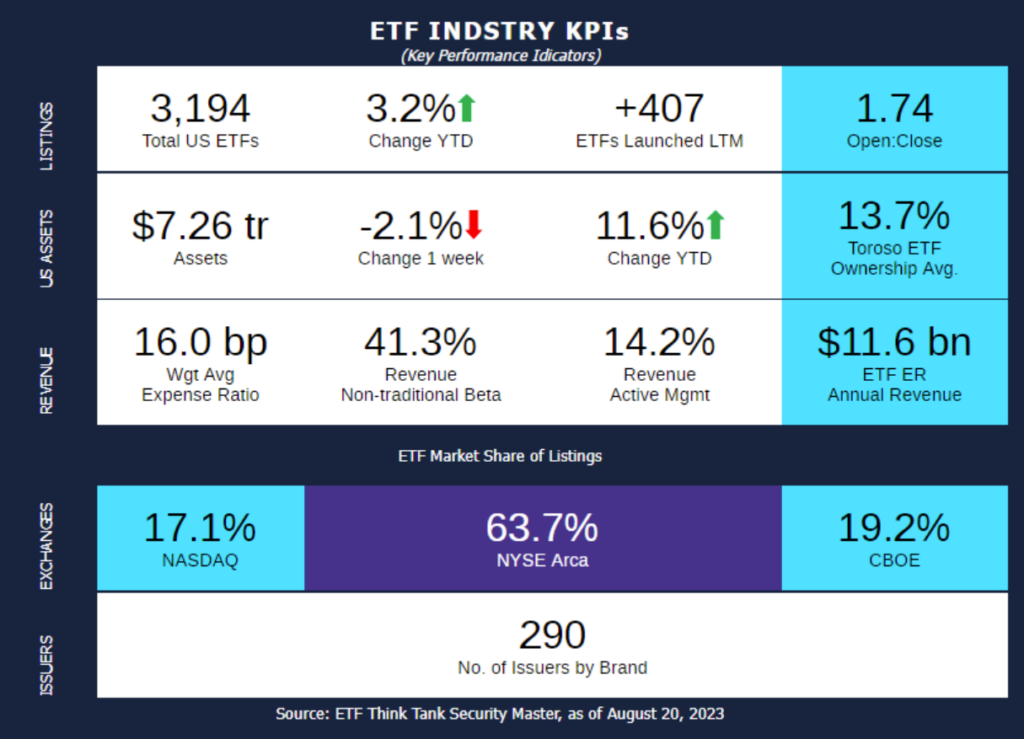

Week of August 14, 2023 KPI Summary

- This week, the industry experienced 7 ETF launches and 4 closures, shifting the 1-year Open-to-Close ratio to 1.74 and total US ETFs to 3,194.

- Today, August 21, is National Senior Citizen Day. As of 2017, 1 in 7 Americans (around 14.5%) were senior citizens, considered age 65+, and that percentage is likely to increase. As we know, one investment strategy that is popular among senior citizens and retired Americans is owning stocks and ETFs that pay dividends. Let’s take a look at the Dividend ETFs industry and how it has fared this year thus far.

- There are about 140 Dividend ETFs on the market today with ~$372.5 billion AUM according to our Tidal ETF Classification tool.

- The top 10 funds account for $273.3 Billion (73%) of the $372.5 and have a total average daily volume of $902 Million.

- Although the average expense of the top 10 funds is approximately 24 bps, the average of the total 140 funds is 49.5 bps.

- Of the top 10 Dividend ETFs based on AUM, the largest AUM increase YTD is from #10 DGRW, WisdomTree US Quality Dividend Growth ETF, with +10.0%. The worst performer in this category is DVY, iShares Select Dividend ETF, with -5.5%.

- The largest jump in AUM of the 140 funds YTD has been SPDR® S&P Emerging Markets Dividend ETF (EDIV) at 25.8%.

- Similarly, all the top 10 funds in AUM have varied from 8.7-13.7% increase in a 3-year time period. With the rest of the 130 ETF averaging 7.8%, it looks like investors continue to prioritize these leaders of the Dividend ETF class.

- There are about 140 Dividend ETFs on the market today with ~$372.5 billion AUM according to our Tidal ETF Classification tool.

- To dig deeper into this data, visit the ETF Think Tank Classification tool.

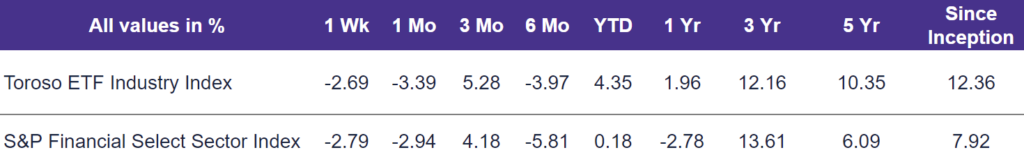

- The tracked indexes experienced a similar performance last week. The Toroso ETF Industry Index was down -2.7% while the S&P Financial Select Sector Index trailed at -2.8%.

ETF Launches

Global X Brazil Active ETF (ticker: BRAZ)

Global X India Active ETF (ticker: NDIA)

Madison Dividend Value ETF (ticker: DIVL)

YieldMax COIN Option Income Strategy ETF (ticker: CONY)

Strive Total Return Bond ETF (ticker: STXT)

Tema Global Royalties ETF (ticker: ROYA)

Tema Oncology ETF (ticker: CANC)

ETF Closures

2ndVote Society Defended ETF (ticker: EGIS)

2ndVote Life Neutral Plus ETF (ticker: LYFE)

NightShares 2000 ETF (ticker: NIWM)

NightShares 500 ETF (ticker: NSPY)

Fund/Ticker Changes

GraniteShares XOUT U.S. Large Cap ETF (ticker: XOUT)

became GraniteShares Nasdaq Select Disruptors ETF (ticker: DRUP)

TETF.Index Performance vs. S&P Financial Select Sector Index

(as of August 18, 2023)

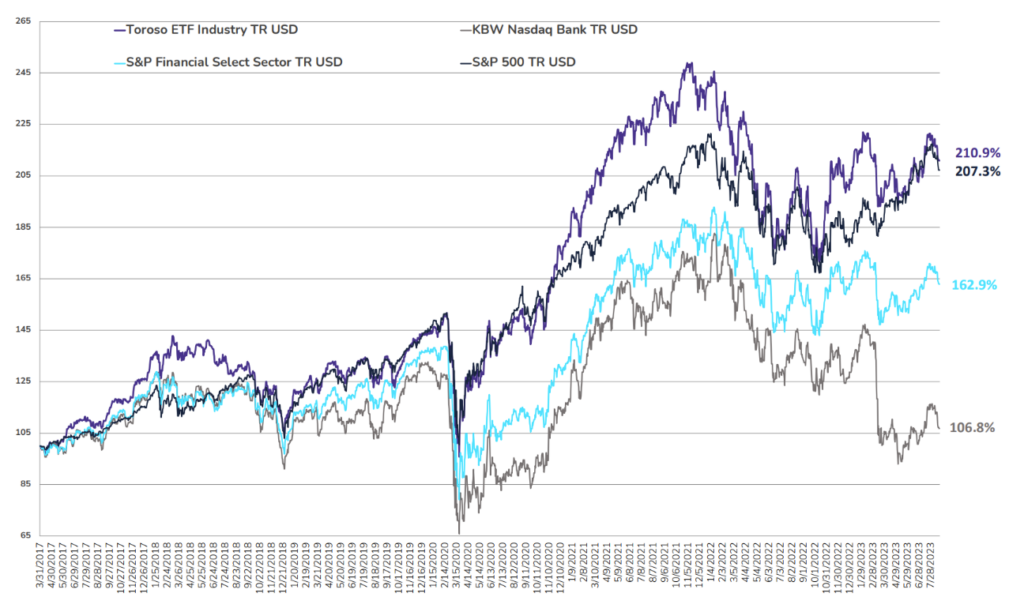

TETF.Index Performance vs. Other Leading Financial Indices

(March 31, 2017 through August 18, 2023)

Why Follow the ETF Industry KPIs

The team at Toroso Investments began tracking the ETF Industry Key Performance Indicators (KPI’s) in the early 2000’s and have been consistently reporting on, and analyzing these metrics ever since. The table above was the impetus for the creation of the TETF.Index, the index that tracks the ETF industry. Each week, we will share the statistics we believe to be the most useful for identifying industry trends, in addition to the performance of the TEFT.Index.

DISCLAIMER

Past performance is no guarantee of future returns. This article is for informational and educational purposes only; is not intended to constitute legal, tax, accounting or investment advice; and does not constitute an offer to sell or a solicitation of an offer to buy any security or service. Furthermore, the Indexes shown above are not investable. While Toroso has gathered the information presented from sources that it believes to be reliable, Toroso cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed are Toroso’s opinions and do not reflect the opinions of any affiliates or related persons. All opinions are current only as of the date of initial publication and are subject to change without notice. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested.