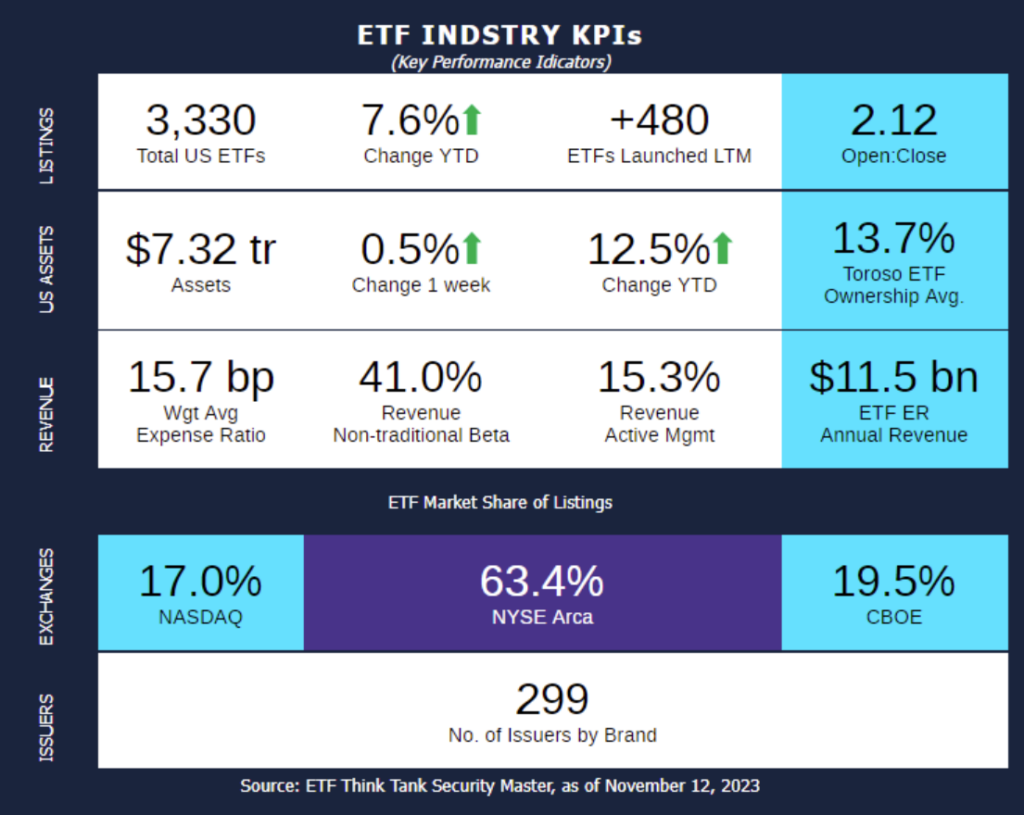

Week of November 6, 2023 KPI Summary

- This week, the industry experienced 15 ETF launches and 7 closures, shifting the 1-year Open-to-Close ratio to 2.12 and total US ETFs to 3,330.

- Two weeks ago, the number of ETF Issuers reached the #300 milestone! Although we currently dropped just below at 299 this week, let’s take a look back at how the industry has changed since there were 150, 200, and 250 issuers.

- Issuers reached #150 in August 2020. As a reminder, SPY, the first ETF, was launched in 1993. Therefore, it took the ETF industry 27 years to get to 150 issuers and just over 3 years to get the next 150.

- At 150 Issuers, there were 2,286 ETFs and $4.7 Trillion in AUM.

- From 150 to 200 issuers, it took 11 months (July 2021).

- There were 2600 ETFs and $6.6 Trillion in AUM.

- From 200-250 issuers, it took 6 months (January 2022).

- There were 2826 ETFs and $7.1 Trillion in AUM.

- Since that point, the market took a step back, with AUM dropping below $6 Trillion.

- From 250-300 issuers, it took 21 months (October 2023).

- There were 3322 ETFs and $6.9 Trillion in AUM.

- Issuers reached #150 in August 2020. As a reminder, SPY, the first ETF, was launched in 1993. Therefore, it took the ETF industry 27 years to get to 150 issuers and just over 3 years to get the next 150.

- The ETF Industry is constantly evolving and innovating. New Issuers cover unfolding market sectors and challenge previous norms in all areas. Additionally, the process of becoming an ETF issuer and bringing your fund to market has become easier with award winning companies like Tidal Financial Group leading the charge.

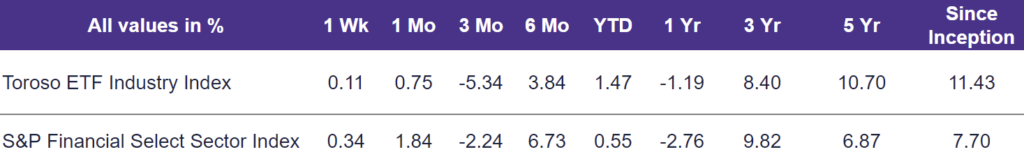

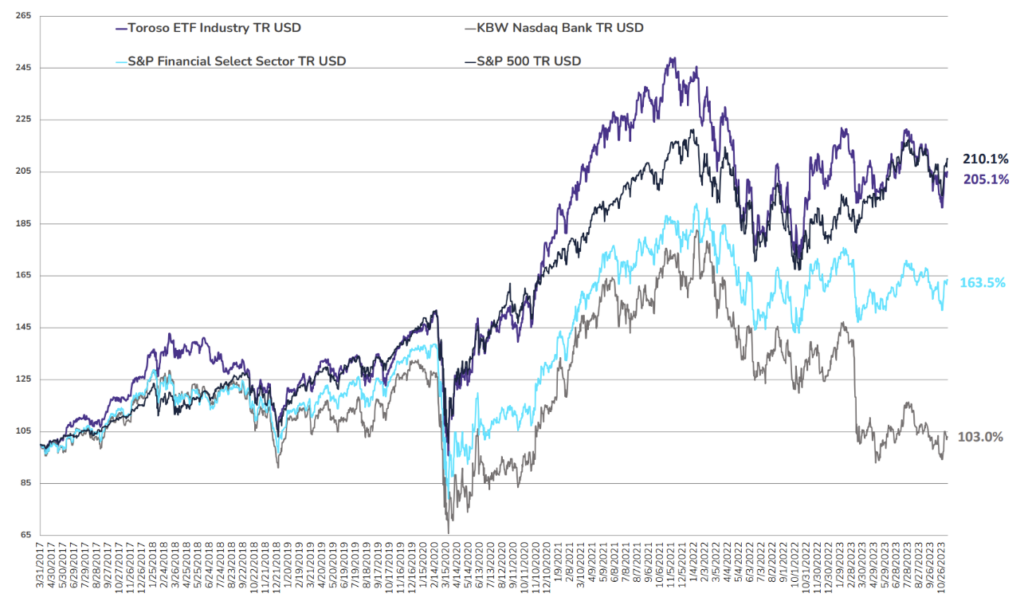

- The highlighted indexes have performed similarly in the past 3 years since the ETF issuer total has doubled. The Toroso ETF Industry Index is up 8.40% while the S&P Financial Select Sector Index leads at 9.82%.

ETF Launches

Avantis Emerging Markets Small Cap Equity ETF (ticker: AVEE)

Avantis U.S. Mid Cap Equity ETF (ticker: AVMC)

Avantis U.S. Mid Cap Value ETF (ticker: AVMV)

Honeytree U.S. Equity ETF (ticker: BEEZ)

Brendan Wood TopGun ETF (ticker: BWTG)

Dimensional Global Core Plus Fixed Income ETF (ticker: DFGP)

Dimensional Global Ex US Core Fixed Income ETF (ticker: DFGX)

Dimensional Global Creidt ETF (ticker: DGCB)

Global X MSCI Emerging Markets Covered Call ETF (ticker: EMCC)

Franklin Focused Growth ETF (ticker: FFOG)

First Trust Core Investment Grade ETF (ticker: FTCB)

Janus Henderson Securitized Income ETF (ticker: JSI)

Simplify MBS ETF (ticker: MTBA)

Gotham Short Strategies ETF (ticker: SHRT)

TBG Dividend Focus ETF (ticker: TBG)

ETF Closures

Simplify Developed Ex-US PLUS Downside Convexity ETF (ticker: EAFD)

Simplify Emerging Markets Equity PLUS Downside Convexity ETF (ticker: EMGD)

BlackRock Future Innovators ETF (ticker:BFTR)

iShares MSCI Germany Small-Cap ETF (ticker: EWGS)

iShares Currency Hedged MSCI Canada ETF (ticker: HEWC)

iShares Currency Hedged MSCI United Kingdom ETF (ticker: HEWU)

iShares Factors US Value Style ETF (ticker: STLV)

Fund/Ticker Changes

Roundhill BIG Tech ETF (ticker: BIGT)

became The Magnificent Seven ETF (ticker: MAGS)

TETF.Index Performance vs. S&P Financial Select Sector Index

(as of November 10, 2023)

TETF.Index Performance vs. Other Leading Financial Indices

(March 31, 2017 through November 10, 2023)

Why Follow the ETF Industry KPIs

The team at Toroso Investments began tracking the ETF Industry Key Performance Indicators (KPI’s) in the early 2000’s and have been consistently reporting on, and analyzing these metrics ever since. The table above was the impetus for the creation of the TETF.Index, the index that tracks the ETF industry. Each week, we will share the statistics we believe to be the most useful for identifying industry trends, in addition to the performance of the TEFT.Index.

DISCLAIMER

Past performance is no guarantee of future returns. This article is for informational and educational purposes only; is not intended to constitute legal, tax, accounting or investment advice; and does not constitute an offer to sell or a solicitation of an offer to buy any security or service. Furthermore, the Indexes shown above are not investable. While Toroso has gathered the information presented from sources that it believes to be reliable, Toroso cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed are Toroso’s opinions and do not reflect the opinions of any affiliates or related persons. All opinions are current only as of the date of initial publication and are subject to change without notice. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested.