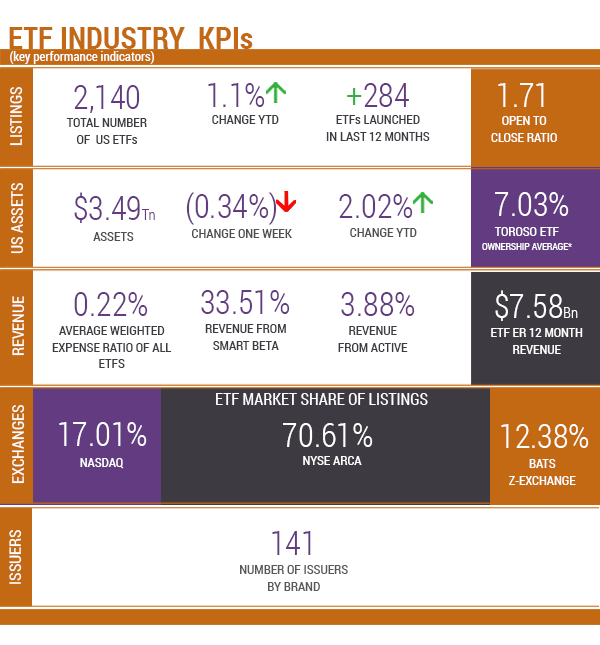

Source of KPIs: Toroso Investments Security Master, as of May 7, 2018

INDEX PERFORMANCE DATA

Returns as of May 7, 2018.

Inception Date: April 4, 2017. Index performance is for informational purposes only and does not represent the ETF.

Indexes are unmanaged and one cannot invest directly in an index.

Past performance is NOT indicative of future results, which can vary.

LIQUIDITY IN THE ETF ECOSYSTEM

The ETF industry is more than just issuers like WisdomTree (WETF) and Invesco (IVZ); it includes: index and data companies, operational service providers, liquidity traders, and exchanges. Each week, we note the listing market share of the three primary US ETF exchanges and some people may take the importance of frictionless liquidity for granted.

However, with exchanges currently representing 17% of TETF.index, the six exchanges that are tracked have performed quite well, and a deeper dive is warranted. After all, what is often lost about high volatility is the fact that the exchanges, as the liquidity provider, are the beneficiary of increased trading activity.

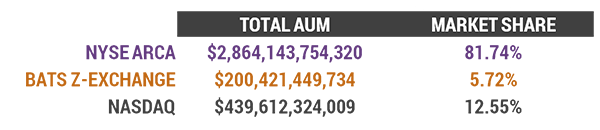

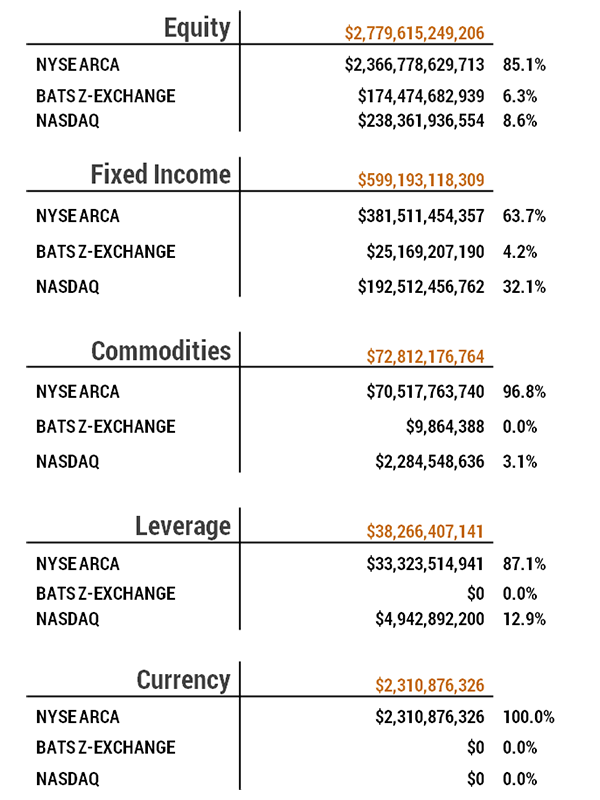

Diving deeper into the various categories of ETFs, it is no surprise that NYSE has the lion’s share of the volume at about 85% of the overall trading volume, but many might be surprised to learn that NASDAQ has over 32% of the fixed income AUM; almost 3 times its 12.55% asset class weighting.

ASSET CLASS BY EXCHANGE

Another standout is the NYSE dominance with 97% of Commodity ETF listings, while it appears almost none are listed on the BATS. The same pattern persists in both Leverage and Currency listing with lion’s share going to the NYSE. First mover advantage almost certainly is the reasoning for this position.

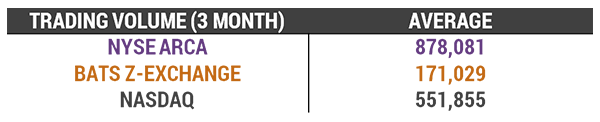

AVERAGE TRADING VOLUME OF AN ETF PER EXCHANGE

The chart above shows the average 3-month trading volume of ETFs listed on each exchange. Again, NYSE is the highest helped by big trading ETFs like SPY as well as most leveraged ETFs. Nasdaq is number 2, but with an impressive 551,855 average volume helped by QQQ. BATS is in last place probably due to the listing of many new funds from the aggressively attractive pricing.

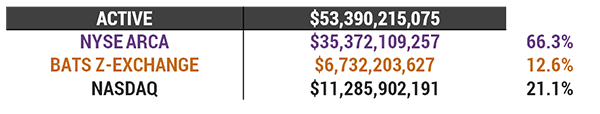

ACTIVE ETFS BY EXCHANGE

The active space surprised us further with both BATS and NASDAQ showing much higher market share than what would have been expected.

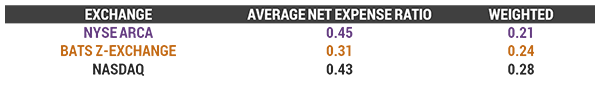

AVERAGE EXPENSE RATIO BY EXCHANGE

The final metric we explored was average and weighted expense ratio per exchange. Here, BATS had the lowest average expense ratio while NYSE had the highest. That said, when weighted for assets, NYSE had the lowest at 0.21 versus Nasdaq at 0.28.

While BlackRock (BLK), State Street Corp (STT), and other issuers get most of the headlines, the Exchanges are an integral part of the ETF ecosystem that provide infrastructure, data, and indexing services. The liquidity that is provided through these exchanges is at the core of why ETFs are successful. It would seem logical that first mover advantage plays to the NYSE strength, but again since technology and price competition continues to drive market share gains, the investor should expect to win across the ETF ecosystem.

ETF LAUNCHES

| Direxion Daily Robotics, Artificial Intelligence & Automation Index Bull 3x Shares | UBOT |

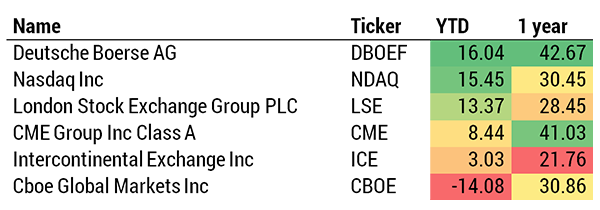

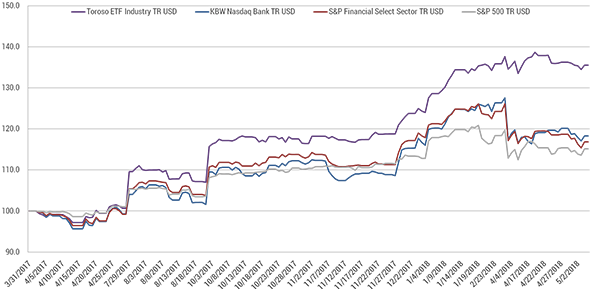

TETF INDEX PERFORMANCE VS LEADING FINANCIAL INDEXES

Returns as of May 7, 2018.

Inception Date: April 4, 2017. Index performance is for informational purposes only and does not represent the ETF.

Indexes are unmanaged and one cannot invest directly in an index.

Past performance is NOT indicative of future results, which can vary.

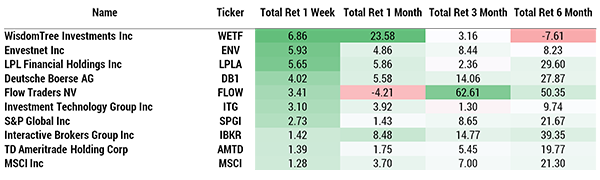

TOP 10 HOLDINGS PERFORMANCE

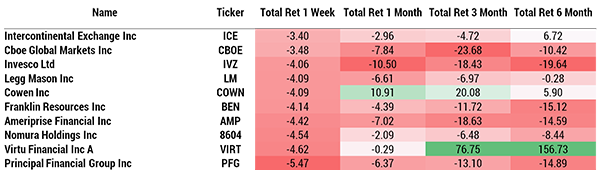

BOTTOM 10 HOLDINGS PERFORMANCE