Week of June 3, 2024 KPI Summary

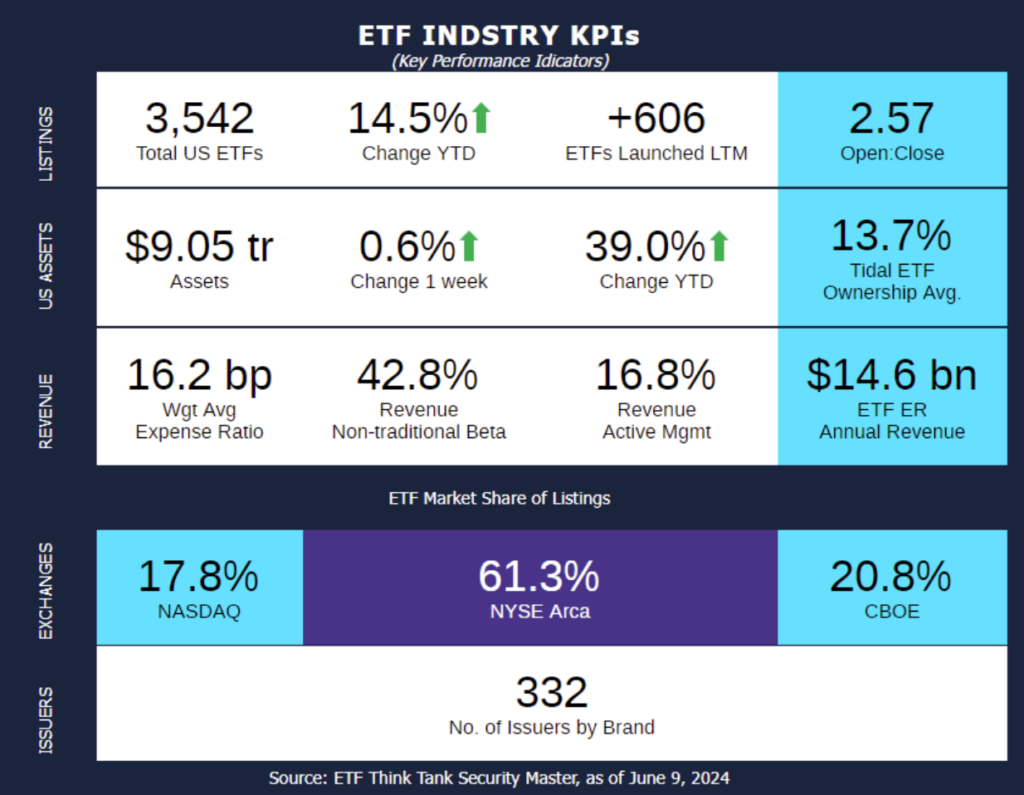

- This week, the industry experienced 15 ETF launches and 2 closures, shifting the 1-year Open-to-Close ratio to 2.57 and total US ETFs to 3,542.

- Here are a few KPI data points that jump out this week:

- In the last 52 weeks, there have been only 17 negative 1-week returns in the ETF industry. Therefore, over two-thirds of our KPI images have noted increases 1-week AUM change.

- All-time highs:

- There have been 606 ETFs Launched in the last 12-months.

- $9.05 Trillion AUM and 3,542 total ETFs are both all-time highs.

- 16.8% revenue from Active ETFs.

- As of 2 years ago, this number was 11.2% and June 2023 it was 13.2%. By the end of 2025, Active ETFs will likely represent ~20% of revenue, taking market share disproportionately from the Traditional ETF category.

- The current open-to-close ratio is 2.57 – we haven’t seen one that high since February 19, 2023. The lowest point during this 16-month period was 1.81 in September 2023.

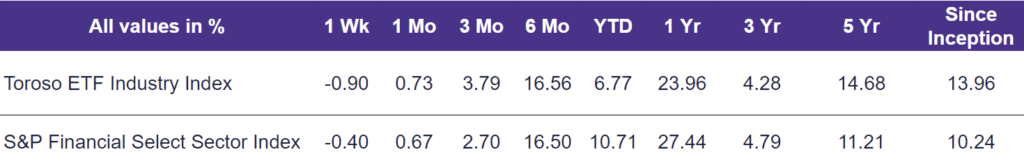

- The tracked indexes had similar experiences this week. The Toroso ETF Industry Index was down -0.90% while the S&P Financial Select Sector Index led at -0.40%.

ETF Launches

REX AI Equity Premium Income ETF (ticker: AIPI)

BlackRock Large Cap Growth ETF (ticker: BGRO)

Calamos Nasdaq-100 Structured Alt Protection ETF – June (ticker: CPNJ)

2x Ether ETF (ticker: ETHU)

Innovator International Developed Power Buffer ETF – June (ticker: IJUN)

AllianzIM U.S. Equity Buffer15 Uncapped June ETF (ticker: JNEU)

PGIM US Large-Cap Buffer 12 ETF – June (ticker: JUNP)

Innovator U.S. Small Cap Power Buffer ETF – June (ticker: KJUN)

Direxion Daily META Bear 1X ETF (ticker: METD)

Direxion Daily META Buff 2X ETF (ticker: METU)

Innovator Growth-100 Power Buffer ETF – June (ticker: NJUN)

PGIM US Large-Cap Buffer 20 ETF – June (ticker: PBJN)

Global X Russell 2000 ETF (ticker: RSSL)

Rareview Total Return Bond ETF (ticker: RTRE)

AllianzIM U.S. Large Cap 6 Month Buffer10 June/December ETF (ticker: SIXD)

ETF Closures

BTD Capital Fund ETF (ticker: DIP)

Teucrium AiLA Long-Short Base Metals Strategy ETF (ticker: OAIB)

Fund/Ticker Changes

Columbia U.S. ESG Equity Income ETF (ticker: ESGS)

became Columbia U.S. Equity Income ETF (ticker: EQIN)

Columbia International ESG Equity Income ETF (ticker: ESGN)

became Columbia International Equity Income ETF (ticker: INEQ)

TETF.Index Performance vs. S&P Financial Select Sector Index

(as of June 7, 2024)

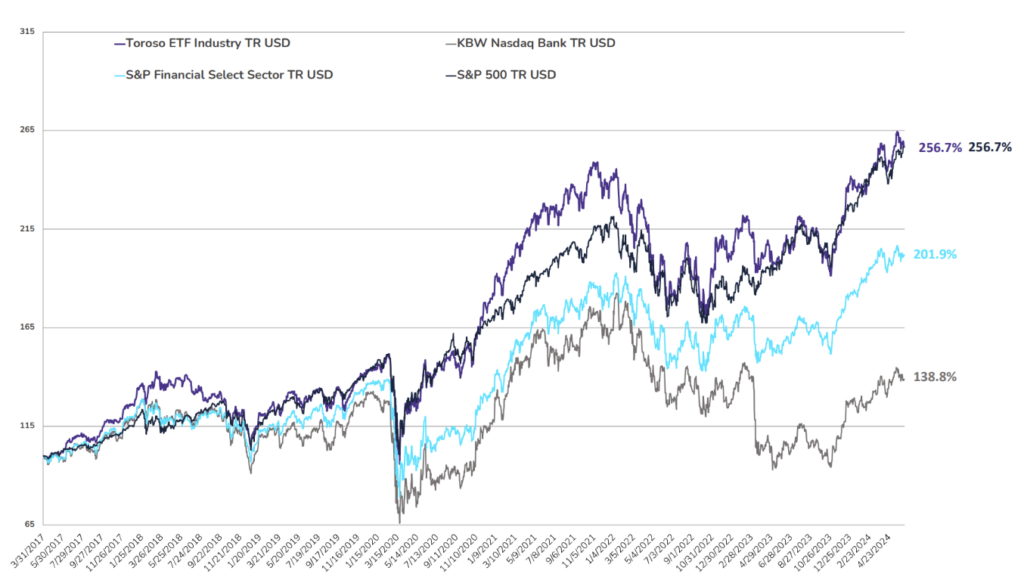

TETF.Index Performance vs. Other Leading Financial Indices

(March 31, 2017 through June 7, 2024)

Why Follow the ETF Industry KPIs

The team at Tidal Investments, originally operating as Toroso Investments, began tracking the ETF Industry Key Performance Indicators (KPIs) in the early 2000s and have been consistently reporting on, and analyzing these metrics ever since. This diligent tracking was the catalyst for the creation of the TETF.Index, an index that tracks the ETF industry. Now, as part of the Tidal Financial Group, which is affiliated with Tidal Investments, LLC, we are positioned to provide even more in-depth analysis and insights. Each week, we will share the statistics we believe to be the most useful for identifying industry trends, in addition to the performance of the TETF.Index.

DISCLAIMER

Past performance is no guarantee of future returns. This article is for informational and educational purposes only; is not intended to constitute legal, tax, accounting, or investment advice; and does not constitute an offer to sell or a solicitation of an offer to buy any security or service. Furthermore, the Indexes shown above are not investable. While Tidal Investments, LLC (formerly known as Toroso Investments, LLC) has gathered the information presented from sources that it believes to be reliable, Tidal Investments, LLC cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed are Tidal Investments, LLC’s opinions and do not reflect the opinions of any affiliates or related persons. All opinions are current only as of the date of initial publication and are subject to change without notice. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested.