Stable Open Close Closings

As of December 2nd, there are currently 2,310 ETFs listed in the U.S., only 3 more than last month. The 12-month trailing number of new launches is 239, down from 264 since the July 2019 report. A declining number indicates that investor choice and ETF innovation may be slowing. The number of closures was 159, resulting in an open-to-close ratio of 1.50 (239/159).

On December 3, 2018, the open-to close ratio was 1.45. Generally, this trend stays in that range. However, closures sometimes overtake launches when issuers make bulk announcements in the product line up. On October 18, 2018, the ratio was 1.75 with 290 openings and 166 closures. On March 4, 2019, the ratio went as low as 1.03 when 222 openings were almost overtaken by 215 closures. A 1.50 open-to-close KPI is telling us issuers remain optimistic about new launches and creative ETF ideas.

Assets Grow While Influence Diversifies

As of December 2, 2019, U.S. ETF assets were $4.27 trillion, an all-time high. That’s an increase of about 26.56% year to date. Another KPI of significance is the “ownership influence score.”

The average ETF “ownership influence score” has declined this year, from 8.25% stock ownership at the beginning of 2019 to 7.50% now, as flows have tilted toward fixed income. The ownership influence score is the average amount of the market cap of every U.S. stock owned by ETFs.

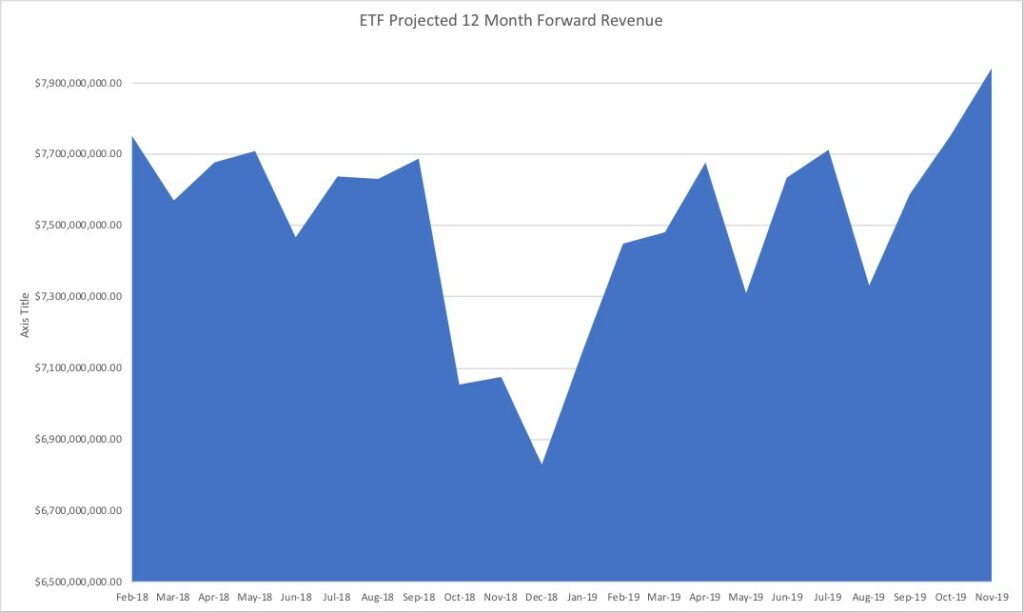

Revenue Grows to An All Time High

The average weighted expense ratio for U.S. ETFs remains steady at 0.19%. However, due to increased assets, the projected 12-month revenue from expense ratios has increased to a new high of $7.944 billion, up from $6.83 billion in December 2018.

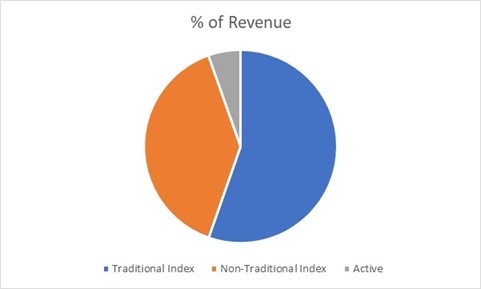

The revenue also continues to drift away from low cost, traditional beta and toward nontraditional passive “smart beta” ETFs and active ETFs. The percentage of ETF revenue from non-traditional passive ETFs as of December 31, 2018 was 36.38%; today it is at 38.84%. Active ETF revenue also gained market share, growing from 5.11% to 5.81%. Traditional passive ETFs are still representing 55.34% of revenues, but this is down from 58.52%. These KPIs help show that investors are still looking for interesting and creative strategies to help diversify their portfolio.

The Number of Branded Issuers Consolidating

The number of branded issuers has declined from 144 in June 30, 2019, to 141 now, but remains substantially higher than from 134 on December 31, 2018, which is a 5% increase. At its peak it was 144. That said, the dominance of the big 3 + Invesco is clear. iShares, State Street and Vanguard have AUM of 38.99%, 16.02% and 25.94% or 80.95%. Invesco is a distant 4th at 5.14%. Invesco’s market share is relevant in the context of the overall revenue picture. The gap between iShares, State Street and Vanguard at 41.64%, 14.01% and 8.55% vs Invesco at a close 8.14% is more narrow.

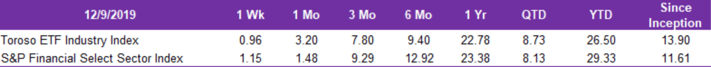

| TETF.Index Performance |

| Returns as of December 9, 2019. Inception Date: April 4, 2017.Index performance is for informational purposes only and does not represent any ETF. Indexes are unmanaged and one cannot invest directly in an index. Past performance is NOT indicative of future results, which can vary. |

| TETF.Index Performance vs. Leading Financial Indexes |

| Click here for information on the Index following the ETF industry |