As ETF Strategists, we often don’t write about the power and importance of the CEO role. This is because as broad allocators of capital we often see that other portfolio factors may be more critical, but that does not mean that we don’t value the important impact that CEOs have on the success of a business. We summarize key attributes we look for in CEOs as follows: First, what is the ambition of the vision and disruptive goals? We do not believe that any business today is immune from being disrupted. Second, is this a CEO who is “bankable” by the capital markets? Third, how well does the CEO communicate to their Team the business need they are filling through the sale of the Company’s products/services and strategy? Fourth, is this a CEO with a track record of success? Is the CEO an implementer, team builder or someone who just delegates? How focused is the CEO on the customer and the shareholder? There is no question that a strong CEO can make a difference.

The skills of a CEO are difficult to project, and we do not believe there is a magic formula, but the definition of a great CEO should not be about the clothes they wear (or don’t, in the case of AMC’s CEO Adam Aaron), but rather a person’s ability to communicate and decisively execute on a long term business strategy. In that vein, knowing how and when to tap the capital markets is an art form that requires aligning the right capital with that CEO’s vision. In 2020, Michael Saylor decisively executed on his plan twice using the Convertible market, but in contrast, targeted very institutional investors.

As portfolio managers, we listen to 15-20 CEOs a week, speaking about their vision of the future. While some impress us, others fail to put the pieces together in a decisive way. Yet in many cases, we look to Twitter as a source of information and tone. We may not make decisions based upon what we hear on there, but it is clear that the ability for a modern CEO to communicate in a transparent and direct way via Twitter is a huge advantage to getting their message across. Of course, finding the right balance is the question. The agenda for a CEO should not be driven by their Twitter followers.

Visionary CEOs Need Decisiveness

As portfolio managers and ETF Strategists, we listen to many presentations each week by CEOs and other portfolio managers. Like many people we enjoy the efficiency of virtual presentations. Yet, with irony the contrasting fashion statements between AMC’s CEO Adam Aaron and the fun that Michael Saylor had on stage at the Miami Bitcoin 2021 conference highlight the times we are in and the need for face to face meetings. However, the power of a great leader as a CEO should not be about the clothes you wear, or don’t in the case of Mr. Aaron. Rather, it is about the ability to communicate and execute for the benefit of the shareholders and employees of the company you run. It is about the ability to raise capital to expand your business opportunity. This is a common factor between Mr. Saylor and Mr. Aaron.

Jack Dorsey, CEO of both Twitter and Match.com, is another visionary CEO who is decisive in his strategic mission for the companies he leads. Moreover, like Saylor, Aaron and Musk, Dorsey is exceptionally transparent in his views. He says “In fact, “if I were not at Square or Twitter, I would be working on bitcoin. If [bitcoin] needed more help than Square or Twitter, I would leave them for bitcoin,” he said. “But, I believe both companies have a role to play.”

Large Cap CEO Visionaries

There are many large cap CEOs who we admire, but Elon Musk is not one of them. There is no question that Elon Musk, CEO and Founder of Tesla Inc, Neuralink Corp and Space Exploration Technologies, is brilliant, and a visionary. However, let’s not forget something – he is not the CEO of Bitcoin and maybe now only a small investor in Bitcoin (less than 1.5%), Regardless, what remains confusing is how he is benefiting the Tesla shareholders through a past investment decision that he now clearly regrets. We like CEOs who are decisive, visionary and focused on execution. We admit that we originally saw synergies between the decision for the CEO of Tesla to pursue selling more cars to Bitcoin HODLERs, but at this point he just seems like a flawed, impulsive leader.

Bob Iger is an example of a leader who also surprised us in the news last week. Iger sold half his Disney stock at $179.48, raking in about $98.67 million. The media highlighted that there might be some questions about his CEO successor Bob Chapek. Iger built a media and theme park giant since becoming CEO in 2005. To name a few more large cap companies run by CEOs we admire, we would include Dr. Lisa Su of AMD, Corie Barry of Best Buy, Marvin Ellison of Lowe’s, Mary Barra of GM, and of course Satya Nadella of Microsoft. A couple of common threads exist in these CEOs:

- Competition is embraced by these CEOs. In the absence of competition there can be no market opportunity.

- Vision followed by focus leads to execution. From a top-down perspective, all these CEOs could see where they needed to be 5+ years out, but remaining focused on how to execute the plan took discipline. Let’s face it – CEOs need to be able to pivot as well.

- It seems that these CEOs were not afraid of taking risk. In fact, in most of these cases, a failure to take risk would have certainly led to the demise of the businesses themselves. Disruption is part of business, so a good CEO either is the disruptor, or at least must be embracing the disruption.

The CEO Factor

A number of ETFs have been launched as packaged solutions to identifying strong CEOs. ERShares Entrepreneurs ETF (ENTR) is one that was launched on November 8, 2017. However, is there really a formula for the Management factor? Thus far, this fund has generated outperformance over the S&P 500 with considerably more volatility than the typical S&P investor can endure. In our judgement, this should not be a surprise. A good CEO pursuing growth and disruption certainly must know how to manage risk for the long term, but also know when to pivot.

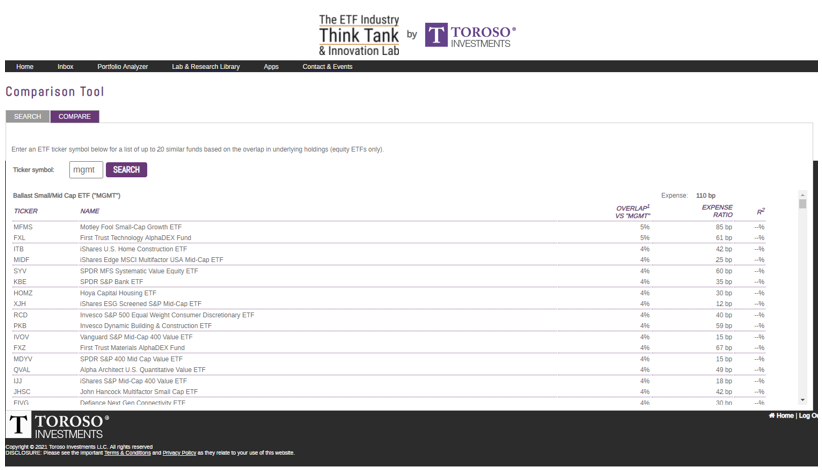

With that in mind, the question then becomes: should a fund focused on management be passive or actively managed? This is why we favor the Ballast Small/Mid Cap ETF (MGMT) because it is actively managed and does have that ability to pivot. Note that MGMT has only a 5% overlap in the ETF landscape, and with what we believe to have great performance since its inception on Dec 3, 2020.

Summary

There is no magic formula for identifying great management, but clearly in a world where conditions are perpetually changing and business disruption is constant, a strong management culture is important. This starts with the top! ETF owners should not forget that regardless of whether we own passive ETFs or active ETFs, we are shareholders of many companies. This means that the CEOs are the shepherds of our capital and their alignment with our interest is critical. In many ways, for us ETF Nerds, we probably tilt towards those CEOs who are most transparent and decisive in their missions.

Disclosure

The information provided here is for financial professionals only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

All investments involve risk, including possible loss of principal.

The value of investments and the income from them can go down as well as up and investors may not get back the amounts originally invested, and can be affected by changes in interest rates, in exchange rates, general market conditions, political, social and economic developments and other variable factors. Investment involves risks including but not limited to, possible delays in payments and loss of income or capital. Neither Toroso nor any of its affiliates guarantees any rate of return or the return of capital invested. This commentary material is available for informational purposes only and nothing herein constitutes an offer to sell or a solicitation of an offer to buy any security and nothing herein should be construed as such. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested, and nothing herein should be construed as a guarantee of any specific outcome or profit. While we have gathered the information presented herein from sources that we believe to be reliable, we cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed herein are our opinions and are current only as of the date of distribution, and are subject to change without notice. We disclaim any obligation to provide revised opinions in the event of changed circumstances.

The information in this material is confidential and proprietary and may not be used other than by the intended user. Neither Toroso or its affiliates or any of their officers or employees of Toroso accepts any liability whatsoever for any loss arising from any use of this material or its contents. This material may not be reproduced, distributed or published without prior written permission from Toroso. Distribution of this material may be restricted in certain jurisdictions. Any persons coming into possession of this material should seek advice for details of and observe such restrictions (if any).