Broad Markets

We as men should excitedly celebrate Women’s History Month with the goal of encouraging change.[i] Change is necessary because we are all better off with the diverse experience and knowledge that women bring to the table. If that is not enough, we should celebrate because we owe it to our mothers, daughters, and wives. These women challenge us as men to be better people, and frankly they deserve all our encouragement and support to empower them. The fact is, while the foundation of the movement is there, the momentum needs more than just one highlighted month per year. Change will not occur in a linear fashion and the challenges of corporate cultures are hard to overcome. While progress is encouraging, parity should be the goal. For the record, the thinking is not to hire according to quotas. Rather, our corporate culture is inspired by a GSD philosophy that is competitive, challenging, and focused on empowering independent thinking. It is a culture that is driven by transparency, accountability, and intensity, measured by goals and client outcomes. This inspires out of the box thinking that requires diversity, but frankly is not right for everyone.

The Gender Gap

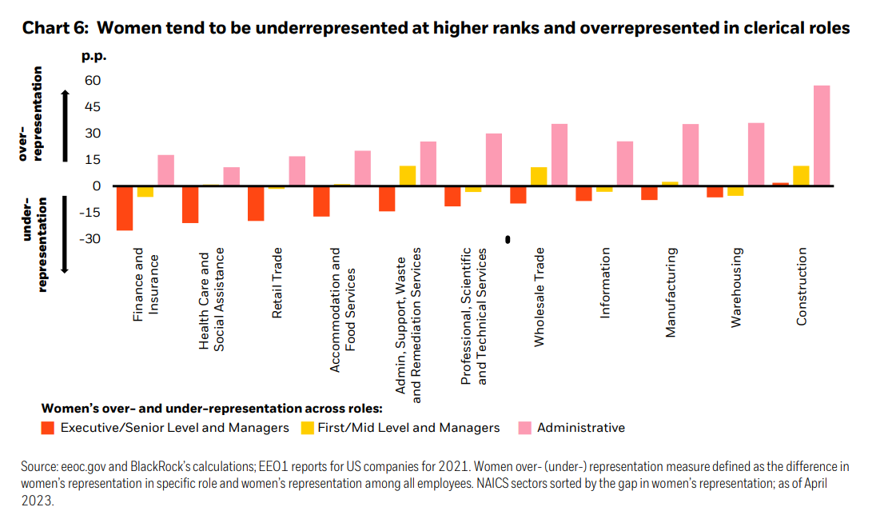

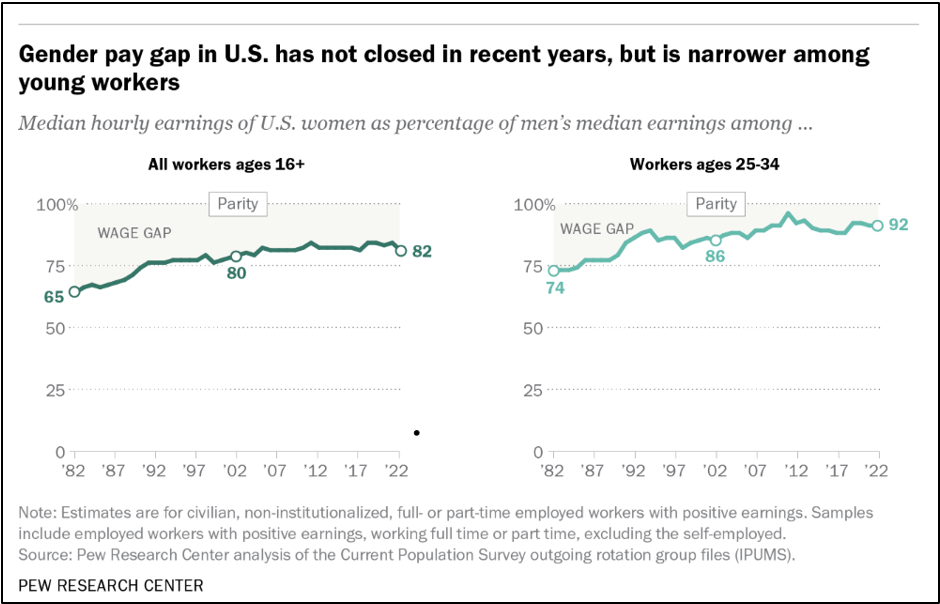

In the ETF Think Tank, we have been writing about the importance of impact investing, diversity, and the gender gap since 2019. Back in 2019, we wrote a piece titled: “The Elephant in the Room: Should “Modern” Labor Day be about the Gender Gap Between Men and Women Salaries in the US?” In this piece, it was highlighted that women are paid 80 cents versus every dollar that their male counterparts are paid. According to Pew Research, this gap has narrowed slightly to 82% and could be as high as 84% according to the US Consensus Bureau. However, there are some even more encouraging trends for the younger generation (25-34 years old), which could bring women’s pay as high as 92%. This is encouraging since the younger generation will further accelerate the narrowing of the gap in senior roles as they get promoted over the next 5-10 years.

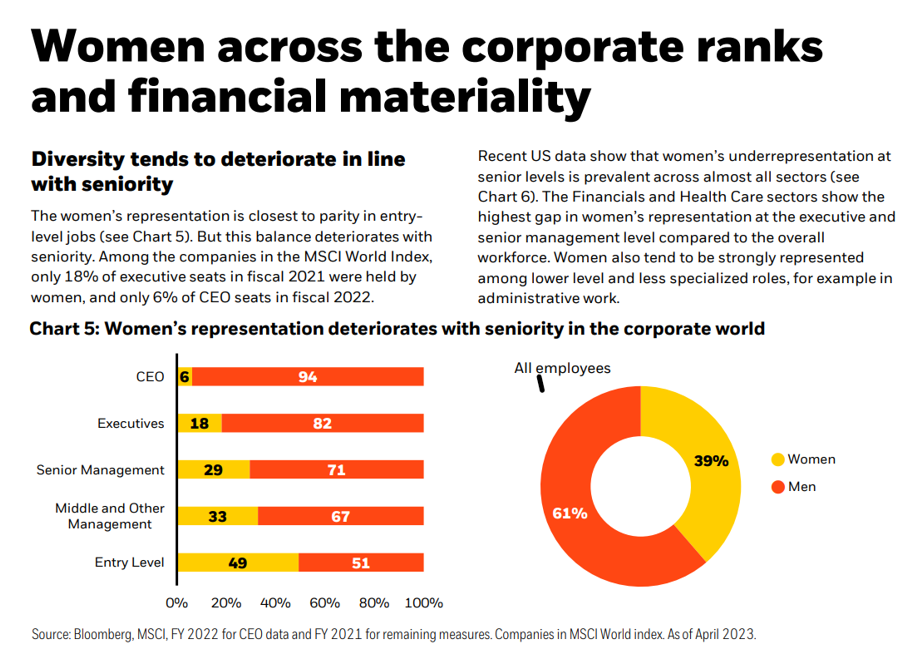

We believe part of the issue is the reality that men and women think differently, and more men are in leadership positions. Over time this will change, in part because the data is so skewed and companies that choose to not seek a proper balance will be less innovative and competitive. In the ETF world, we again should be reminded that Kathleen Moriarty, known as the Spider-Woman, wrote the SPY prospectus as well as the first Bitcoin Spot ETF prospectus. She is also credited as a patent holder on Crypto SPOT ETP. Shocking, however, is the data point from Banknote “that the gender gap in the legal profession is quoted at 54%”[ii], the lowest of all industries. Then again, what may be even more of a surprise is that only 20-31% of financial advisors are women according to an article titled “How the Financial Industry Can Attract and Retain More Women Advisors” written by Jenn D. Daly, CFP ® at Janney Mongomery Scott. Talk about an extraordinary opportunity for women!

All this is to say, if over 50% of the population is female, and more than 50% of the $68 trillion wealth transfer is going to be controlled by women, the pendulum is likely going to swing in favor of women. And why shouldn’t it? Women, on average, outlive men by about 6 years. We expect more women to play a greater role in investing, including directly as financial advisors. This will mean that female financial advisors should have a great career path!

Ideas From Women in the Trenches:

- Negotiating for fair pay starts with research.

- Don’t divulge your earnings history with recruiters or hiring managers.

- Don’t be afraid to job hop.

- Always ask for more.

- Get comfortable with negotiating by practicing.

- Come to the table with ways to demonstrate what you are worth.

- Don’t be afraid to ask for more reviews.

- Have an open dialogue about the domestic work burden that befalls many women.

Read the whole article here: Fighting the gender pay gap: working women shed light on how they’re advocating for equal pay. It’s an important read!

Hidden Gems: ETFs Targeting the WOMAN Factor

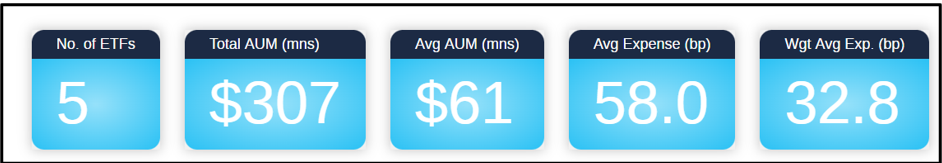

Many women in business are successful, and there are examples of ETFs built to drive this cause forward. Women and men do not always think the same, so as my colleague Cinthia Murphy pointed out – there is a woman factor which should be celebrated. However, for some unknown reason, this factor has not been embraced by the capital markets. Surprisingly, the woman factor ETFs have only gathered $307M in assets under management. Part of the issue may be the dispersion of return outcomes, so investors should drill deep into the different investment allocation processes (aka structure matters). See charts below. The overlap between the funds is mostly in the range of 25-62%, again surprisingly low. Our thinking is that we are still very early, and there will be room for a next evolution with more defined solutions. ESG may have been an embarrassment for some, but that does not mean it will go away. The issue is more definitional than whether it is in demand.

Real Life Tank Battle Ground Stories: Do Women Investors Really Think Differently to Men?

Wake up people! While the answer to the above question is most certainly yes, the following are some key highlights from a straightforward article by British-based Lombard Odier titled: Do women investors really think differently to men? Most importantly, we would argue that as the $68 trillion wealth transfer is ultimately going to swing in favor of women, men should get on board and quickly embrace this trend. The outcome is inevitable, deserved, and better for society. Balance comes from diversity!

Highlights:

- There’s a clear preference for sustainable investments among women, with 80% believing they will outperform or match traditional investments.

- Women try to invest in women, and offer better growth outcomes with 10% more revenues than men within the first five years in venture and private companies.

- Women investors tend to have a more moderated approach to risk. A mix of biological factors, genetic factors, and social identity stereotypes all impact this approach, researchers believe.

- If women invested at the same rate as men, this could generate USD $3.2 trillion of extra capital to invest globally.

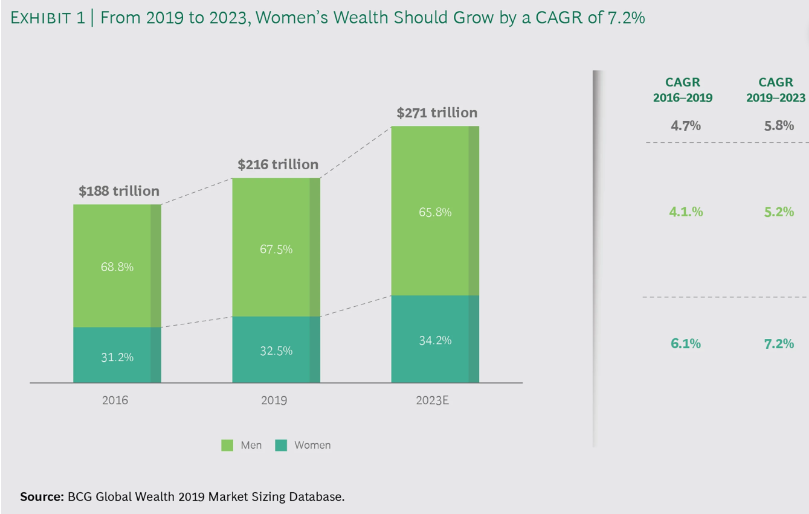

Regardless of whether a reader sees this data as skewed by its focus on the U.K. market and on private equity and venture capital, the facts remain consistent with what we read in the U.S. Those who prefer videos will enjoy https://youtu.be/27TJUC7XoEQ . Moreover, here in the BCG are some great datapoints from a report back in 2020 titled “Managing the Next Decade of Women’s Wealth.”

- Women control 32% of the World’s $271 trillion wealth ($93 trillion in 2023).

- The gender distinctions in financial products designed for women are often superficial or reflect outdated assumptions about women’s role in driving wealth.

- Five key themes:

- For women, wealth is a means to a number of ends, not an end in itself.

- Women make investment decisions based upon facts, not their guts. Although both men and women are willing to embrace risk, women tend to be more deliberative and are more averse to uncertainty.

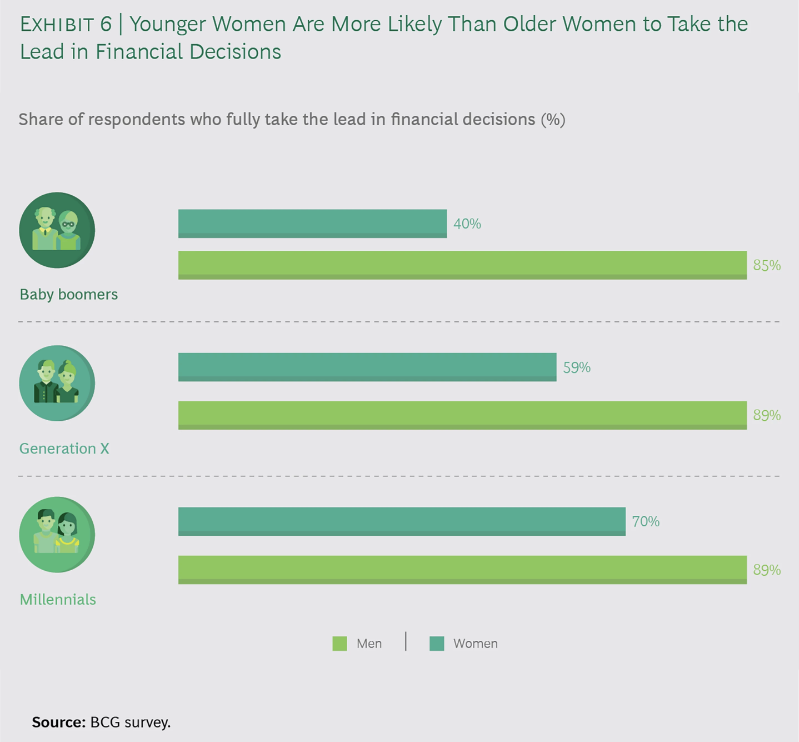

- Culture differences play a significant role in shaping investment behavior. Of the millennial women who participated in our study, 98% are in professional careers compared with 86% of female Gen Y-ers and 73% of female baby boomers.

- Unconscious bias still permeates the wealth management sector.

- To win the 20s, wealth managers must focus on the individual, not the gender.

Summary

We all know hard working women. They are mothers, sisters, wives, daughters, or simply a respected colleague. We as men think differently than women and as such should look to them as innovators, leaders, and equals. In time the gender gap will narrow, but until it does it will certainly have an impact on the retirement experience for women who, ironically, also live longer. There are many reasons why anything less than equal pay should not be tolerated. However, if we are to be honest, some of it must come through women asserting themselves. This is happening now! Men should advocate for this change or run the risk of being caught on the wrong side of an inevitable demographic change. The transfer of hundreds of trillions of dollars of global wealth in the future will make this wave one of the most important and necessary changes in everyone’s lifetime.

[i] https://www.internationalwomensday.com/Partners

[ii] The gender gap in the legal profession sites 54% https://finance.yahoo.com/news/11-ways-women-fight-against-051006592.html?guccounter=1&guce_referrer=aHR0cHM6Ly93d3cuZ29vZ2xlLmNvbS8&guce_referrer_sig=AQAAAA3QpRdoZeKo84rQ8nXN3mOuB-58nz9BMHvFYq-sxuvyzVbVtbh5w9L6F5FRrtgib1Y0IpZ_NwN1Enx4zKtZ3_Zcfhq556LpBFonLgmLg_CqUaF5LmSry7cZHL_ByS6cjFT9lAB0zDxJv2-fM3fRL9dv15GbAuQEDv_dvVA73o43, but in this article it lists 83% https://www.enjuris.com/students/gender-wage-gap/#:~:text=Median%20weekly%20earnings,-488%2C000&text=A%20female%20lawyer%20earns%2081,earned%20by%20a%20male%20lawyer.&text=One%20of%20the%20reasons%20there,uppermost%20tiers%20of%20law%20firms.

Additional links and footnotes:

- Support the YWCA https://www.ywca.org/ , https://womeninetfs.com/

- https://indexes.morningstar.com/indexes/details/morningstar-womens-empowerment-FS0000DXKU?currency=GBP&variant=TR&tab=holdings

- https://www.barrons.com/advisor/report/top-financial-advisors/women?page=1&

- https://www.womenshistory.org/womens-history/womens-history-month

- https://1.reutersevents.com/LP=36724?utm_campaign=6301-08MAR24-WK3-NA%20DB&utm_medium=email&utm_source=Eloqua&elqTrackId=9887e996c4b649a08b17b3715f057

- https://www.pewresearch.org/short-reads/2023/03/01/gender-pay-gap-facts/

- These are the 2024 CNBC Changemakers: Women transforming business

- August 31, 2019 https://etfthinktank.tidalfinancialgroup.com/2019/08/31/elephant-in-the-room-should-modern-labor-day-be-about-the-gender-gap-between-men-and-women-salaries-in-the-us/

- Is Gender Pay Gap Reporting an Effective Tool for Change? – Bloomberg

- https://www.lombardodier.com/contents/corporate-news/responsible-capital/2024/march/do-women-investors-really-think.html

- Managing the Next Decade of Women’s Wealth | BCG

Disclosure

All investments involve risk, including possible loss of principal.

The material provided here is for informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third-party providers is obtained from what are considered reliable sources. However, its accuracy, completeness, or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

The value of investments and the income from them can go down as well as up and investors may not get back the amounts originally invested, and can be affected by changes in interest rates, exchange rates, general market conditions, political, social, and economic developments, and other variable factors. Investment involves risks including but not limited to, possible delays in payments and loss of income or capital. Neither Tidal nor any of its affiliates guarantees any rate of return or the return of capital invested. This commentary material is available for informational purposes only and nothing herein constitutes an offer to sell or a solicitation of an offer to buy any security and nothing herein should be construed as such. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested, and nothing herein should be construed as a guarantee of any specific outcome or profit. While we have gathered the information presented herein from sources that we believe to be reliable, we cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed herein are our opinions and are current only as of the date of distribution, and are subject to change without notice. We disclaim any obligation to provide revised opinions in the event of changed circumstances.

The information in this material is confidential and proprietary and may not be used other than by the intended user. Neither Tidal nor its affiliates or any of their officers or employees of Tidal accepts any liability whatsoever for any loss arising from any use of this material or its contents. This material may not be reproduced, distributed, or published without prior written permission from Tidal. Distribution of this material may be restricted in certain jurisdictions. Any persons coming into possession of this material should seek advice for details of and observe such restrictions (if any).