Week of July 1, 2024 KPI Summary

This week, the ETF industry experienced 16 ETF launches and 0 closures.

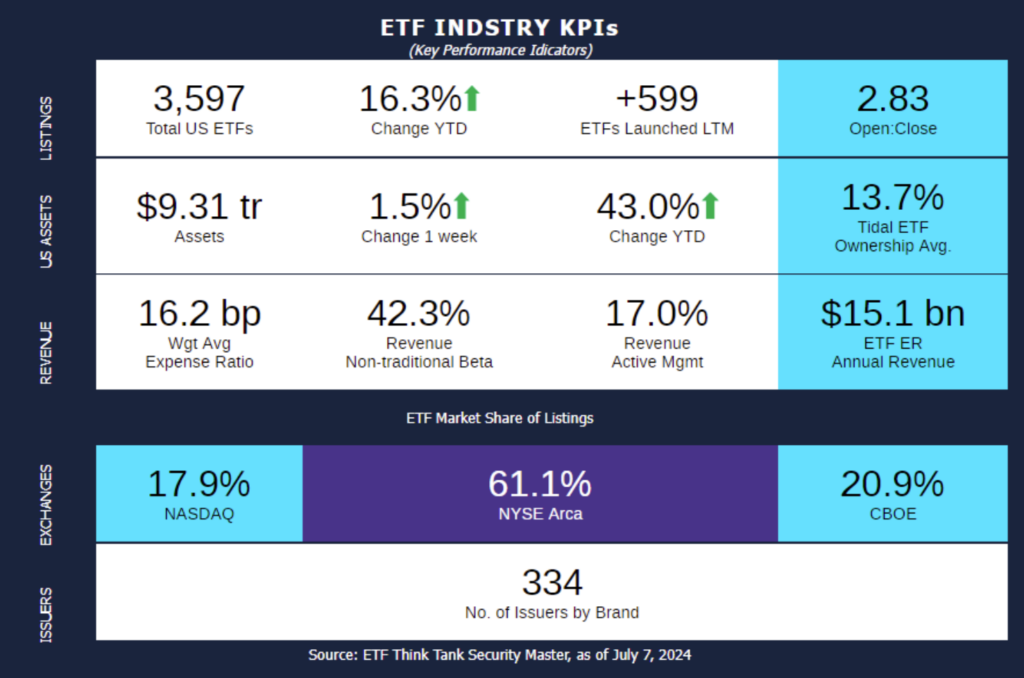

- 1 Year Open-to-Close ratio is upheld at 2.83.

- Total US ETFs increased to 3,597, a +12.7% YoY Increase.

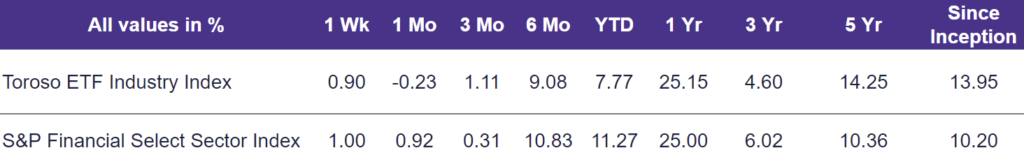

Our Toroso ETF Industry Index, which tracks companies generating revenue from the ETF ecosystem, rose 0.90% last week, underperforming the S&P Financial Select Sector Index, which rose by 1.00%.

ETF listings in the first week of July highlight the growing prevalence of Buffer ETFs.

- Innovator ETFs: Innovator started the month on a high note, introducing 9 new ETFs on July 1st. Innovator listed 3 new 100% Buffer ETFs and 6 other Buffer and Buffer Income ETFs.

- iShares: iShares debuted its first buffer ETF, the iShares Large Cap Max Buffer Jun ETF (MAXJ), offering 11.14% potential upside exposure to an S&P 500 ETF while protecting 100% against downside performance.

- Calamos Investments: Calamos released the first ETF to provide 100% downside protection to Russell 2000 over a one-year period, (CPRJ).

A buffer ETF is designed for investors to benefit from potential market gains while limiting downside risk within a specified range or “buffer zone”. Buffer ETFs often reset periodically, adjusting their protection levels based on market conditions or predetermined dates.

The “Buffer ETF” sector has expanded significantly since its inception in 2018, now comprising over 250 ETFs with nearly $50 billion in assets.

ETF Launches

AllianzIM U.S. Equity Buffer15 Uncapped Jul ETF (ticker: JULU)

Calamos Russell 2000 Structured Alt Protection ETF – July (ticker: CPRJ)

Calamos S&P 500 Structured Alt Protection ETF – July (ticker: CPSJ)

Innovator Emerging Markets 10 Buffer ETF – Quarterly (ticker: EBUF)

Innovator International Developed 10 Buffer ETF – Quarterly (ticker: IBUF)

Innovator Equity Defined Protection ETF – 1 Year July (ticker: ZJUL)

Innovator Equity Defined Protection ETF – 2 Years to July 2026 (ticker: AJUL)

Innovator Equity Defined Protection ETF – 6 Months January/July (ticker: JAJL)

Innovator Nasdaq-100 10 Buffer ETF – Quarterly (ticker: QBUF)

Innovator Premium Income 15 Buffer ETF – July (ticker: LJUL)

Innovator Premium Income 9 Buffer ETF – July (ticker: HJUL)

Innovator U.S. Small Cap 10 Buffer ETF – Quarterly (ticker: RBUF)

iShares Large Cap Max Buffer Jun ETF (ticker: MAXJ)

SMI 3Fourteen Full-Cycle Trend ETF (ticker: FCTE)

TrueShares Quarterly Bear Hedge ETF (ticker: QBER)

TrueShares Quarterly Bull Hedge ETF (ticker: QBUL)

ETF Closures

None

Fund/Ticker Changes

None

TETF.Index Performance vs. S&P Financial Select Sector Index

(as of July 5, 2024)

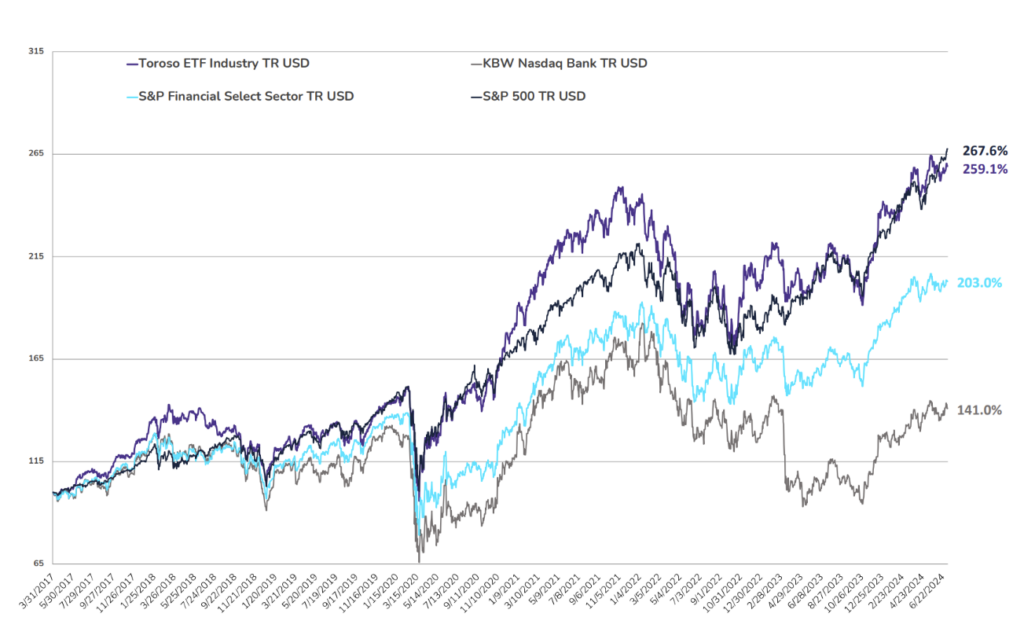

TETF.Index Performance vs. Other Leading Financial Indices

(March 31, 2017 through July 5, 2024)

Why Follow the ETF Industry KPIs

The team at Tidal Investments, originally operating as Toroso Investments, began tracking the ETF Industry Key Performance Indicators (KPIs) in the early 2000s and have been consistently reporting on, and analyzing these metrics ever since. This diligent tracking was the catalyst for the creation of the TETF.Index, an index that tracks the ETF industry. Now, as part of the Tidal Financial Group, which is affiliated with Tidal Investments, LLC, we are positioned to provide even more in-depth analysis and insights. Each week, we will share the statistics we believe to be the most useful for identifying industry trends, in addition to the performance of the TETF.Index.

DISCLAIMER

Past performance is no guarantee of future returns. This article is for informational and educational purposes only; is not intended to constitute legal, tax, accounting, or investment advice; and does not constitute an offer to sell or a solicitation of an offer to buy any security or service. Furthermore, the Indexes shown above are not investable. While Tidal Investments, LLC (formerly known as Toroso Investments, LLC) has gathered the information presented from sources that it believes to be reliable, Tidal Investments, LLC cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed are Tidal Investments, LLC’s opinions and do not reflect the opinions of any affiliates or related persons. All opinions are current only as of the date of initial publication and are subject to change without notice. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested.