Week of August 28, 2023 KPI Summary

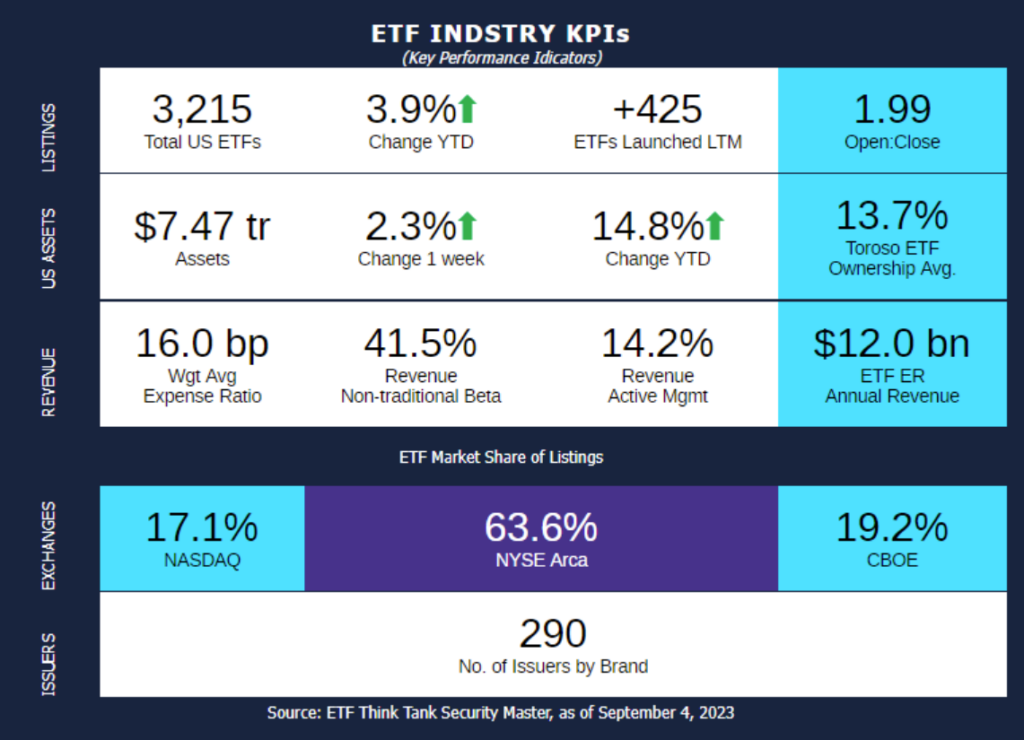

- This week, the industry experienced 9 ETF launches and 3 closures, shifting the 1-year Open-to-Close ratio to 1.99 and total US ETFs to 3,215.

- After 5 consecutive months of positive total asset growth for the ETF industry, the streak has come to a halt with August. Let’s review our notable KPIs from August (data comparing 7/30/23-9/4/23).

- Total assets decreased -1.6%, there was an increase of 34 ETFs to total US ETF count (3,181), and 5 additional issuers by brand.

- From our 11 asset class categories, Managed Futures increased the most (6.4%) with Options next (4.3%). Volatility had the worst performance again (-4.8%) with Geared/Swaps at second worst (-4.2%). The two largest asset classes of Equity (77.1% of assets) and Fixed Income (18.4%) dipped -1.9% and -0.4% respectively.

- After 3 months in the top 2 performing categories, Geared/Swaps drops to the bottom 2.

- This is consecutive months with Options in the top 2.

- The ETF expense ratio of annual revenue dropped from $12.7 Bn to $12.0 Bn.

- The record streak is broken, yet there are still positives to take away from August. Total ETF count increasing by 34 is above the average and +5 issuers is only second to April (+7) in 2023 YTD. This is only the second month in 2023 with a decrease in total assets, the other being February at -2.6%.

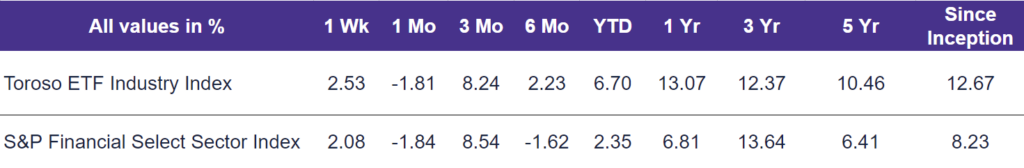

- The tracked indexes had very similar experiences in August. The Toroso ETF Industry Index was down -1.81% while the S&P Financial Select Sector Index trailed at -1.84%.

ETF Launches

Strive FAANG 2.0 ETF (ticker: FTWO)

Innovator International Developed Power Buffer ETF – September (ticker: ISEP)

AllianzIM U.S. Large Cap Buffer10 September ETF (ticker: SEPT)

AllianzIM U.S. Large Cap Buffer20 Septbmer ETF (ticker: SEPW)

KraneShares Dynamic Emerging Markets Strategy ETF (ticker: KEM)

Madison Aggregate Bond ETF (ticker: MAGG)

Polen Capital Global Growth ETF (ticker: PCGG)

Segall Bryant & Hamill Select Equity ETF (ticker: USSE)

YieldMax XOM Option Income Strategy ETF (ticker: XOMO)

ETF Closures

Harbor Small Cap Explorer ETF (ticker: QWST)

ETFMG Sit Ultra Short ETF (ticker: VALT)

Fund/Ticker Changes

Invesco 1-30 Laddered Treasury ETF (ticker: PLW)

became Invesco Equal Weight 0-30 Year Treasury ETF (ticker: GOVI)

Invesco Defensive Equity ETF (ticker: DEF)

became Invesco Bloomberg Pricing Power ETF (ticker: POWA)

Invesco Dynamic Market ETF (ticker: PWC)

became Invesco Bloomberg MVP Multi-Factor ETF (ticker: BMVP)

Invesco Dynamic Media ETF (ticker: PBS)

became Invesco Next Gen Media and Gaming ETF (ticker: GGME)

Invesco Dynamic Networking ETF (ticker: PXQ)

became Invesco Next Gen Connectivity ETF (ticker: KNCT)

Invesco Dynamic Software ETF (ticker: PSJ)

became Invesco AI and Next Gen Software ETF (ticker: IGPT)

Invesco S&P MidCap 400 Equal Weight ETF (ticker: EWMC)

became Invesco S&P MidCap 400 GARP ETF (ticker: GRPM)

Invesco Treasury Collateral ETF (ticker: CLTL)

became Invesco Short Term Treasury ETF (ticker: TBLL)

High Yield ETF (ticker: HYLD)

became AXS Real Estate Income ETF (ticker: RINC)

Grizzle Growth ETF (ticker: GRZZ)

became Grizzle Growth ETF (ticker: DARP)

TETF.Index Performance vs. S&P Financial Select Sector Index

(as of September 1, 2023)

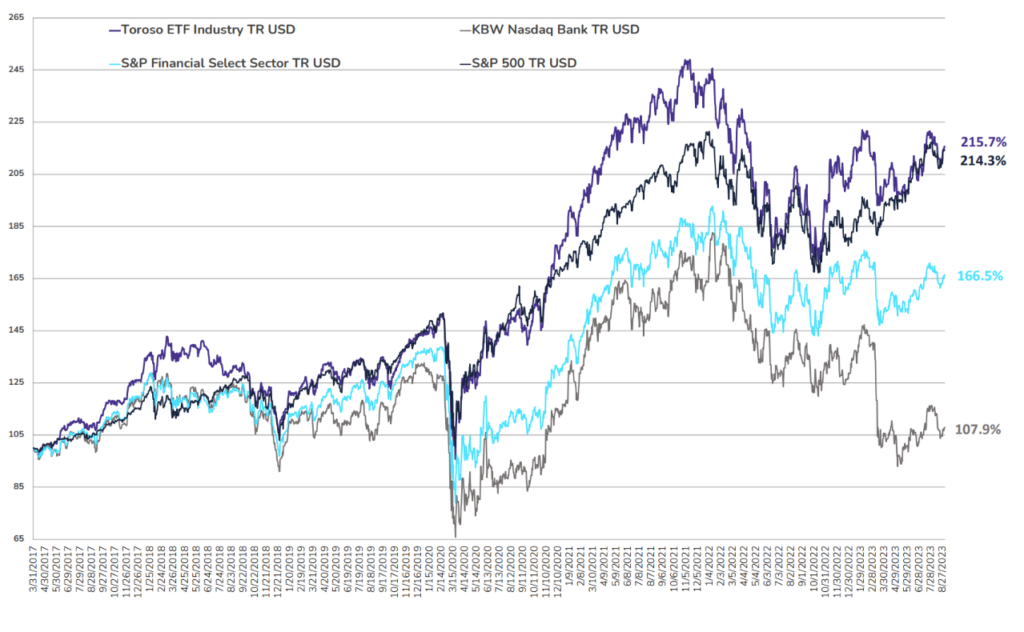

TETF.Index Performance vs. Other Leading Financial Indices

(March 31, 2017 through September 1, 2023)

Why Follow the ETF Industry KPIs

The team at Toroso Investments began tracking the ETF Industry Key Performance Indicators (KPI’s) in the early 2000’s and have been consistently reporting on, and analyzing these metrics ever since. The table above was the impetus for the creation of the TETF.Index, the index that tracks the ETF industry. Each week, we will share the statistics we believe to be the most useful for identifying industry trends, in addition to the performance of the TEFT.Index.

DISCLAIMER

Past performance is no guarantee of future returns. This article is for informational and educational purposes only; is not intended to constitute legal, tax, accounting or investment advice; and does not constitute an offer to sell or a solicitation of an offer to buy any security or service. Furthermore, the Indexes shown above are not investable. While Toroso has gathered the information presented from sources that it believes to be reliable, Toroso cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed are Toroso’s opinions and do not reflect the opinions of any affiliates or related persons. All opinions are current only as of the date of initial publication and are subject to change without notice. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested.