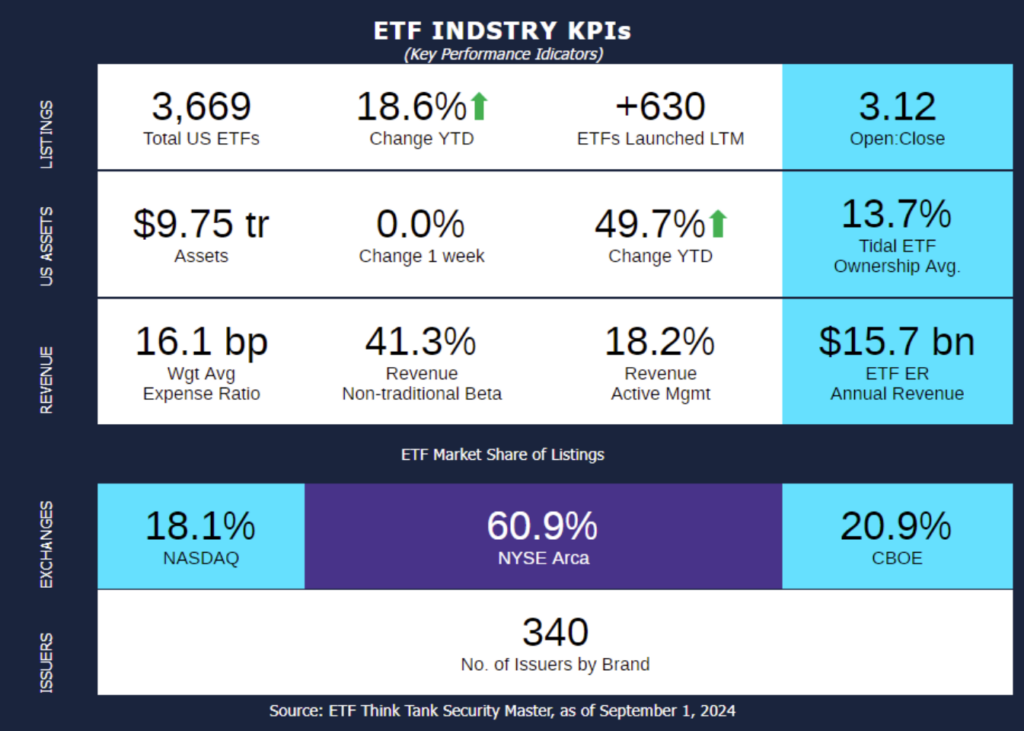

Week of August 26, 2024 KPI Summary

The ETF industry welcomed 5 new additions during the final week of August, spanning August 26th to 30th.

- Last week was the quietest for ETF launches in 10 weeks, the fewest since June 24th.

- The 1 Year ETF Open-to-Close ratio sits as 3.12.

- The total number of US ETFs has risen to 3,669, representing a year-to-date growth of 8.6%.

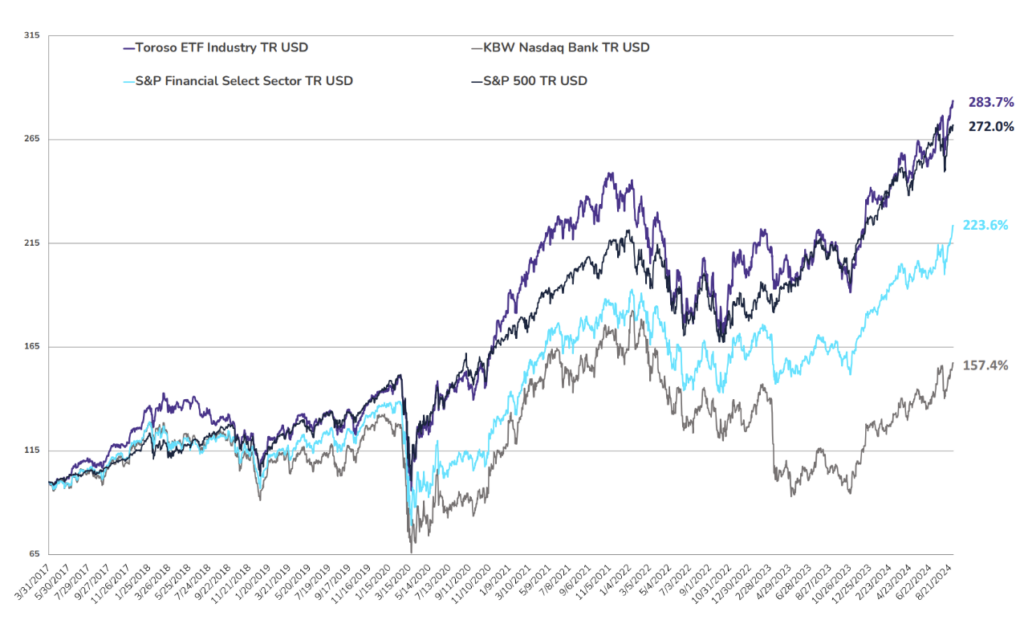

Our Toroso ETF Industry Index, which tracks companies generating revenue from the ETF ecosystem, rose 1.21% last week, underperforming the S&P Financial Select Sector Index, which rose by 2.95%.

ETF launches from the past week include:

- VanEck releases first ever Fabless Semiconductor ETF: As semiconductors become increasingly vital to industries like AI, machine learning, smartphones, and data centers, investor enthusiasm is similarly on the rise. VanEck, the ETF issuer behind the largest semiconductor ETF, SMH (~$22B AUM), is pioneering the first Fabless Semiconductor ETF, SMHX. This new ETF targets companies that design and sell chips but chooses to outsource manufacturing to specialized foundries. This approach allows fabless companies to focus on design innovation, while being unburdened by the financial and logistical demands of manufacturing.

- Global X Launches Similar ETF to Popular Flagship Fund: Global X, a leading thematic issuer with ~$50b in AUM, is expanding its successful infrastructure franchise with IPAV, a new ETF complementing its popular US Infrastructure Development ETF, PAVE (~$7.9b AUM). While PAVE focuses on infrastructure development, construction, and maintenance inside the United States, IPAV targets companies outside of the United States, providing exposure to critical infrastructure development companies across both developed and emerging markets outside of the U.S.

- KraneShares launch an AI Driven China ETF: KraneShares, a leading provider of China-focused ETFs, has introduced the KraneShares China Alpha Index ETF (KCAI), a cutting-edge investment vehicle designed to outperform the CSI 300 Index. The CSI 300 Index is a benchmark for China’s top 300 publicly traded companies listed on the Shanghai and Shenzhen exchanges. KCAI’s underlying Qi China Alpha Index utilizes a proprietary machine learning approach to systematically identify and optimize alpha opportunities in China A-Shares, aiming to deliver excess returns.

ETF Launches

ERShares Private-Public Crossover ETF (ticker: XOVR)

Global X Infrastructure Development ex-U.S. ETF (ticker: IPAV)

Harbor Active Small Cap ETF (ticker: SMLL)

KraneShares China Alpha Index ETF (ticker: KCAI)

VanEck Fabless Semiconductor ETF (ticker: SMHX)

ETF Closures

None

Fund/Ticker Changes

None

TETF.Index Performance vs. S&P Financial Select Sector Index

(as of August 30, 2024)

TETF.Index Performance vs. Other Leading Financial Indices

(March 31, 2017 through August 30, 2024)

Why Follow the ETF Industry KPIs

The team at Tidal Investments, originally operating as Toroso Investments, began tracking the ETF Industry Key Performance Indicators (KPIs) in the early 2000s and have been consistently reporting on, and analyzing these metrics ever since. This diligent tracking was the catalyst for the creation of the TETF.Index, an index that tracks the ETF industry. Now, as part of the Tidal Financial Group, which is affiliated with Tidal Investments, LLC, we are positioned to provide even more in-depth analysis and insights. Each week, we will share the statistics we believe to be the most useful for identifying industry trends, in addition to the performance of the TETF.Index.

DISCLAIMER

Past performance is no guarantee of future returns. This article is for informational and educational purposes only; is not intended to constitute legal, tax, accounting, or investment advice; and does not constitute an offer to sell or a solicitation of an offer to buy any security or service. Furthermore, the Indexes shown above are not investable. While Tidal Investments, LLC (formerly known as Toroso Investments, LLC) has gathered the information presented from sources that it believes to be reliable, Tidal Investments, LLC cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed are Tidal Investments, LLC’s opinions and do not reflect the opinions of any affiliates or related persons. All opinions are current only as of the date of initial publication and are subject to change without notice. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested.