At the ETF Think Tank, we strive to educate investors on the benefits of the ETF structure. As our ETF Professor Dan Weiskopf (@ETFProfessor on twitter) would say, “structure matters,” and the transparency of the ETF wrapper is the key to understanding the structure of investments packaged in ETFs. This week, we explore one of the most powerful marketing components of the ETF ecosystem: the Ticker. The ETF Ticker can become synonymous with the name, and imply the promise of growth or exposure. Ironically, the ticker is subject to far less regulatory scrutiny then the ETF name, which explains why looking under the hood is even more important with catchy, intelligently chosen tickers.

Inspiration

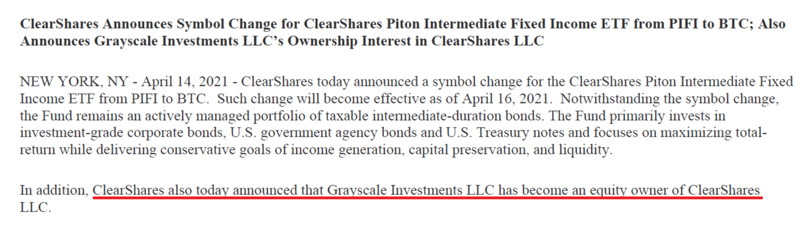

We had two things inspire us to write about “ETF Ticker Premium.” First, our partners at SoFi won best new ticker at the ETF.com awards for TGIF, the Sofi Weekly Income ETF. Second, we saw a strange phenomenon over the last couple of weeks where a fixed income ETF, previously known as PIFI, changed its ticker to BTC. The impact was documented by fellow ETF Nerd, Nate Geraci.

Under the Hood

Throughout the 30-year history of ETFs, the ticker premium has been very evident. Similar funds in name and strategy can have very different assets, which is usually attributed to either performance or the ticker. For issuers, the ticker is a powerful tool that can convey intent in just three or four letters. For investors, the ticker can be concise, whimsical, or a trap. At the ETF Think Tank, we urge investors to embrace the transparency of the ETF structure, look beyond the ticker, and remember that structure matters.

Disclosure

The information provided here is for financial professionals only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

All investments involve risk, including possible loss of principal.

The value of investments and the income from them can go down as well as up and investors may not get back the amounts originally invested, and can be affected by changes in interest rates, in exchange rates, general market conditions, political, social and economic developments and other variable factors. Investment involves risks including but not limited to, possible delays in payments and loss of income or capital. Neither Toroso nor any of its affiliates guarantees any rate of return or the return of capital invested. This commentary material is available for informational purposes only and nothing herein constitutes an offer to sell or a solicitation of an offer to buy any security and nothing herein should be construed as such. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested, and nothing herein should be construed as a guarantee of any specific outcome or profit. While we have gathered the information presented herein from sources that we believe to be reliable, we cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed herein are our opinions and are current only as of the date of distribution, and are subject to change without notice. We disclaim any obligation to provide revised opinions in the event of changed circumstances.

The information in this material is confidential and proprietary and may not be used other than by the intended user. Neither Toroso or its affiliates or any of their officers or employees of Toroso accepts any liability whatsoever for any loss arising from any use of this material or its contents. This material may not be reproduced, distributed or published without prior written permission from Toroso. Distribution of this material may be restricted in certain jurisdictions. Any persons coming into possession of this material should seek advice for details of and observe such restrictions (if any).