We turned to social media this weekend to look for inspiration and found by surveying our LinkedIn readers that most were curious about insights related to short side ETFs rather than another article about inflation, Apple stock, or some random ETF ideas for Father’s Day.

ETF Shorts

There is limited information written about inverse ETFs, the practice of shorting ETFs, or “ETFs worth shorting” as indicated by the survey. This may be because there are only a small number of inverse ETFs (101) and very few ETFs offering active short exposure. Check out the latest KPI data for detailed information. Bottom line, the 101 inverse ETFs represent only 3.2% of the 3,179 ETFs, and the $20.6 billion in AUM is highly concentrated in the Proshares UltraPro Short QQQ ETF (SQQQ), which has nearly $5 billion in AUM. It is not surprising that the fee for inverse ETFs is about 5x that of the weighted average fee for traditional ETFs (81.6 Bps vs 16.8 Bps, respectively). Additionally, the average AUM for inverse ETFs is around $200 million vs the average for traditional ETFs at $2.3 billion. All this is to say that 95-99% of investors in the $7.3 trillion ETF market are thinking of investing in something that goes up, not down. Nevertheless, there have been periods of time where ETFs offering short exposure have played a crucial role in protecting investor portfolios from disaster, or simply providing a diversification sleave. Remember, 2022 is not long past!

We would also like to remind our readers that the short side of an ETF wrapper has caused unwarranted concern in the past. Back in September 2010, there was a paper written by Andrew Bogan suggesting that the SPDR S&P Retail ETF (XRT) would collapse from the pressure of the short side and leave long investors holding the bag (read it here: “Can an ETF Collapse”). Old timers in the ETF market, like Herb Greenberg, will remember the hysteria that this article caused (see Greenberg’s response). Today, the ETF wrapper is a well-established and traditional tool for investors, but let’s not forget that the ETF revolution was tested in many ways over these past 20-30 years (sound like crypto/digital assets?). Old timers probably also remember the rumor that there really wasn’t any gold behind GLD. All this is to say, sorry Mr. Bogan, as well as those who are still shorting XRT in hopes of an outright collapse. See chart since inception June 22, 2006 – Anyone at SSgA thinking about a Bell Ringing, please invite me and Marcus Lemonis of Camping World.

The following chart highlights the number of shares short since 2013. See footnotes for a longer time frame. It is important to consider that liquidity and trading volume is clearly more important than outstanding share count. Presently, there are 22,648,675 shares short, with an average trading volume of 6,200,000 and outstanding shares of 6,500,000 on a market value of $404,000,000.

ETF Ideas

All this is not to discourage the practice of shorting ETFs or undermine its importance as a critical component in markets. The fact is that the rationale for why the shorts might work is less important than how they can be used to manage risk in a portfolio. There are many rational valid reasons for why XRT should go down despite high current consumer confidence, according to McKinsey & Co. However, it is important to recognize that this data is subject to change, so the metrics driving XRT could lead to a short opportunity, as well as a reason to manage risk off.

It is important to note, as the chart above illustrates, with the yield on 3-month U.S. Treasury bills at 5.3%, about the same rate as forward earnings yield on the S&P 500 or corporate investment grade bonds, the rationale for “risk on for broad index” is challenging to justify. For this reason, the simple premise behind the named shorts below is that market breadth needs to expand ($RSP and $VTI), or the market will peak with the leadership currently priced to perfection. Even perfect execution has limits and an indigestion period with a pullback of 10% would not surprise anyone (note that this is why we remain committed to an investor’s long approach to actively managed equity strategies that are high conviction in nature (see Think Tank Exchange Video with Davis Advisors) or an orientation towards ETFs with a discipline on high cash flow ETFs.)

Inverse & Direct Short ETF Ideas

- Will the “law of large numbers” eventually lead to an air pocket when Apple hits $3 trillion in value (watch for the media hype at $295 a share). Arguably, the Stock is over-owned and not providing investors with growth (down to flat revenues and EPS) or relative value (30X EPS vs the S&P PE of about 20x). As a “cult stock” worth $3 trillion we see this as a candidate for the short side and would look at AAPL Inverse 1X and 1.5x, AAPD and AAPU Long, Inverse QQQ (PSQ or SQQQ) and short technology. Those who want to get more aggressive can also look at the Direxion Inverse technology ETFs. As a reminder, Apple reports their next quarter on July 28, 2023, and expectations are for revenues to be at $83B, up 1.9% from a year ago, and a decline of 7.7% on EPS at $1.20 per share. The good news is that free cashflow is projected to reach almost $23 billion, an increase of close to $2 billion, so they can continue to buy back shares (only problem – free cash flow per share is not forecasted to increase).

- The SPDR S&P Retail ETF (XRT) makes consumer sentiment a great metric to measure both negative consumer confidence and market behavior given that 70% of US GDP comes from consumer demand. We acknowledge that Direxion had an ETF to capitalize on this down trend, but it closed.

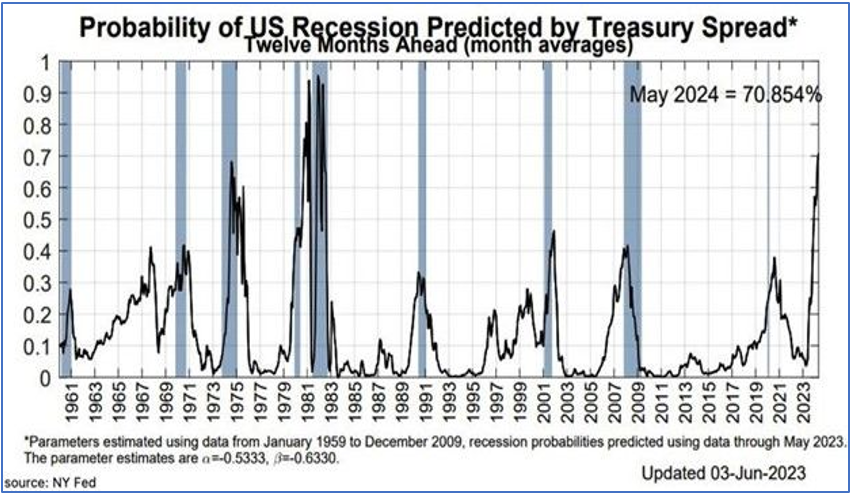

- In considering bond shorts, it is important to evaluate the risks associated with anticipating a recession and its impact on long duration bonds. TIPS (Treasury Inflation-Protected Securities) prices may go down under that scenario where yields without inflation collapse. Short: TIPS, SCHP. See below chart that highlights the increased probability of the US Recession, as predicted by the Treasury Spread.

- Financial pros and fiduciaries know that implementing the execution of a short portfolio requires a certain element of market timing that is focused on macro factors such as interest rates, stock multiples, and economic conditions. This usually means more portfolio turnover and a different kind of risk management protocol than the traditional long book. More information can be found using the ETF Think Tank Tools and searching for the Inverse attribute.

Summary

Thankfully, you can be bearish if you want, and short ETFs until the cows come home! They won’t be manipulated by short interest or crush under the pressure! Moreover, investors should feel free to short any ETF. Shorting can help smooth out returns, but a risk-on and risk-off strategy should be actively managed, especially if using leveraged inverse ETFs. We highlight the SPDR Retail ETF (XRT) and a couple of ways to play short technology in this report but warn that shorting into weakness when a fundamental change causes a directional price change tends to be more manageable for investors. Traders will confirm – valuation shorts do not work well without a catalyst. Having said that, we highlight Apple stock since expectations are so high as a vulnerable short to watch. The risk of perfect execution continues to be a challenge, and the fallout would be so devastating to the market. Apple stock is so over owned that it needs to be segmented as its own asset class, as it ranges across value, growth, and thematic investing. As a reminder, these ideas are not recommendations for investment purposes as much as they are ways to highlight risk metrics.

Another reminder – last weekend was Father’s Day.

P.S. Those looking for a late Father’s Day gift ETF could check out the Pro-Shares Pet Care ETF (PAWZ). Unconditional love does have a price and a focus around an industry worth about $120 billion.

Disclosure

All investments involve risk, including possible loss of principal.

The material provided here is for informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

The value of investments and the income from them can go down as well as up and investors may not get back the amounts originally invested, and can be affected by changes in interest rates, in exchange rates, general market conditions, political, social and economic developments and other variable factors. Investment involves risks including but not limited to, possible delays in payments and loss of income or capital. Neither Toroso nor any of its affiliates guarantees any rate of return or the return of capital invested. This commentary material is available for informational purposes only and nothing herein constitutes an offer to sell or a solicitation of an offer to buy any security and nothing herein should be construed as such. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested, and nothing herein should be construed as a guarantee of any specific outcome or profit. While we have gathered the information presented herein from sources that we believe to be reliable, we cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed herein are our opinions and are current only as of the date of distribution, and are subject to change without notice. We disclaim any obligation to provide revised opinions in the event of changed circumstances.

The information in this material is confidential and proprietary and may not be used other than by the intended user. Neither Toroso or its affiliates or any of their officers or employees of Toroso accepts any liability whatsoever for any loss arising from any use of this material or its contents. This material may not be reproduced, distributed or published without prior written permission from Toroso. Distribution of this material may be restricted in certain jurisdictions. Any persons coming into possession of this material should seek advice for details of and observe such restrictions (if any).