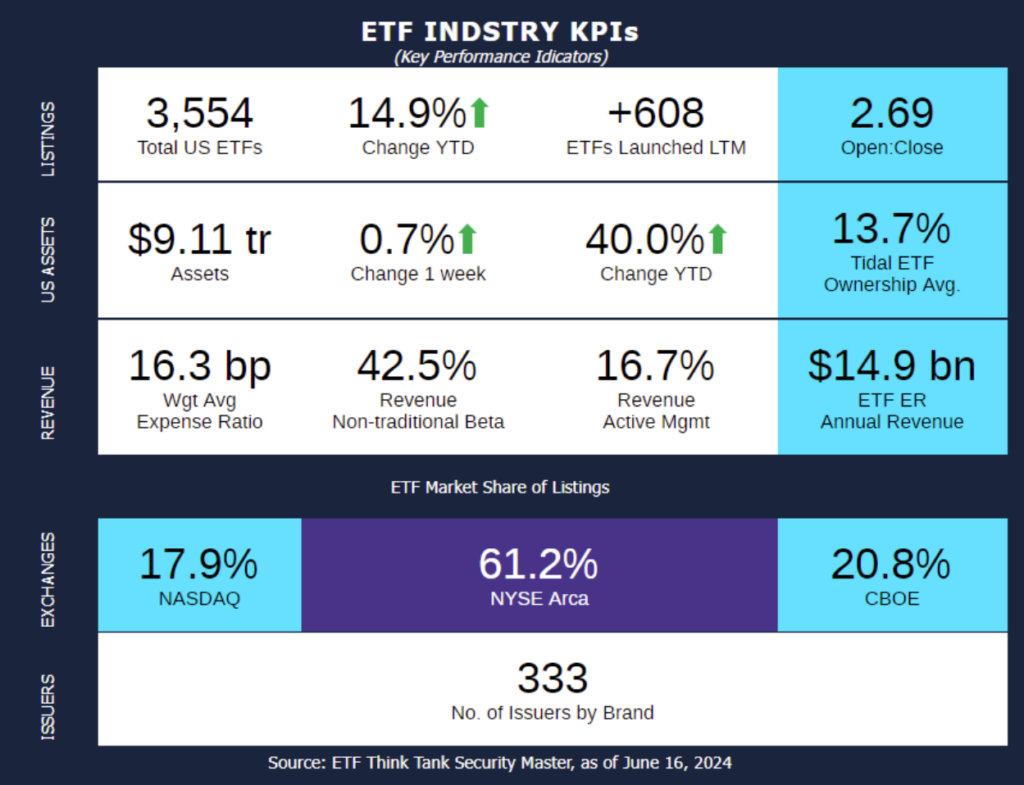

Week of June 10, 2024 KPI Summary

- This week, the industry experienced 12 ETF launches and 2 closures, shifting the 1-year Open-to-Close ratio to 2.69 and total US ETFs to 3,554.

- Happy Summer everyone! This Thursday, June 20, is the first day of summer. While Winter 2024 was hot with assets (+8.0%), let’s see how Spring 2024 fared (data comparing 3/18/2024 to 6/17/24).

- 5.1% increase in total assets (~$442 Bn) and a 3.2% increase in total US ETFs (+109).

- For comparison, Spring 2023 had 10.0% asset increase and +56 in ETFs.

- The ETF expense ratio 12-month revenue increased from $13.8 Bn to $14.9 Bn.

- Revenue from Active Management increased from 16.1% to 16.7% during the 3-month span.

- Issuers increased +18 (315 to 333). For comparison, Winter 2024 was +11.

- 5.1% increase in total assets (~$442 Bn) and a 3.2% increase in total US ETFs (+109).

- The National Oceanic and Atmospheric Administration released an article last week stating: “The average global May temperature was 2.12 degrees F (1.18 degrees C) above the 20th-century average of 58.6 degrees F (14.8 degrees C), ranking as the warmest May in NOAA’s 175-year global record. May 2024 marked the 12th-consecutive month of record-high temperatures for the planet.”

- While it hasn’t been 12 consecutive months of positive assets in the ETF industry, it has been positive 11 of the last 15 months and, more pertinently, a ‘hot’ Spring after a red hot Winter of growth with 5.1% assets increase and more new ETFs than Spring days!

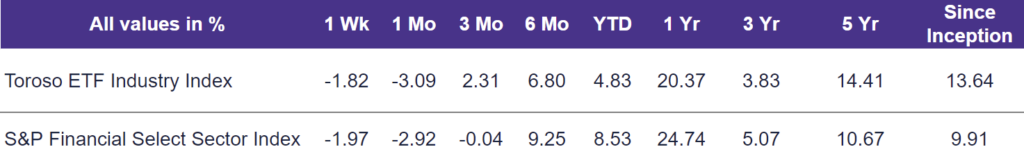

- The tracked indexes had very different experiences over the Spring. Toroso ETF Industry Index was up 2.31% while the S&P Financial Select Sector Index trailed at -0.04%.

ETF Launches

Invesco BulletShares 2034 Corporate Bond ETF (ticker: BSCY)

Invesco BulletShares 2032 High Yield Corporate Bond ETF (ticker: BSJW)

PGIM Laddered Fund of Buffer 12 ETF (ticker: BUFP)

PGIM Laddered Fund of Buffer 20 ETF (ticker: PBFR)

Proshares UltraShort Ether ETF (ticker: ETHD)

Proshares Ultra Ether ETF (ticker: ETHT)

iShares iBonds Dec 2044 Term Treasury ETF (ticker: IBGA)

iShares iBonds Dec 2054 Term Treasury ETF (ticker: IBGK)

iShares iBonds Dec 2034 Term Treasury ETF (ticker: IBTP)

OneAscent Small Cap Core ETF (ticker: OASC)

SGI Enhanced Nasdaq-100 ETF (ticker: QXQ)

YieldMax SNOW Option Income Strategy ETF (ticker: SNOY)

ETF Closures

ClearBridge All Cap Growth ESG ETF (ticker: CACG)

Xtrackers S&P SmallCap600 ESG ETF (ticker: SMLE)

Fund/Ticker Changes

First Trust Mid Cap US Equity Select ETF (ticker: RNMC)

became First Trust SMID Capital Strength ETF (ticker: FSCS)

iShares Factors US Growth Style ETF (ticker: STLG)

became iShares MSCI USA Quality GARP ETF (ticker: GARP)

AB Short Duration Income Portfolio (ticker: SHUYX)

became AB Short Duration Income ETF (ticker: SDFI)

AB Short Duration High Yield Portfolio (ticker: ALHRX)

became AB Short Duration High Yield ETF (ticker: SYFI)

TETF.Index Performance vs. S&P Financial Select Sector Index

(as of June 14, 2024)

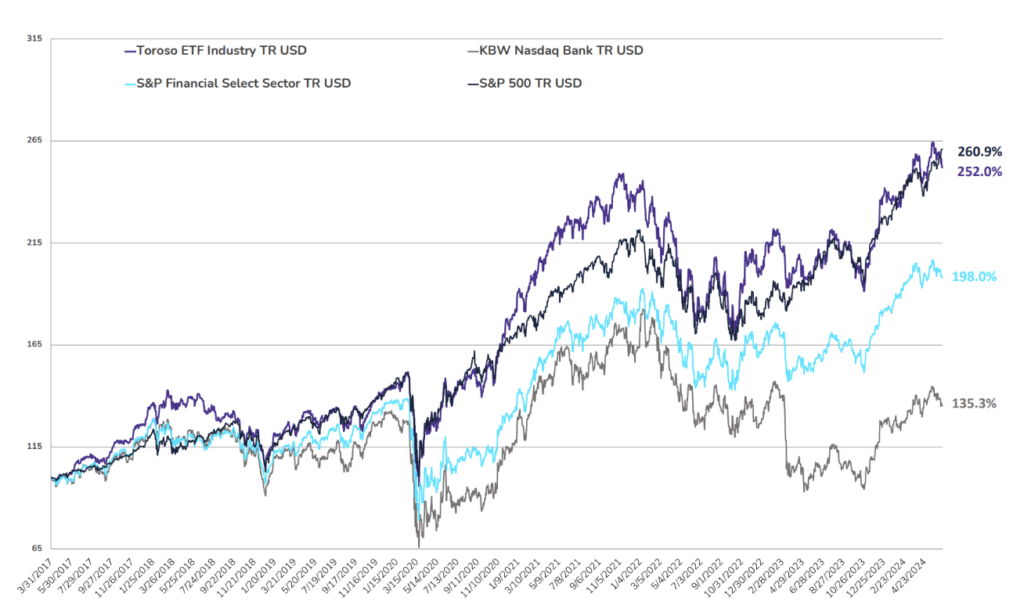

TETF.Index Performance vs. Other Leading Financial Indices

(March 31, 2017 through June 14, 2024)

Why Follow the ETF Industry KPIs

The team at Tidal Investments, originally operating as Toroso Investments, began tracking the ETF Industry Key Performance Indicators (KPIs) in the early 2000s and have been consistently reporting on, and analyzing these metrics ever since. This diligent tracking was the catalyst for the creation of the TETF.Index, an index that tracks the ETF industry. Now, as part of the Tidal Financial Group, which is affiliated with Tidal Investments, LLC, we are positioned to provide even more in-depth analysis and insights. Each week, we will share the statistics we believe to be the most useful for identifying industry trends, in addition to the performance of the TETF.Index.

DISCLAIMER

Past performance is no guarantee of future returns. This article is for informational and educational purposes only; is not intended to constitute legal, tax, accounting, or investment advice; and does not constitute an offer to sell or a solicitation of an offer to buy any security or service. Furthermore, the Indexes shown above are not investable. While Tidal Investments, LLC (formerly known as Toroso Investments, LLC) has gathered the information presented from sources that it believes to be reliable, Tidal Investments, LLC cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed are Tidal Investments, LLC’s opinions and do not reflect the opinions of any affiliates or related persons. All opinions are current only as of the date of initial publication and are subject to change without notice. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested.