Financial advisors are faced today with dueling demands. On one side, clients want personalization and customization while, on the other, the business needs standardization and streamlining to scale.

The exchange-traded fund wrapper has been an interesting tool in the pursuit of meeting both those needs.

In some of our recent research, we’ve explored the ancillary benefits ETFs bring to advisory business who’ve relied on separately managed accounts for client experience. From simpler tax management to the ability to implement and manage complex strategies, to broader reach and distribution of a brand and expertise, everything from building and implementing the portfolio, to rebalancing, to trading, to reporting is easier to do through ETFs than in multiple SMAs. All without sacrificing the delivery of focused solutions to each individual client. That’s what operational streamlining looks like.

In many ways, ETF model portfolios are a logical extension of that effort.

The adoption of different models built around different outcomes can be a cost-effective path to scale and growth while still providing clients with a thoughtful, targeted experience that’s centered on their long-term goals.

To quote Joshua Wilson, head of United Ethos Advisors, “Until you streamline your investment process, consider your growth capped. To uncap, save time and effort by offering a set of pre-defined investment strategies that can be easily replicated across multiple clients with similar risk profiles and investment objectives.”

ETF model portfolios can simplify an advisor’s day to day, freeing up time to focus on other value-added activities such as relationship management, financial planning, and marketing.

“As the client base grows, model portfolios enable advisors to manage a larger number of accounts more efficiently,” Wilson said. “It’s never too early to think about scale.”

Our Models

The ETF Think Tank has long been committed to building and running ETF model portfolios as an extension of our research efforts. In fact, since the inception of the Tank around 2012, we’ve been running a lineup of ETF model portfolios in house because we believe them to be an integral tool in an advisor’s toolkit.

In a project born out of our co-founder and CIO Mike Venuto’s “infatuation with the idea of a permanent portfolio,” as he tells it, we set out to improve upon the original concept of a 60/40 mutual fund but with better vehicles and more targeted outcomes. According to Venuto, the original vision was to build “a better version” of the concept with ETFs – a vision that was the seed for what the ETF Think Tank is today.

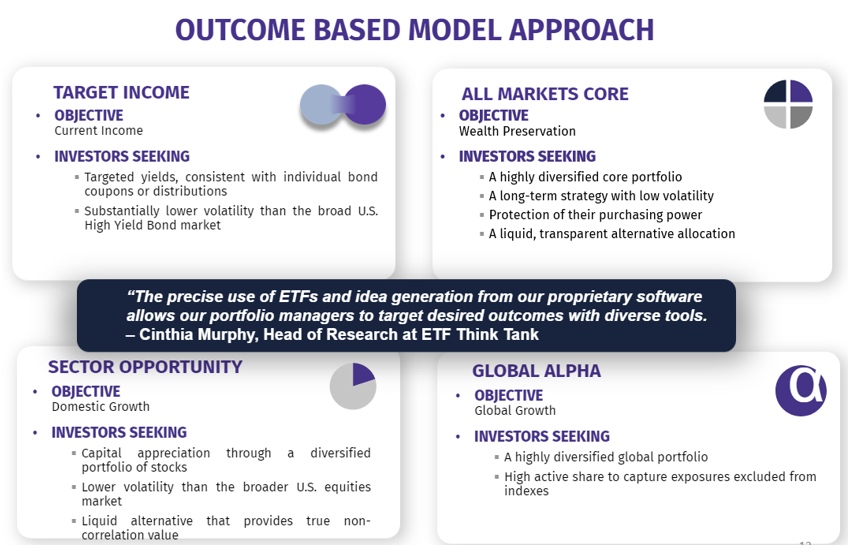

The lineup of outcome-based models consists of the following portfolios:

- Target Income Portfolio is an income strategy designed to produce a targeted yield (much like a bond) while protecting principal.

- All Markets Core Allocation Portfolio is a wealth preservation strategy designed to outpace inflation while offering a lower volatility ride relative to the U.S. market.

- Sector Opportunity is a domestic growth strategy designed to offer a diversified equity basket that’s lower vol than the broader market while also incorporating alternatives for diversification.

- Global Alpha is a global growth strategy that looks for opportunities broad benchmarks may miss.

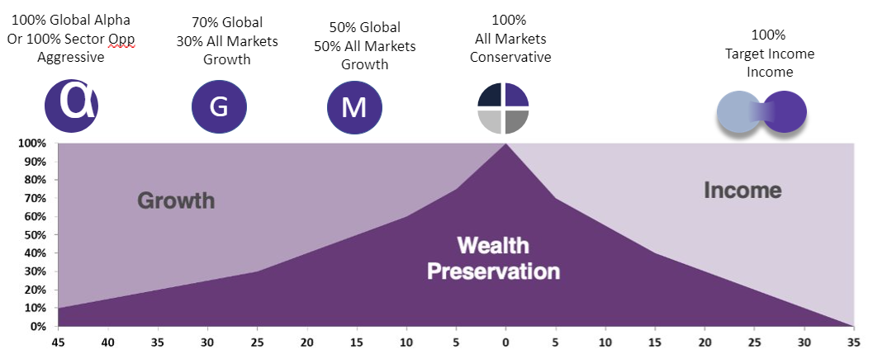

The idea is that these outcome-based models, each comprising several ETFs from different providers and brands (manager diversification), can then be implemented across a broad spectrum of risk tolerances and preferred outcomes based on a risk-centered glide path allocation philosophy. (See below)

What About Models Now

You could say that the ETF Think Tank ETF models have been in “incubation” for over a decade, building up a quiet track record in the realm of research in a corner of Tidal Financial Group’s broad umbrella of services. Why are we talking about them now? Here’s the quick story.

When it comes to ETF investing, ETF model portfolios have long been an interesting corner of the industry. Originally the playground of innovative investment managers and strategists who put together all sorts of models aimed at all sorts of investor needs, ETF model portfolios eventually became the turf of big players – the BlackRocks of the world – who stepped into the space and disrupted everyone on price thanks to scale no one could easily match.

Ironically, it was around that time that the ETF Think Tank was entering the business – a time, as Venuto recalls it, when the market wasn’t looking for models, and was unwilling to pay for them when big providers were offering them for free.

“We spent the next 10 years using all that IP, all that content to help others launch and grow ETFs,” Venuto said of the build out of the ETF Think Tank and Tidal’s white label business. “Now, we’re unique in that we’ve got track records, we’ve helped develop products, and we can offer free models where none of the products look like they’re from the same provider because they’re not, they’re all from different IPs.”

What’s new today vs. a decade ago is that today we are now in a position to share these models for free. Our hope is to make them available to anyone looking to access our way of thinking, our multi-manager approach, and our research expertise. These models use a lot of ETFs that are on Tidal’s platform, but they also use ETFs from many outside providers because our commitment is to finding the right portfolio mix for a designated outcome.

Advisor Perspective On Models

To go back to Wilson, our advisor partner who’s helming United Ethos, ETF models can have interesting utility for advisors that extend beyond the notion of outsourcing investment management. They can help streamline investment process for growth and scale, and, according to Wilson, they can also help with:

- Simplifying client communication.

“Model portfolios facilitate clear and concise communication with clients. By categorizing investments into different models, advisors can easily explain the rationale behind investment decisions and how they align with clients’ goals. This helps build trust and fosters a better understanding of the advisor’s approach.”

- Leveraging research and education for stronger marketing and messaging.

“If you want to grow, you’ve got to think about the synergy between your marketing and your investing. Model portfolios simplify this challenge because they can easily be used as a basis for educational content, webinars, or seminars. Don’t underestimate the impact of being able to more easily monitor and compare the performance of your strategies.”

New Series Tells It All

As we talk about ETF model portfolios, allow us to share one final plug, a new video series we are excited to tell you about.

Called “Captain’s Log,” we are now sitting down one-on-one with our CIO Mike Venuto to pick his brain about the latest investment themes, ETF ideas, product innovation that matters, and all of the things that make the ETF ecosystem an exciting place to be. The first episode explores the history and our take on ETF model portfolios.

You can find that episode on our YouTube channel soon. Check it out and let us know what you think. Come see what the Tank’s Captain has to say.

As always, if we can help you with your research, don’t hesitate to reach out.

Disclosure

All investments involve risk, including possible loss of principal.

The material provided here is for informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

The value of investments and the income from them can go down as well as up and investors may not get back the amounts originally invested, and can be affected by changes in interest rates, in exchange rates, general market conditions, political, social and economic developments and other variable factors. Investment involves risks including but not limited to, possible delays in payments and loss of income or capital. Neither Toroso nor any of its affiliates guarantees any rate of return or the return of capital invested. This commentary material is available for informational purposes only and nothing herein constitutes an offer to sell or a solicitation of an offer to buy any security and nothing herein should be construed as such. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested, and nothing herein should be construed as a guarantee of any specific outcome or profit. While we have gathered the information presented herein from sources that we believe to be reliable, we cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed herein are our opinions and are current only as of the date of distribution, and are subject to change without notice. We disclaim any obligation to provide revised opinions in the event of changed circumstances.

The information in this material is confidential and proprietary and may not be used other than by the intended user. Neither Toroso or its affiliates or any of their officers or employees of Toroso accepts any liability whatsoever for any loss arising from any use of this material or its contents. This material may not be reproduced, distributed or published without prior written permission from Toroso. Distribution of this material may be restricted in certain jurisdictions. Any persons coming into possession of this material should seek advice for details of and observe such restrictions (if any).