Structure Matters

I remain grateful to Kathleen Moriarty (aka “spdrwoman”) for sharing her knowledge about the differences between ETFs and ETNs in this 2014 interview. I think it is a MUST read for everyone who owns ETNs.

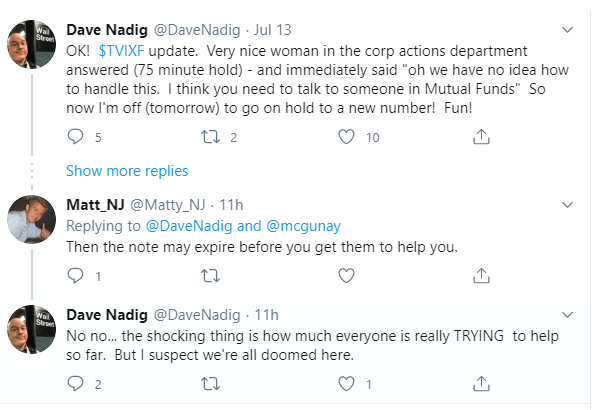

How timely this interview is to read given how so many holders of ETNS have to contend with the Delisting process. When a fund like VelocityShares (TVIX) is delisted it will trade with a wider spread and possibly even a premium to a “stated estimated Net Asset Value (INAV). A key benefit to ETPs is liquidity, but when the symbol of an ETN has an F at the end (TVIXF) it means that it no longer trades on a major market and, therefore; will not offer the same liquidity characteristics expected of most ETPs – especially ETFs . Strange as it sounds – YOU WERE WARNED!

Per Dave Nadig’s mission to figure out what is happening with TVIX I would point out that many banks; including UBS, Credit Suisse and Barclays ETNs seem to be getting out of the ETN business. Bottom line – for ETN buyers/owners – note that these banks have borrowed money from ETN investors in the form of a subordinated debenture in exchange for agreeing to provide a return similar to an index. Read the prospectus! When you loan money to someone shouldn’t you know the terms? Moreover, if the terms are unclear – assume that means that the bank that borrowed your money wrote the document that favors THEIR interest.