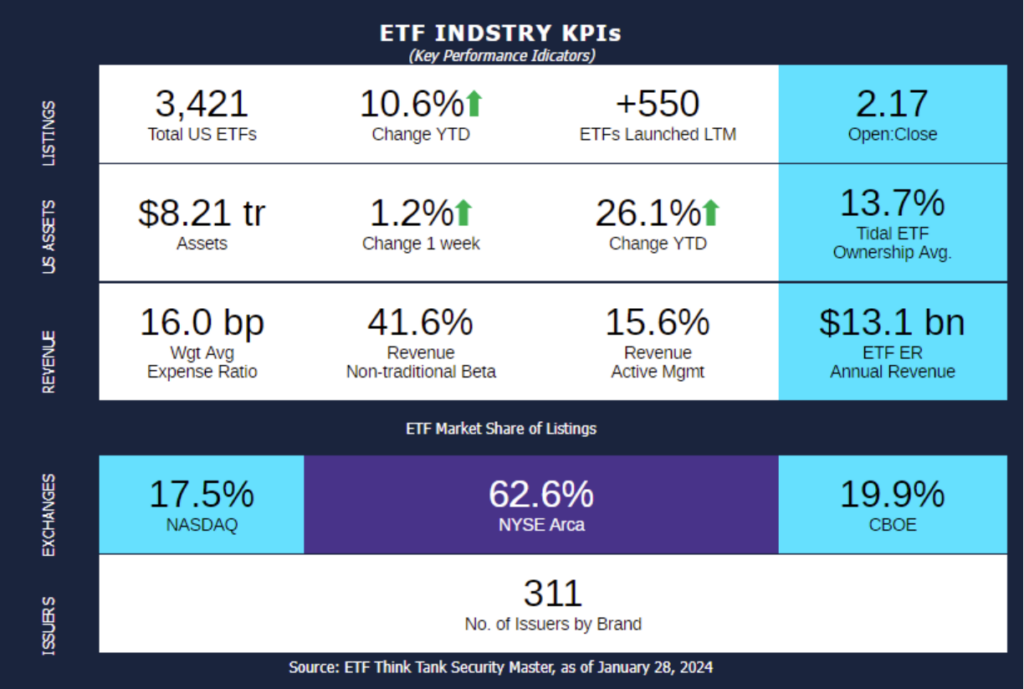

Week of January 22, 2024 KPI Summary

- This week, the industry experienced 18 ETF launches and 0 closures, shifting the 1-year Open-to-Close ratio to 2.17 and total US ETFs to 3,421.

- Happy National Puzzle Day to all our fellow puzzlers out there! To celebrate, enjoy today’s ETF Think Tank KPI crossword puzzle in the link below!

- https://crosswordlabs.com/view/etf-think-tank-kpi-crossword

- Need a little help? Use the code “Wavemaker” to reveal the answers.

- Want a PDF of the crossword grid – click here.

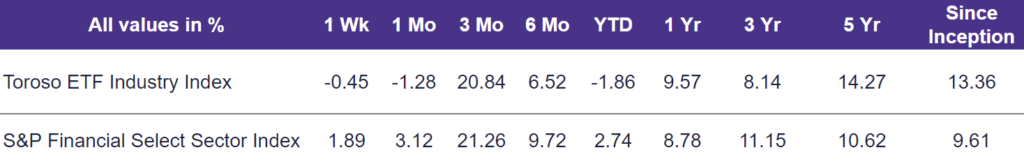

- The tracked indexes experienced similar performance last week. The Toroso ETF Industry Index was down -0.45% while the S&P Financial Select Sector Index led at 1.89%.

ETF Launches

BondBloxx BBB Rated 5-10 Year Corporate Bond ETF (ticker: BBBI)

BondBloxx BBB Rated 10+ Year Corporate Bond ETF (ticker: BBBL)

BondBloxx BBB Rated 1-5 Year Corporate Bond ETF (ticker: BBBS)

Range Global Coal ETF (ticker: COAL)

Range Global LNG Ecosystem ETF (ticker: LNGZ)

Range Nuclear Renaissance ETF (ticker: NUKZ)

Range Global Offshore Oil Services ETF (ticker: OFOS)

Mohr Industry Nav ETF (ticker: INAV)

Langar Global HealthTech ETF (ticker: LGHT)

Matthews China Discovery Active ETF (ticker: MCHS)

Matthews Emerging Markets Discovery Active ETF (ticker: MEMS)

Tema Neuroscience and Mental Health ETF (ticker: MNTL)

Innovator Technology Managed Floor ETF (ticker: QFLR)

WisdomTree U.S. Mid Cap Quality Growth ETF (ticker: QMID)

WisdomTree U.S. Small Cap Quality Growth ETF (ticker: QSML)

FT Raymond James Multicap Growth Equity ETF (ticker: RJMG)

FT Vest U.S. Equity Enhance & Moderate Buffer ETF – January (ticker: XJAN)

Defiance Treasury Alternative Yield ETF (ticker: TRES)

ETF Closures

None

Fund/Ticker Changes

None

TETF.Index Performance vs. S&P Financial Select Sector Index

(as of January 26, 2024)

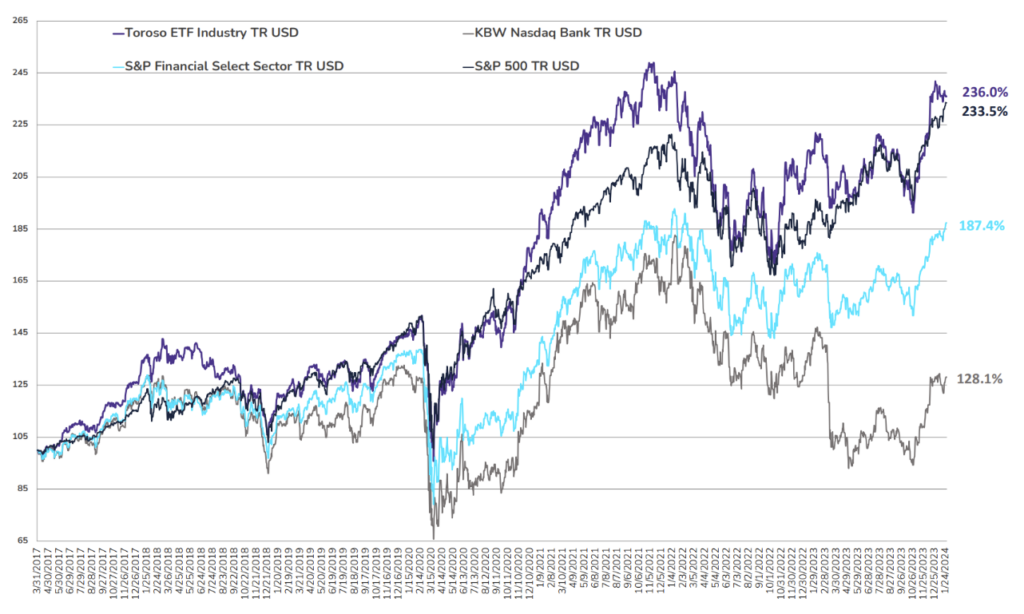

TETF.Index Performance vs. Other Leading Financial Indices

(March 31, 2017 through January 26, 2024)

Why Follow the ETF Industry KPIs

The team at Tidal Investments, originally operating as Toroso Investments, began tracking the ETF Industry Key Performance Indicators (KPIs) in the early 2000s and have been consistently reporting on, and analyzing these metrics ever since. This diligent tracking was the catalyst for the creation of the TETF.Index, an index that tracks the ETF industry. Now, as part of the Tidal Financial Group, which is affiliated with Tidal Investments, LLC, we are positioned to provide even more in-depth analysis and insights. Each week, we will share the statistics we believe to be the most useful for identifying industry trends, in addition to the performance of the TETF.Index.

DISCLAIMER

Past performance is no guarantee of future returns. This article is for informational and educational purposes only; is not intended to constitute legal, tax, accounting, or investment advice; and does not constitute an offer to sell or a solicitation of an offer to buy any security or service. Furthermore, the Indexes shown above are not investable. While Tidal Investments, LLC (formerly known as Toroso Investments, LLC) has gathered the information presented from sources that it believes to be reliable, Tidal Investments, LLC cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed are Tidal Investments, LLC’s opinions and do not reflect the opinions of any affiliates or related persons. All opinions are current only as of the date of initial publication and are subject to change without notice. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested.