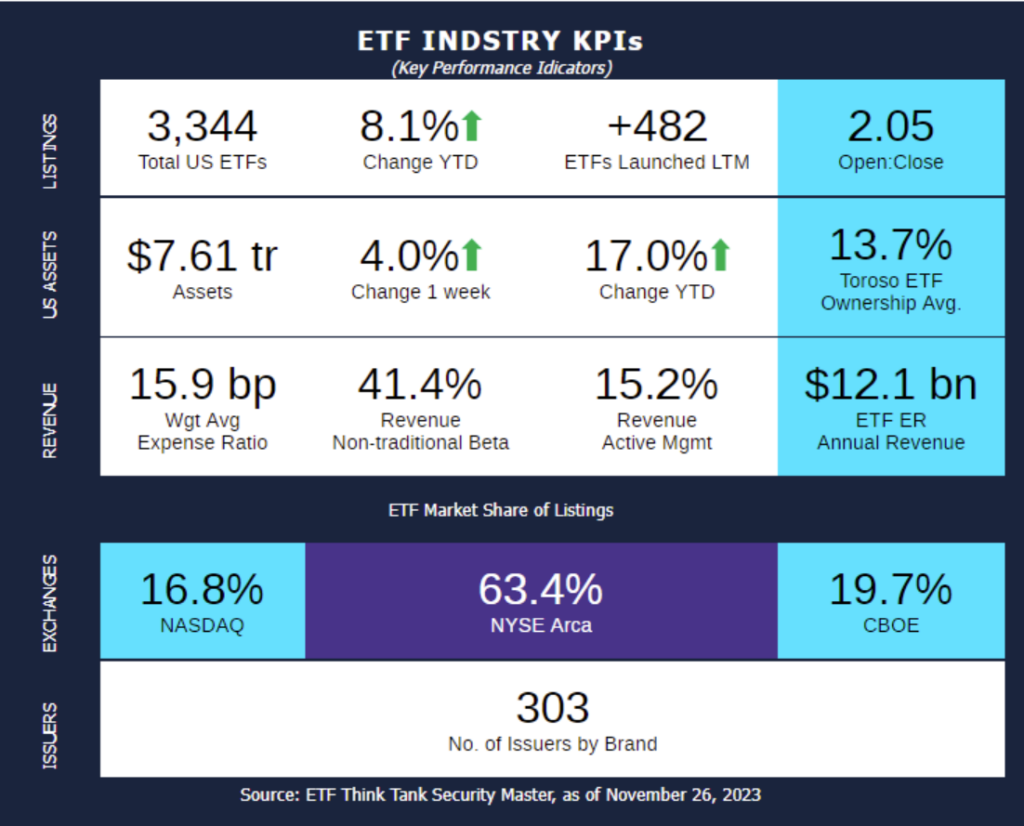

Weeks of November 13 & 20, 2023 KPI Summary

- Here are some updates from the last 2 weeks – The industry experienced 25 ETF launches and 12 closures, shifting the 1-year Open-to-Close ratio to 2.05 and total US ETFs to 3,344.

- We hope everyone had a great Thanksgiving last week! Here are some notable KPIs this week that we are thankful for:

- Total US ETF Assets are up to $7.61 Trillion, an all-time high, surpassing the previous high on July 30, 2023 of $7.59 Trillion.

- It is no surprise that we are also at an all-time high for total US ETFs (3,344) and issuers (303). However, the +482 ETFs launched in the last twelve months as of today is ranked 5th all-time since we started keeping track in February 2018.

- The week with the highest “Launched LTM” was December 19, 2021 (+489).

- Lastly, this week’s percentage of Revenue from Actively managed ETFs is 15.2%, 2nd all-time to two weeks ago November 5th mark of 15.3%.

- These are just a few of the metrics demonstrating the direction the ETF industry is moving: Forward. We at the ETF Think Tank are very grateful for the issuers, investors, market makers, and everyone in between that help make the ETF industry special.

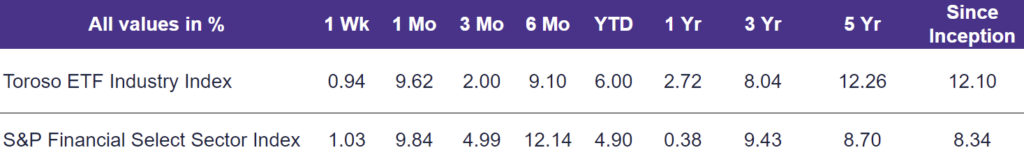

- The tracked indexes experienced similar performance last week. The Toroso ETF Industry Index was up 0.94% while the S&P Financial Select Sector Index led at 1.03%.

ETF Launches

ARK 21Shares Active Bitcoin Futures Strategy ETF (ticker: ARKA)

ARK 21Shares Active On-Chain Bitcoin Strategy ETF (ticker: ARKC)

ARK 21Shares Digital Asset and Blockchain Strategy ETF (ticker: ARKD)

ARK 21Shares Active Bitcoin Ethereum Strategy ETF (ticker: ARKY)

ARK 21Shares Active Ethereum Futures Strategy ETF (ticker: ARKZ)

Xtrackers US National Critical Technologies ETF (ticker: CRTC)

IDX Dynamic Innovation ETF (ticker: DYNI)

Fidelity Enhanced Large Cap Core ETF (ticker: FELC)

Fidelity Enhanced Large Cap Growth ETF (ticker: FELG)

Fidelity Enhanced Large Cap Value ETF (ticker: FELV)

Fidelity Enhanced International ETF (ticker: FENI)

Fidelity Enhanced Small Cap ETF (ticker: FESM)

Fidelity Enhanced Mid Cap ETF (ticker: FMDE)

Goose Hollow Enhanced Equity ETF (ticker: GHEE)

Goose Hollow Multi-Strategy Income ETF (ticker: GHMS)

FT Cboe Vest U.S. Equity Moderate Buffer ETF – November (ticker: GNOV)

FT Cboe Vest U.S. Small Cap Moderate Buffer ETF – November (ticker: SNOV)

FT Cboe Vest U.S. Equity Enhance & Moderate Buffer ETF – November (ticker: XNOV)

Tema Cardiovascular and Metabolic ETF (ticker: HRTS)

LG QRAFT AI-Powered U.S. Large Cap Core ETF (ticker: LQAI)

GMO U.S. Quality ETF (ticker: QLTY)

Virtus Newfleet Short Duration Core Plus Bond ETF (ticker: SDCP)

Amplify Samsung SOFR ETF (ticker: SOF)

Simplify US Equity Plus QIS ETF (ticker: SPQ)

SoFi Enhanced Yield ETF (ticker: THTA)

ETF Closures

The Clouty Tune ETF (ticker: TUNE)

Credit Suisse S&P MLP Index ETN (ticker: MLPO)

Franklin FTSE France ETF (ticker: FLFR)

Franklin FTSE South Africa ETF (ticker: FLZA)

Franklin FTSE Italy ETF (ticker: FLIY)

Franklin FTSE Russia ETF (ticker: FLRU)

Global X Emerging Markets Internet & E-Commerce ETF (ticker: EWEB)

Global X Founder-Run Companies ETF (ticker: BOSS)

Global X China Innovation ETF (ticker: KEJI)

Global X Education ETF (ticker: EDUT)

Merlyn.AI Bull-Rider Bear-Fighter ETF (ticker: WIZ)

Merlyn.AI SectorSurfer Momentum ETF (ticker: DUDE)

Fund/Ticker Changes

First Trust Dynamic Europe Equity Income Fund (ticker: FDEU)

merged into First Trust Active Global Quality Income ETF (ticker: AGQI)

TETF.Index Performance vs. S&P Financial Select Sector Index

(as of November 24, 2023)

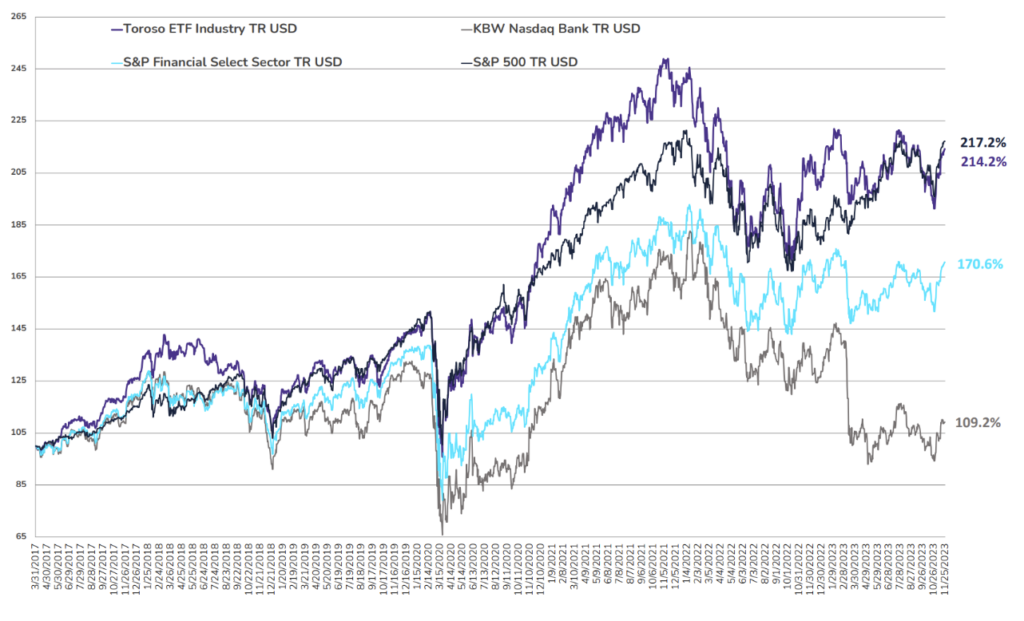

TETF.Index Performance vs. Other Leading Financial Indices

(March 31, 2017 through November 24, 2023)

Why Follow the ETF Industry KPIs

The team at Toroso Investments began tracking the ETF Industry Key Performance Indicators (KPI’s) in the early 2000’s and have been consistently reporting on, and analyzing these metrics ever since. The table above was the impetus for the creation of the TETF.Index, the index that tracks the ETF industry. Each week, we will share the statistics we believe to be the most useful for identifying industry trends, in addition to the performance of the TEFT.Index.

DISCLAIMER

Past performance is no guarantee of future returns. This article is for informational and educational purposes only; is not intended to constitute legal, tax, accounting or investment advice; and does not constitute an offer to sell or a solicitation of an offer to buy any security or service. Furthermore, the Indexes shown above are not investable. While Toroso has gathered the information presented from sources that it believes to be reliable, Toroso cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed are Toroso’s opinions and do not reflect the opinions of any affiliates or related persons. All opinions are current only as of the date of initial publication and are subject to change without notice. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested.