COVID-19 is Back: Cultural Differences and Markets

- What’s at Risk: An 18 Month View of a Post Covid-19 World

- ETF Innovation and solutions

- As the Central banks flush the system with cash, individual savings rates are spiking.

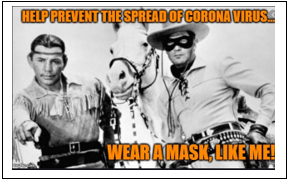

Reopening the economy was a necessary decision, but how prepared are we for the implications of the new “Masked World?” History has proven that bringing an entire government, business or social structure together against a common enemy is not always easy. As we push forward on this July 4th weekend, we hope everyone will put aside their differences and responsibly wear a mask.

We all would agree that less spread of COVID-19 and a smaller death toll should indicate success in the current battle. Beyond that, investors and fiduciaries should address the reality that conditions, risks and personal circumstances have changed for the foreseeable future. This is not a call to re-test the market lows, nor is it a prediction about a new liquidity bull run. Rather, it is a call to action for investors to take a more targeted approach. This call to action stems from new lows in interest rates, Central Bank’s coordinate support of markets, and inflated market multiples.

A 20% Portfolio Allocation to ETF Innovation Brings Targeted and Differentiated Solutions

A 20% targeted approach with an allocation towards ETF innovation can offer three things: the prospects of Access to differentiated investment solutions that may help diversify a portfolio risk, a search for Alpha with alternative approaches to themes, or Active Management that provides high active share. In recognition of changes in the economy and how business will operate, we were excited to see that over 34 new ETFs have been launched in June, and many are very targeted with high active share and less than 25% ETF overlap.

- Direxion launched the Work From Home ETF (WFH) and appears to have attracted almost $20 million since its launch on June 25, 2020.

- Round Hill launched the Betting and Gaming ETF (BETZ) and has attracted $85 million since its launch on June 4, 2020.

- ETFMG launched the Treatments, Testing and Advancements ETF (GERM) on June 17, 2020.

In June, the big AUM winner is a surprise ETF invested in Treasuries (FLGV) sponsored by Franklin Liberty. With a 9 BPS Net Expense Ratio after fee waivers, this Low Cost Solution is also actively managed. This ETF may fall more in the “index plus” camp, because while it plans to operate with a low tracking error to the Bloomberg Barclays Treasury Index, it also can buy TIPs and Federal Agencies. Franklin now offers 44 ETFs across a $6 billion platform, and is not shy about the bring your own assets (BYOA) strategy, or about making acquisitions where it seems appropriate. Franklin recently agreed to buy AdvisorEngine and will be closing on the Legg Mason acquisition probably in Q3. Legg Mason controls Precidian, the ActiveShare solution for fund managers who want to launch ETFs but don’t want to be fully transparent with their portfolio holdings.

What’s At Risk: An 18 Month View of a Post-COVID World

In light of the various outcomes of COVID-19, we found the Iman Ghosh article, titled “What’s At Risk: An 18 -Month View of a Post-COVID World,” important to highlight. In the article, Ghosh uses the data from a recent World Economic Forum, created by 347 risk analysts in order to rank the likelihood of major risks we face in the aftermath of the pandemic. The survey was completed between April 1st and April 13th, 2020. Given the valuation may have less to do with the market surveyed audience, it is no surprise that an economic decline is the highest concern, and categorized as having the highest probable outcome from a risk standpoint. It also supports why investors need to be more targeted in their approach, and arguably why performance. Investors should be willing to pay high multiples for companies in the right segment of the economy and business paradigm shift. Let’s face it – no one knows how long COVID-19 will be around, so paying to be in the correct industry or theme makes some sense. Moreover, in a decline, it is reasonable to expect a faster rebound in the areas that have the strongest business outlook.

Of course, back in April, everyone was concerned with the possibility of another COVID-19 outbreak (30.8% of those surveyed ranked this concern at #10). Yet, the risk still seemed low compared to concerns about the deepness of an economic contraction – this risk was measured at about 68%. What was surprisingly not a big concern of those surveyed was the social anxiety that has clearly followed. Attendees of our May 8th Marc Faber Get Think Tanked Happy Hour may recall the discussion about the Fed’s future problem of social unrest. The fact is, too many economists and risk managers seem to under appreciate the social fears around civil liberty (#13), Exacerbation of mental health (#14) and a Fresh surge in inequality and social division (#15). It also highlights why we should expect market volatility, and why so many people now seem to have tons of cash on the sidelines. We would encourage everyone to read this survey and article closely (link).

Record Cash, Liquidity = Trading Range

According to a Bloomberg article, Americans are hoarding cash, Central Banks are pumping liquidity into the system, and COVID-19 isn’t going away any time soon. Arguably, this may lead markets within a trading range of 10-20% for the foreseeable future. The media may find this boring to talk about, but investors would certainly find some relief, and let’s face it – we all could use some calm. The fact is, hoarding cash isn’t good for the economy, but it may be good for the soul.

We will be taking a holiday break this week in the Get Think Tanked Happy Hour, but hope you will join us on July 9th with our special guest Katie Stockton of Fairlead Strategies. Here is the link to sign up.

Happy Fourth of July! Be safe!