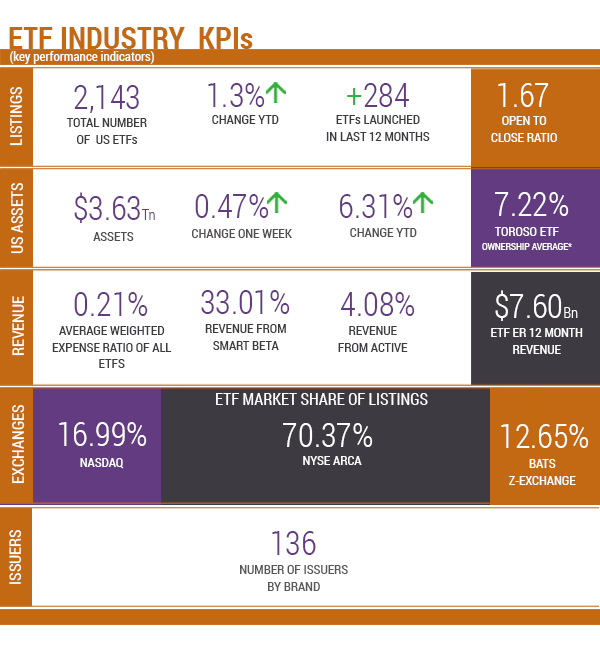

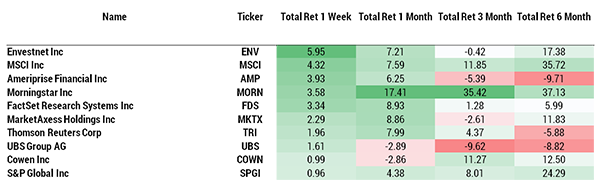

Source of KPIs: Toroso Investments Security Master, as of June 15, 2018

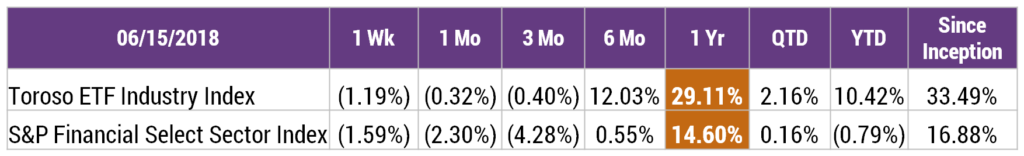

INDEX PERFORMANCE DATA

Returns as of June 15, 2018.

Inception Date: April 4, 2017. Index performance is for informational purposes only and does not represent the ETF.

Indexes are unmanaged and one cannot invest directly in an index.

Past performance is NOT indicative of future results, which can vary.

PIONEERING IN BLOCKCHAIN AND CRYPTO-ASSETS

Each week we discuss how client alignment and innovation are driving the growth of the ETF industry. But in this week’s TETF Index update we are highlighting ETF innovators that are looking at the blockchain and crypto assets. Although Toroso is very interested in this space as a sub-advisor to a blockchain focused ETF, we want to put our focus on key individuals that are putting their well-earned reputations and experience into new frontiers of blockchain and crypto-assets. While most are projecting ETF growth of 15 to 20% to continue over the next 5-10 years, we thought it would be worth asking the question. What does it mean that these key ETF pioneers are now embracing blockchain and crypto-assets? Could this new innovation improve or potentially replace ETFs one day?

Many ETF pioneers are now examining blockchain and crypto-assets very closely. Considering how many of these innovators have already changed finance for the better and created investments aligned with clients, this bold move toward blockchain must be thoroughly vetted and watched carefully. ETFs are still in the early innings of its growth and mutual funds still represent 80% of the assets in the combination of mutual funds and ETFS. But, the blockchain is revolutionary and crypto-assets are rapidly finding a place in investor portfolios. So paying attention is important to knowing what’s next!

Let’s look at a few key people:

First, there is Kathleen Moriarty. Kathleen was actively involved in the construction of the SPDRs, the first US ETFs, the first physical metals ETF (GLD), and many other ETF’s creation, structuring, and development. From her influence in SPDR’s, she actually has the nickname “SPDRwoman.” She is regularly quoted in the media about issues related to ETFs, financial indexes, and Bitcoin. Kathleen recently represented the Winklevosses with their Bitcoin ETF application just a few months ago. She continues to press the boundaries of the ETF universe as she shifts some of her focus to the undefined potential of blockchain and crypto.

Second, Jan Van Eck is the Chief Executive Officer of Van Eck Associates Corporation. He has created a variety of international, emerging markets, and commodity-related investment strategies in mutual funds, ETFs, and alternative investment formats. He is certainly an example of a first mover in the ETF space that demonstrates a lot of interest in blockchain and cryptocurrency. Van Eck has focused on creating institutional quality indexes of crypto-assets and recently refiled for a Bitcoin ETF that would list at $200,000 per share. Another boundary being tested.

Third on our list is Matt Hougan. CNBC once called him, “The Master of All Things ETF.” Only a few months ago though, Matt left his position as CEO of Inside ETFs to join a small startup called Bitwise Asset Management, which created the world’s first cryptocurrency index fund. He is now Bitwise’s Global Head of Research. Matt is still involved with ETFs, but has shifted his focus to crypto. Matt said, “The potential for crypto to both improve the world and improve investor portfolios is tremendous. It’s exciting to get in on the ground floor of another generationally-important financial innovation.” He was recently featured on the Exponential Podcast discussing this transition: https://exponentialetfs.com/podcast/. We are eager to see how Bitwise grows and evolves with Matt’s research and vision.

Another new Bitwise employee, John Hyland, is our next candidate for ETF Nerd now Blockchain Brainiac. Hyland joins the firm as its new global head of exchange-traded products. He is well-known for spearheading the launch of the first crude oil ETF, the first natural gas ETF, the first copper ETF, and one of the most innovative commodity basket funds in the world, the United States Commodity Index Fund. Working with crypto should be a no-brainer for John.

All four of these individuals represent financial innovators that saw the potential of the ETF industry early on, and now believe they see equal opportunity with blockchain, Bitcoin, and cryptocurrencies. That said, despite the “brain drain” of innovators shifting focus, the advent of blockchain technology presents many shorter-term opportunities for ETF growth. But, in the long-term will the ETF structure, as we know it, be changed or possibly consumed by the blockchain technology. Time will tell.

ETF LAUNCHES

| iShares Gold Strategy ETF | IAUF |

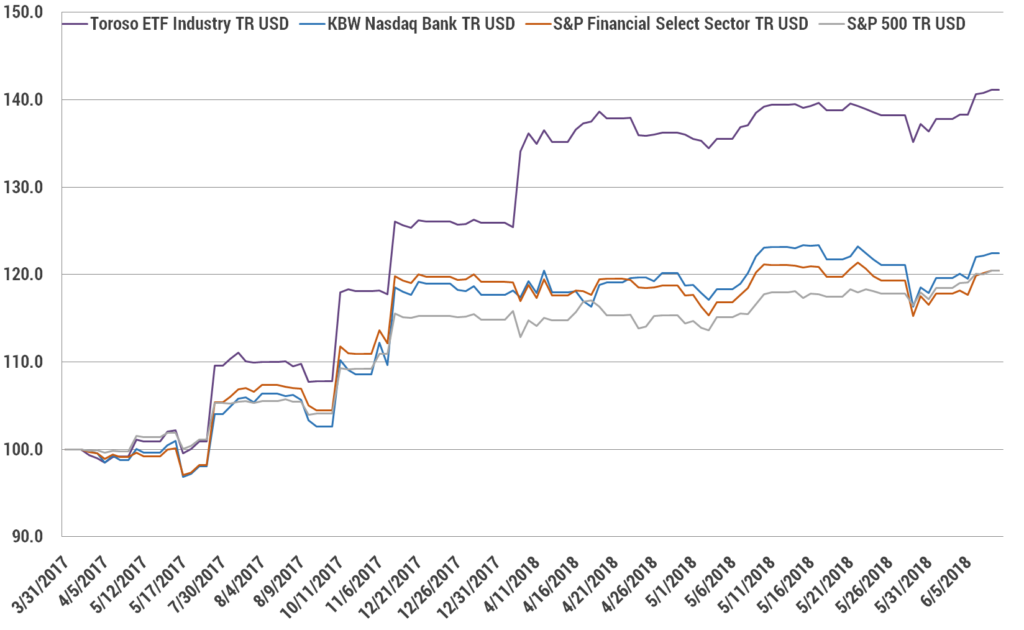

TETF INDEX PERFORMANCE VS LEADING FINANCIAL INDEXES

Returns as of June 15, 2018.

Inception Date: April 4, 2017. Index performance is for informational purposes only and does not represent the ETF.

Indexes are unmanaged and one cannot invest directly in an index.

Past performance is NOT indicative of future results, which can vary.

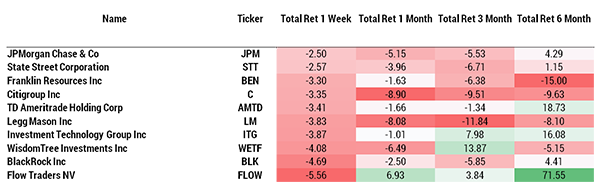

TOP 10 HOLDINGS PERFORMANCE

BOTTOM 10 HOLDINGS PERFORMANCE