Week of October 7, 2024 KPI Summary

During the second week of October, the ETF industry saw 17 new launches, 2 mutual fund conversions, and 4 fund closures.

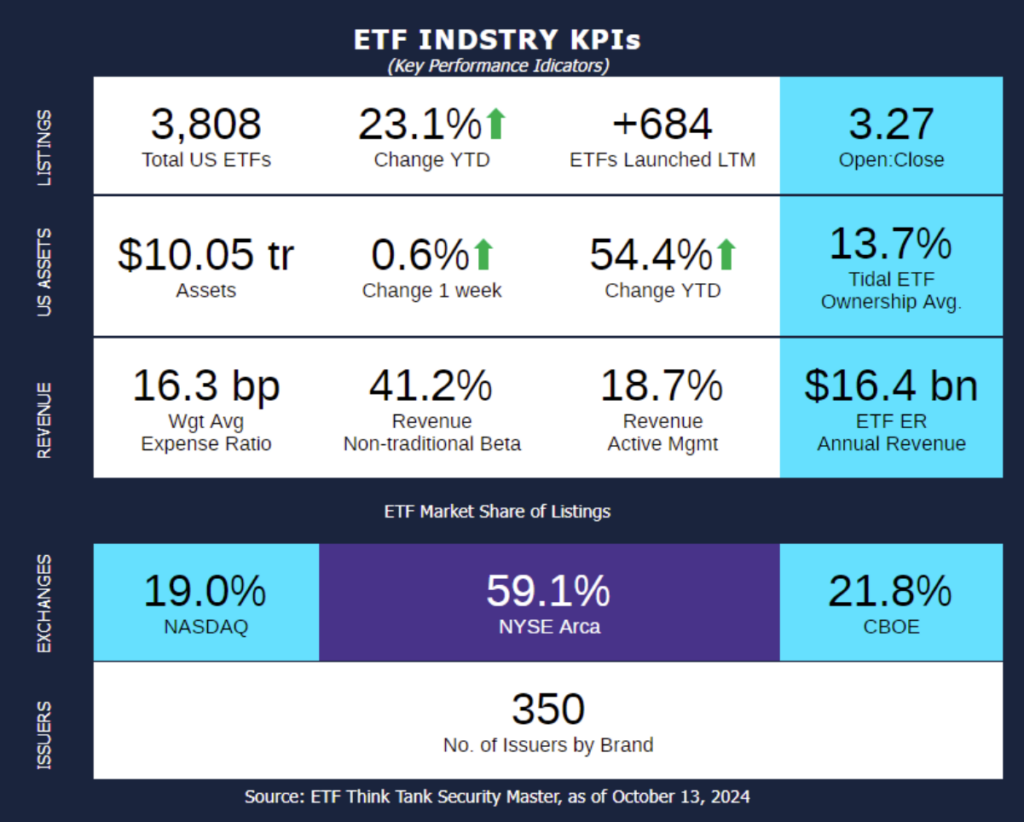

- The current 1 Year ETF Open-to-Close ratio sits at 3.27.

- The total number of US ETFs has risen to 3,808.

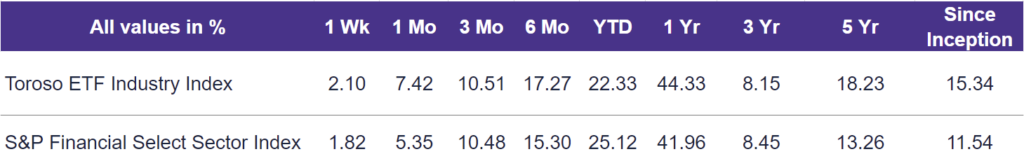

Our Toroso ETF Industry Index, which tracks companies generating revenue from the ETF ecosystem, rose 2.10% last week, outperforming the S&P Financial Select Sector Index, which rose by 1.82%.

ETF activity from the past week includes:

- Direxion Expands Single Stock Semiconductor ETFs: Direxion launched four new leveraged and inverse ETFs providing single-stock exposure to the semiconductor sector. The Direxion Daily AVGO Bull 2X Shares (AVL) and AVGO Bear 1X Shares (AVS) focus on Broadcom, while the Direxion Daily Bull 2X Shares (MUU) and MU Bear 1X Shares (MUD) target Micron Technologies. These new ETFs expand Direxion’s offerings in the semiconductor space, where the firm now manages over $13 billion in assets.

- Precidian Launch First ADR Currency Hedged Securities in the US: Precidian Investments announced the launch of ADRhedged™ securities (ADRHs), designed to provide U.S. investors with exposure to international companies alongside a built-in currency hedge. ADRHs combine an ADR on an underlying international company with a currency hedge, offering a cost-effective way to mitigate foreign exchange risk. The first three ADRHs to launch are AstraZeneca (AZNH), HSBC (HSBH), and Shell (SHEH), with 14 more to follow.

- Rockefeller Asset Management Launches First Equity ETF: Rockefeller Asset Management has launched its first equity ETF. This ETF is actively managed and focuses on generating long-term capital growth by investing primarily in U.S. small- and mid-cap equities, including common stocks, ADRs, and GDRs.

ETF Launches

AstraZeneca PLC ADRhedged ETF (ticker: AZNH)

Direxion Daily AVGO Bear 1X Shares ETF (ticker: AVS)

Direxion Daily AVGO Bull 2X Shares ETF (ticker: AVL)

Direxion Daily MU Bear 1X Shares ETF (ticker: MUD)

Direxion Daily MU Bull 2X Shares ETF (ticker: MUU)

Direxion Daily NFLX Bear 1X Shares ETF (ticker: NFXS)

Harbor PanAgora Dynamic Large Cap Core ETF (ticker: INFO)

HSBC Holdings plc ADRhedged ETF (ticker: HSBH)

KraneShares Man Buyout Beta Index ETF (ticker: BUYO)

Rockefeller U.S. Small-Mid Cap ETF (ticker: RSMC)

SEI Select Emerging Markets Equity ETF (ticker: SEEM)

SEI Select International Equity ETF (ticker: SEIE)

SEI Select Small Cap ETF (ticker: SEIS)

Shell plc SDRhedged ETF (ticker: SHEH)

Themes Transatlantic Defense ETF (ticker: NATO)

Xtrackers US 0-1 Year Treasury ETF (ticker: TRSY)

YieldMax PLTR Option Income Strategy ETF (ticker: PLTY)

ETF Closures

American Century Emerging Markets Bond ETF (ticker: AEMB)

Pacer CSOP FTSE China A50 ETF (ticker: AFTY)

Innovator Hedged TSLA Strategy ETF (ticker: TSLH)

Pacer BioThreat Strategy ETF (ticker: VIRS)

Fund/Ticker Changes

WCM Developing World Equity Fund Instl Shares (ticker: WCMDX) & WCM Developing World Equity Fund Invstr Shares (ticker: WCMUX)

became First Trust WCM Developing World Equity ETF (ticker: WCME)

WCM International Equity Fund Instl Shares (ticker: WCMMX) & WCM International Equity Fund Invstr Shares (ticker: WESGX)

became First Trust WCM International Equity ETF (ticker: WCMI)

TETF.Index Performance vs. S&P Financial Select Sector Index

(as of October 11, 2024)

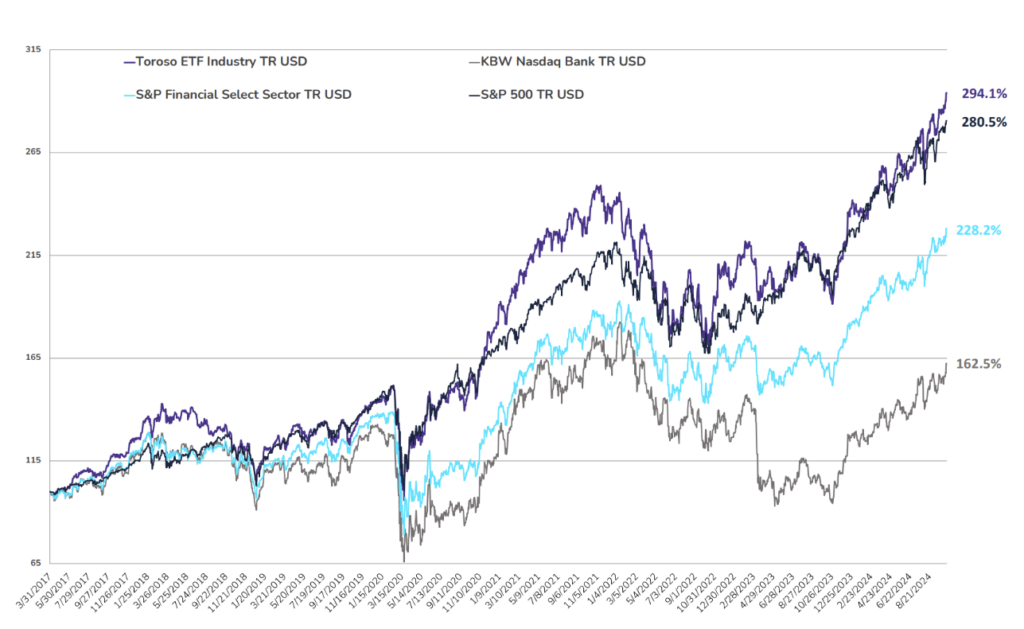

TETF.Index Performance vs. Other Leading Financial Indices

(March 31, 2017 through October 11, 2024)

Why Follow the ETF Industry KPIs

The team at Tidal Investments, originally operating as Toroso Investments, began tracking the ETF Industry Key Performance Indicators (KPIs) in the early 2000s and have been consistently reporting on, and analyzing these metrics ever since. This diligent tracking was the catalyst for the creation of the TETF.Index, an index that tracks the ETF industry. Now, as part of the Tidal Financial Group, which is affiliated with Tidal Investments, LLC, we are positioned to provide even more in-depth analysis and insights. Each week, we will share the statistics we believe to be the most useful for identifying industry trends, in addition to the performance of the TETF.Index.

DISCLAIMER

Past performance is no guarantee of future returns. This article is for informational and educational purposes only; is not intended to constitute legal, tax, accounting, or investment advice; and does not constitute an offer to sell or a solicitation of an offer to buy any security or service. Furthermore, the Indexes shown above are not investable. While Tidal Investments, LLC (formerly known as Toroso Investments, LLC) has gathered the information presented from sources that it believes to be reliable, Tidal Investments, LLC cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed are Tidal Investments, LLC’s opinions and do not reflect the opinions of any affiliates or related persons. All opinions are current only as of the date of initial publication and are subject to change without notice. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested.