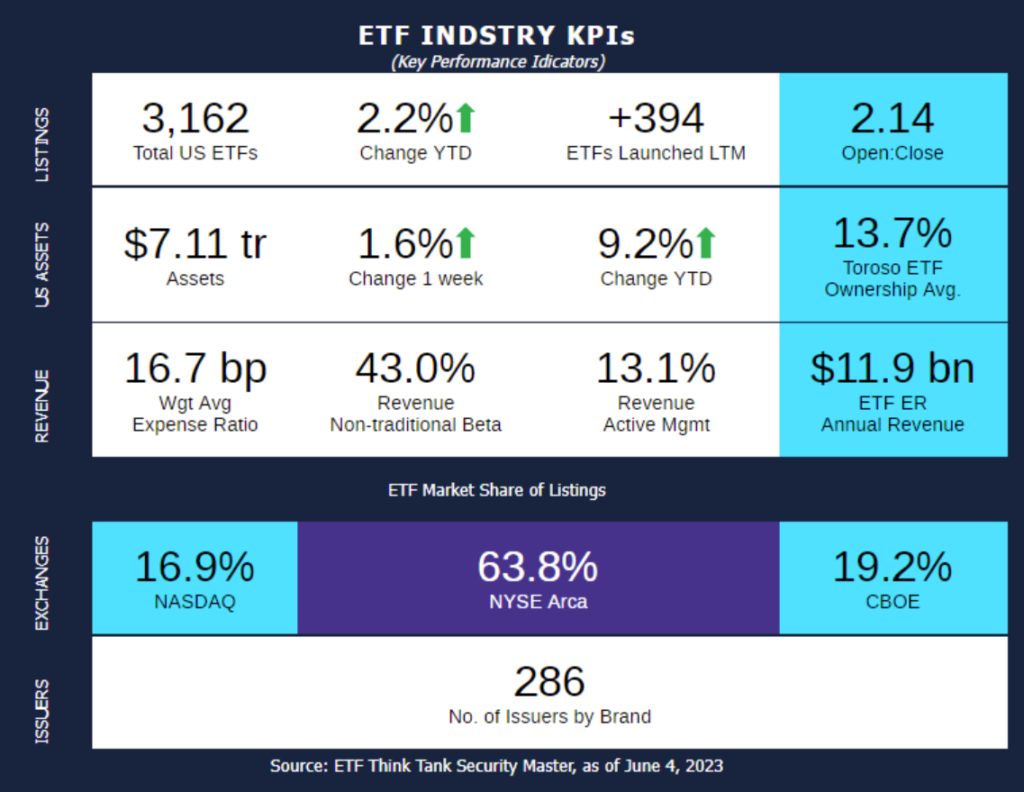

Week of May 29, 2023 KPI Summary

The ETF industry welcomed 9 ETFs in the past week (ended June 4) and bid farewell to 5 funds, pushing the open-to-close ratio to 2.14. For perspective, about a year ago that ratio was around 5 amid a more robust ETF launch – and tamer ETF closure – pace.

This week, 7 of the new launches were active ETFs. The proliferation of active management in ETFs remains one of the biggest themes across product innovation.

- Active ETFs now command more than $400 billion in assets, or about 5.6% of all U.S.-listed ETF assets. They also represent 13% of all revenue generated from expense ratios.

- Appetite for active ETFs, which so far in 2023 has commanded roughly 30% of all net inflows, also continues to grow as investors look for diversification, for alpha and for risk management opportunities in challenging markets.

The ongoing demand for ways to manage downside risk in the face of uncertainty has also fueled the growth of a segment we call “Buffer ETFs” – funds that offer access to U.S. equities but rely on options contracts to deliver downside protection in pre-determined tranches.

- There are now about 140 Buffer ETFs in the market with more than $25 billion in total assets across them.

- FT Cboe Vest, Allianz, Innovator and TrueShares are among the most prolific issuers in this category.

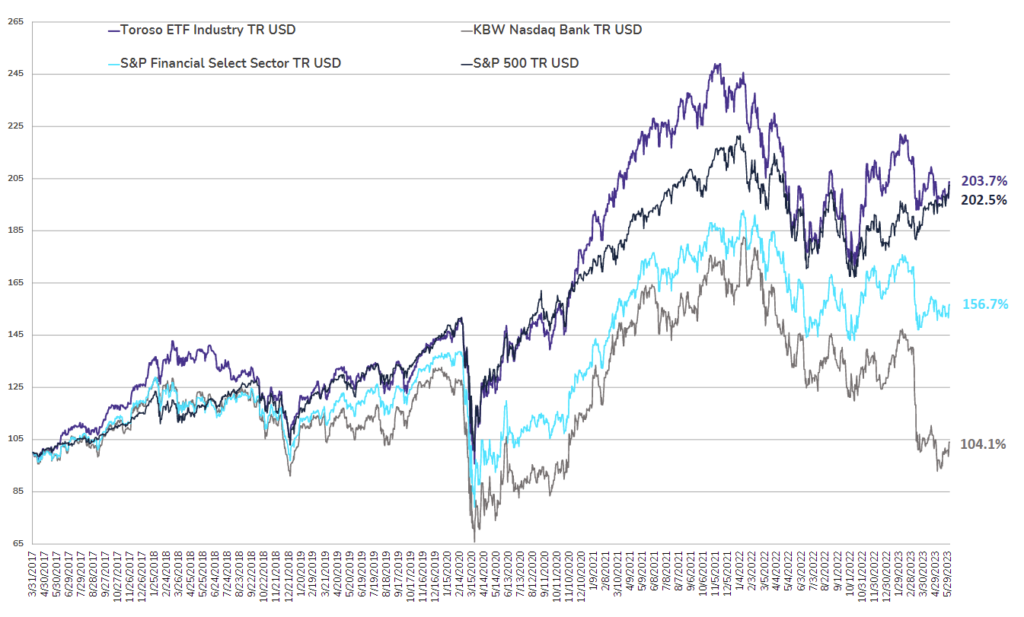

As a final note, our proprietary Toroso ETF Industry Index (TETF), which measures the performance of the ETF industry as a whole, continued its outperformance relative to the S&P Financial Select Sector Index since inception (chart below).

ETF Launches

QRAFT AI-Pilot U.S. Large Cap Dynamic Beta ETF (ticker: AIDB)

BlackRock Flexible Income ETF (ticker: BINC)

BlackRock Large Cap Value ETF (ticker: BLCV)

FT Cboe Vest U.S. Equity Moderate Buffer ETF – May (ticker: GMAY)

FT Cboe Vest U.S. Small Cap Moderate Buffer ETF – May (ticker: SMAY)

AllianzIM U.S. Large Cap Buffer10 June ETF (ticker: JUNT)

AllianzIM U.S. Large Cap Buffer20 June ETF (ticker: JUNW)

Global X Carbon Credits Strategy ETF (ticker: NTRL)

X-Square Municipal Income Tax Free ETF (ticker: ZTAX)

ETF Closures

Upholdings Compound Kings ETF (ticker: KNGS)

KraneShares Global Carbon Transformation ETF (ticker: KGHG)

Alpha Intelligent – Large Cap Growth ETF (ticker: AILG)

Alpha Intelligent – Large Cap Value ETF (ticker: AILV)

Fount Subscription Economy ETF (ticker: SUBS)

Fund/Ticker Changes

None

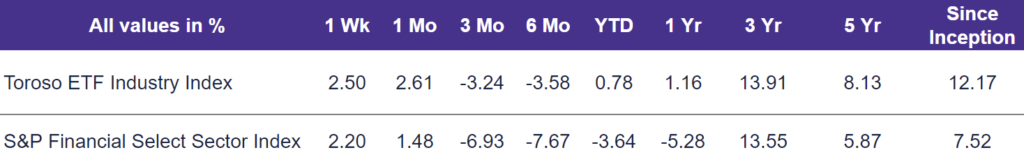

TETF.Index Performance vs. S&P Financial Select Sector Index

(as of June 2, 2023)

TETF.Index Performance vs. Other Leading Financial Indices

(March 31, 2017 through June 2, 2023)

Why Follow the ETF Industry KPIs

The team at Toroso Investments began tracking the ETF Industry Key Performance Indicators (KPI’s) in the early 2000’s and have been consistently reporting on, and analyzing these metrics ever since. The table above was the impetus for the creation of the TETF.Index, the index that tracks the ETF industry. Each week, we will share the statistics we believe to be the most useful for identifying industry trends, in addition to the performance of the TEFT.Index.

DISCLAIMER

Past performance is no guarantee of future returns. This article is for informational and educational purposes only; is not intended to constitute legal, tax, accounting or investment advice; and does not constitute an offer to sell or a solicitation of an offer to buy any security or service. Furthermore, the Indexes shown above are not investable. While Toroso has gathered the information presented from sources that it believes to be reliable, Toroso cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed are Toroso’s opinions and do not reflect the opinions of any affiliates or related persons. All opinions are current only as of the date of initial publication and are subject to change without notice. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested.