Week of May 15, 2023 KPI Summary

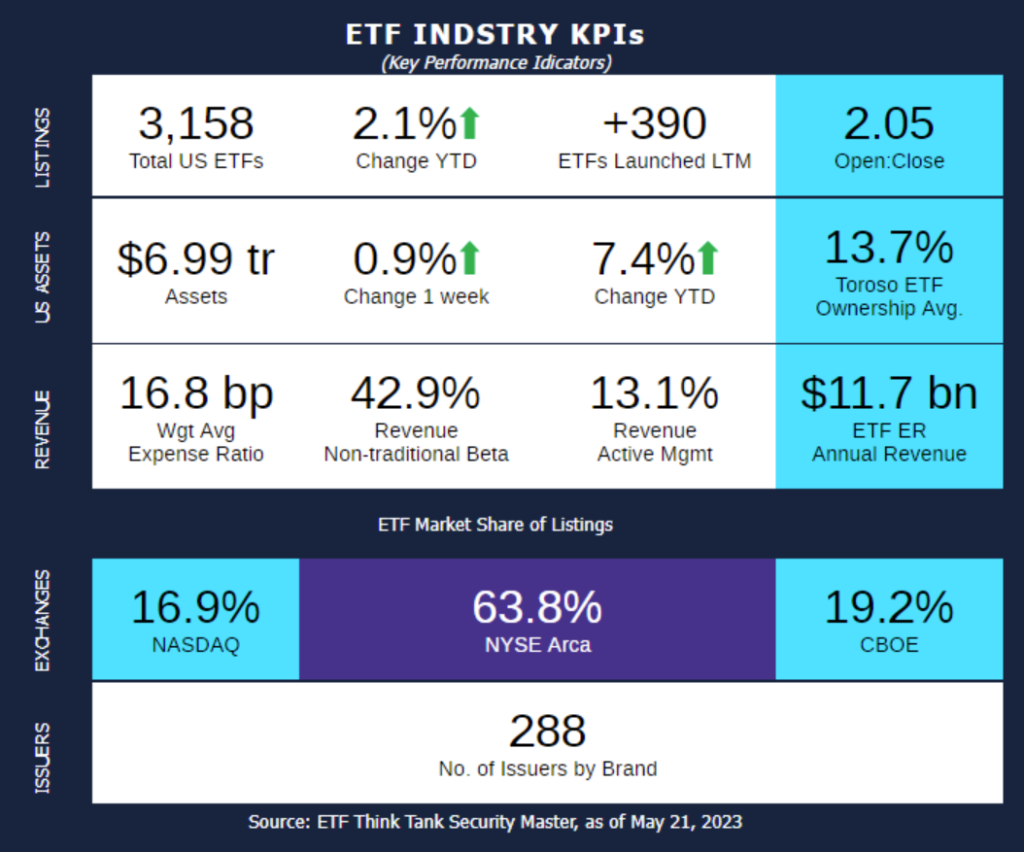

- This week, the industry experienced 7 ETF launches and 4 closures, shifting the 1-year Open-to-Close ratio to 2.05 and total US ETFs to 3,158.

- The ETF Think Tank is at the Wealth Management EDGE Conference this week. One topic that has been circulating around the conference (and global markets as a whole) is Artificial Intelligence. Let’s look at the AI ETFs and how they have fared so far this year.

- There are 14 ETFs that the Think Tank’s Security Master classifies its specific attribute as Artificial Intelligence. These 14 ETFs total $5.6 Bn with inception dates ranging from 2013 to April 2023.

- These 14 ETFs are managed by 10 different issuers.

- At a broader definition of AI, there are upwards of 36 ETFs that can be classified under Artificial Intelligence according to VettaFi.

- The largest ETF is BOTZ (Global X Robotics & Artificial Intelligence ETF) with $1.9 Bn in net assets with ROBO (Robo Global Robotics & Automation ETF) not far behind at $1.4 Bn.

- The 14 ETFs have an average YTD return of 17.2% with BOTZ leading the pack at 28.2% return.

- When looking from a 1-year outlook, the average return of the group is 7.3% and IQM (Franklin Intelligent Machines ETF) is the leader at 22.1%.

- Last week Tidal client Roundhill Investments launched Generative AI & Technology ETF (ticker: CHAT).

- There are 14 ETFs that the Think Tank’s Security Master classifies its specific attribute as Artificial Intelligence. These 14 ETFs total $5.6 Bn with inception dates ranging from 2013 to April 2023.

- There are varying opinions on the buzz and gravity of artificial intelligence. However, one thing is certain: it is investable in a great deal of ways through our ETF industry and capturing great returns in 2023 thus far.

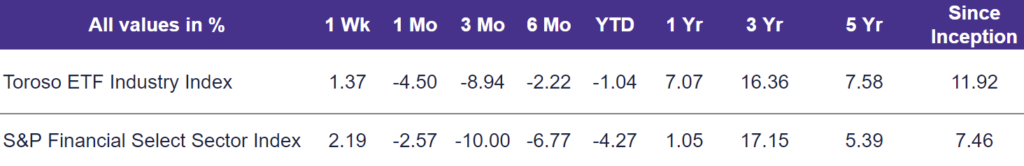

- The highlighted indexes experienced different performance last week. The Toroso ETF Industry Index was up 1.37% while the S&P Financial Select Sector Index led at 2.19%.

ETF Launches

CNIC ICE US Carbon Neutral Power Futures ETF (ticker: AMPD)

BNY Mellon Innovators ETF (ticker: BKIV)

BNY Mellon Women’s Opportunities ETF (ticker: BKWO)

Roundhill Generative AI & Technology ETF (ticker: CHAT)

Euclidean Fundamental Value ETF (ticker: ECML)

AB High Yield ETF (ticker: HYFI)

Putnam Emerging Markets Ex-China ETF (ticker: PEMX)

ETF Closures

Simplify Nasdaq 100 Plus Convexity ETF (ticker: QQC)

Simplify Nasdaq 100 Plus Downside Convexity ETF (ticker: QQD)

Simplify US Small Cap Plus Downside Convexity ETF (ticker: RTYD)

Simplify Volt Cloud & Cybersecurity Disruption ETF (ticker: VCLO)

Fund/Ticker Changes

Franklin Responsibly Sourced Gold ETF (ticker: FGLD)

became Franklin Responsibly Sourced Gold ETF (ticker: FGDL)

Mirae Asset Emerging Markets Great Consumer Fund (ticker: MICGX)

became Global X Emerging Markets Great Consumer ETF (ticker: EMC)

Mirae Asset Emerging Markets Fund (ticker: MILGX)

became Global X Emerging Markets ETF (ticker: EMM)

TETF.Index Performance vs. S&P Financial Select Sector Index

(as of May 19, 2023)

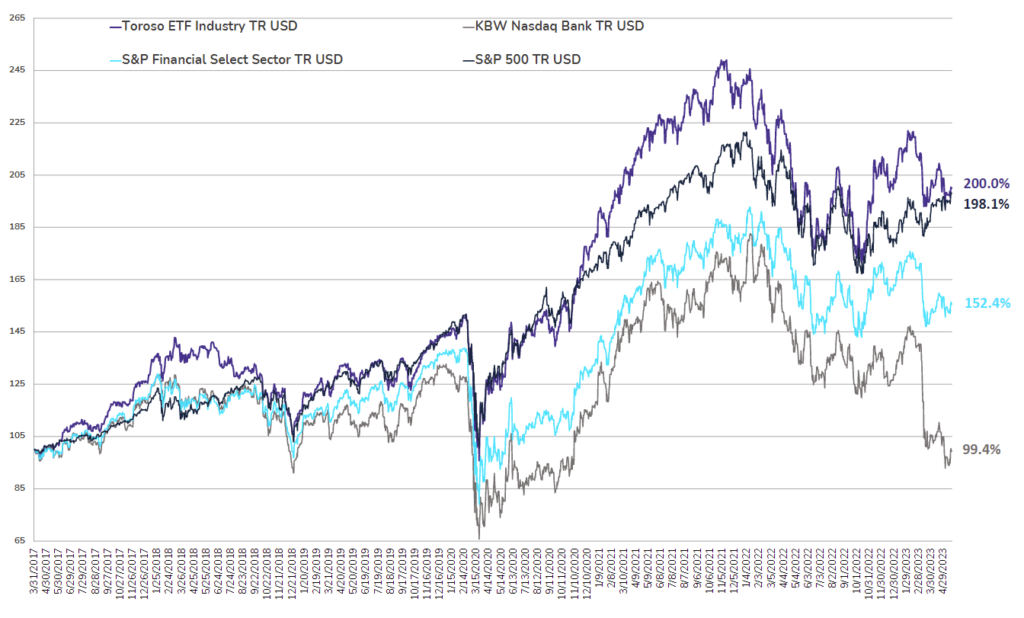

TETF.Index Performance vs. Other Leading Financial Indices

(March 31, 2017 through May 19, 2023)

Why Follow the ETF Industry KPIs

The team at Toroso Investments began tracking the ETF Industry Key Performance Indicators (KPI’s) in the early 2000’s and have been consistently reporting on, and analyzing these metrics ever since. The table above was the impetus for the creation of the TETF.Index, the index that tracks the ETF industry. Each week, we will share the statistics we believe to be the most useful for identifying industry trends, in addition to the performance of the TEFT.Index.

DISCLAIMER

Past performance is no guarantee of future returns. This article is for informational and educational purposes only; is not intended to constitute legal, tax, accounting or investment advice; and does not constitute an offer to sell or a solicitation of an offer to buy any security or service. Furthermore, the Indexes shown above are not investable. While Toroso has gathered the information presented from sources that it believes to be reliable, Toroso cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed are Toroso’s opinions and do not reflect the opinions of any affiliates or related persons. All opinions are current only as of the date of initial publication and are subject to change without notice. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested.