Hey Recession, Are We There Yet?

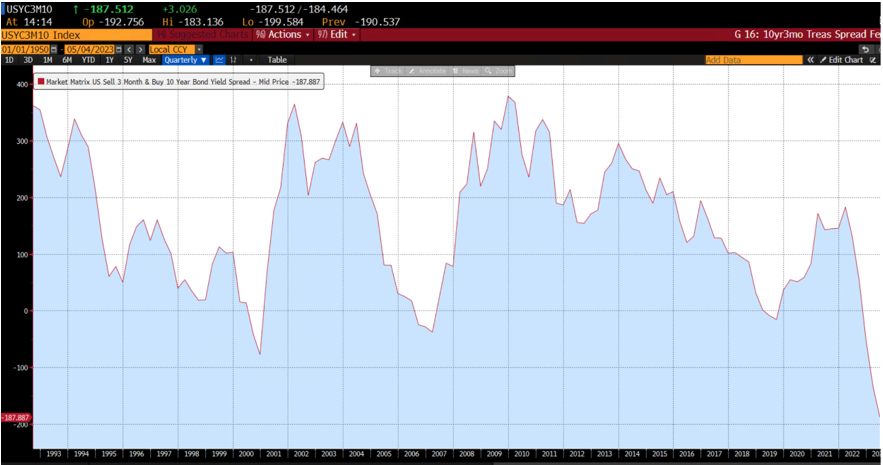

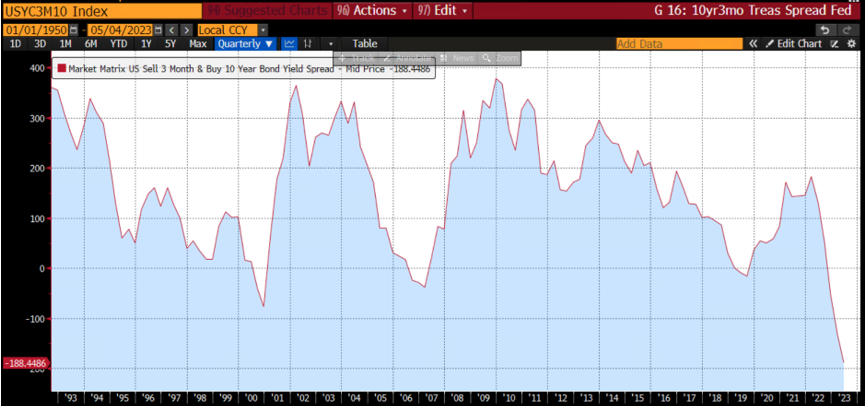

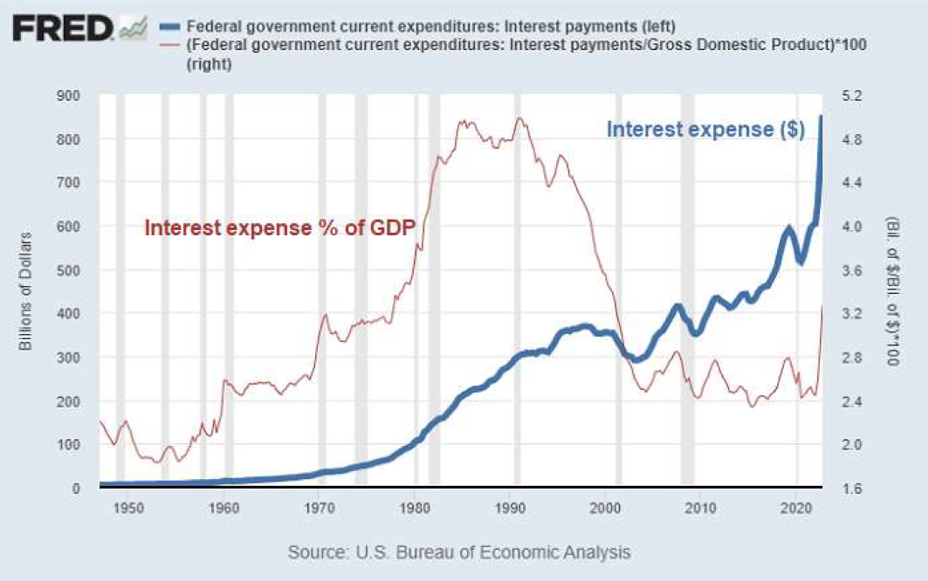

US labor markets continue to be secularly tight, while advancements in the Fed funds rate is doing everything but fighting supply-driven inflationary pressures. The Fed funds rate hit 5-5.25%, the treasury yield curve is as inverted as it’s been in decades, credit markets are drying up, and bank deposits seem to drop further with every increase in short term rates as banks can’t compete with money markets, especially with an inverted yield curve. If that sounds confusing, it is! Quantitative tightening (QT) would likely have a greater effect on liquidity and demand than short term rate moves are having. QT is something often planned and infrequently executed. The Fed is attempting to be proactive instead of reactive when it comes to short-term rates, and only time will tell if they are successful. The Fed is applying measures used to slow down a growth market fueled by a booming credit market, except credit markets are as rocky as they’ve ever been.

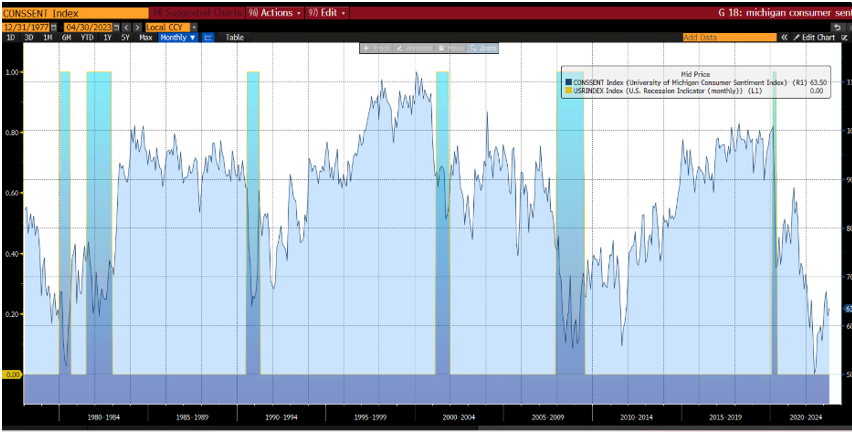

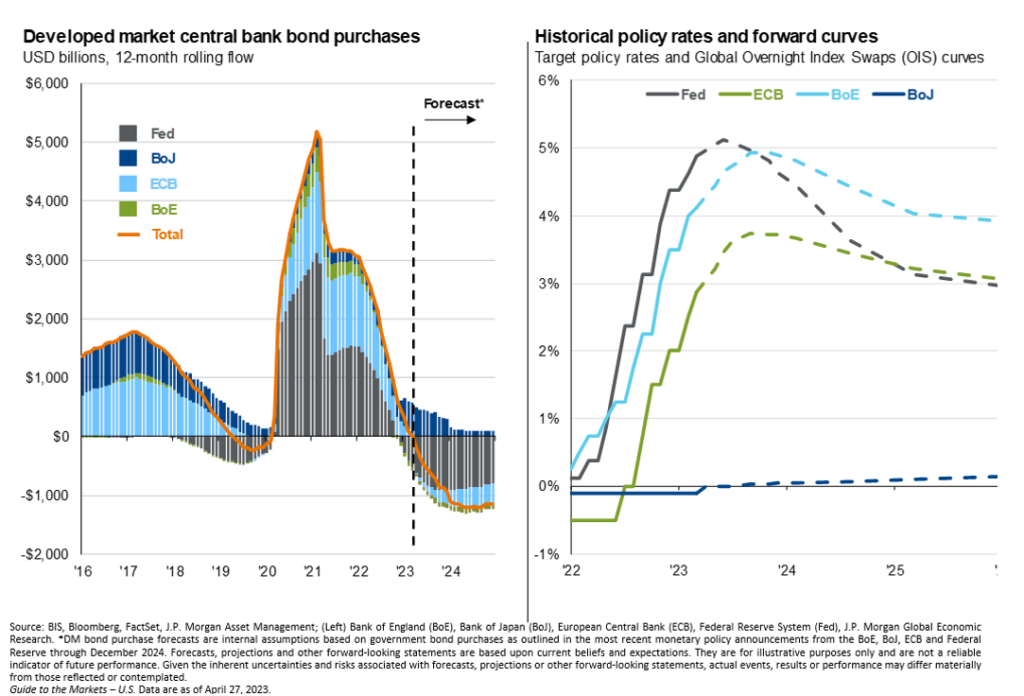

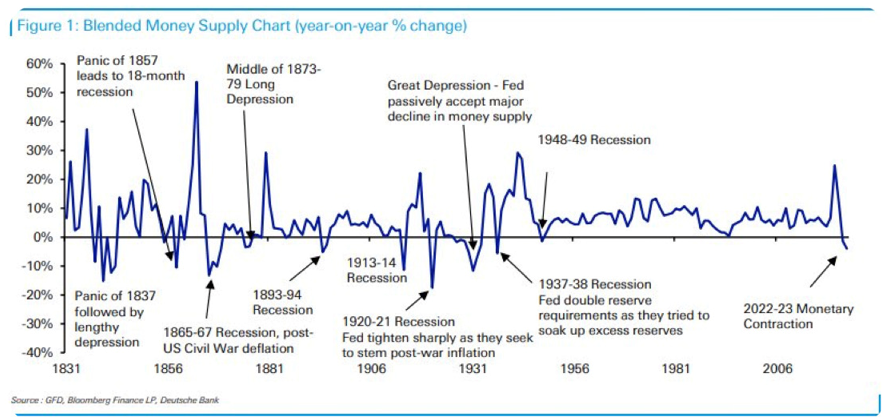

The truth is, we believe, this time is different. Most of us have never seen a market environment where the Federal Reserve had intentions of sucking Trillions of dollars out of the market successfully, without it causing mass market disruptions. The last time we had intentions of reducing the balance sheet at just a fraction of the size of this quantitative tightening cycle was 2019. That quantitative tightening cycle was quite honestly, going disastrously in our opinion, and many believe covid QE covered up the fear we all have now. Do any of us really believe they will be able to unwind the balance sheet to the extent they say (95 billion a month – never achieved in the history of monetary policy)? If consumers tighten their belt spending wise what will happen? And how quick might consumers they cut their spending? Will it be led by unemployed tech workers? Confidence is quite low.

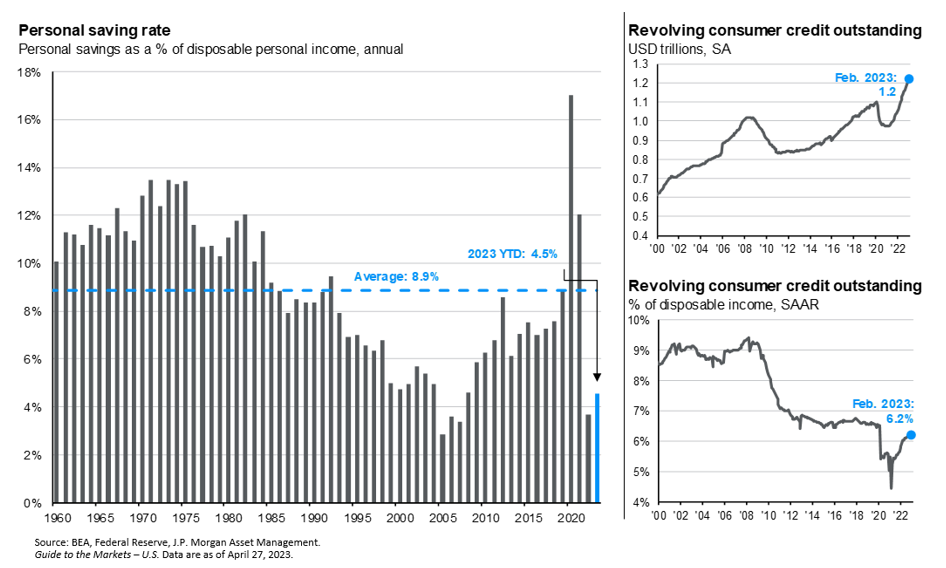

Wall Street & the FinTwit world are freaking out, almost eagerly awaiting a pending recession, oddly enough doing so while spending within the cities they reside is booming. Try and book a restaurant in New York, LA, Austin, or Miami (sorry San Francisco), and you will see how well metropolitan economies are seemingly holding up. The odd thing about human behavior is that it’s easy to increase your level of spending, but very hard to decrease. Economists around the world are looking at inflation led by housing costs, as either a renter or new owner, and trying to figure out where the disposable income is coming from. Wage growth is still relatively high but subdued and still below inflation. While the savings rate has climbed to 5.1% since June last year, is still very low historically. Credit card debt has certainly increased, and interest rates on that credit are much higher. If we need to kill wage growth and employment to slow this market down, we are essentially begging for Stagflation to kill inflation in hopes of leading to a 2% inflationary environment. This is not easy to pull off.

More than 85% of the S&P 500’s return year-to-date has been concentrated in 6 names. Many market pundits believe some sort of debt spiral led by tightened lending, a frozen private credit market, or commercial real estate is on the horizon. It’s equally likely that the proverbial “climbing the wall of worry” leads markets higher for much longer than many have patience for (are we there yet, recession??). It could be a bit of both, and a continued see-saw between the two scenarios, credit concerns and old school asset inflation lead by megacap stocks that may be more solvent than governments across the globe. The difficulty in these large cycle moves is that it could be tomorrow, or 5 years from now. In the coming months, we will find out how malleable private credit markets are, and how much damage has been done. It does appear that a great portion of the commercial real estate space ultimately ended up on the balance sheet of pensions through hedge fund allocations and could be the next “too big to fail” industry.

We’ve spoken at length about risks in the commercial real estate space. This has been highlighted of late by the behemoth in the space, Blackstone. More specifically, their massive $70 billion Blackstone real estate income trust (BREIT). Since October 2022, outflows have exceeded redemption limits. In April, investors attempted to withdraw $4.5 billion. The Fund paid out just 29% of that $4.5 billion, a similar ratio to what it paid out in March. What would have to happen in this world for redemption requests to stop? We don’t have an answer to that, which is terrifying.

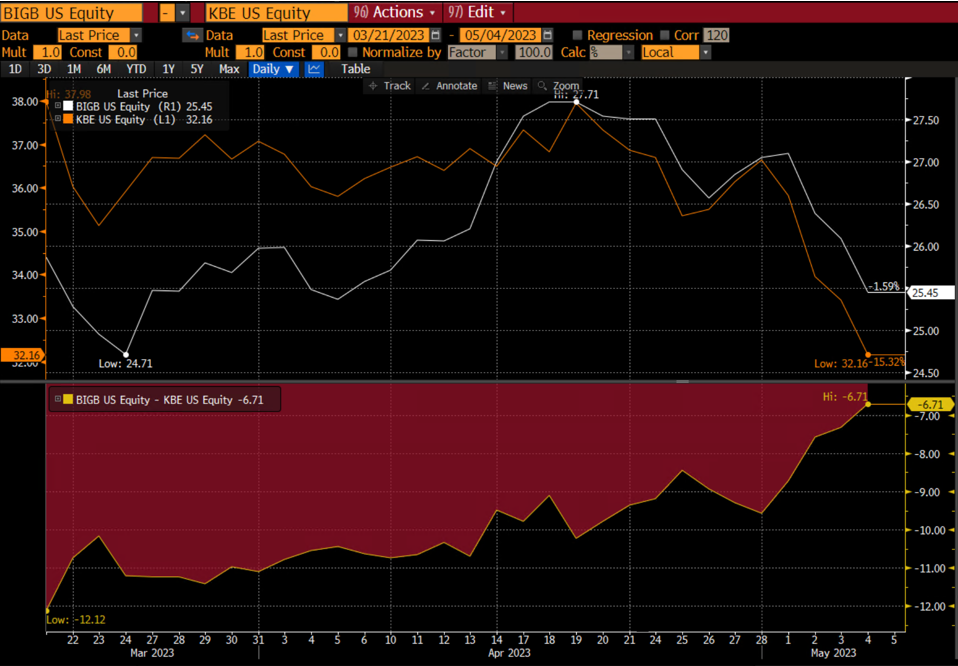

With multiple banks in receivership, and all other regionals down over -35% on the year, Powell stated “conditions in [the banking] sector have broadly improved since early March, and the U.S. banking system is sound and resilient,” followed by the next leg down in regional banking, with Pac West down -41% on May 4th, the day after the FOMC meeting. This is a cry against an inverted yield curve.

We’ve written continuously that the time spent in dislocated markets is sometimes more important than the actual depths of a recession in a world where we need more debt to fuel growth to keep up with old debt payments. With First Republic Bank going to JP Morgan, JP Morgan and Bank of America now comprise approximately 31% of all bank deposits. Too big to fail gets even bigger, backed by not only the FDIC (these banks are too big) but the government, which is amid another debt ceiling debacle. Gold, Bitcoin, and Mega Cap US Stocks rallied, and a case could be made for why each is a more secure asset class than US Treasury bonds, other than short-term paper. We believe that there is no compelling reason to ever hold more cash on a not-too big to fail bank balance sheet than what is allowed under FDIC insurance. Regional Banks are backed by FDIC insurance, big banks are backed by the government. $250k is too small for businesses to run payroll, and the Fed has forced small businesses that have thrived on regional banking relationships to beg the big players for attention. Unfortunately, since the financial crisis, these larger banks have outperformed all other banks, slowly eroding market share from regional banks.

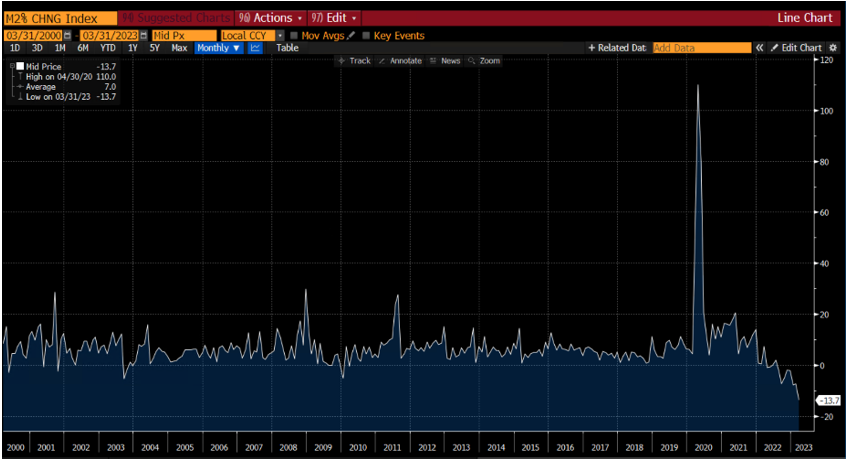

If commercial real estate paper continues to erode, with redemptions from institutional players like Blackstone, a future Lehman moment event is still a possibility, especially late in 2023, and it’s unlikely to be regional. Credit default swaps going out a year are just wacky. It’s also equally likely that growth stocks rally further first, and a credit event could easily be pushed out to 2024. There is no certainty at this time. M2 has absolutely fallen off a cliff.

US EQUITIES

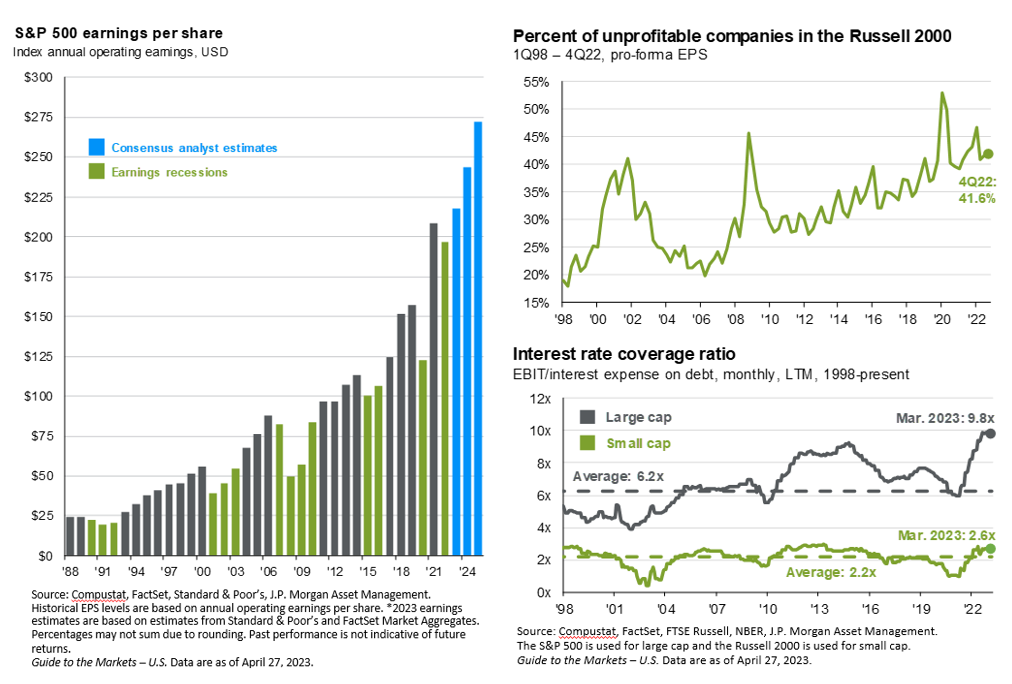

The technology sector led the way in Q1 earnings, with strong profits driven by mass layoffs. However, future growth prospects are uncertain. Will the productivity gains from artificial intelligence be realized in the short term? Or will bottom line gains take longer to realize? Most tech firms mentioned AI between 40-200 times in this most recent earnings season. The iShares Core S&P 500 ETF (IVV) returned 9.16% through April. The iShares Russell 2000 ETF (IWM) returned only 0.91%. The divergence is even worse than it looks once you start looking at the individual names that produced almost all the S&P 500 returns this year. The march towards unprofitability in the Russell 2000 continues.

International Developed and Emerging Market Equity

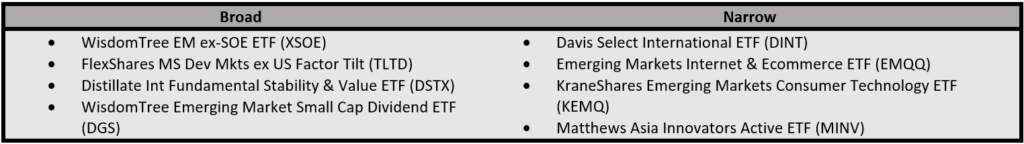

The iShares MSCI EAFE ETF (EFA) returned 11.59% through April, while the iShares MSCI Emerging Markets ETF (EEM) returned 3.28%. China started the year strong but has since retraced and is again trailing US markets. EMQQ Emerging Markets Internet & Ecommerce ETF (EMQQ) was down over 7% for April, and its year-to-date total was -0.74%. This is all while the US dollar has given up ground, especially to emerging market currencies. The move away from the US dollar as the reserve currency hit news circuits. There is a shortage of US dollars available in emerging markets, fueling to the fire to find a replacement. Any actual change to global settlement happens slowly over time, and not on a light switch.

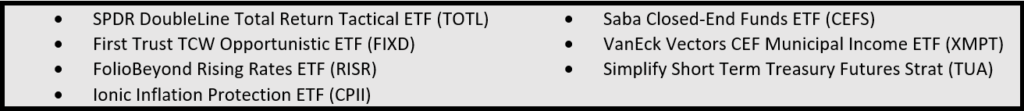

FIXED INCOME

After a disastrous 2022, iShares Barclays Aggregate Bond ETF (AGG) returned 3.74%. Long term treasuries, measured by PIMCO 25+ Year Zero Coupon US Treasury ETF (ZROZ) bounced back, returning 9.56% through April. The inverted yield curve (3-month / 10 year) is more inverted than it has ever been.

We are again expecting a huge drawdown in central bank balance sheets that is unlikely to come to fruition.

Alternatives

The dollar lost ground to most developed and emerging currencies, while gold jumped 9.25% on the year. Bitcoin bounced back strongly, fueled by a gold-like rally post banking crisis, as its hedge against the credit worthiness of nations came into play.

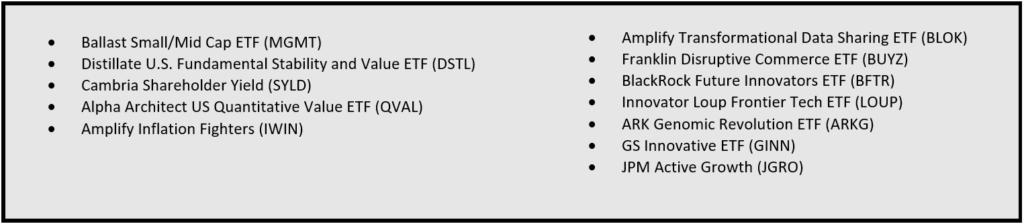

A hypothetical high-active-share reconstruction of a traditional 60/40:

• 5% PIMCO 25+ Year Zero Coupon US Treasury Index ETF (ZROZ)

• 2% Angel Oak UltraShort Income ETF (UYLD)

• 2% Simplify Short Term Treasury Futures (TUA)

• 2% Simplify Managed Futures (CTA)

• 10% Saba Closed-End Funds ETF (CEFS)

• 2.5% AGFiQ US Market Neutral Anti-Beta Fund (BTAL)

• 1% Ionic Inflation Protection ETF (CPII)

• 1% FolioBeyond Rising Rates ETF (RISR)

• 2.5% WisdomTree Enhanced Commodity Strategy Fund (GCC)

• 1% Tecrium Agricultural Strategy No K-1 ETF (TILL)

• 4% SPDR Gold MiniShares Trust (GLDM)

• 4% Amplify Inflation Fighters ETF (IWIN)

• 5% Amplify Transformational Data Sharing ETF (BLOK)

• 5% Sofi Be Your Own Boss ETF (BYOB)

• 5% Franklin Disruptive Commerce ETF (BUYZ)

• 5% BlackRock Future Innovators ETF (BFTR)

• 4% Ark Genomic Revolution ETF (ARKG)

• 4% Emerging Markets Internet & Ecommerce ETF (EMQQ)

• 5% Ballast Small/Mid Cap ETF (MGMT)

• 5% ETF 6 Meridian Small Cap Equity ETF (SIXS)

• 5% Alpha Architect US Quantitative Value ETF (QVAL)

• 5% Cambria Shareholder Yield ETF (SYLD)

• 5% Distillate International Fundamental Stability Value ETF (DSTX)

• 2.5% Distillate US Fundamental Stability & Value ETF (DSTL)

• 2.5% GS Innovative Equity (GINN)

• 5% Mathews Asia Innovators Active (MINV)

Disclosure

All investments carry risks, and investors may lose their principal.

The material provided here is for informational purposes only and should not be considered personalized investment advice. The investment strategies mentioned here may not be suitable for everyone, and each investor should review their own situation before making an investment decision.

Opinions expressed here are subject to change without notice due to market conditions. Third-party data presented here is obtained from sources believed to be reliable, but accuracy, completeness, or reliability cannot be guaranteed.

The examples provided are for illustrative purposes only and should not be considered reflective of actual results.

Investments’ value and income can fluctuate, and investors may not recover their initial investment. Factors that can affect investments include interest rate changes, exchange rate fluctuations, general market conditions, political, social, and economic developments, and other variable factors. Investment carries risks, such as payment delays, and loss of income or capital. Neither Toroso nor any of its affiliates guarantee any rate of return or the return of capital invested.

This commentary material is for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy any security.

All investments and investment strategies carry risks of loss, including the possible loss of all amounts invested, and nothing herein should be construed as a guarantee of any specific outcome or profit. While we have gathered information from sources we believe to be reliable, we cannot guarantee the accuracy or completeness of the information presented.

The information in this material is confidential and proprietary and may only be used by the intended user. Toroso, its affiliates, or any of their officers or employees are not liable for any losses arising from the use of this material or its contents. This material may not be reproduced, distributed, or published without prior written permission from Toroso. Distribution of this material may be restricted in certain jurisdictions. Anyone receiving this material should seek advice to determine whether there are any restrictions in their jurisdiction.