Week of July 29, 2024 KPI Summary

In the week of July 29th – August 2nd, the ETF industry experienced 19 ETF launches and 4 closures.

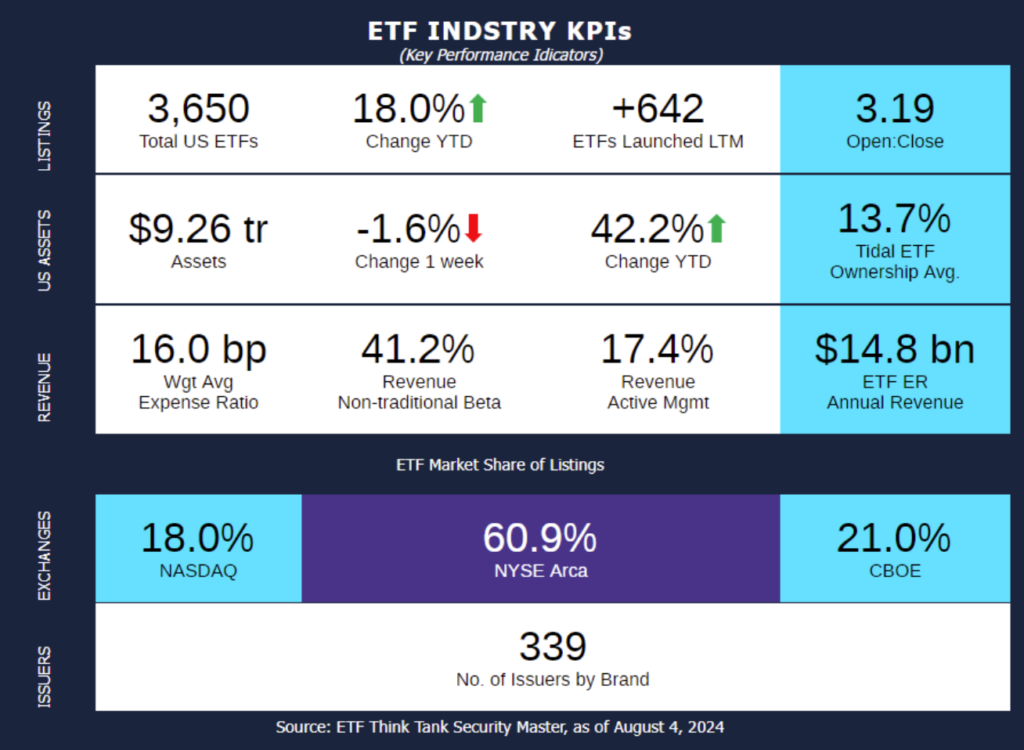

- The 1 Year ETF Open-to-Close ratio has remained steady at 3.19 for consecutive weeks.

- The total number of ETFs listed in the US has reached a new high of 3,650, representing a +14.7% YoY growth rate.

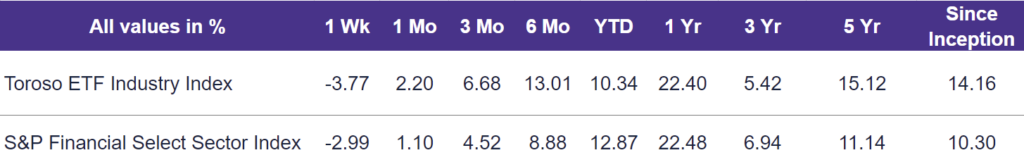

Our Toroso ETF Industry Index, which tracks companies generating revenue from the ETF ecosystem, experienced a 3.77% decline last week, trailing the S&P Financial Select Sector Index, which dropped by 2.99%.

Recent ETF launches and closures from the past week:

- Federated Hermes Doubles its ETF lineup: Federated Hermes has expanded its ETF offerings with the launch of four new actively managed quantitative funds:

- Federated Hermes MDT Large Cap Core ETF (FLCC), Federated Hermes MDT Large Cap Growth ETF (FLCG), Federated Hermes MDT Large Cap Value ETF (FLCV), Federated Hermes MDT Small Cap Core ETF (FSCC).

- Each ETF starts with a foundation from a prominent Russell Index related to the ETFs investment focus, then applies its proprietary quantitative model that incorporates fundamental and technical analysis to select stocks. This approach includes a strict discipline over stock selection and diversification constraints to limit exposure to individual companies and correlated groups. Federated Hermes now manages a total of eight ETFs, including its largest fund, Federated Hermes U.S. Strategic Dividend ETF (FDV), which has amassed $117 million in AUM.

- Grayscale unveils the “Mini” Bitcoin ETF: Grayscale Investments, a leading crypto asset manager, has introduced the Grayscale Bitcoin Mini Trust (BTC) that has been launched through a unique “spin-off” mechanism, where 10% of Grayscale Bitcoin Trust’s (GBTC) underlying Bitcoin was distributed to seed the new fund. Notably, BTC stands out in the market with its exceptionally low fee structure and share price. Specifically, it boasts an expense ratio of just 0.15% and a share price of approximately $5, making it an attractive option for investors seeking affordable Bitcoin exposure.

- Direxion closes 3 ETFs: Direxion, a leading ETF issuer with ~$40 billion in assets under management, ranking among the top 20, has recently announced the closure of three ETFs. The affected funds include two thematic ETFs and one leveraged ETF, which will be shutting down operations.

- Direxion Hydrogen ETF (HJEN): tracked a modified market-cap-weighted index of global companies involved in businesses related to the hydrogen industry.

- Direxion Moonshot Innovators ETF (MOON): tracked a tier-weighted index that selects US-listed companies seeking innovative technologies.

- Direxion Daily Global Clean Energy Bull 2X Shares (KLNE): aimed for 2x leveraged daily exposure to a tiered index of global companies involved in clean energy businesses.

ETF Launches

AAM Brentview Dividend Growth ETF (ticker: BDIV)

AAM Sawgrass U.S. Large Cap Quality Growth ETF (ticker: SAWG)

AAM Sawgrass U.S. Small Cap Quality Growth ETF (ticker: SAWS)

AllianzIM U.S. Equity Buffer15 Uncapped August ETF (ticker: AUGU)

Calamos S&P 500 Structured Alt Protection ETF – August (ticker: CPSA)

Federated Hermes MDT Large Cap Core ETF (ticker: FLCC)

Federated Hermes MDT Large Cap Growth ETF (ticker: FLCG)

Federated Hermes MDT Large Cap Value ETF (ticker: FLCV)

Federated Hermes MDT Small Cap Core ETF (ticker: FSCC)

Goldman Sachs Access U.S. Preferred Stock & Hybrid Securities ETF (ticker: GPRF)

Grayscale Bitcoin Mini Trust (ticker: BTC)

Innovator Equity Defined Protection ETF – 1 Year August (ticker: ZAUG)

Innovator Growth-100 Power Buffer ETF – August (ticker: NAUG)

Innovator International Developed Power Buffer ETF – August (ticker: IAUG)

Innovator U.S. Small Cap Power Buffer ETF – August (ticker: KAUG)

Neuberger Berman Core Equity ETF (ticker: NBCR)

Nicholas Global Equity and Income ETF (ticker: GIAX)

Octaine All-Cap Value Energy ETF (ticker: OCTA)

Xtrackers Artificial Intelligence and Big Data ETF (ticker: XAIX)

ETF Closures

DriveWealth ICE 100 ETF (ticker: CETF)

Direxion Hydrogen ETF (ticker: HJEN)

Direxion DaiIy Global Clean Energy Bull 2X Shraes ETF (ticker: KLNE)

Direxion Moonshot Innovators ETF (ticker: MOON)

Fund/Ticker Changes

None

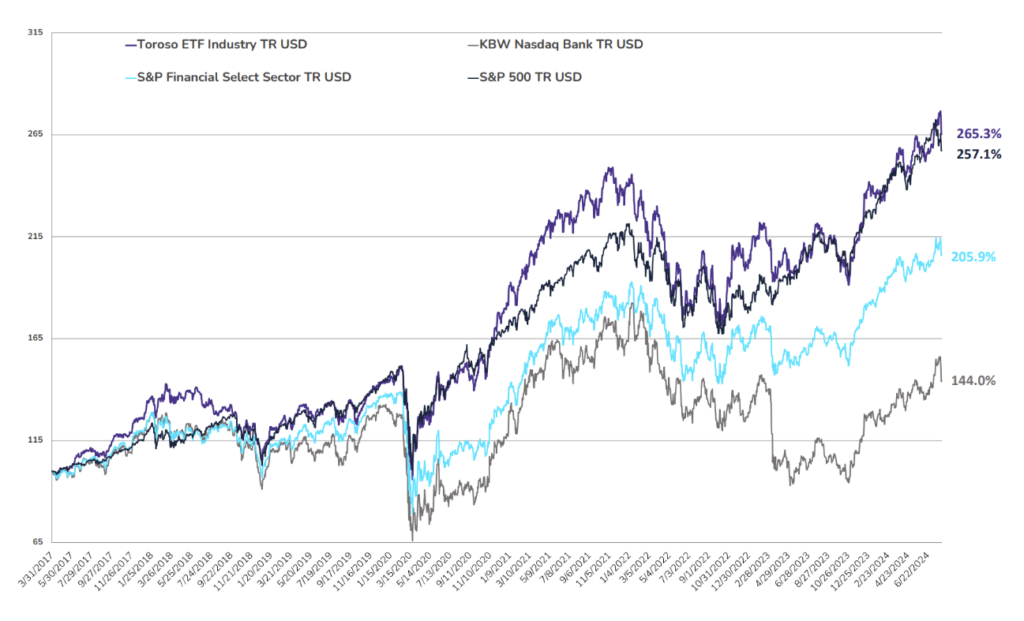

TETF.Index Performance vs. S&P Financial Select Sector Index

(as of August 2, 2024)

TETF.Index Performance vs. Other Leading Financial Indices

(March 31, 2017 through August 2, 2024)

Why Follow the ETF Industry KPIs

The team at Tidal Investments, originally operating as Toroso Investments, began tracking the ETF Industry Key Performance Indicators (KPIs) in the early 2000s and have been consistently reporting on, and analyzing these metrics ever since. This diligent tracking was the catalyst for the creation of the TETF.Index, an index that tracks the ETF industry. Now, as part of the Tidal Financial Group, which is affiliated with Tidal Investments, LLC, we are positioned to provide even more in-depth analysis and insights. Each week, we will share the statistics we believe to be the most useful for identifying industry trends, in addition to the performance of the TETF.Index.

DISCLAIMER

Past performance is no guarantee of future returns. This article is for informational and educational purposes only; is not intended to constitute legal, tax, accounting, or investment advice; and does not constitute an offer to sell or a solicitation of an offer to buy any security or service. Furthermore, the Indexes shown above are not investable. While Tidal Investments, LLC (formerly known as Toroso Investments, LLC) has gathered the information presented from sources that it believes to be reliable, Tidal Investments, LLC cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed are Tidal Investments, LLC’s opinions and do not reflect the opinions of any affiliates or related persons. All opinions are current only as of the date of initial publication and are subject to change without notice. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested.