One of the common themes we hear from advisors is that doing ETF due diligence is difficult in a marketplace that welcomes 5 to 10 new funds almost every week. Keeping up with product innovation – and evaluating new ETF ideas – is not an easy job.

That task is especially challenging in the actively managed ETF space because, here, investment philosophies and portfolio managers with differing views on a theme and/or strategy play a big role in the ultimate investor outcome. Evaluating active managers to assess the value proposition behind the pursuit of alpha for a fee can be tricky.

In fact, the due diligence hurdle is one of the factors preventing faster adoption of active ETFs, we have been told. As a segment, active ETFs now exceed 1,100 funds (roughly twice the number of traditional passive beta ETFs), but command only about $400 billion in assets – about 5% of total ETF market share, which is relatively small but increasing.

That said, product innovation in actively managed wrappers has serious momentum behind it, with the category now representing the bulk of ETF launches – more than 60% this year. Asset gathering is also picking up some steam, with active ETF snagging about 30% of all flows so far in 2023, almost twice the pace seen last year.

Consider that in its latest “U.S. ETF Themes for 2023” report, Bloomberg Intelligence noted that from 2019-to-date, 19 out of the 25 most successful launches were active ETFs thanks to some fee compression in the segment, product differentiation and strong distribution by some providers.

For all of the years we in this industry debated whether active ETFs “had arrived,” it looks like they finally have some 15 years after the launch of the very first one. And what’s more, the growth trend in active management is more likely to be in its infancy than reaching maturity because the stars have just aligned for active ETF development. Among the factors fueling this segment:

- Friendlier regulation that allows for more complexity, use of derivatives and expedited access has facilitated active ETF innovation.

- Distribution and client demand trends continue to fuel active mutual fund-to-ETF conversions.

- Appetite for high conviction thematic plays where active management often adds value is strong.

The good news is that if you are looking to evaluate an active ETF, we can help you with that homework. Our ETF database and analytics tools are free to use and can be a good starting point for your research.

Here’s how to go about it.

5 Easy ETF Due Diligence Steps

1) Find the ticker you want in our Classification Tool – this tool can be found on our website at https://etfthinktank.tidalfinancialgroup.com/etf-finder/ or through our Data Tool Portal (login credentials are free – just reach out):

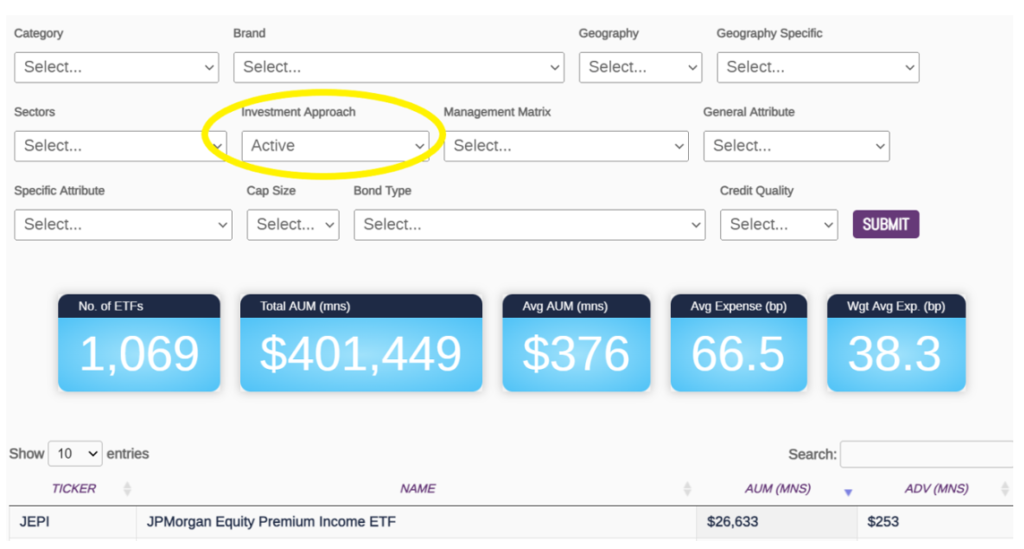

The Classification Tool allows you to search the universe of ETFs by many filters – actively managed ETFs are, at first, isolated by investment approach, where you immediately learn how many active ETFs are in the market, how much money is invested in them, and how much they cost on average:

2) Once you have the ticker you want to investigate, dive into “My apps” to find all sorts of tools that help you do fund due diligence. First stop: the Comparison Tool.

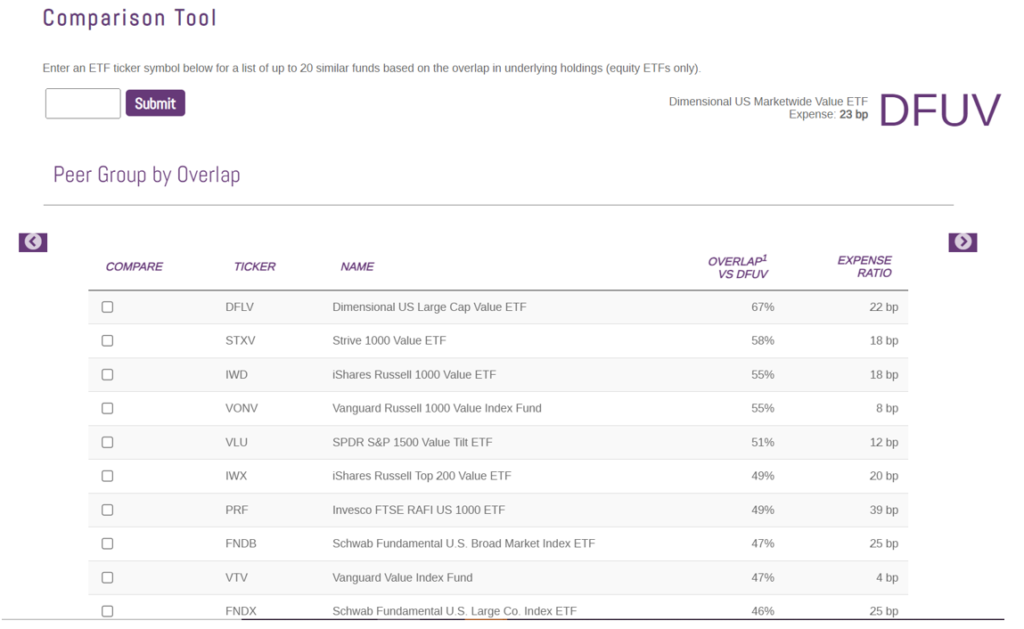

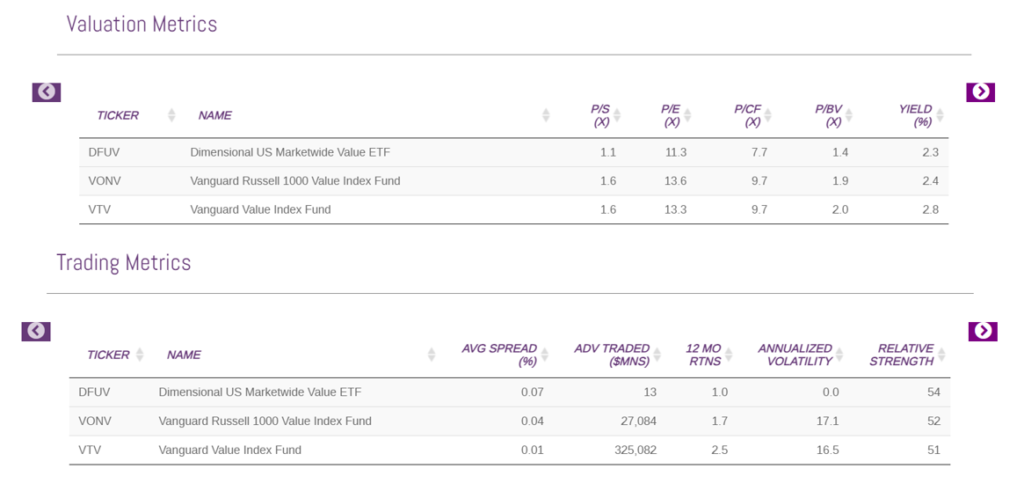

In the Comparison Tool, by entering the desired ticker, you will find a universe of comparable ETFs noting how much overlap exists between these funds. Consider, for example, Dimensional’s DFUV, one of the biggest active ETFs:

Here you learn that DFUV has more than 55% overlap to VONW, for example, but costs almost 3x as much in expense ratio, and it has almost 50% overlap to VTV, which costs only 4 bps vs. DFUV’s 23 bps. If cost is a driving decision factor for you, you’ve already learned a lot about the value prop of a fund relative to other large value ETFs. The comparison tool allows you to put your active manager in a broader context.

If you click on the “compare” boxes of a couple of funds in the list and hit one of the arrows on either side for a closer comparison, you will learn things like fundamentals metrics and trading stats. For example, you will see that DFUV as a value fud tilts more heavily into the value factor than its Vanguard competitors as measured by our metrics, but it yields a little less. You will also see that the fund doesn’t trade as tightly with a wider spread vs. segment counterparts.

This step offers you the opportunity to focus on specific data points that you deem important, and possibly extend your research to other comparable tickers as well.

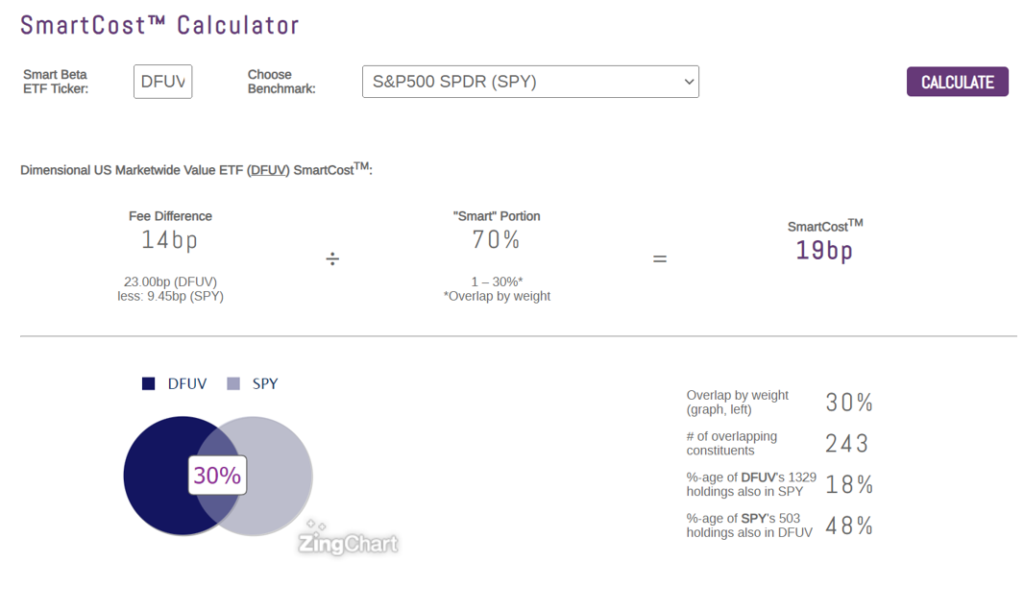

3) Cost is an important consideration in any investment decision. When it comes to actively managed ETFs, it’s especially important to know how much “active share” you are paying for relative to the market. Our Smart Cost Calculator allows you to compare any ticker to a broader benchmark.

In the case of DFUV, this tool shows you that about 70% of the portfolio is “smart,” offering plenty of non-beta like opportunity relative to the S&P 500, and you are paying 19bps for that. As a rule of thumb, a good result in this calculator is when the Smart Cost is equal to or less than the ETF’s total expense ratio, meaning you are getting enough active management for your buck. In this case, DFUV passes the cost test.

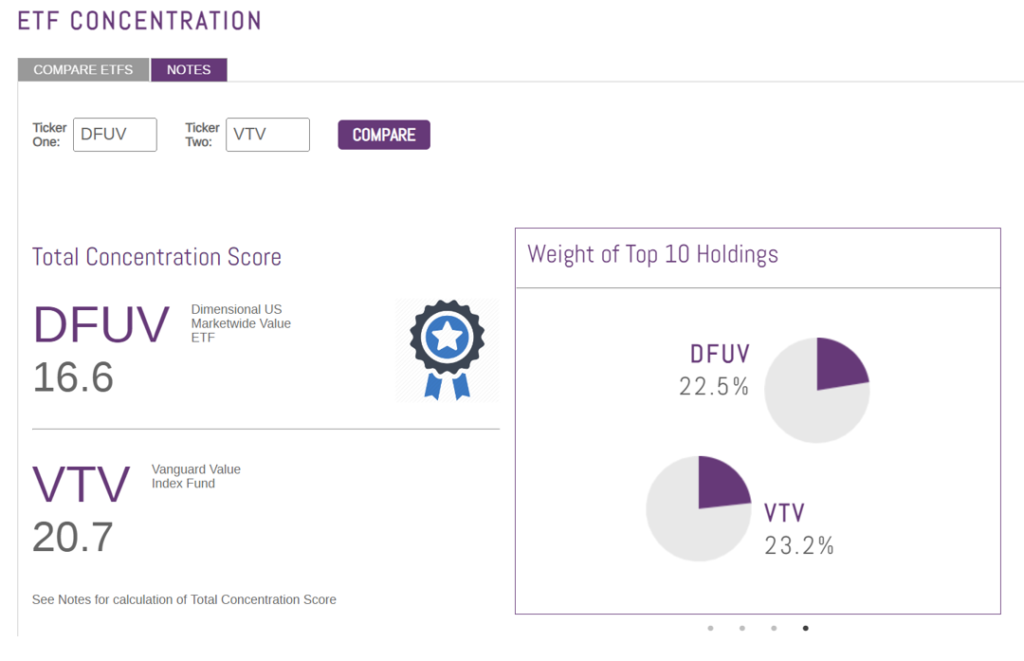

4) Portfolio concentration is another key consideration when choosing an ETF. Our Concentration App allows you to compare 4 different portfolio concentration metrics of two competing ETFs to understand just how concentrated (or diluted) the fund’s exposure is.

It’s often the case that among active (and thematic ETFs), your intended time horizon can impact how much concentration you want. If you are looking, say, for a short-term tactical play that captures a hot theme, high conviction/big concentration may be what you are looking for. But if you are taking a fundamental view or looking for a more long-term strategic allocation, lower concentration may be best suited for that outcome. Either way, this tool allows you to understand just how much concentration you are getting with any ETF. You get to compare any 2 funds at a time (and note that the tab on top “notes” explains in detail each of these concentration metrics.)

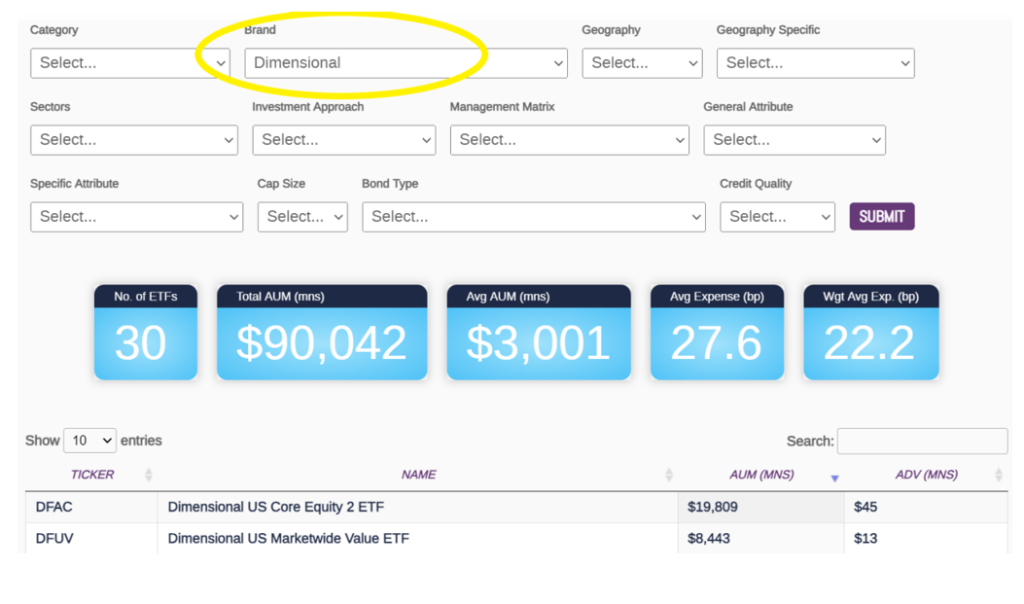

5) Finally, you can take stock of the fund provider behind your ticker of choice with the Classification Tool. If for nothing else, this step can help give you some color on their expertise as a brand, or closure risk as a provider.

Do they manage other strategies? Do they have a sizeable footprint? If not, are they a boutique provider that brings unique expertise to the table? These are questions that can help answer client concerns about the choice of a specific active manager.

For this effort, circle back to where we started in our Classification Tool and search by provider brand. In the case of DFUV, you will learn that Dimensional has more than $90 billion in U.S.-listed ETF assets spread across 30 ETFs today. This is recognized as a solid fund from a solid provider.

Take the Plunge

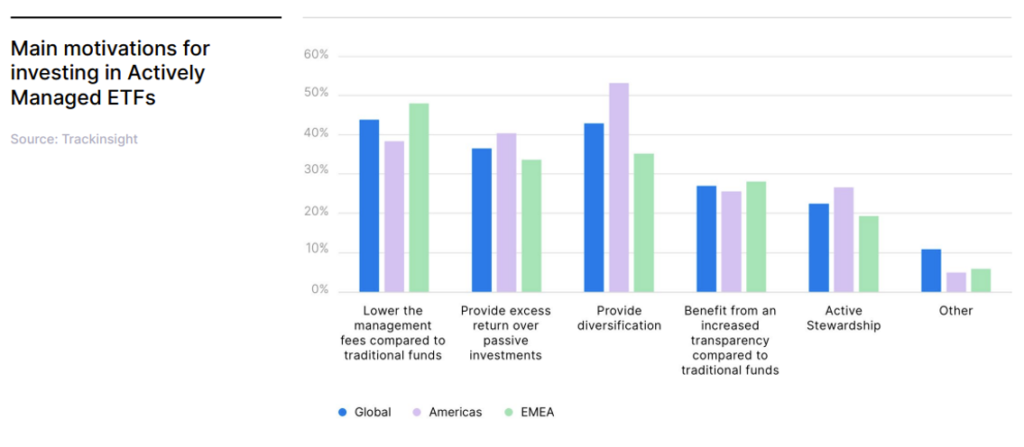

Trackinsight’s latest Global ETF Survey 2023 (of over 500 professional investors putting to work nearly $1 trillion in assets) found that active ETFs and thematic ETFs are hugely popular themes with investors this year. More than 2/3 of those surveyed cited allocating to active and thematic ETFs, and most said they planned to increase those allocations in the next 3 years.

More importantly, the report found that 80% of investors in the U.S. and Americas would be more inclined to invest in an active strategy if it were packaged as an ETF rather than a mutual fund. If that translates into demand, brace for a wave of mutual fund-to-ETF conversions that could follow the 39 conversions we’ve already seen in the past 2 years.

“This overwhelming interest in an ETF wrapper is likely due to most ETFs’ lower expense ratios relative to mutual funds. The greater transparency of ETFs and the improved tax efficiency are also likely reasons for the appeal of an ETF wrapper,” the report said.

The point is that active ETFs have been around for a while, but it’s still early days for this category. Due diligence isn’t going to get simpler, but it doesn’t have to stand in the way of adoption and implementation either.

Got ETF due diligence questions? You know what we like to say: Don’t think alone. We are here to help. And for a dive into the history of active management, check out our latest episode of The Captain’s Log.

Disclosure

All investments involve risk, including possible loss of principal.

The material provided here is for informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

The value of investments and the income from them can go down as well as up and investors may not get back the amounts originally invested, and can be affected by changes in interest rates, in exchange rates, general market conditions, political, social and economic developments and other variable factors. Investment involves risks including but not limited to, possible delays in payments and loss of income or capital. Neither Toroso nor any of its affiliates guarantees any rate of return or the return of capital invested. This commentary material is available for informational purposes only and nothing herein constitutes an offer to sell or a solicitation of an offer to buy any security and nothing herein should be construed as such. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested, and nothing herein should be construed as a guarantee of any specific outcome or profit. While we have gathered the information presented herein from sources that we believe to be reliable, we cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed herein are our opinions and are current only as of the date of distribution, and are subject to change without notice. We disclaim any obligation to provide revised opinions in the event of changed circumstances.

The information in this material is confidential and proprietary and may not be used other than by the intended user. Neither Toroso or its affiliates or any of their officers or employees of Toroso accepts any liability whatsoever for any loss arising from any use of this material or its contents. This material may not be reproduced, distributed or published without prior written permission from Toroso. Distribution of this material may be restricted in certain jurisdictions. Any persons coming into possession of this material should seek advice for details of and observe such restrictions (if any).