Broad Market

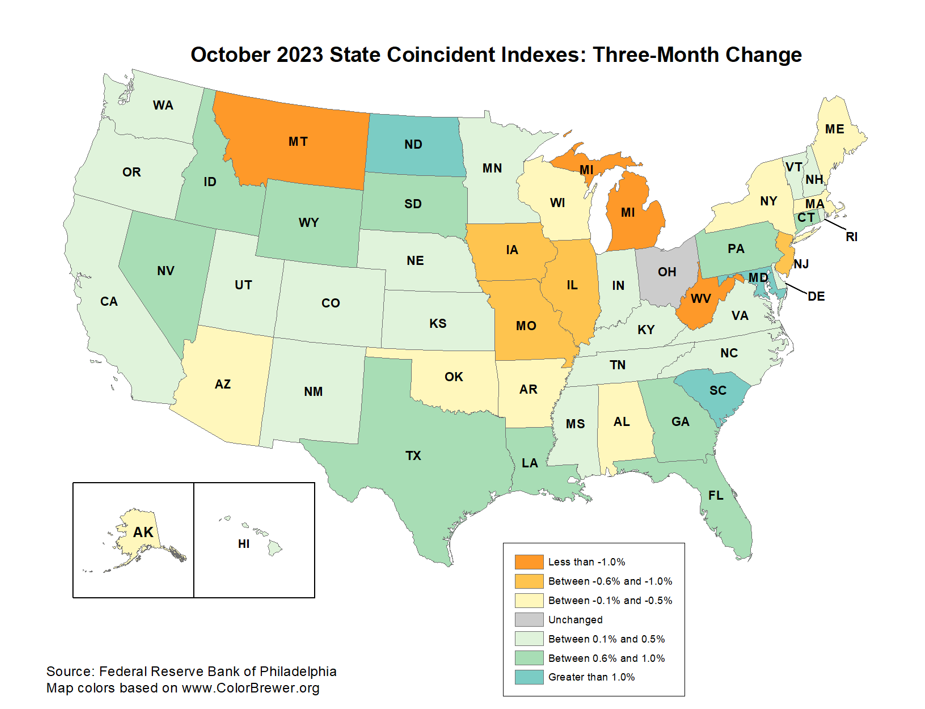

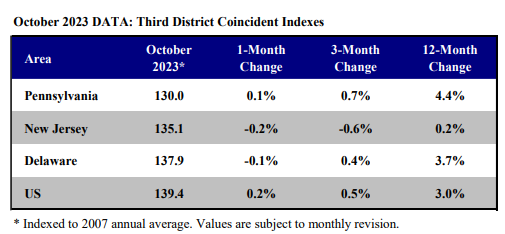

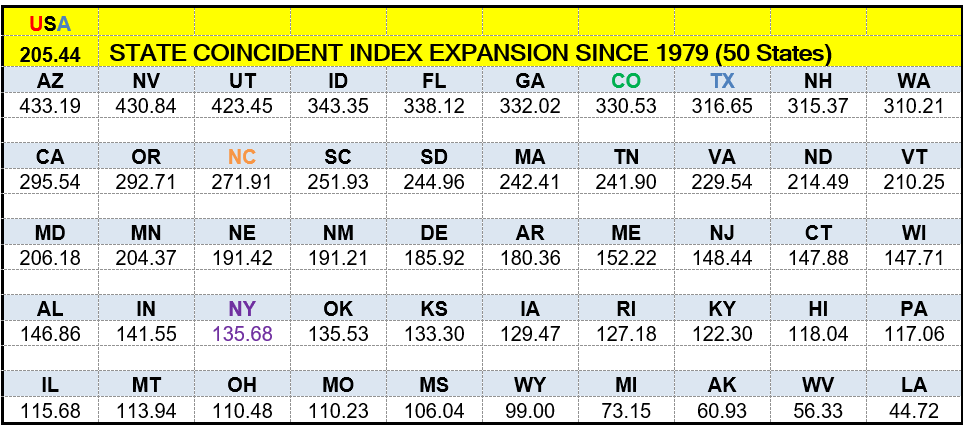

The Federal Reserve Bank of Philadelphia has produced a monthly “coincidental index” since 1979 for each of the 50 states. This index follows the Bureau of Labor Statistics (BLS) and is designed to provide a single KPI which aggregates the nonfarm payroll index, average hours worked in manufacturing by production workers, the unemployment rate, and wage and salary disbursements. As a short term KPI, it can be useful to measure economic trends that signal economic strength or weakness. To this point, many investors use this KPI as a broad indication of when the U.S. might be headed for a recession. While this signal can be useful in the short term for these purposes, we would like to highlight strong State GDP growth per state. To this point, we believe it is interesting to highlight how different states have grown their GDP since 1979 as measured by this index. An expanding GDP by state could arguably lead to a higher standard of living or quality of life since it would reflect stronger employment. In certain cases, we would also highlight that states like Arizona (433), Nevada (430), Florida (338), and Texas (316) may also have friendlier tax structures that would benefit people in retirement. As a baseline, we note that the US has expanded by 205.44 versus the low 44.72 for Louisiana. To put this into context, in January 1979, the metric for Louisiana was 75.31, and as of October 2023 the metric is 108.98. [i]

Our point is that the coincident indicator may ironically reflect what is not necessarily a coincidence. After all, when it comes to structure matters, where you live may not be a coincidence, but rather a decision based on employment, quality of life, or family preference. Maybe it is not a coincidence that one of our founders, our wise Chief Financial Officer, lives in Pennsylvania, which has shown growth of 4.4% over these past 12 months, versus a few of us who live in New Jersey.

Hidden Gems: Targeting Cash Flows

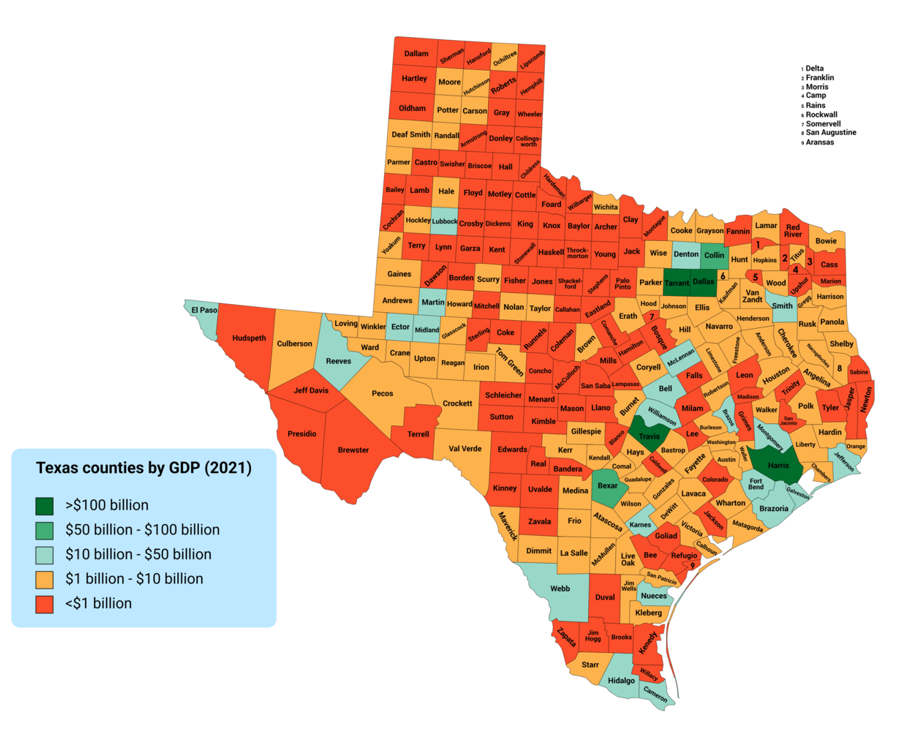

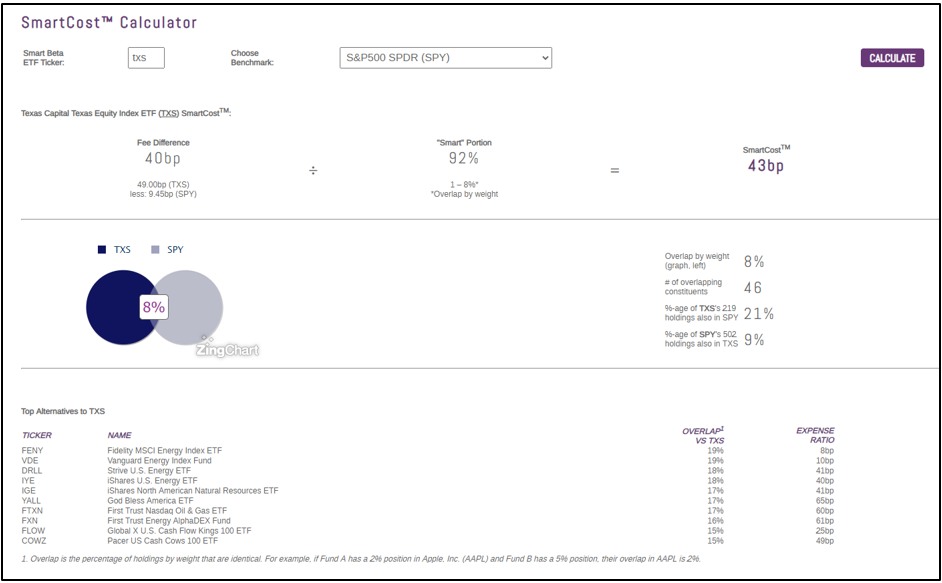

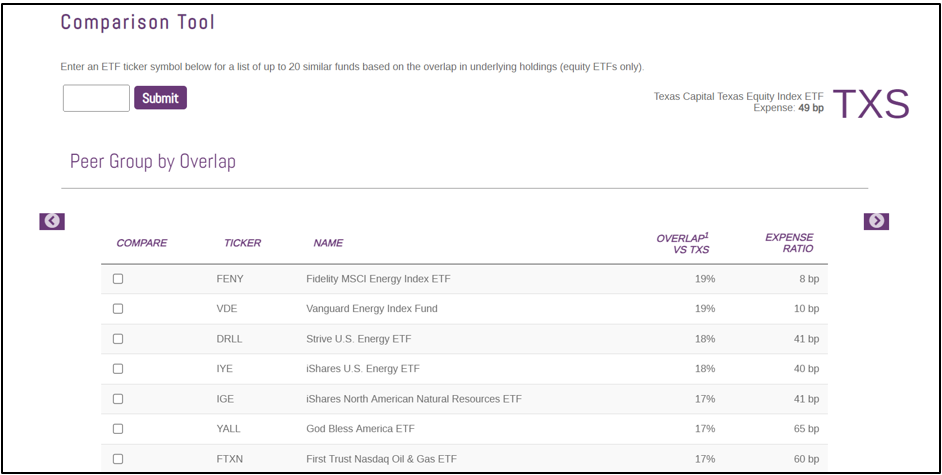

The Texas economy [ii] is officially the 8th largest economy in the world and the second largest economy in the U.S., valued at more than $2.4 trillion (IMF GDP 2022), [iii] which is GDP growth of about 7%. This is the fastest growth rate among the states in real GDP terms, and well ahead of the 2.6% experienced by the U.S. in aggregate. For those who think this is just silly trivia, we would point out that Texas reached a new historic high in terms of having the largest labor force ever in its history, at a record 15,162,000. This is driven in part by a population of 14,536,000 who are self-employed. Moreover, yes, there is an ETF that offers access to these positive trends. Here is the link to find out more. The surprise in reviewing the weighting of this ETF is not that it has about 21% in energy and pipeline exposure, but that it provides high active share with only 10 ETFs having an overlap of between 19% and 15%. Moreover, in using the proprietary ETF Think Tank Smart Cost Calculator, we highlight that 92% and 94% of the “Smart Portion” is truly differentiated versus SPY and MDY. As a result, with a 49 Bps Expense Ratio (ER), we calculate a low 28 to 42 Bps SmartCost.

Real Life Tank Battle Ground Stories

Traveling around Texas earlier in the month, we came across a bullish signal around breadth broadening out in the equity markets. Not all signals can be back tested! If this is your car, please email me at dweiskopf@tidalfg.com. As a two-part riddle for our ETF Think Tank Members, (A) What was the name of the firm which launched the Nashville Area ETF? (B) What industry dominated the weighting of this ETF?

Summary

We hope everyone had a great Thanksgiving. Those reading closely may wonder why North Carolina (NC) and Colorado (CO) are especially color coded in the above Coincident chart. The answer is simple. We are offering a special holiday reward to financial advisors in those two states. If your practice is focused on either of those states, do reach out and collect your reward! Our conclusion in highlighting Texas (TXS) as the state to invest in makes sense, given the structure around its high active share and smart cost. Texas is known to work with businesses to continue to innovate and expand its GDP. We will also be watching this ETF closely because it matches the desire of so many investors who live in Texas. Regardless, with so many investors focused on the possibility of a short-term recession or even a Goldilocks scenario, our point is that investors should look beyond the broad US economy and look deeper into how the state they live in will expand their own individual opportunity and quality of life. (Do you live in the top category or the bottom row? Why? If structure matters, why not address the issue with a choice and move?)

[i] https://www.philadelphiafed.org/surveys-and-data/regional-economic-analysis/state-coincident-indexes and https://www.philadelphiafed.org/-/media/frbp/assets/surveys-and-data/coincident/2023/coincidentindexes1023.pdf

[iii] https://en.wikipedia.org/wiki/Economy_of_Texas

Disclosure

All investments involve risk, including possible loss of principal.

The material provided here is for informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third-party providers is obtained from what are considered reliable sources. However, its accuracy, completeness, or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

The value of investments and the income from them can go down as well as up and investors may not get back the amounts originally invested, and can be affected by changes in interest rates, exchange rates, general market conditions, political, social, and economic developments, and other variable factors. Investment involves risks including but not limited to, possible delays in payments and loss of income or capital. Neither Tidal nor any of its affiliates guarantees any rate of return or the return of capital invested. This commentary material is available for informational purposes only and nothing herein constitutes an offer to sell or a solicitation of an offer to buy any security and nothing herein should be construed as such. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested, and nothing herein should be construed as a guarantee of any specific outcome or profit. While we have gathered the information presented herein from sources that we believe to be reliable, we cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed herein are our opinions and are current only as of the date of distribution, and are subject to change without notice. We disclaim any obligation to provide revised opinions in the event of changed circumstances.

The information in this material is confidential and proprietary and may not be used other than by the intended user. Neither Tidal nor its affiliates or any of their officers or employees of Tidal accepts any liability whatsoever for any loss arising from any use of this material or its contents. This material may not be reproduced, distributed, or published without prior written permission from Tidal. Distribution of this material may be restricted in certain jurisdictions. Any persons coming into possession of this material should seek advice for details of and observe such restrictions (if any).