We have a new interview series at the ETF Think Tank that sets out to accomplish one thing: To meet the people behind ETFs.

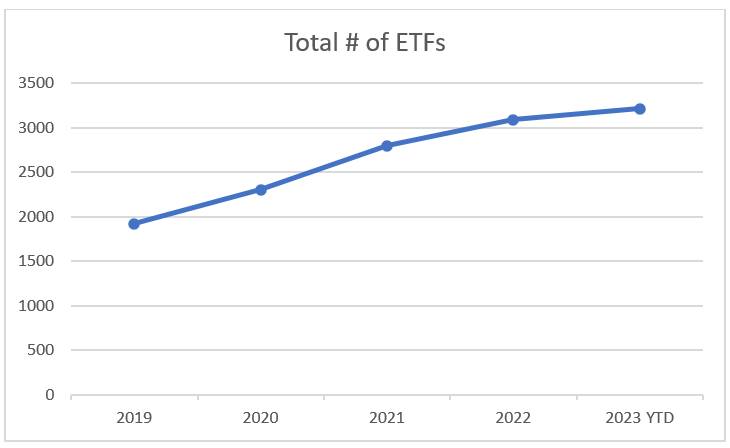

We know that as a market, ETFs have exploded in number over the years. Totaling more than 3,200 funds listed across U.S. exchanges today, the number of ETFs has grown about 70% in the past five years alone. We’ve come a long way since ‘SPY’ first came to market 30 years ago.

From a product expansion perspective, consider us impressed.

Just as impressive are the people behind these products. Our new series, titled “Wavemakers” has been uncovering the stories of the folks who take the plunge into the ETF pond.

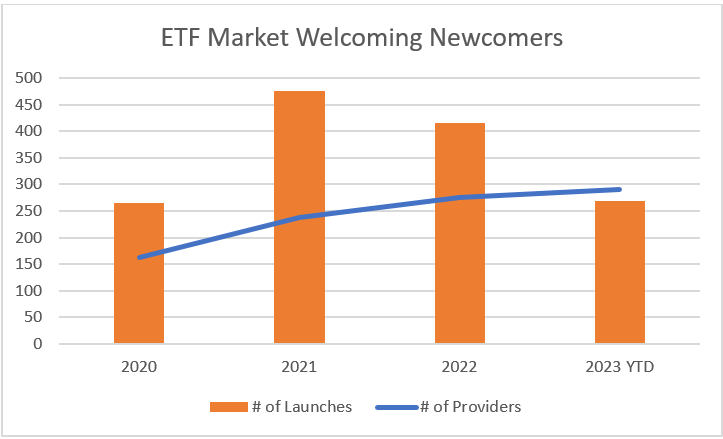

Since 2019 alone, we’ve almost doubled the number of ETF providers in the U.S., which now are approaching 300.

These newcoming product providers – many of them new to ETFs – come from all parts of the investment and asset management industry, from advisors, hedge fund-ers and mutual fund-ers, to institutions, insurance companies, and family offices, to all-out entrepreneurs and even the occasional influencers – we, as an industry, are welcoming them all.

Our series, which airs a new episode on our YouTube channel every other week, explores what is bringing new people into the business, what drives product innovation, what makes ETFs the choice vehicle to so many, and what lessons they are learning along the way.

With 3 interviews already live, here are a few nuggets of wisdom we’ve picked up:

- ETFs are a better way to deliver access.

This is not surprising – we talk ad nauseum about ETFs being the great democratizer of market access. In fact, we say it so much, it now feels like an industry cliché.

But it’s actually true. It’s one of the beautiful, well-known story lines for the ETF wrapper. Providers are bringing their expertise to the masses through a wrapper that welcomes everyone – one that’s transparent, easy to implement and to trade, lower cost and tax efficient.

Jay Pestrichelli, head of Zega and Yieldmax ETFs, tells it this way:

“The ETF wrapper is such a matter of convenience for the end client. It removes things like high minimums that might be associated with an option strategy. We’ve been running individual option strategies for clients in individual accounts since 2010, and there are some constraints when it comes to using options. Zega is primarily an options-based advisor – every one of our strategies that we manage has some component of options in them. As such, there’s additional disclosures and approvals and separate accounts that must be opened up.

That was the universe we lived in up until a few years ago, but now with the advancement of ETFs, it’s so much easier to deliver those strategies, and you don’t have to be a high net worth client to have access to professional option management. You can buy an ETF for $20 a share and get the experience of an investor who might come to us with a large concentrated position and we’re going to hedge it or we’re going to sell options over it for income. ETFs help bring sophisticated, active management strategies to everyday investors, which is what Zega is about.”

- The ETF business isn’t about guarantees as much as it’s about conviction.

The ETF market is crowded. It’s highly competitive. It’s absurdly transparent. And it does not promise success to anyone. Consider that the product cycle is long, and as you navigate the path from ideation to launch, there are no IP protections – “you are building in public,” to quote Phil Bak, CEO of Armada ETF Advisors.

The hurdles to success are high, but folks are braving this landscape everyday because they believe in the strategy and in the wrapper. Longevity begins with a good product built on conviction and a unique, sound value proposition.

Phil Bak, CEO of Armada ETF Advisors, tells it this way:

“In any trading strategy and allocations, you have to tilt the odds in your favor. But at the end of the day, the market does its thing. So much of what we do is about probabilities and possibilities, not guarantees, and not certainties. Entrepreneurship is not for the faint of heart. It is hard. It’s not always fun. But the rewards are tremendous.

There’s a lot of saturation, there’s a lot of competition, there’s not a lot of protection for intellectual properties. The odds are very tilted in favor of the bigger corporations, so it’s hard. You have to be ready for a very tough fight. I was willing to potentially fail publicly. Everyone can see your assets. A lot of people you would think would be rooting for you end up saying ‘oh, we only work with a certain size company.’ These different things hurt and are difficult to process and to understand when you believe you have a product that’s better for the investor, and the investor agrees but still wants to work with a bigger company. But that’s the game.

You have to find those pockets of the market that are protectable somehow with active management, thought leadership, that kind of thing. Nobody can replicate a personality. Nobody can replicate the ideas that are coming out of a company or person. There are things that that you can do as an independent that that can’t ever be copied.”

- ETFs are a team sport.

ETFs are a relationship industry. It may have something to do with the fact that building, launching, trading, supporting and growing an ETF requires many hands across all sorts of product and service providers, so no one really goes at this alone.

What’s unique, however, about the ETF industry is that you rarely come across a bad egg. This is an ecosystem where it’s become the norm to work well with friends and competitors, and to support each other for the benefit of a broader industry we all believe in. We all know it’s non-traditional-Wall-Street-like, it’s surprising to outsiders coming in, and it’s kind of mushy and feely. But it’s fact, not fiction. Somehow, we all buy in to the notion that good players make for good teams, and good teams win games.

Bob Elliott, head of Unlimited Funds, tell it this way:

“The biggest thing I would say is that being new to the ETF space and coming in with no experience in the structure and no knowledge of the space, it was incredible how great the ETF industry is in terms of helping to bring people up the curve on how to get started. I always like to highlight that I started thinking about ETFs when I listen to a podcast from Wes Gray, from Alpha Architect, but when I talked to him he said, ‘I think you would be better served with a different white label provider.’ In what industry does someone say, ‘Hey, look, I know we’re competitors, but you you’ve got a good idea and these other people are better at executing that idea, given the nature of it and given the support that you need. Let me introduce you.’

It really speaks to the fact that, at a high level, all of us in the ETF business are sitting there fighting against traditional asset management that is too expensive, too illiquid, not transparent enough. We are at the cutting edge of developing the next generation of financial products for the everyday investor. So, it’s incredible to see that so many people in the industry recognize that, and recognize that success of the overall industry, and the increasing sophistication of it, is going to improve everyone who’s involved.”

First-Hand Stories

If you are vetting the idea of launching an ETF (why launch an ETF), wondering what leads to success (what makes an ETF successful), considering allocating or investing in ETFs, or is just curious about what it takes to be in this business, there’s a lot of wisdom in the experience of those who’ve done it. This is what our new interview series ‘Wavemakers’ is about.

You can find the growing library of interviews on the ETF Think Tank website here or check out the conversations in their entirety on our YouTube channel – links below.

- Wavemakers: Options Trading & ETFs with Jay Pestrichelli

- Wavemakers: Phil Bak of ETF Success, Failures & Opportunities

- Wavemakers: Bob Elliott Shakes Up Alternatives ETF Space

Disclosure

All investments involve risk, including possible loss of principal.

The material provided here is for informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

The value of investments and the income from them can go down as well as up and investors may not get back the amounts originally invested, and can be affected by changes in interest rates, in exchange rates, general market conditions, political, social and economic developments and other variable factors. Investment involves risks including but not limited to, possible delays in payments and loss of income or capital. Neither Toroso nor any of its affiliates guarantees any rate of return or the return of capital invested. This commentary material is available for informational purposes only and nothing herein constitutes an offer to sell or a solicitation of an offer to buy any security and nothing herein should be construed as such. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested, and nothing herein should be construed as a guarantee of any specific outcome or profit. While we have gathered the information presented herein from sources that we believe to be reliable, we cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed herein are our opinions and are current only as of the date of distribution, and are subject to change without notice. We disclaim any obligation to provide revised opinions in the event of changed circumstances.

The information in this material is confidential and proprietary and may not be used other than by the intended user. Neither Toroso or its affiliates or any of their officers or employees of Toroso accepts any liability whatsoever for any loss arising from any use of this material or its contents. This material may not be reproduced, distributed or published without prior written permission from Toroso. Distribution of this material may be restricted in certain jurisdictions. Any persons coming into possession of this material should seek advice for details of and observe such restrictions (if any).