In the ETF Think Tank, we share and promote third-party research insights from many different diverging views. We believe that independent insights and research shared by entrepreneurial thought leaders make for valuable, timely, cutting-edge, and premium content. Two such entrepreneurs we’d like to highlight this week are Darius Dale and Lyn Alden. Given the constant headlines around banks in the last 30 days, it is no surprise that both individuals have had a focus on this sector. However, their approaches are different: tactical vs fundamental.

Darius Dale / 42 Macro, the Macro Tactician

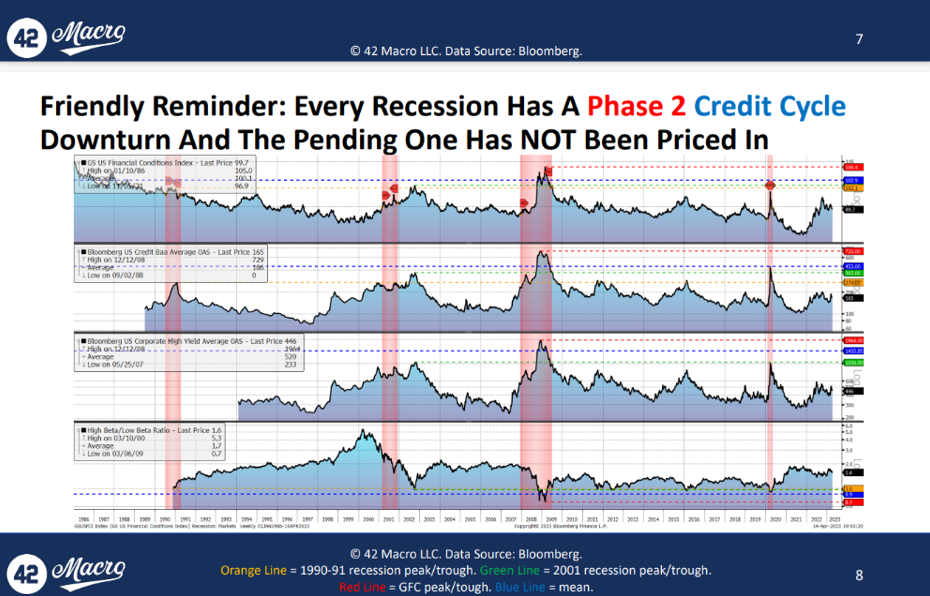

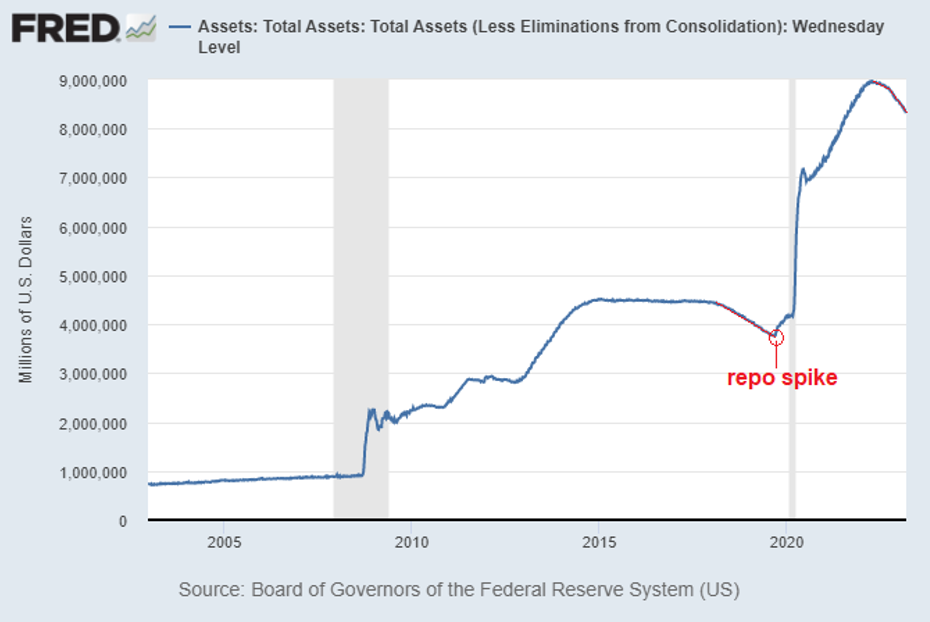

Darius Dale, through the 42 Macro approach, uses proprietary signals to manage portfolios and risk assets as related to markets that fit different models under various economic conditions. During his recent interview with Anthony Pompliano, where he discusses the Federal Reserve’s decision to pause, the increasing willingness of investors to take on risk, and the substantial injection of liquidity into the top 5 central banks, with a particular focus on the United States and China. The injection of liquidity has caused a significant turning point, which may result in inflationary concerns and a reduction in demand for US treasuries. As a result, the Federal Reserve may need to pause to demonstrate confidence in its ability to control inflation. However, while this could be an optimistic view, Darius notes that he does not anticipate a return to the easy-money policies of 2020-2021 and expects that asset prices may not move in a predictable fashion due to factors such as competition for investor funds, risks associated with inflation and deflation, and the complex balancing act that the Fed must undertake.

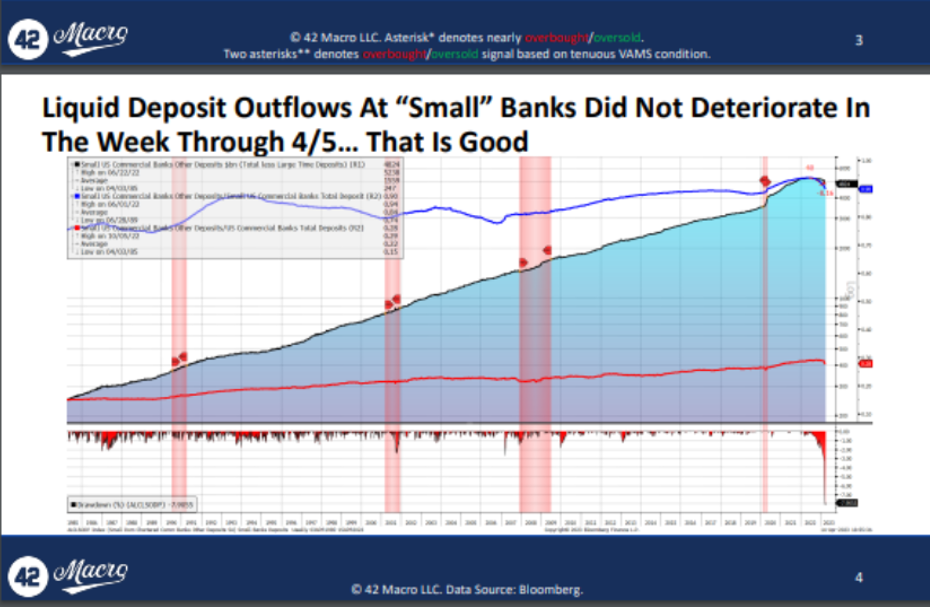

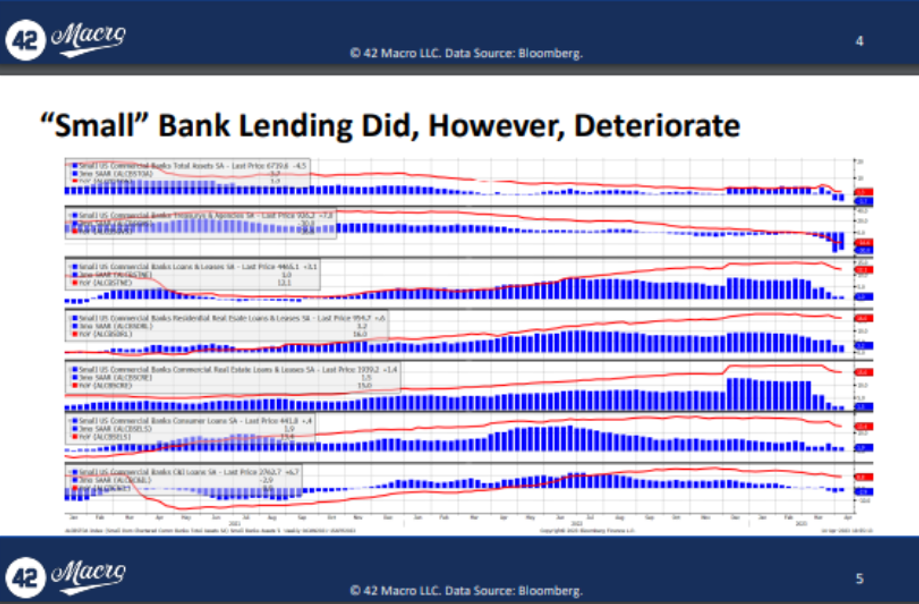

The encouraging news, illustrated in three charts, is that small bank liquidity looks to be stabilizing despite the recent crisis. The next step needed is increased lending activity in small banks. Typically, increased bank tightening signals an approaching recession, but this information is not particularly helpful on its own. As statements go, this information is not so helpful. For ETF Strategists, CIOs or PMs who need to explain the economic phases, these charts provide valuable context. Additionally, Darius provides a helpful, tactical approach to navigating this complex situation, which goes beyond merely framing the significance of the banking narrative.

Lyn Alden, the Fundamental Bottoms-Up Approach

It is hard not to be a fan of Lyn Alden’s work, as it is consistently informative and provides crucial context and details regarding various problems. Her newsletter is often a go-to resource for investors seeking a factual understanding of these issues. Like Darius, Lyn relies heavily on data to support her work rather than opinions that are shaped to fit a particular narrative. Therefore, her March 2023 newsletter: A Look at Bank Solvency is a must-read for investors and financial advisors looking to navigate the minefield of future solvency issues. As is usually the case, the newsletter is very well written, and the highlights below may serve as an introduction for those who need the motivation to delve deeper into the details.

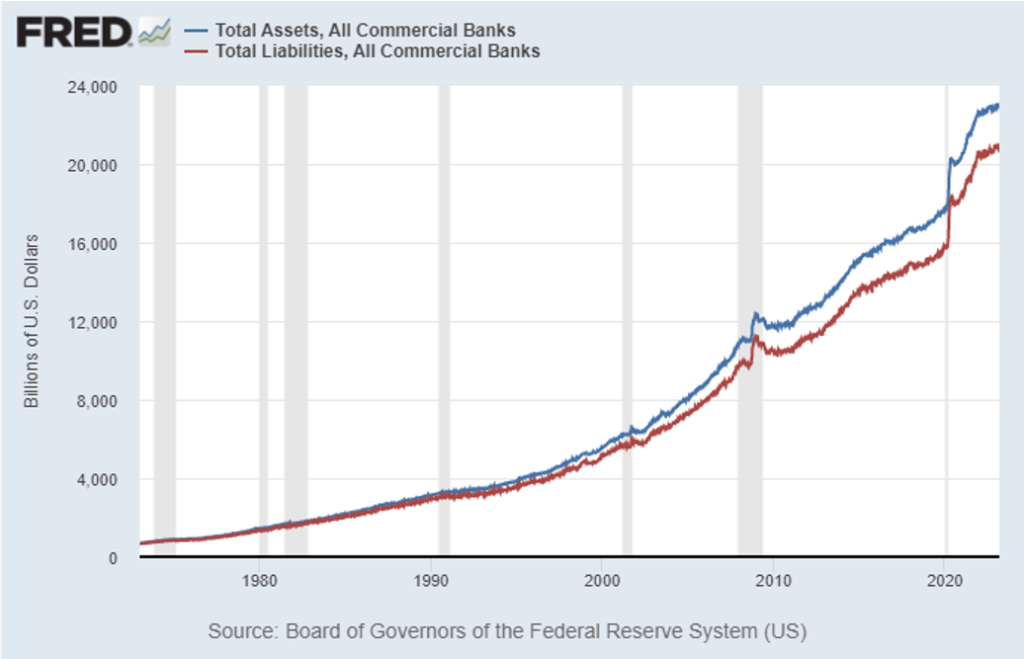

Again, just following the facts as we share some of the great FRED charts from Lyn Alden’s newsletter. Chart 1 highlights the well-known but unsettling fact that the US banking system has nearly $23 trillion in assets, with $20.7 trillion in liabilities. Lynn points out that the match between assets/liabilities is also diverse in terms of quality, duration, and liquidity (as deposits). As mentioned, the bulk of bank liabilities are deposits from individuals and businesses, and these deposits currently total $17.6 trillion. It is worth noting that depositors now expect a return on their deposits, despite the fact that safety was previously their primary concern. In the absence of safety, it is clear that money will be moved easily, resulting in a less efficient system.

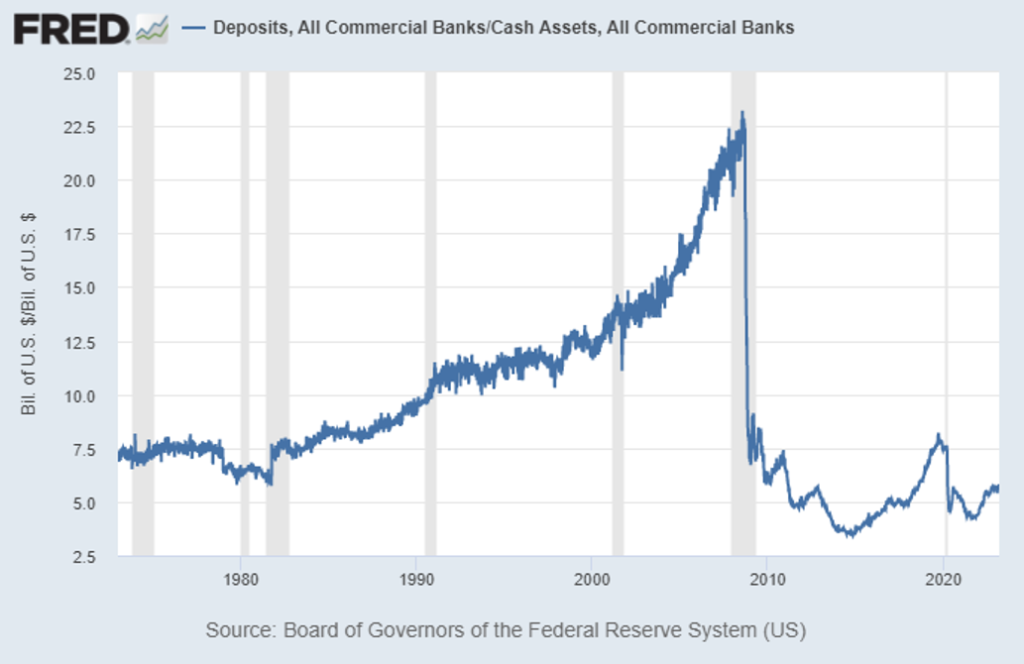

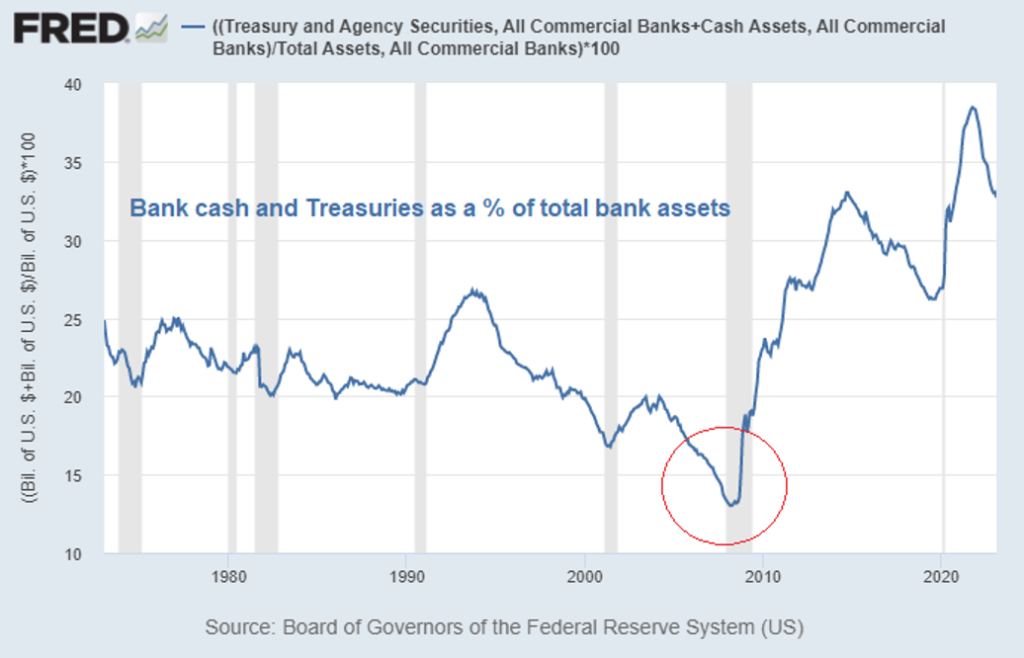

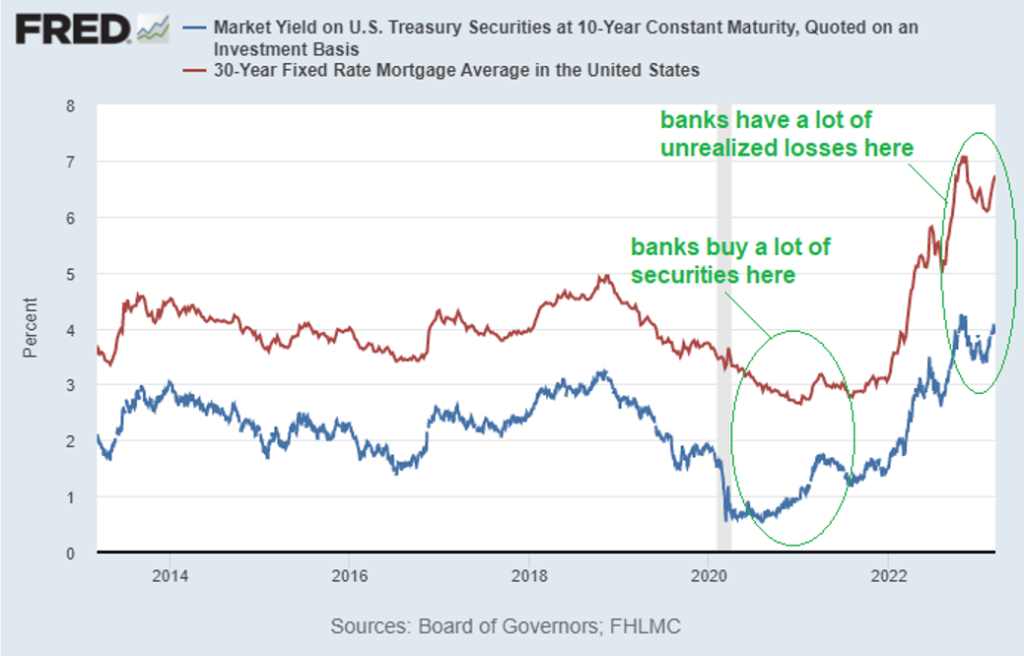

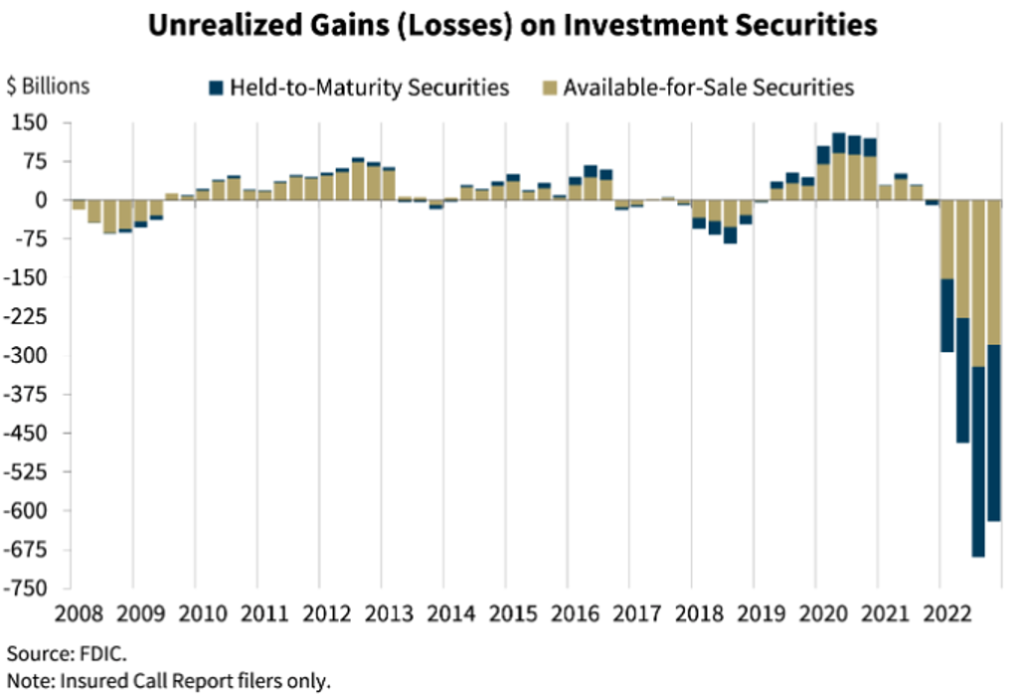

It’s ironic that while we face the risk of a recession, there is good news in the fact that bank deposits are now safer than they were in the past. As Lyn points out, banks credit quality in 2023 is less risky than it was in 2008, which is crucial given today’s banks primarily act as service providers for depositors who seek yield on their cash. The problem, of course, is that if banks hold too much cash, they won’t be able to earn a profit and those going out on duration risk gambling on the yield curve. Lyn appropriately highlights this by distinguishing between credit risk and duration risk.

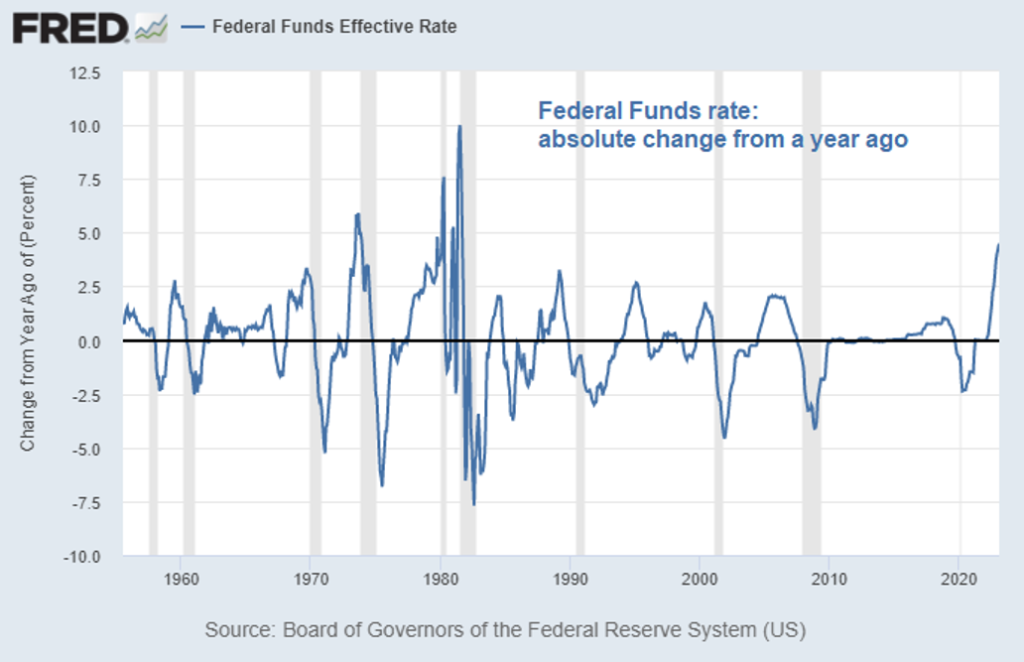

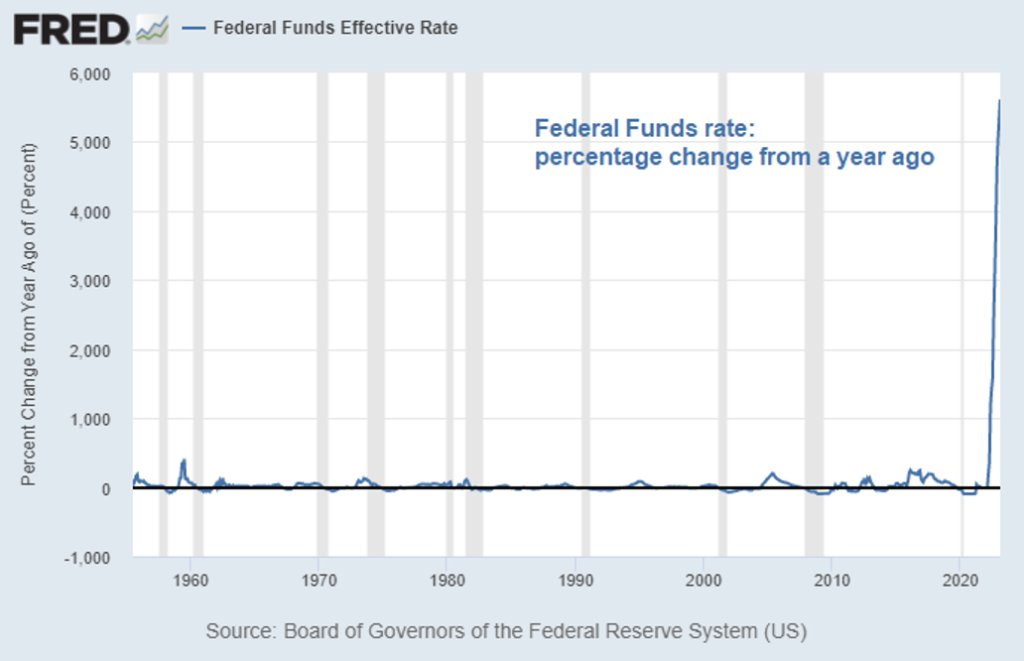

So, the issue is not credit quality, but rather a market-to-market situation that enables the Fed to increase rates and exclude everyone but the bankers. Lyn highlights that, “The Federal reserve has raised interest rates at the quickest absolute pace in decades or on a relative basis – ever.” Rising them 4.49% from .08 % in one year. Despite this, you may be asking yourself “Why is this good news?”.

Perhaps the answer to this could be wishful thinking. Afterall, if the genie gets put back in the bottle and inflation finds balance, then rates will come down and bankers can become whole again. This outcome would be preferable to credit deterioration because in the event of a short recessionary period, the lower interest rates and open window can simply make $600 billion of bad marks disappear. However, orchestrating a soft market landing may be wishful thinking, but when the stakes are this high, what choice is there? Unfortunately, for the regional bankers, it may already be too late. It’s worth noting that in 2022, the top 10 banks alone held approximately half of all the bank assets, while the remaining 4,200+ banks combined held the other half. Concentrating risk in the hands of a few isn’t always a good thing, and while I believe the weak may need to fail in a business that is built on scale, this trend will only serve to make the system more vulnerable.

Summary

We are proud to be sponsoring access to premium research for qualified financial advisors looking to hear from independent thinkers. We understand that due diligence cannot be conducted in isolation, and clients expect portfolio solutions that take into account current market conditions, not just past performance. It is important to remember that relying solely on what has worked in the past presumes that market conditions are not dynamic. While it’s important to acknowledge the value of back-tested experience, fiduciaries should not limit themselves solely to this approach. We extend our gratitude to Lyn and Darius for collaborating with our ETF Think Tank members, and we are pleased to see our community embracing innovative, forward-thinking strategies.

To learn more, please reach out to Dan Weiskopf at dweiskopf@tidalfg.com, but either way, do explore the full articles written by Darius and Lyn on their websites, 42Macro and Lyn Alden.