Week of September 23, 2024 KPI Summary

During the fourth week of September, the ETF industry saw 29 new launches, 2 fund closures, 2 ticker changes, and 1 Mutual Fund Conversion.

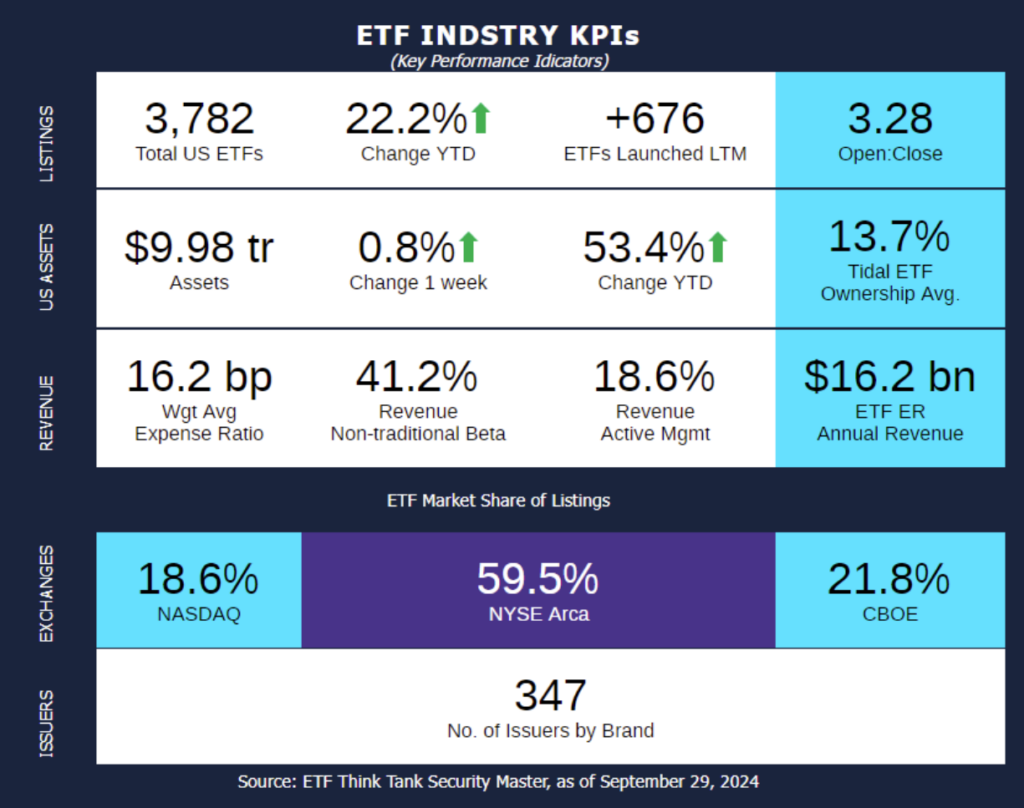

- The current 1 Year ETF Open-to-Close ratio sits at 3.28.

- The total number of US ETFs has risen to 3,782, representing a year-to-date growth of 12%.

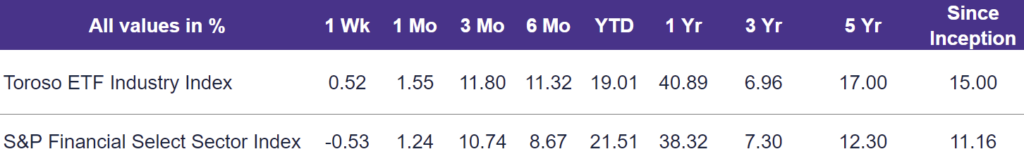

Our Toroso ETF Industry Index, which tracks companies generating revenue from the ETF ecosystem, rose 0.52% last week, outperforming the S&P Financial Select Sector Index, which fell by 0.53%.

ETF activity from the past week includes:

- PIMCO Completes $100 Million Mutual Fund Conversion: PIMCO has transitioned its Mortgage-Backed Securities Fund, PTRIX, from a mutual fund to an ETF, PMBS, marking its first mutual fund-to-ETF conversion. This move addresses a gap in PIMCO’s ETF lineup, which previously lacked a mortgage-focused product. As part of the firm’s broader strategy to expand its ETF offerings, this development is notable, with PIMCO already managing $29 billion in ETF assets.

- State Street launches 14 Actively Managed ETFs: State Street Global Advisors has launched the SPDR SSGA MyIncome ETFs, the first actively managed corporate and municipal target maturity bond ETFs in the U.S. market. This innovative suite of 14 ETFs offers maturities from 2026 to 2034, enabling investors to build custom bond ladder portfolios to manage cash flow, interest rate risk, and liquidity needs. Designed to balance income and capital preservation, the nine corporate bond ETFs focus on maximizing current income, while the five municipal bond ETFs seek to deliver tax-exempt income.

- Pacer ETFs Launches a NASDAQ 6x Dividend Multiplier ETF: Pacer ETFs has launched the Pacer Metaurus Nasdaq-100 Dividend Multiplier 600 ETF (QSIX), aiming to deliver six times the ordinary dividend yield of the Nasdaq-100 index, while maintaining modestly reduced exposure to the overall performance of the index, with no use of options or leverage. QSIX separates the index’s returns into dividend cash flow and price appreciation, reducing equity exposure to 90% and allocating the rest to cash-like instruments. This innovative ETF offers a unique blend of growth and income. This launch follows the impressive success of its sister fund, the US Large Cap Dividend Multiplier 400 ETF (QDPL), which has attracted roughly $300 million in net flows year over year.

ETF Launches

JPMorgan Dividend Leaders ETF (ticker: JDIV)

Pacer Metarus Nasdaq 100 Dividend Multiplier 600 ETF (ticker: QSIX)

Simplify Wolfe US Equity 150/50 ETF (ticker: WUSA)

FT Vest Emerging Markets Buffer ETF – September (ticker: TSEP)

FT Vest Laddered International Moderate Buffer ETF (ticker: BUFY)

FT Vest U.S. Equity Equal Weight Buffer ETF – Septemer (ticker: RSSE)

FT Vest U.S. Equity Max Buffer ETF – September (ticker: SEPM)

SPDR SSGA My2026 Corporate Bond ETF (ticker: MYCF)

SPDR SSGA My2026 Municipal Bond ETF (ticker: MYMF)

SPDR SSGA My2027 Corporate Bond ETF (ticker: MYCG)

SPDR SSGA My2027 Municipal Bond ETF (ticker: MYMG)

SPDR SSGA My2028 Corporate Bond ETF (ticker: MYCH)

SPDR SSGA My2028 Municipal Bond ETF (ticker: MYMH)

SPDR SSGA My2029 Corporate Bond ETF (ticker: MYCI)

SPDR SSGA My2029 Municipal Bond ETF (ticker: MYMI)

SPDR SSGA My2030 Corporate Bond ETF (ticker: MYCJ)

SPDR SSGA My2030 Municipal Bond ETF (ticker: MYMJ)

SPDR SSGA My2031 Corporate Bond ETF (ticker: MYCK)

SPDR SSGA My2032 Corporate Bond ETF (ticker: MYCL)

SPDR SSGA My2033 Corporate Bond ETF (ticker: MYCM)

SPDR SSGA My2034 Corporate Bond ETF (ticker: MYCN)

SWP Growth & Income ETF (ticker: SWP)

T-REX 2X Long NFLX Daily Target ETF (ticker: NFLU)

Texas Capital Government Money Market ETF (ticker: MMKT)

Themes Copper Miners ETF (ticker: COPA)

Themes Lithium & Battery Metal Miners ETF (ticker: LIMI)

Themes Uranium & Nuclear ETF (ticker: URAN)

THOR Index Rotation ETF (ticker: THIR)

VanEck AA-BB CLO ETF (ticker: CLOB)

ETF Closures

iMGP DBi Hedge Strategy ETF (ticker: DBEH)

VanEck Ethereum Strategy ETF (ticker: EFUT)

Fund/Ticker Changes

Defiance S&P 500 Enhanced Options Income ETF (ticker: JEPY)

became Defiance S&P 500 Enhanced Options Income ETF (ticker: WDTE)

Amplify Samsung SOFR ETF (ticker: SOF)

became Amplify Samsung SOFR ETF (ticker: SOFR)

PIMCO Mortgage-Backed Securities Fund (ticker: PTRIX)

became PIMCO Mortgage-Backed Securities Active ETF (ticker: PMBS)

TETF.Index Performance vs. S&P Financial Select Sector Index

(as of September 27, 2024)

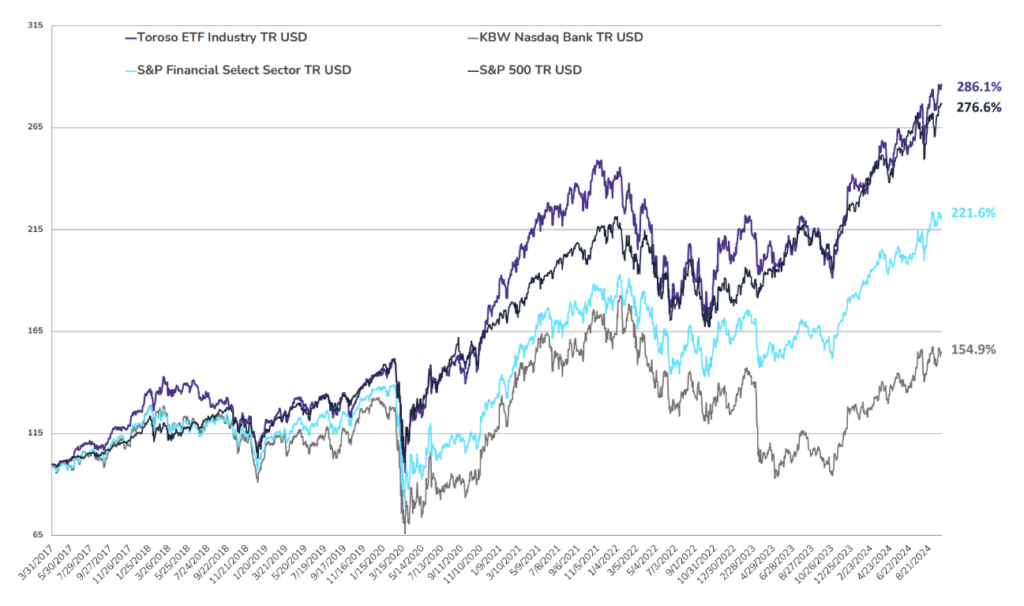

TETF.Index Performance vs. Other Leading Financial Indices

(March 31, 2017 through September 27, 2024)

Why Follow the ETF Industry KPIs

The team at Tidal Investments, originally operating as Toroso Investments, began tracking the ETF Industry Key Performance Indicators (KPIs) in the early 2000s and have been consistently reporting on, and analyzing these metrics ever since. This diligent tracking was the catalyst for the creation of the TETF.Index, an index that tracks the ETF industry. Now, as part of the Tidal Financial Group, which is affiliated with Tidal Investments, LLC, we are positioned to provide even more in-depth analysis and insights. Each week, we will share the statistics we believe to be the most useful for identifying industry trends, in addition to the performance of the TETF.Index.

DISCLAIMER

Past performance is no guarantee of future returns. This article is for informational and educational purposes only; is not intended to constitute legal, tax, accounting, or investment advice; and does not constitute an offer to sell or a solicitation of an offer to buy any security or service. Furthermore, the Indexes shown above are not investable. While Tidal Investments, LLC (formerly known as Toroso Investments, LLC) has gathered the information presented from sources that it believes to be reliable, Tidal Investments, LLC cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed are Tidal Investments, LLC’s opinions and do not reflect the opinions of any affiliates or related persons. All opinions are current only as of the date of initial publication and are subject to change without notice. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested.