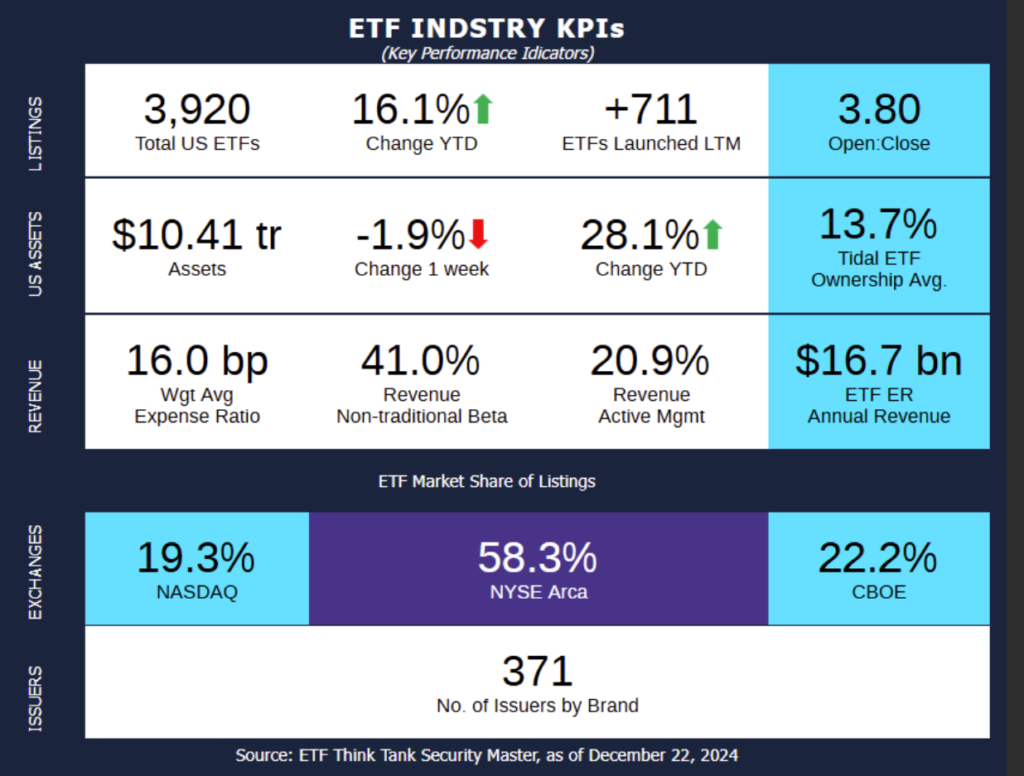

Week of December 16, 2024 KPI Summary

The ETF industry had a busy week before the holiday season, highlighted by 31 Launches, 5 ETF Ticker Changes, and 10 Closures.

- The current 1 Year ETF Open-to-Close ratio rose to 3.80.

- The total number of US ETFs further increased to 3,920.

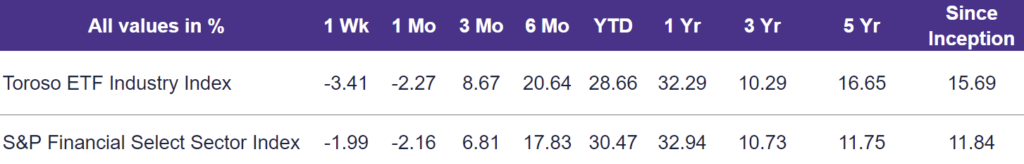

Our Toroso ETF Industry Index, which tracks companies generating revenue from the ETF ecosystem, fell 3.41% last week, underperforming the S&P Financial Select Sector Index, which fell by 1.99%.

ETF activity from the past week includes:

Pacer Expands Cash Cows Series: Building on the success of Pacer’s Cash Cows 100, Pacer has launched the US Cash Cows Bond ETF (MILK), a corporate bond strategy designed to enhance portfolio yield. MILK takes a unique approach by targeting companies with high free cash flow and cash flow margins, selecting bonds across the credit spectrum rather than relying solely on credit ratings. This strategy provides investors with a fixed-income solution that leverages the strengths of Pacer’s Cash Cows Series.

Cambria Launches Tax-Efficient ETF: Cambria has introduced the Tax Aware ETF (TAX), targeting U.S. stocks with value and quality traits while minimizing dividend yields and taxable gains. Launched with $27 million in seed funding, TAX offers investors a tax-efficient solution through the ETF wrapper, addressing challenges in traditional tax-loss harvesting.

Osprey Launches First U.S. Publicly Traded BNB Crypto Fund: Osprey Funds has introduced the Osprey BNB Chain Trust, (OBNB). As the first U.S. publicly traded fund based on BNB, the native token of the BNB Chain, it offers a rare way for U.S. investors to access BNB through traditional brokerage and IRA accounts.

ETF Launches

Alpha Architect Aggregate Bond ETF (ticker: BOXA)

BeeHive ETF (ticker: BEEX)

Cambria Tax Aware ETF (ticker: TAX)

Coastal Compass 100 ETF (ticker: ROPE)

Eventide US Market ETF (ticker: EUSM)

First Eagle Global Equity ETF (ticker: FEGE)

First Eagle Overseas Equity ETF (ticker: FEOE)

FIS Bright Portfolios Focused Equity ETF (ticker: BRI)

Frontier Asset Absolute Return ETF (ticker: FARX)

Frontier Asset Core Bond ETF (ticker: FCBD)

Frontier Asset Global Small Cap Equity ETF (ticker: FGSM)

Frontier Asset Opportunistic Credit ETF (ticker: FOPC)

Frontier Asset Total International Equity ETF (ticker: FINY)

Frontier Asset U.S. Large Cap Equity ETF (ticker: FLCE)

Global X U.S. Electrification ETF (ticker: ZAP)

GraniteShares YieldBOOST TSLA ETF (ticker: TSYY)

Harbor Osmosis Emerging Markets Resource Efficient ETF (ticker: EFFE)

John Hancock Core Bond ETF (ticker: JHCR)

John Hancock Core Plus Bond ETF (ticker: JHCP)

LSV Disciplined Value ETF (ticker: LSVD)

Neuberger Berman Growth ETF (ticker: NBGX)

Neuberger Berman Total Return Bond ETF (ticker: NBTR)

North Square RCIM Tax-Advantaged Preferred & Income Securities ETF (ticker: QTPI)

Osprey BNB Chain Trust (ticker: OBNB)

Pacer Solactive Whitney Future of Warfare (ticker: FOWF)

Pacer US Cash Cows Bond ETF (ticker: MILK)

Return Stacked Bonds & Merger Arbitrage ETF (ticker: RSBA)

WEBs Defined Volatility QQQ ETF (ticker: DVQQ)

WEBs Defined Volatility SPY ETF (ticker: DVSP)

YieldMax Dorsey Wright Featured 5 Income ETF (ticker: FEAT)

YieldMax Dorsey Wright Hybrid 5 Income ETF (ticker: FIVY)

ETF Closures

Grayscale Future of Finance ETF (ticker: GFOF)

Harbor Disruptive Innovation ETF (ticker: INNO)

Harbor Energy Transition Strategy ETF (ticker: RENW)

Invesco BulletShares 2024 Municipal Bond ETF (ticker: BSMO)

Invesco BulletShares 2024 Corporate Bond ETF (ticker: BSCO)

Invesco BulletShares 2024 High Yield Corporate Bond ETF (ticker: BSJO)

iShares iBonds 2024 Term High Yield and Income ETF (ticker: IBHD)

iShares iBonds December 2024 Term Corporate ETF (ticker: IBDP)

iShares iBonds December 2024 Term Treasury ETF (ticker: IBTE)

LHA Market State Alpha Seeker ETF (ticker: MSVX)

Fund/Ticker Changes

Donoghue Forlines Risk Managed Inovation ETF (ticker: DFNV)

became Abacus FCF Innovation Leaders ETF (ticker: ABOT)

Donoghue Forlines Tactical High Yield ETF (ticker: DFHY)

became Abacus Tactical High Yield ETF (ticker: ABHY)

Donoghue Forlines Yield Enhanced Real Asset ETF (ticker: DFRA)

became Abacus FCF Real Assets Leaders ETF (ticker: ABLD)

FCF International Quality ETF (ticker: TTAI)

became Abacus FCF International Leaders ETF (ticker: ABLG)

FCF US Quality ETF (ticker: TTAC)

became Abacus FCF Leaders ETF (ticker: ABFL)

TETF.Index Performance vs. S&P Financial Select Sector Index

(as of December 20, 2024)

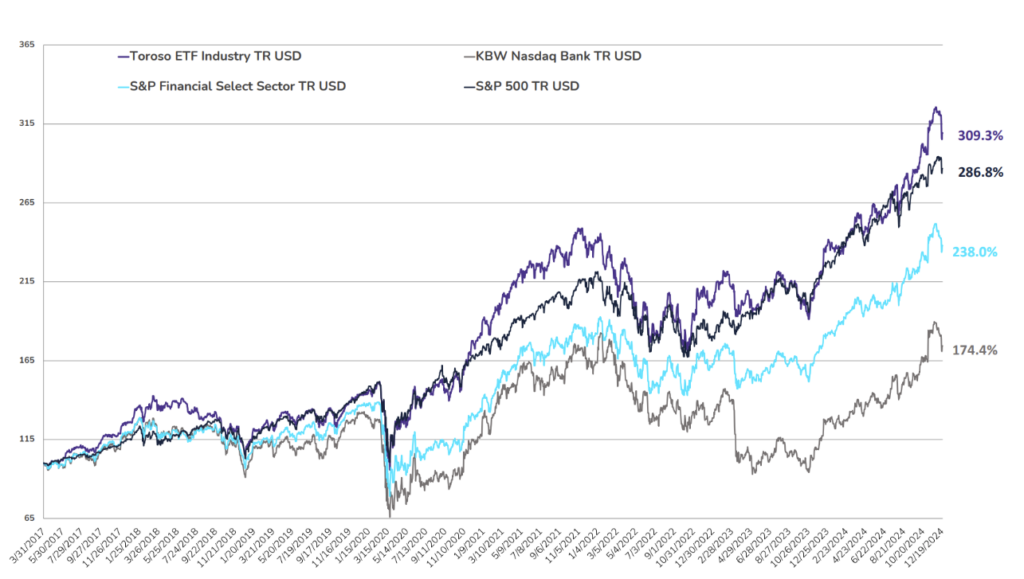

TETF.Index Performance vs. Other Leading Financial Indices

(March 31, 2017 through December 20, 2024)

Why Follow the ETF Industry KPIs

The team at Tidal Investments, originally operating as Toroso Investments, began tracking the ETF Industry Key Performance Indicators (KPIs) in the early 2000s and have been consistently reporting on, and analyzing these metrics ever since. This diligent tracking was the catalyst for the creation of the TETF.Index, an index that tracks the ETF industry. Now, as part of the Tidal Financial Group, which is affiliated with Tidal Investments, LLC, we are positioned to provide even more in-depth analysis and insights. Each week, we will share the statistics we believe to be the most useful for identifying industry trends, in addition to the performance of the TETF.Index.

DISCLAIMER

Past performance is no guarantee of future returns. This article is for informational and educational purposes only; is not intended to constitute legal, tax, accounting, or investment advice; and does not constitute an offer to sell or a solicitation of an offer to buy any security or service. Furthermore, the Indexes shown above are not investable. While Tidal Investments, LLC (formerly known as Toroso Investments, LLC) has gathered the information presented from sources that it believes to be reliable, Tidal Investments, LLC cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed are Tidal Investments, LLC’s opinions and do not reflect the opinions of any affiliates or related persons. All opinions are current only as of the date of initial publication and are subject to change without notice. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested.