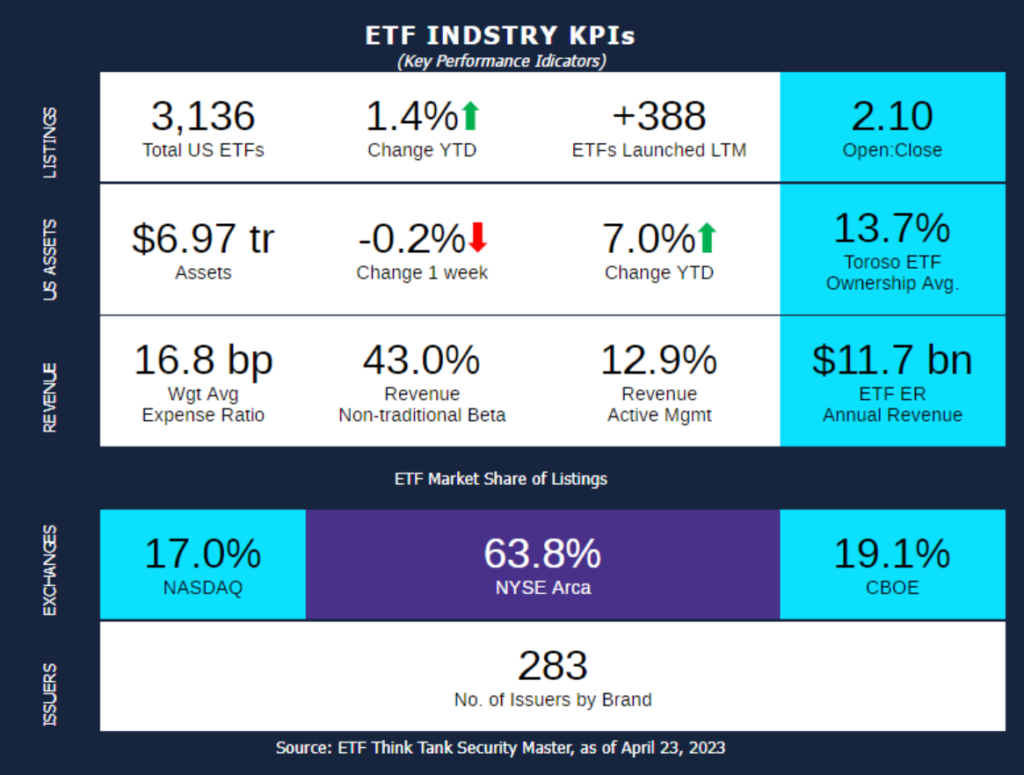

Week of April 17, 2023 KPI Summary

- This week, the industry experienced 8 ETF launches and 8 closures, shifting the 1-year Open-to-Close ratio to 2.10 and total US ETFs to 3,136.

- On this date last year, the open-to-close ratio was 5.79, the highest ever recorded since we started our weekly KPIs back in 2018. Today, it is 2.10, the lowest it’s been since June 2021 due to the trimming of funds (closures) in the industry.

- The old saying says “April showers bring May flowers.” This week, we are, once again, “diving” into the water themed ETFs to see if the showers have been stormy or calm. This is a sequel to the water themed ETF article we wrote last year around this time.

- There are 7 ETFs that focus on water ranging from $1.75 Billion in assets to $6 million, totaling $4.4 Billion.

- The oldest and largest of its assets is Invesco Water Resources (PHO), which was launched in 2005 and has $1.75 Billion, no significant change from last year (4/25/22). The next two largest funds are First Trust Water (FIW) and Invesco S&P Global Water (CGW), both launched in 2007 and have over $1 Billion in assets. The final 4 are PIO, EBLU, AQWA, and IWTR (the newest from September 2022).

- April has been a calm month for these Water ETFs. The 7 ETFs have averaged 0.04% returns MTD, with the newbie IWTR leading the pack at 1.1%. However, the 2023 YTD returns are great with an average of 6.2% and IWTR again leading at 9.1%.

- This contrasts with last year’s April and 2022 YTD returns of -4.5% and -17.1% on average respectively.

- While the start of 2022 through April was thunderous, this year has started out a lot calmer for this pack of water ETFs. Hopefully this means May will bring the flowers to the ETF industry in return!

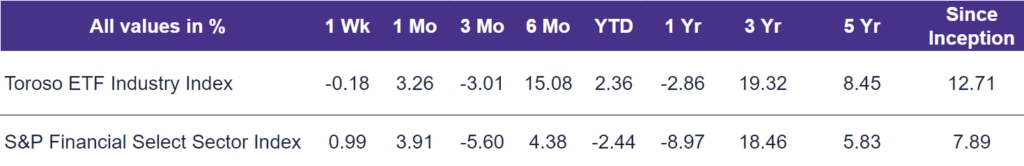

- The highlighted indexes experienced different performance last week. The Toroso ETF Industry Index was down -0.18% while the S&P Financial Select Sector Index led at 0.99%.

ETF Launches

-1x Short VIX Mid-Term Futures Strategy ETF (ticker: ZIVB)

Beacon Selective Risk ETF (ticker: BSR)

Beacon Tactical Risk ETF (ticker: BTR)

YieldMax AAPL Option Income Strategy ETF (ticker: APLY)

JPMorgan BetaBuilders U.S. Treasury Bond 1-3 Year ETF (ticker: BBSB)

JPMorgan BetaBuilders U.S. Treasury Bond 20+ Year ETF (ticker: BBLB)

JPMorgan BetaBuilders U.S. Treasury Bond 3-10 Year ETF (ticker: BBIB)

Tactical Advantage ETF (ticker: FDAT)

ETF Closures

ETFMG 2x Daily Travel Tech ETF (ticker: AWYX)

Morgan Creek-Exos Active SPAC Arbitrage ETF (ticker: CSH)

Invesco Focused Discovery Growth ETF (ticker: IVDG)

Invesco US Large Cap Core ESG ETF (ticker: IVLC)

Invesco Select Growth ETF (ticker: IVSG)

SPDR Bloomberg SASB Corporate Bond ESG Select ETF (ticker: RBND)

SPDR Bloomberg SASB Developed Markets Ex US ESG Select ETF (ticker: RDMX)

SPDR Bloomberg SASB Emerging Markets ESG Select ETF (ticker: REMG)

Fund/Ticker Changes

None

TETF.Index Performance vs. S&P Financial Select Sector Index

(as of April 21, 2023)

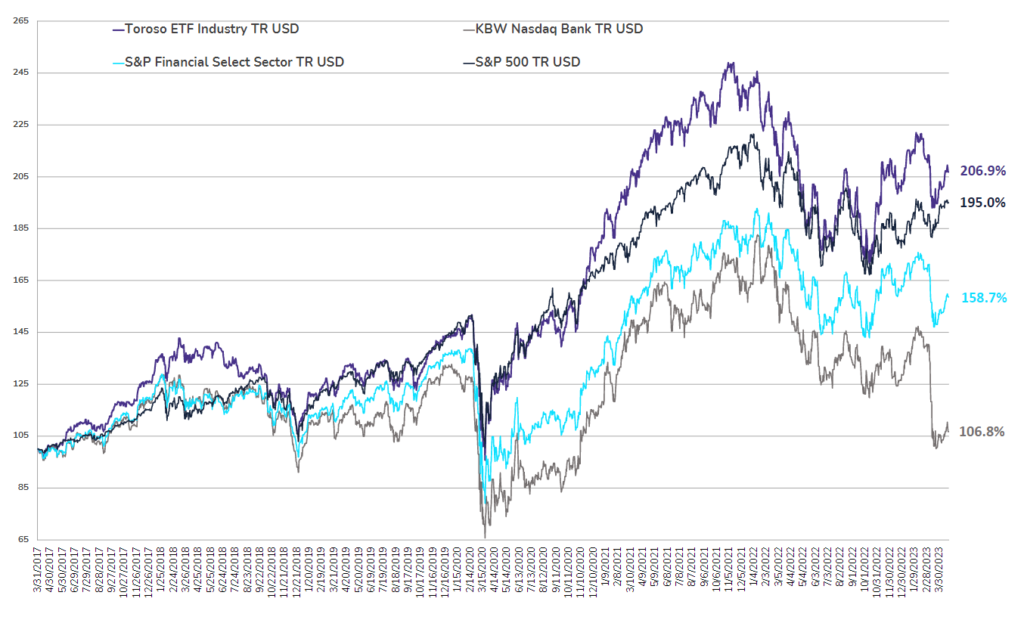

TETF.Index Performance vs. Other Leading Financial Indices

(March 31, 2017 through April 21, 2023)

Why Follow the ETF Industry KPIs

The team at Toroso Investments began tracking the ETF Industry Key Performance Indicators (KPI’s) in the early 2000’s and have been consistently reporting on, and analyzing these metrics ever since. The table above was the impetus for the creation of the TETF.Index, the index that tracks the ETF industry. Each week, we will share the statistics we believe to be the most useful for identifying industry trends, in addition to the performance of the TEFT.Index.

DISCLAIMER

Past performance is no guarantee of future returns. This article is for informational and educational purposes only; is not intended to constitute legal, tax, accounting or investment advice; and does not constitute an offer to sell or a solicitation of an offer to buy any security or service. Furthermore, the Indexes shown above are not investable. While Toroso has gathered the information presented from sources that it believes to be reliable, Toroso cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed are Toroso’s opinions and do not reflect the opinions of any affiliates or related persons. All opinions are current only as of the date of initial publication and are subject to change without notice. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested.