Week of October 14, 2024 KPI Summary

During the third week of October, the ETF industry saw 4 new launches, 2 ticker changes, and 1 fund closure.

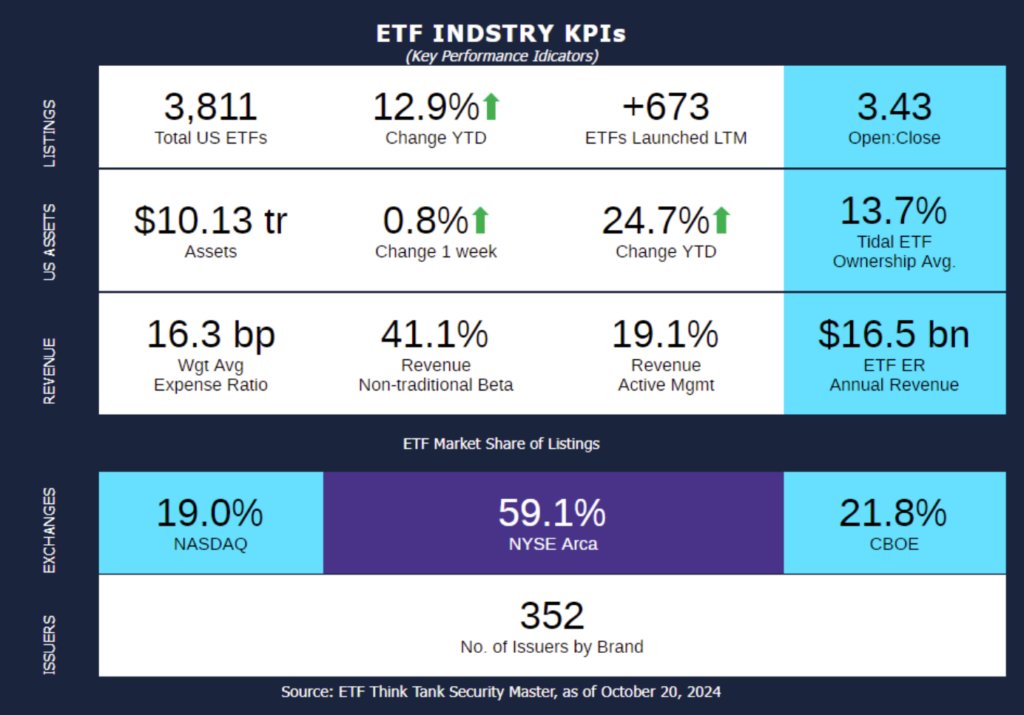

- The current 1 Year ETF Open-to-Close ratio sits at 3.43.

- The total number of US ETFs has risen to 3,811.

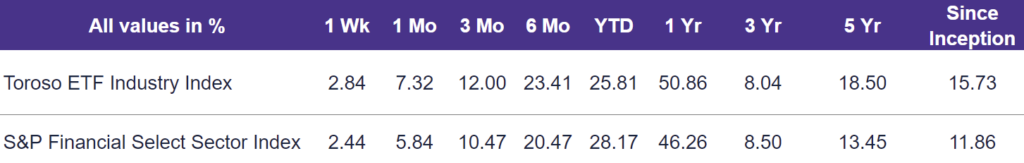

Our Toroso ETF Industry Index, which tracks companies generating revenue from the ETF ecosystem, rose 2.84% last week, outperforming the S&P Financial Select Sector Index, which rose by 2.44%.

ETF activity from the past week includes:

- Bitcoin ETF Spin-offs Continue:

- STKD, short for Stacked, launched STKD Bitcoin & Gold a new ETF, seeking to provide 100% exposure to both bitcoin and gold strategies for every dollar invested. The bitcoin strategy focuses on price returns through bitcoin futures and ETPs, while the gold strategy targets gold price returns via investments in gold futures and ETPs.

- The NEOS Bitcoin High Income ETF (BTCI) combines bitcoin exposure with a covered call strategy designed to benefit from high volatility. For investors with a risk tolerance for bitcoin, BTCI offers the potential for enhanced returns through high income generation. The fund actively manages its portfolio, investing in bitcoin ETPs, bitcoin futures ETFs, and options contracts, while using a covered call strategy to generate monthly income.

- BlackRock to rebrand ETFs into iShares: BlackRock Inc. will rebrand 22 of its 26 active ETFs under the iShares name. According to a recent SEC filing, this change will integrate the affected funds into BlackRock’s broader iShares lineup, which already includes 420 ETFs.

ETF Launches

NEOS Bitcoin High Income ETF (ticker: BTCI)

STKD Bitcoin & Gold ETF (ticker: BTGD)

Virtus KAR Mid-Cap ETF (ticker: KMID)

Ned Davis Research 360 Dynamic Allocation ETF (ticker: NDAA)

ETF Closures

VanEck Dynamic High Income ETF (ticker: INC)

Fund/Ticker Changes

BlackRock Future US Themes ETF (ticker: BTHM)

became iShares U.S. Thematic Rotation Active ETF (ticker: THRO)

BlackRock Short-Term CA Muni Bond ETF (ticker: CALY)

became iShares Short-Term CA Muni Active ETF (ticker: CALI)

TETF.Index Performance vs. S&P Financial Select Sector Index

(as of October 18, 2024)

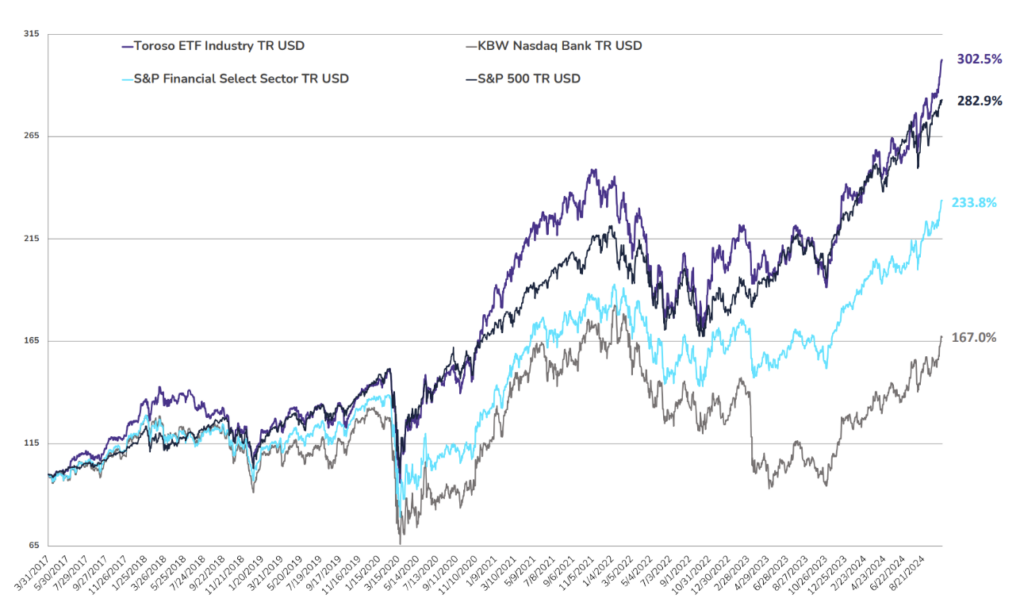

TETF.Index Performance vs. Other Leading Financial Indices

(March 31, 2017 through October 18, 2024)

Why Follow the ETF Industry KPIs

The team at Tidal Investments, originally operating as Toroso Investments, began tracking the ETF Industry Key Performance Indicators (KPIs) in the early 2000s and have been consistently reporting on, and analyzing these metrics ever since. This diligent tracking was the catalyst for the creation of the TETF.Index, an index that tracks the ETF industry. Now, as part of the Tidal Financial Group, which is affiliated with Tidal Investments, LLC, we are positioned to provide even more in-depth analysis and insights. Each week, we will share the statistics we believe to be the most useful for identifying industry trends, in addition to the performance of the TETF.Index.

DISCLAIMER

Past performance is no guarantee of future returns. This article is for informational and educational purposes only; is not intended to constitute legal, tax, accounting, or investment advice; and does not constitute an offer to sell or a solicitation of an offer to buy any security or service. Furthermore, the Indexes shown above are not investable. While Tidal Investments, LLC (formerly known as Toroso Investments, LLC) has gathered the information presented from sources that it believes to be reliable, Tidal Investments, LLC cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed are Tidal Investments, LLC’s opinions and do not reflect the opinions of any affiliates or related persons. All opinions are current only as of the date of initial publication and are subject to change without notice. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested.