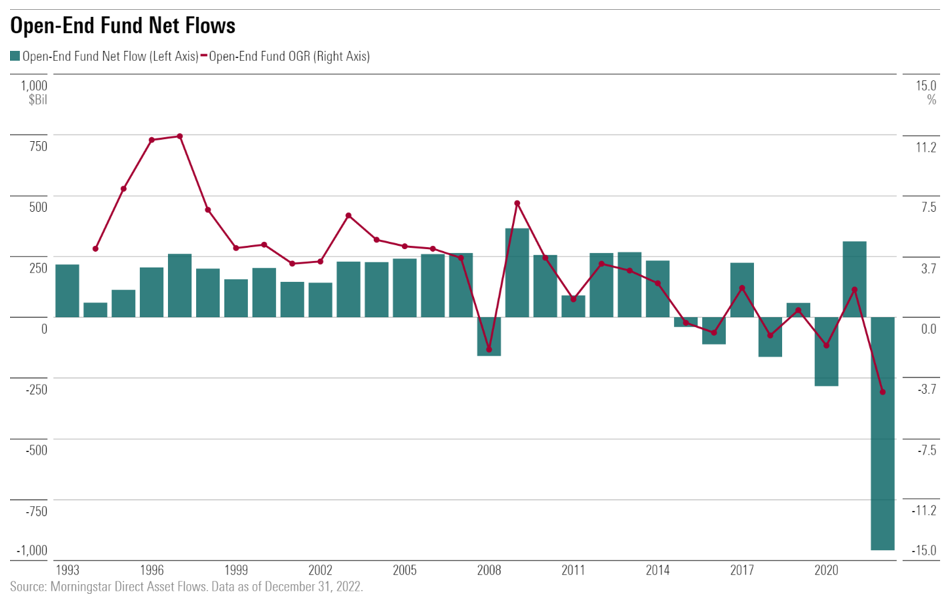

Much has been written since January 2023 about how investors voted with their feet in 2022 to the tune of almost a trillion. The breakdown is well covered by Morningstar’s Adam Sabban, CFA, and Ryan Jackson in an article, “U.S Fund Flows: Investors Bail.” Simply put, a bear market in fixed income and equities on top of tax distributions forced action from investors and their financial advisors. Moreover, the relatively weak performance by active portfolio managers was the final straw for many. What has not been so clear is that actively managed ETFs have accelerated over cheap beta in terms of new launches. Arguably, this makes sense – who wants to compete just on price against Vanguard, Schwab, and Bank of New York/Mellon, who have a natural cost and distribution advantage?

Uncertain Conditions Will Lead to More Changes

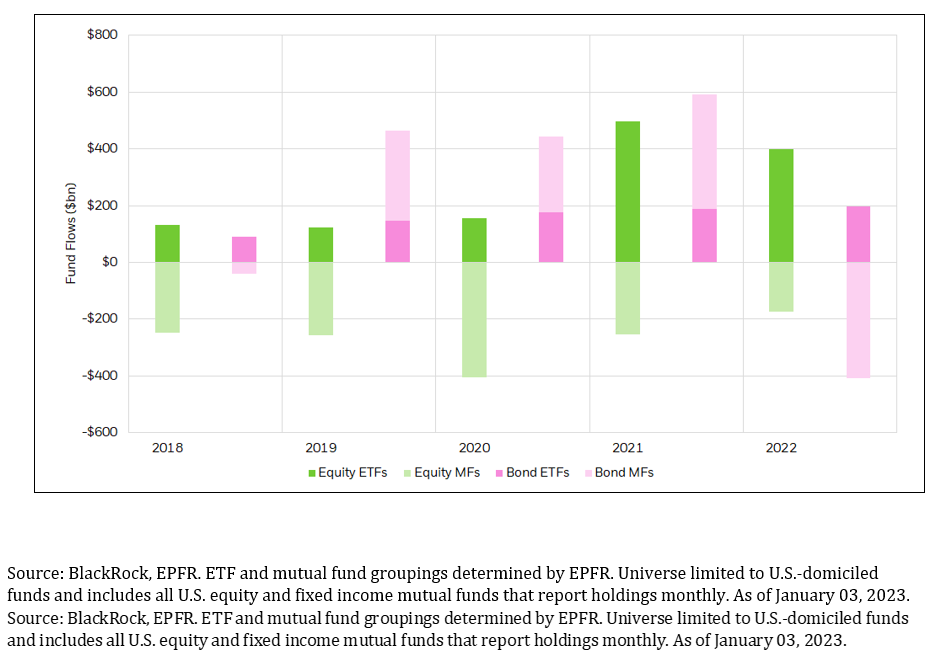

However, with more money in motion than ever before in 2022, these same advisors and investors are now looking at ETFs in a different light and are arguably even more inclined to make additional changes in 2023. Simply put, despite Warren Buffet’s call for patience in his latest Shareholders Letter 2022, we would expect precarious economic conditions to show further shifting in asset allocation. According to Kristy Akullian, CFA at Blackrock iShares, this can also be seen by the fact that 32% of exchange trading is now ETFs (on average for the year), up from 25% in the previous 4 years. We would argue that this amount could be even larger if rebalances of underlying holdings were included. More importantly, the bifurcation of outcomes from flows between ETFs and mutual funds, since 2018, are made even more clear in the beautiful chart below, which highlights about 2x inflows in equities and fixed income ETFs vs outflows in mutual funds. Equity ETF flows (shades of green) show $400M in vs about $200 million out in mutual funds. In fixed income, Blackrock shows (shades of pink) outflows of $400M in mutual funds vs inflows of $200 million in ETFs.

ETF Innovation Accelerates in 2021 and 2022

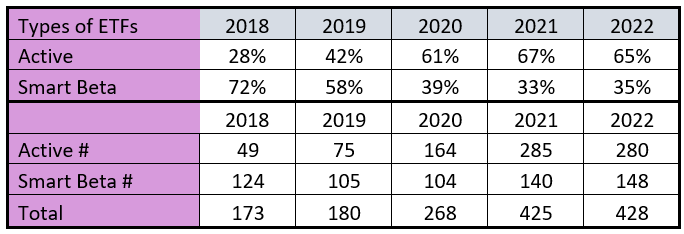

Of course, with trillions at stake, we appreciate that much has been highlighted about the positive flows into ETFs at the expense of mutual funds. This expected paradigm shift was highlighted in the June 10th 2020 “Measuring Innovation in the ETF Industry” which we are in the process of updating. However, we think it is timely to highlight what others may be missing regarding trends in new launches being more focused on active and smart beta, rather than low cost. Specifically, from 2018 to today, the number of active ETFs increased from 49 net new launches to over 280 in 2022. This is remarkable in the context of the recent two years, where actively managed ETFs amounted to 67% of new launches in 2021, and 65% of new launches in 2022. We would also note that the trend towards pricing ETFs below the average expense ratio is unsurprisingly only done about 8% to 24% of the time. This means active and smart beta charge more than the average of 19 bps about 92% to 76% of the time. We would also note that fixed income continues to be competitively priced at about 3-10 bps. At some point, one has to ask the question as an issuer – what is the point of taking all the risk to reach scale? Lastly, on the issue of pricing – as Ryan Fitzgerald points out in our Weekly KPI Summary, the Average KPI on Expense Ratios is no longer 19 bps, but rather 17 bps.

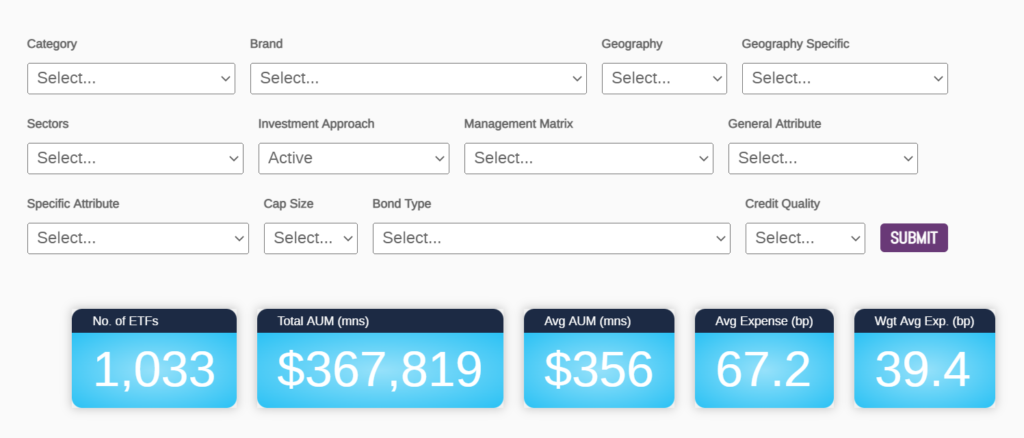

This does not mean that firms like Dimensional, Franklin, Avantis, and JP Morgan with their broad offerings do not plan to compete also by adding value through Alpha. ETF Think Tank members should note that we recently expanded the database search function on the outside of the website from just allowing Active (see Investment Approach) to also having the capability to screen across two different types of Active (see Management Matrix):

- Active/Concentrated https://etfthinktank.tidalfinancialgroup.com/etf-finder/

- Active/Semi-Diverse https://etfthinktank.tidalfinancialgroup.com/etf-finder/

The ETF (as a wrapper) has evolved and can now offer targeted single security applications. This has increased the number of ETFs and as an innovation has created very targeted opportunities for investors. Also, as frequently highlighted, we continue to see alternative strategies pushed forward by ETF entrepreneurs wrapped as active strategies.

Summary

The expected broadening out of strategies and issuers is encouraging. Investor acceptance of ETF innovation wrapped as actively managed and “smart beta” makes sense to us, as it enriches the ecosystem and investors who are willing to recognize that financial conditions have changed from the past and most likely in the future. We continue to believe that those just focused on low-cost solutions as measured by flows or assets under management (AUM) are simply missing the opportunity and frankly doing a disservice to their clients.

Disclosures

All investments involve risk, including possible loss of principal.

This material is provided for informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

The value of investments and the income from them can go down as well as up and investors may not get back the amounts originally invested, and can be affected by changes in interest rates, in exchange rates, general market conditions, political, social and economic developments and other variable factors. Investment involves risks including but not limited to, possible delays in payments and loss of income or capital. Neither Toroso nor any of its affiliates guarantees any rate of return or the return of capital invested. This commentary material is available for informational purposes only and nothing herein constitutes an offer to sell or a solicitation of an offer to buy any security and nothing herein should be construed as such. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested, and nothing herein should be construed as a guarantee of any specific outcome or profit. While we have gathered the information presented herein from sources that we believe to be reliable, we cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed herein are our opinions and are current only as of the date of distribution, and are subject to change without notice. We disclaim any obligation to provide revised opinions in the event of changed circumstances.

The information in this material is confidential and proprietary and may not be used other than by the intended user. Neither Toroso or its affiliates or any of their officers or employees of Toroso accepts any liability whatsoever for any loss arising from any use of this material or its contents. This material may not be reproduced, distributed or published without prior written permission from Toroso. Distribution of this material may be restricted in certain jurisdictions. Any persons coming into possession of this material should seek advice for details of and observe such restrictions (if any).