1. GROWING INTEREST IN ETFs

As of August 31, 2017

2. LONG TERM INDUSTRY GROWTH

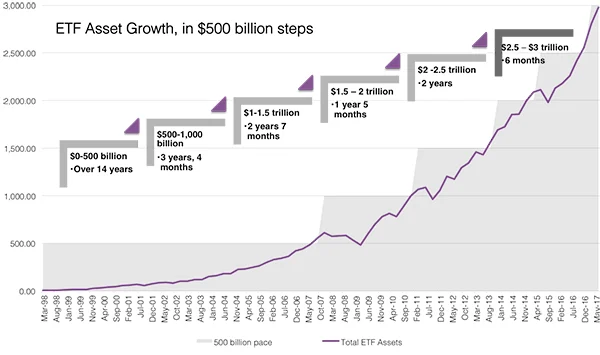

“Global ETF AUM set to exceed $7 trillion by 2021”Over the last decade, AUM in the ETF space grew at an annualized 19.4%, and in 2016, the U.S. ETF industry recorded record inflows totaling $293 billion—the highest ever.

PriceWaterHouseCoopers

3. THE REVOLUTION

“The rise of passive investing – exchange-traded funds, index funds and the like—has revolutionized the investment world…”

New York Times, Mar 2017

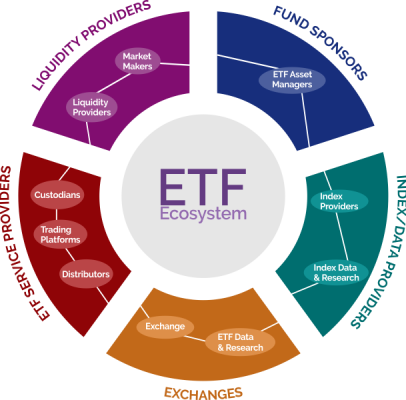

ETF sponsors are not the only entities to benefit from expansion throughout the space. Toroso’s TETF Index measures the growth of the entire ETF value chain—the intricate ecosystem of financial innovators and service providers that profit from the success and benefits of ETFs.

ETF Ecosystem

The TETF Index is designed to provide exposure to publicly traded companies that derive revenue from the Exchange Traded Funds ecosystem.

Now investors and advisors have the opportunities to participate in the growth of the ETF industry itself.

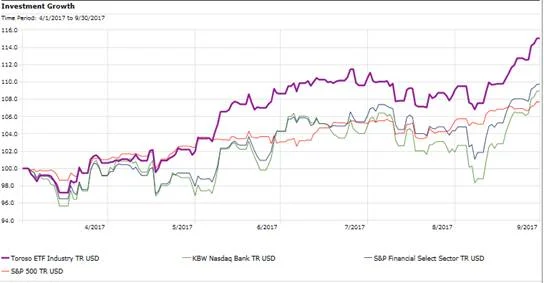

The Toroso ETF Industry Index measures and monitors the performance of publicly traded companies that derive revenue from the Exchange Traded Funds ecosystem. Constituents range from fund sponsors, to index & data companies, trading & custody platforms, liquidity providers, and exchanges.