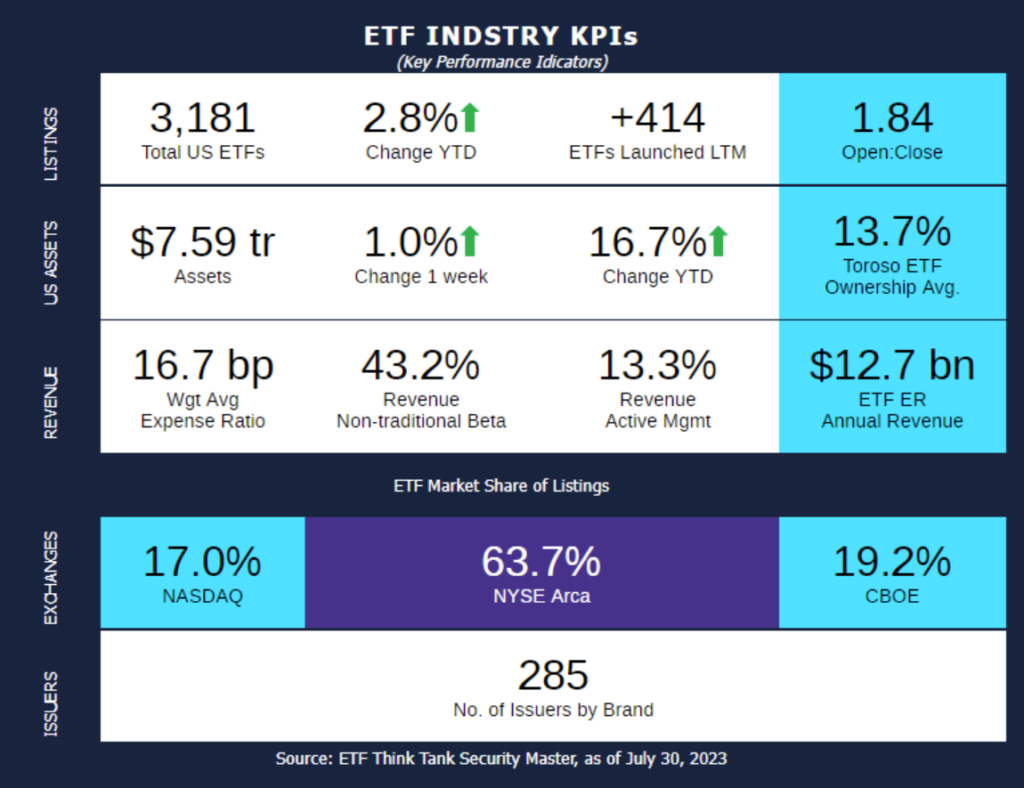

Week of July 24, 2023 KPI Summary

This was a big week for exchange-traded product closures. We saw Barclays delist 21 iPath ETNs, and 4 ETFs from providers including First Trust, Amplify, and Natixis also shuttered this week. The 25 closures stood in stark contrast to the 9 fund launches, helping push the open-to-close ratio well below 2.

Closures are typically seen as a sign of an ETF market that’s maturing – it’s a competitive landscape battling for investor assets, and sometimes funds don’t survive.

About the iPath ETNs:

- The move to delist nearly half its lineup of notes came as no surprise given Barclays’ recent struggles with that business. It has been widely reported that an internal paperwork issue associated with these products last year resulted in massive losses to the bank.

- An ETN is an unsecured debt note that doesn’t actually hold any securities – it simply tracks an index or an asset. Counterparty risk is a big component of user experience in this product, and when banks struggle, that quickly becomes apparent.

- ETN closures have been a quiet but steady trend in the ETF landscape, with many calling for their eventual extinction. There are fewer than 80 ETNs currently trading in the U.S. today in an exchange-traded product market approaching 3,200 funds – it’s a really small sliver of the market.

About the 4 ETFs:

- A look back at ETF closures shows that ETFs that don’t make it for lack of asset gathering tend to close in their first 3 years in the marketplace.

- Surviving the 3-year-mark is a good prospect for the future. But this is not a business for guarantees. In fact, of the 4 ETFs being shuttered this week, 2 were under 3 years old, but 2 had longer track records and still struggled to find a solid asset base.

Among fund launches, we continue to see proliferation of options-heavy strategies designed to generate outsized income or buffered protection to the downside.

ETF Launches

YieldMax AMZN Option Income Strategy ETF (ticker: AMZY)

Global X Dow 30 Covered Call & Growth ETF (ticker: DYLG)

YieldMax META Option Income Strategy ETF (ticker: FBY)

BrandywineGLOBAL – U.S. Fixed Income ETF (ticker: USFI)

FT Cboe Vest U.S. Equity Moderate Buffer ETF – July (ticker: GJUL)

YieldMax GOOG Option Income Strategy ETF (ticker: GOOY)

PGIM AAA CLO ETF (ticker: PAAA)

PGIM Short Duration Multi-Sector Bond ETF (ticker: PSDM)

FT Cboe Vest U.S. Equity Enhanced & Moderate Buffer ETF – July (ticker: XJUL)

ETF Closures

iPath® B Bloomberg Cotton Total Return ETN (ticker: BAL)

iPath® Pure Beta Broad Commodity ETN (ticker: BCM)

First Trust BICK ETF (ticker: BICK)

Amplify Digital & Online Trading ETF (ticker: BIDS)

iPath® B Bloomberg Livestock Total Return ETN (ticker: COW)

Natixis U.S. Equity Opportunities ETF (ticker: EQOP)

EquityCompass Risk Manager ETF (ticker: ERM)

iPath® B Bloomberg Natural Gas Subindex Total Return ETN (ticker: GAZ)

iPath® S&P GSCI® Total Return ETN (ticker: GSP)

iPath® B Bloomberg Agriculture Total Return ETN (ticker: JJA)

iPath® B Bloomberg Copper Total Return ETN (ticker: JJC)

iPath® B Bloomberg Energy Total Return ETN (ticker: JJE)

iPath® B Bloomberg Grains Total Return ETN (ticker: JJG)

iPath® B Bloomberg Industrial Metals Total Return ETN (ticker: JJM)

iPath® B Bloomberg Nickel Total Return ETN (ticker: JJN)

iPath® B Bloomberg Precious Metals Total Return ETN (ticker: JJP)

iPath® B Bloomberg Softs Total Return ETN (ticker: JJS)

iPath® B Bloomberg Tin Total Return ETN (ticker: JJT)

iPath® B Bloomberg Aluminum Total Return ETN (ticker: JJU)

iPath® B Bloomberg Coffee Total Return ETN (ticker: JO)

iPath® B Bloomberg Lead Subindex Total Return ETN (ticker: LD)

iPath® B Bloomberg Cocoa Subindex Total Return ETN (ticker: NIB)

iPath® Pure Beta Crude Oil ETN (ticker: OIL)

iPath® B Bloomberg Platinum Total Return ETN (ticker: PGM)

iPath® B Bloomberg Sugar Total Return ETN (ticker: SGG)

Fund/Ticker Changes

FlexShares Quality Dividend Dynamic ETF (ticker: QDYN)

merged into FlexShares Quality Dividend Index Fund (ticker: QDF)

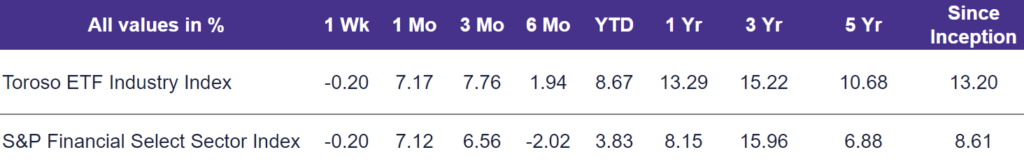

TETF.Index Performance vs. S&P Financial Select Sector Index

(as of July 28, 2023)

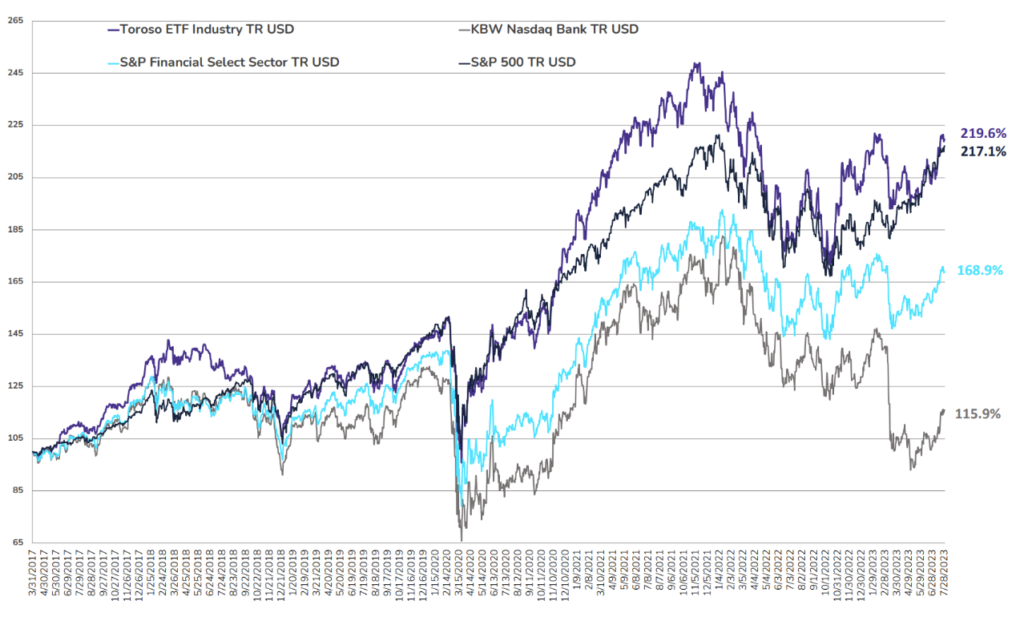

TETF.Index Performance vs. Other Leading Financial Indices

(March 31, 2017 through July 28, 2023)

Why Follow the ETF Industry KPIs

The team at Toroso Investments began tracking the ETF Industry Key Performance Indicators (KPI’s) in the early 2000’s and have been consistently reporting on, and analyzing these metrics ever since. The table above was the impetus for the creation of the TETF.Index, the index that tracks the ETF industry. Each week, we will share the statistics we believe to be the most useful for identifying industry trends, in addition to the performance of the TEFT.Index.

DISCLAIMER

Past performance is no guarantee of future returns. This article is for informational and educational purposes only; is not intended to constitute legal, tax, accounting or investment advice; and does not constitute an offer to sell or a solicitation of an offer to buy any security or service. Furthermore, the Indexes shown above are not investable. While Toroso has gathered the information presented from sources that it believes to be reliable, Toroso cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed are Toroso’s opinions and do not reflect the opinions of any affiliates or related persons. All opinions are current only as of the date of initial publication and are subject to change without notice. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested.