Broad Market

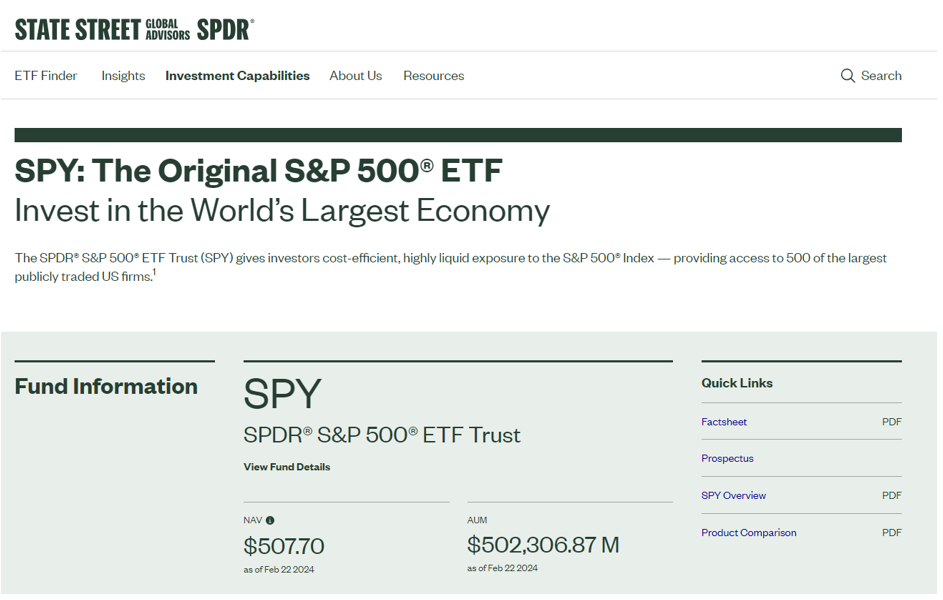

Last week, the SPDR S&P500 ETF Trust (SPY) celebrated two milestones. First, amazingly, the fund’s AUM eclipsed over $500 billion. This is no small feat considering that SPY charges 3x its rival ETF issuers, iShares Core S&P 500 ETF (IVV) and Vanguard S&P 500 ETF (VOO), which have $442 billion and $413 billion, respectively. We are cheering for our friends at StateStreet for maintaining the lead in terms of AUM, but also in terms of liquidity as measured by trading volume. Simply put, SPY is a liquidity beast like none other, and trading volume makes a monumental difference for major institutions and traders. Even when trading spreads between bid/ask are razor thin versus competitors, SPY confidently leads the pack. Nevertheless, as is typically the case, there are still 13 competitors with 95% overlap to SPY. The top 3 firms maintain 99% control over the index, and if an investor has a set it and forget it strategy, they can still buy the index through StateStreet at 2 Bps in the form of the SPDR Portfolio S&P 500 (SPLG). Of course, for those who just care about these metrics, there is the BNY Mellon US Large Cap Core Equity (BKLC) that has no fee, for now.

SPY’s second milestone came in the form of its third largest holding reaching $1 trillion in market value with a stellar earnings report. NVIDIA, with a 4.5% weighting in the S&P 500, now defines “smart beta” as well as active management. In fact, in a twist of irony, the “passive” process now leads the S&P 500 to an overweighted position of about 30% in technology stocks, and a spectacular YTD start for 2024. YTD (as of 02-23-24), SPY is up 6.85%, which brings the return to a staggering 28.69%.

Hidden Gems

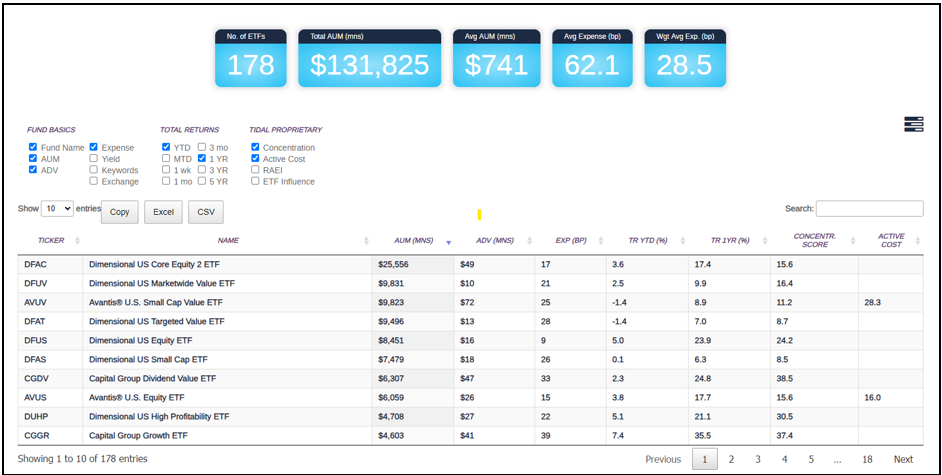

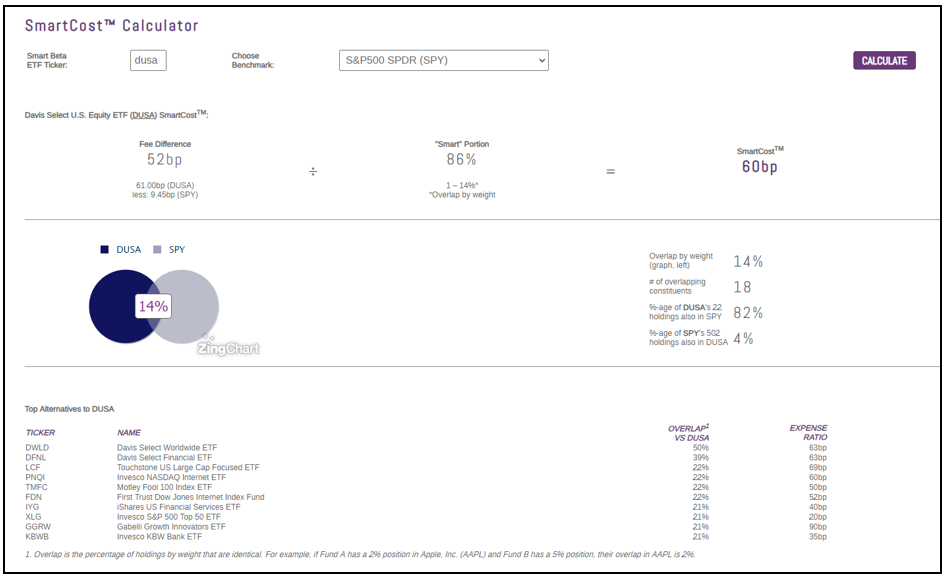

Screens are quick ways to target factors and trends. In the Hidden Gems section, we like to write about smaller funds and asset managers who warrant deep dives. As we frequently say, bigger is not always better. Of course, this does not mean we are not sincere in our celebration for investors who own SPY. However, it’s the closet index copycats that we watch out for. Most importantly, we would like to highlight that active share remains a place to add value. To this point, take the Davis Select US Equity ETF (DUSA). The fund has extraordinarily high active share, is a focus of many due diligence calls in the ETF Think Tank, and is up 37.22% as of (DAN – February 23, 2024 ). We think this is important because few firms are willing to manage money with a high conviction portfolio that only holds their top 20-25 names. To this point, DUSA only has a 14% overlap to SPY. The most similar ETFs, which have 22% overlapping portfolios, are Touchstone US Large Cap Focused ETF (LCF) and the Invesco Nasdaq Internet ETF (PNQI).

To say Chris Davis and his team are comfortable in their own skin is an understatement, and why shouldn’t they be? Don’t be fooled by the modesty. This is a team with conviction and competitive spirit. After all, when everyone was selling META stock (FB), they were hunkering down and even buying more. FB was up 181% during this period and contributed about 13.9% to the fund’s return. We would also note that Chris is on the board of Berkshire Hathaway, Inc (BRK) which during this period was up about 37.66%, adding about 3.84% to the fund’s return. Our last point on this fund is that it remains overweight financials at about 30% as a core focus, which includes well known banks like JPM, Wells Fargo, and Bank of New York. Capital One (COF) has been a long-time firm winner, and this latest move to acquire Discoverer Card (DFS) has been welcomed by markets.

Funds with high conviction strategies can provide lumpy returns that sometimes are not aligned with indexes, but they can be a wonderful way to manage a core-satellite strategy designed by a financial advisor to add long-term alpha. We are big believers in isolating trends through thematic ETFs, and arguably expectations around the possibility of rates going lower could benefit financials. To capture this trend, we would also highlight Davis Select Financial (DFNL)

Real Life Tank Battle Ground Stories

We enjoyed seeing many of the Think Tank members at Exchange ETFs earlier in the month, and look forward to the conference in 2025 moving to Las Vegas. A couple of highlights from the event include watching our own Cinthia Murphy, head of ETF Research, dancing on stage rattling off ETF KPIs with other ETF Nerds! It really was fun and inspiring! However, Chris Sullivan captured it well in his tweet when he said, “What happens when a group of ETF nerds get together for a game show? Lots of arguing about the rules.” Always fun and personal!! https://x.com/CSullivanPR/status/1756798162109435983?s=20

Then there was the serious ETF due dilgence meeting that provided CE credits held appropriatly in the Flicker room. ETF Nerds always have a consistent educational message and love to chat about their favorite tools!

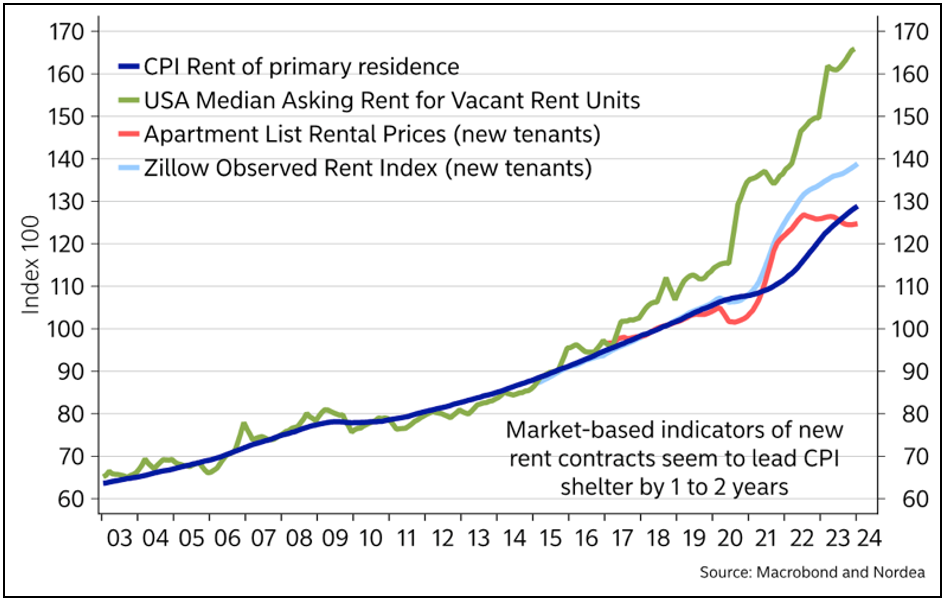

Other favorite panel discussions worth highlighting were about thematics ETFs and spot bitcoin. However, missing was a deep discusison about inflation. Okay, who needs to talk about such a depressing subject? It needs to be discussed because, if inflation is not brought under control, all hypotheticals are trash in 2024. Readers – watch this trend closely. As most global macro “gurus” will tell you, complacency on this issue could lead to many surprises.

Summary

We celebrate Funds with high active share because these are the strategies which can be most challenging for financial advisors to embrace. Lumpy returns do not always sell well to financial advisors, but over time can reward investors with bigger outcomes. We highlight Davis Funds in this piece because of their commitment to their own processes and philosophies and delivering high value as related to the Tank tool that measures “Smart Cost.” We also highlight StateStreet’s SPY for paving the way and achieving $500 billion of AUM while maintaining well deserved pricing power. Lastly, we mention inflation as a key KPI to watch overall as this is clearly the metric that will drive volatility in markets and have the greatest influence over both bond and equity markets. The conundrum is that, while no one wants a recession, those economic conditions clear the path to a reset around inflation. Therefore, avoiding a recession will in fact keep the risks of inflation higher.

Disclosure

All investments involve risk, including possible loss of principal.

The material provided here is for informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third-party providers is obtained from what are considered reliable sources. However, its accuracy, completeness, or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

The value of investments and the income from them can go down as well as up and investors may not get back the amounts originally invested, and can be affected by changes in interest rates, exchange rates, general market conditions, political, social, and economic developments, and other variable factors. Investment involves risks including but not limited to, possible delays in payments and loss of income or capital. Neither Tidal nor any of its affiliates guarantees any rate of return or the return of capital invested. This commentary material is available for informational purposes only and nothing herein constitutes an offer to sell or a solicitation of an offer to buy any security and nothing herein should be construed as such. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested, and nothing herein should be construed as a guarantee of any specific outcome or profit. While we have gathered the information presented herein from sources that we believe to be reliable, we cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed herein are our opinions and are current only as of the date of distribution, and are subject to change without notice. We disclaim any obligation to provide revised opinions in the event of changed circumstances.

The information in this material is confidential and proprietary and may not be used other than by the intended user. Neither Tidal nor its affiliates or any of their officers or employees of Tidal accepts any liability whatsoever for any loss arising from any use of this material or its contents. This material may not be reproduced, distributed, or published without prior written permission from Tidal. Distribution of this material may be restricted in certain jurisdictions. Any persons coming into possession of this material should seek advice for details of and observe such restrictions (if any).