Week of November 18, 2024 KPI Summary

The ETF industry had an eventful pre-Thanksgiving week, marked by 19 new launches, 3 closures, a ticker change, 4 mutual fund-to-ETF conversions, and a fund merger.

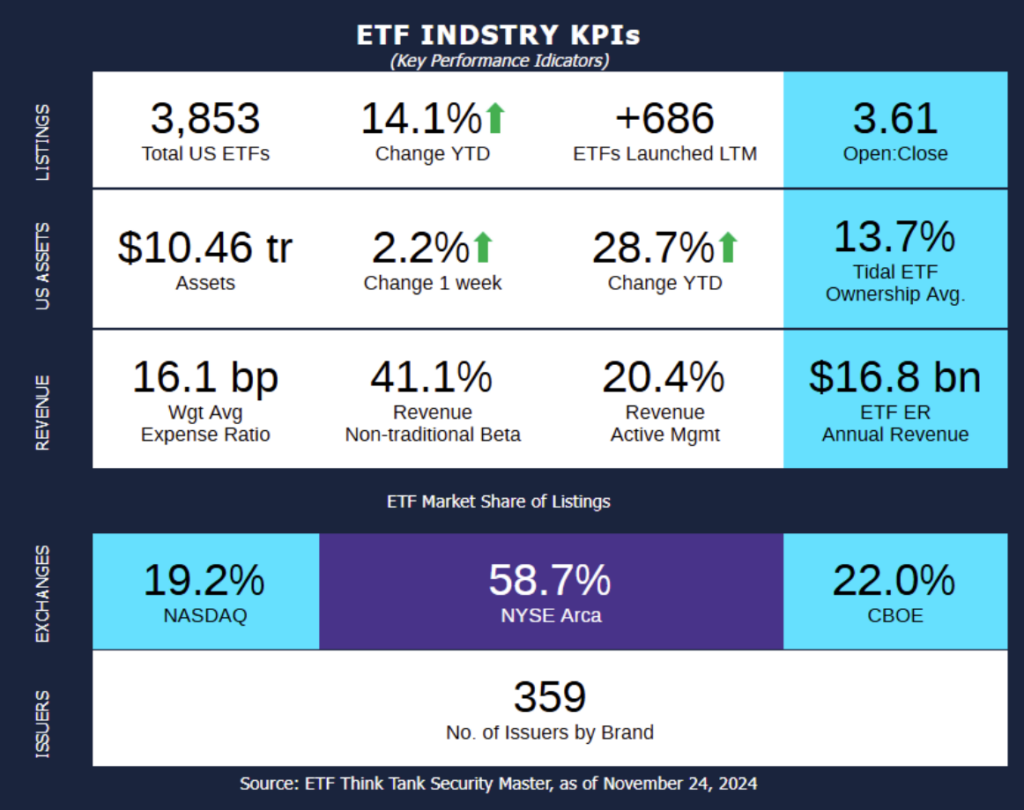

- The current 1 Year ETF Open-to-Close ratio rises to 3.61.

- The total number of US ETFs has risen to 3,853.

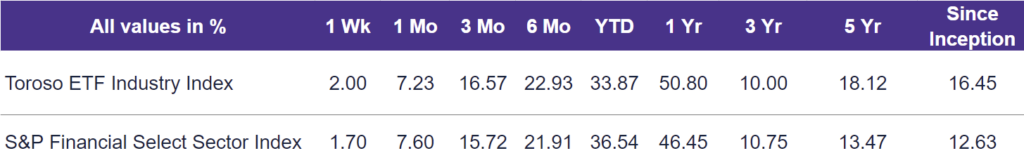

Our Toroso ETF Industry Index, which tracks companies generating revenue from the ETF ecosystem, rose 2% last week, outperforming the S&P Financial Select Sector Index, which rose by 1.70%.

ETF activity from the past week includes:

Fidelity Launches 5 Active ETFs: Fidelity has launched five new actively managed equity ETFs, including strategies focused on U.S. all-cap, Global ex-US, international, and emerging markets equities, expanding its ETF lineup to 76 products. This move highlights Fidelity’s push into active ETFs, as their lineup consists of 76 ETFs and ETPs with $93 billion in AUM.

Blackrock Completes its First Mutual Fund to ETF Conversion: BlackRock has introduced the BlackRock International Dividend ETF (BIDD), its first active mutual fund-to-ETF conversion. This fund targets dividend-paying companies across developed and emerging markets, marking a significant step in BlackRock’s push for innovative, accessible investment solutions.

2 New ETFs Targeting the FIRE Community: Two new ETFs launched this week, designed with themes aligned to the Financial Independence, Retire Early (FIRE) movement. These actively managed fund-of-funds emphasize transparency, tax efficiency, and strategies commonly associated with FIRE principles, such as wealth-building and income generation.

ETF Launches

Aptus Large Cap Upside ETF (ticker: USPD)

Atlas America Fund (ticker: USAF)

Brown Advisory Flexible Equity ETF (ticker: BAFE)

Fidelity Enhanced Emering Markets ETF (ticker: FEMR)

Fidelity Enhanced U.S. All-Cap Equity ETF (ticker: FEAC)

Fidelity Fundamental Developed International ETF (ticker: FFDI)

Fidelity Fundamental Emering Markets ETF (ticker: FFEM)

Fidelity Fundamental Global ex-U.S. ETF (ticker: FFGX)

FIRE Funds Income Target ETF (ticker: FIRI)

FIRE Funds Wealth Builder ETF (ticker: FIRS)

First Trust Bloomberg Artificial Intelligence ETF (ticker: FAI)

FT Vest Nasdaq-100 Moderate Buffer ETF – November (ticker: QMNV)

FT Vest U.S. Equity Max Buffer ETF – November (ticker: NOVM)

FT Vest U.S. Equity Quarterly Dynamic Buffer ETF (ticker: FHDG)

Schwab Mortgage-Backed Securities ETF (ticker: SMBS)

Stance Sustainable Beta ETF (ticker: STSB)

TCW AAA CLO ETF (ticker: ACLO)

TCW Multisector Credit Income ETF (ticker: MUSE)

YieldMax Target 12 Big 50 Option Income ETF (ticker: BIGY)

ETF Closures

IQ Engender Equality ETF (ticker: EQUL)

IQ CBRE NextGen Real Estate ETF (ticker: ROOF)

IQ 500 International ETF (ticker: IQIN)

Fund/Ticker Changes

-1x Short VIX Mid-Term Futures Strategy ETF (ticker: ZIVB)

became -1x Short VIX Mid-Term Futures Strategy ETF (ticker: ZVOL)

iShares LifePath Target Date 2025 ETF (ticker: ITDA) and iShares LifePath Retirement ETF (ticker: IRTR)

became iShares LifePath Retirement ETF (ticker: IRTR)

BlackRock International Dividend Fund (ticker: BREKX) and BlackRock International Dvidend Fund (ticker: BRECX)

became BlackRock International Dividend ETF (ticker: BIDD)

TCW MetWest Corporate Bond Fund I (ticker: MWCBX) and TCW MetWest Corporate Bond Fund M (ticker: MWCSX)

became TCW Corporate Bond ETF (ticker: IGCB)

TCW High Yield Bond Fund I (ticker: TGHYX) and TCW High Yield Bond Fund M (ticker: MWHYX)

became TCW High Yield Bond ETF (ticker: HYBX)

TCW MetWest Floating Rate Income Fund M (ticker: MWFRX) and TCW MetWest Floating Rate Income Fund I (ticker: MWFLX)

became TCW Senior Loan ETF (ticker: SLNZ)

TETF.Index Performance vs. S&P Financial Select Sector Index

(as of November 22, 2024)

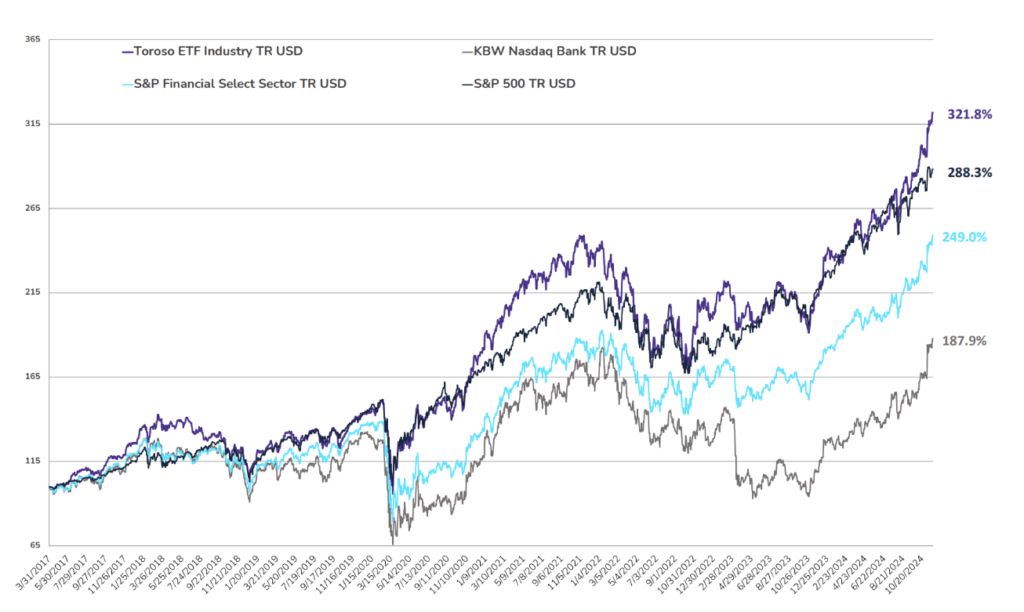

TETF.Index Performance vs. Other Leading Financial Indices

(March 31, 2017 through November 22, 2024)

Why Follow the ETF Industry KPIs

The team at Tidal Investments, originally operating as Toroso Investments, began tracking the ETF Industry Key Performance Indicators (KPIs) in the early 2000s and have been consistently reporting on, and analyzing these metrics ever since. This diligent tracking was the catalyst for the creation of the TETF.Index, an index that tracks the ETF industry. Now, as part of the Tidal Financial Group, which is affiliated with Tidal Investments, LLC, we are positioned to provide even more in-depth analysis and insights. Each week, we will share the statistics we believe to be the most useful for identifying industry trends, in addition to the performance of the TETF.Index.

DISCLAIMER

Past performance is no guarantee of future returns. This article is for informational and educational purposes only; is not intended to constitute legal, tax, accounting, or investment advice; and does not constitute an offer to sell or a solicitation of an offer to buy any security or service. Furthermore, the Indexes shown above are not investable. While Tidal Investments, LLC (formerly known as Toroso Investments, LLC) has gathered the information presented from sources that it believes to be reliable, Tidal Investments, LLC cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed are Tidal Investments, LLC’s opinions and do not reflect the opinions of any affiliates or related persons. All opinions are current only as of the date of initial publication and are subject to change without notice. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested.