Broad Markets

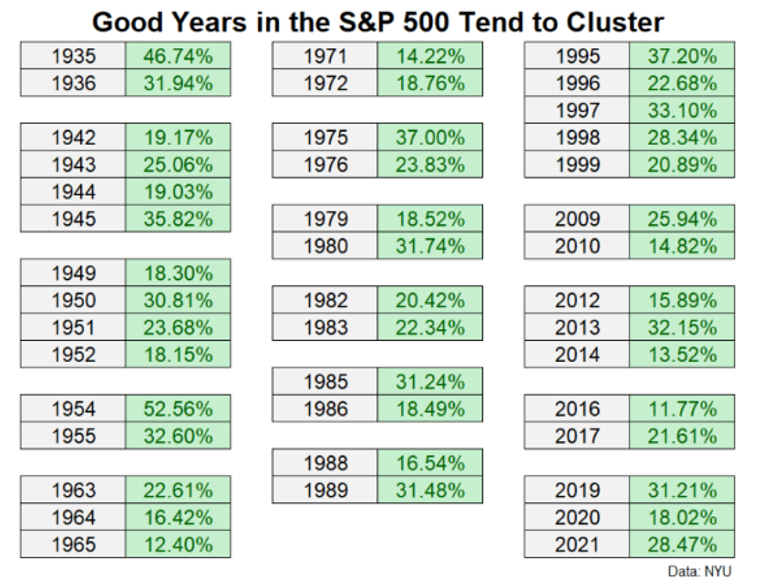

Amazingly, the S&P 500 is up 10% YTD as of March 21, which is a rough run rate of 40%. To many, this is shocking given the risks and unknowns that exist in the market today. However, the same risks existed last year, and the same market was up 24%. It may be irrational, but double-digit up years frequently come in clusters (according to a Wealth of Common Sense [i]) and 13% of the time lead to gains of 15% or more. We would also point out that the results of late have been extraordinary in many ways.

Warning: Stock Market Returns have been Extraordinary vs Inflation, but…

Dating back to 1913 when the U.S. Bureau of Labor Statistics began recording CPI, the S&P 500 has compounded at about 10% per year for a net return over inflation of 6.66%. That does not change the fact that there was a lost decade between 1999 and 2009, where after 10 years investors lost 15.34% cumulatively, or -1.5% per year. Many investors may have missed this painful period, and simply enjoyed the exceptional rally since 2009, compounding at a fairly steady 14% (or 11.38% cumulative after inflation). What a gift to a generation! Check out the tool that provided such fun data: Official Data.Org

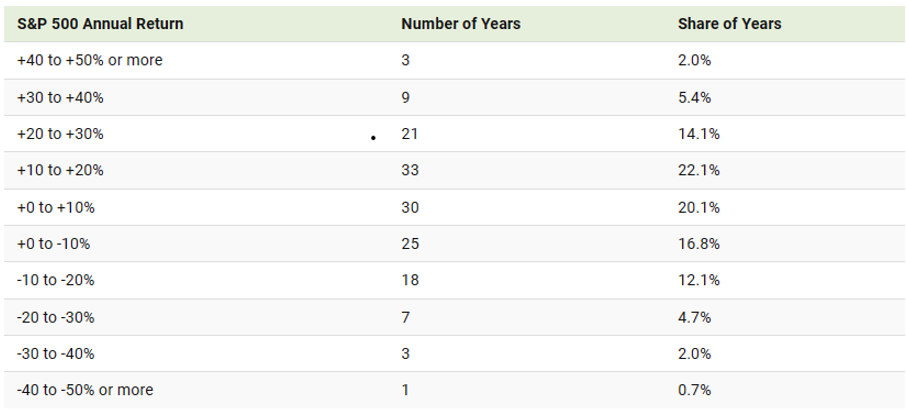

To put this further into context, we would remind investors that despite the massive return last year, some 72% of stocks underperformed the index, and in only 21 out of the 150 years since 1874 has the S&P 500 provided +20-30% returns. [ii] This argues possibly for further upside if the market broadens out as inflation comes under control. However, it most certainly won’t come in a linear fashion, so holding cash with an interest rate of 5% certainly makes sense.

Of course, the most recent return of the S&P 500, led by the performance of 7 stocks, should not be the minimum measure of success for every asset class and portfolio manager, or a proper measure of return on invested capital. However, ask a client what their portfolio expectations are for 2024 and they will likely say, “the S&P500 – and remind me why I need to be diversified? If diversification only serves to dilute a portfolio return, then why bother?”

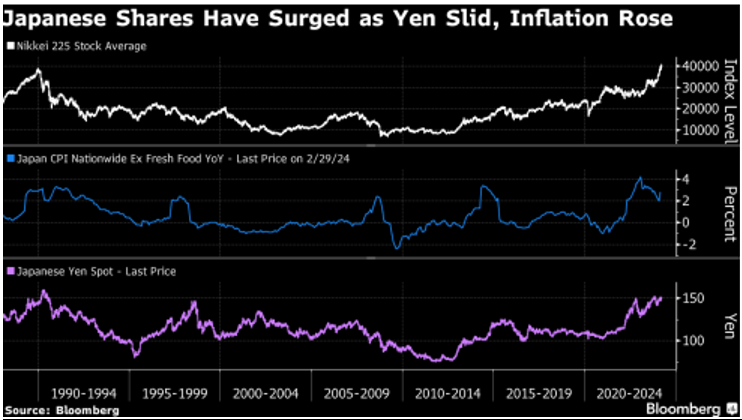

Japan is a perfect example of why bother! For decades, the market has done very little, and investors have been mostly frustrated as the Bank of Japan (BOJ) has quietly and consistently been buying up the Japanese market using ETFs.[iii] Then, growth came back, and this country – as the second largest economy in Asia and the third largest globally – is underweighted by most investors.

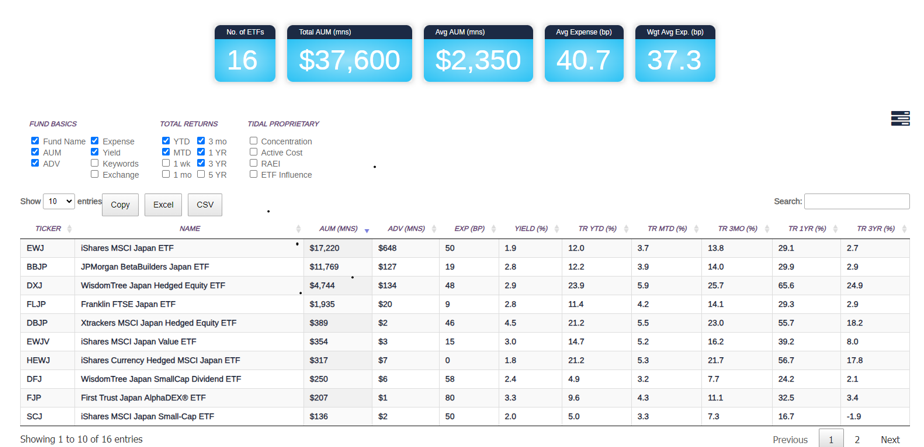

Hidden Gems: Japan ETFs

There are 16 different ways to directly invest in the Japanese ETF market. As usual in the ETF market the largest 4 funds make up 95% of the Assets Under Management (AUM). WisdomTree, with DXJ and HEDGJ, scored a huge victory with its dominance in hedging currency back in 2010 and practically invented the concept for ETF buyers. However, today’s DWS’s X-Trackers offer strong competing products (DBJP), with a meaningful yield of almost 5%. As a reminder, a hedged product is a way to bet on a strengthening dollar over the Japanese yen.

Japan – Will the next decade make up for two lost decades?

Don’t push back at us for highlighting the performance of the Japanese market, as it sets new records in this first quarter of 2024. After all, on multiple occasions, the ETF Think Tank hosted speakers from DWS on Twitter Spaces that highlighted the opportunity in 2023. We typically prefer not to make currency trades, but in this case, trend followers would agree – this trend is pretty clear to embrace. Japan wants its yen to be weak against the dollar to foster exports and the positive trend in its equity market. They really don’t have much choice, as any move in interest rates would have to be slow and marginal.

The weaker yen is expected to continue, since a cheap yen gives the exporters an advantage and the economy just sputtered into a recession. The yen has been the worst performer this year among major currencies against the dollar, falling more than 6%. With a 10 bp increase in rates, the BOJ has shown that it will be sensitive to reversing the highly accommodative course it has taken for almost 17 years. Rates are currently 0 to 10 bps, and free money is the best way to keep the markets happy. A mild or short recession is not a bad thing when economies are trying to fight inflation and are at full employment. Current unemployment is at 2.4%, and the economy needs a resilient and confident consumer. Moreover, the stock market and the underlying companies in Japan have gone through a massive restructuring to build credibility and trend. Today, the Bank of Japan owns over $475 billion worth of stocks through ETFs and is collecting wonderful dividends on these securities. Buying began in 2013 as a measured way to support their equity market and show confidence in their economy. Buying subsided in 2020 and since then the market has naturally drifted higher because of a constructive imbalance between demand and equity supply. According to Bloomberg, on a market-to market basis, the BOJ has about a 50% return on its unrealized gains since it began buying equities.

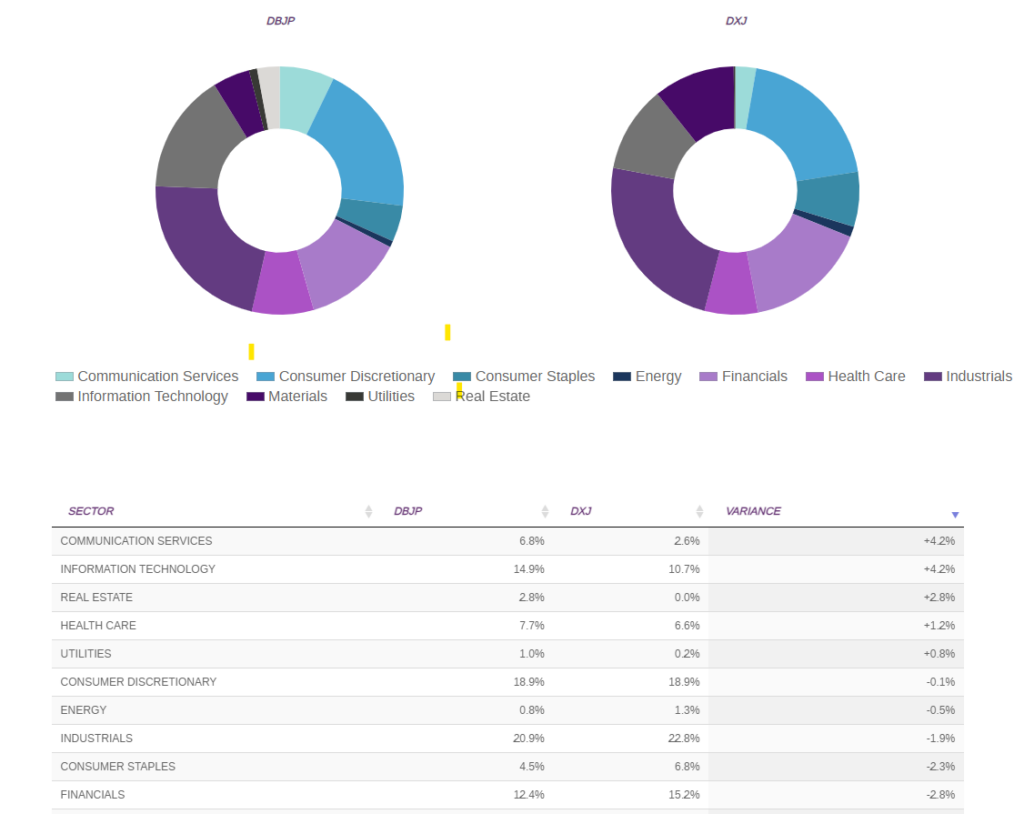

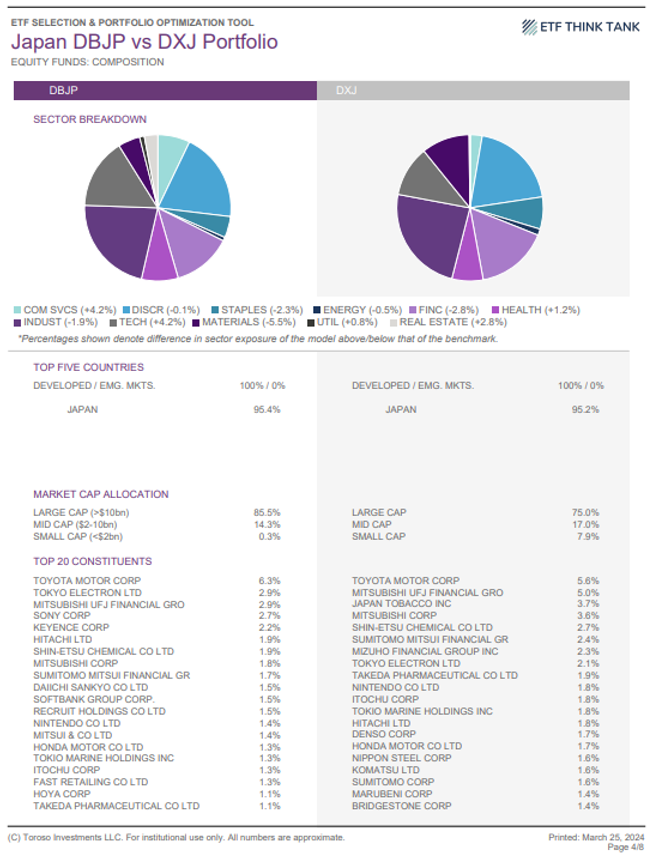

As the Tank software tools highlight, in isolating the yen trade there are only two choices: Wisdomtree’s DXJ, and DWS- X-Tracker DBJP. Fortunately, the overlap between the two is only 56%. While DXJ has outperformed over the past year, the real question is which industries will perform in the next year. From March 25, 2023, to March 22, 2024, the performance of DXJ was up 78.23% vs DBJP up 59.75%. However, when we compare the two ETFs, we see a material difference in their sector weightings with DBJP offering an overweighted position in technology and communications. We also highlight the fact that DBJP is underweight in the materials sector at 4.6%, versus 10.1% for DXJ. We believe that growth is where you want to be overvalued in an economy that is expected to rebound.

Summary

It is possible that the U.S. market, as measured by the S&P 500, will continue to compound at recent high levels. After all, the S&P 500 has survivor bias and thus is somewhat of a momentum index. However, given we as investors remain dependent on the success of global economic outcomes and most investors are underweighted in Japan, we see an opportunity to add both a currency hedge strategy and an investment in the fourth largest economy. Germany is now the third largest economy and will likely be the subject of our next report (EWG). Diversification is an important component in a properly balanced portfolio, but that does not necessarily mean that its allocations must always be broad. Some clients and financial advisors prefer to take a more refined or targeted approach than a broad strategic allocation.

[i] https://awealthofcommonsense.com/2024/01/what-comes-after-a-good-year-in-the-stock-market/

[ii] Visualizing 150 Years of S&P 500 Returns (visualcapitalist.com)

Extra Footnote:

Disclosure

All investments involve risk, including possible loss of principal.

The material provided here is for informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third-party providers is obtained from what are considered reliable sources. However, its accuracy, completeness, or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

The value of investments and the income from them can go down as well as up and investors may not get back the amounts originally invested, and can be affected by changes in interest rates, exchange rates, general market conditions, political, social, and economic developments, and other variable factors. Investment involves risks including but not limited to, possible delays in payments and loss of income or capital. Neither Tidal nor any of its affiliates guarantees any rate of return or the return of capital invested. This commentary material is available for informational purposes only and nothing herein constitutes an offer to sell or a solicitation of an offer to buy any security and nothing herein should be construed as such. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested, and nothing herein should be construed as a guarantee of any specific outcome or profit. While we have gathered the information presented herein from sources that we believe to be reliable, we cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed herein are our opinions and are current only as of the date of distribution, and are subject to change without notice. We disclaim any obligation to provide revised opinions in the event of changed circumstances.

The information in this material is confidential and proprietary and may not be used other than by the intended user. Neither Tidal nor its affiliates or any of their officers or employees of Tidal accepts any liability whatsoever for any loss arising from any use of this material or its contents. This material may not be reproduced, distributed, or published without prior written permission from Tidal. Distribution of this material may be restricted in certain jurisdictions. Any persons coming into possession of this material should seek advice for details of and observe such restrictions (if any).