Let’s talk about ETF research.

As an advisor, or as an investor have you ever found yourself wondering something like:

We certainly have wondered about it all at the ETF Think Tank.

From where we sit, ETF research never ends in a market where product innovation shows no sign of stopping either, and where the macro backdrop keeps us on our toes. If you are an ETF investor or an advisor, you know this all too well: there’s always something new to learn when it comes to ETFs.

There are many expert voices in ETF research – a lot of excellent material in all sorts of media formats everywhere you look. Information is abundant and, in truth, a lot of it is really, really good. Allow us to take a moment to share how we at the ETF Think Tank go about that effort.

We’ve been tackling ETF research for more than a decade as students of the market, as practitioners in portfolio management, and as ETF Nerds who love the nitty-gritty details of this structure. We believe that ETFs can be an effective investment for many investors, and it all begins with ETF innovation being born of a problem-solving mindset.

Unleashing that potential to transform investing results demands due diligence. There are many ETF choices out there. Where do you begin?

For us, it all begins with robust data.

Good Data Is Key

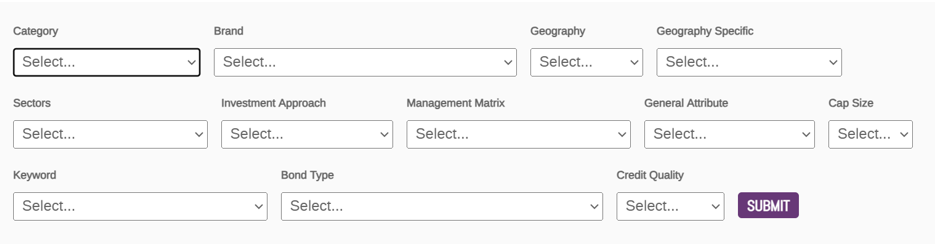

We gather extensive data from various data providers, and we derive our own using a proprietary way of categorizing ETFs that reflect our view of the market. For example, we tackle ETF categorization in terms of attributes, looking under the hood for the true drivers of returns in a given ETF. Is ETF “XYZ” an equity fund or an options fund? We search for the primary drivers before we tag it one thing or the other.

Our asset class categories are reflective of these primary performance drivers – information that requires deep prospectus dives every time a new ETF comes to market. Believe it or not, in the era of amazing AI technology, this is still very much manual labor for the level of detail we want to capture.

All of our other classification criteria benefits from this level of attention to detail as well, such as investment approach – ‘is it really active?’ – and general attribute – ‘is this fund really built in an ESG foundation or just loosely captures ESG as a theme?’

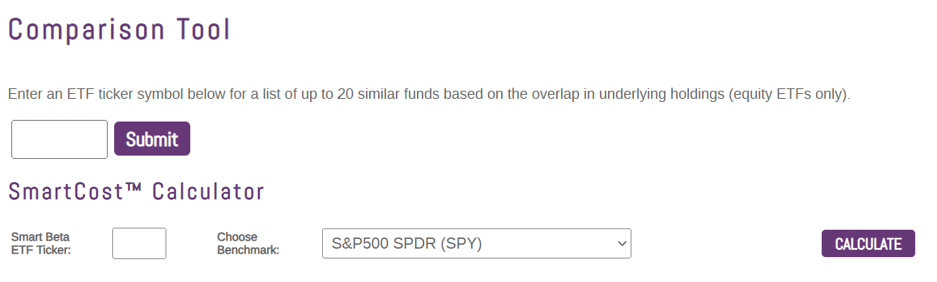

In the end, our data powers up our ETF Finder and a family of simple-to-use analytical tools designed for ETF due diligence. From understanding cost to concentration to fit in a portfolio, our tools provide answers – and you can even play around with model portfolio attribution and ETF portfolio analysis too.

We believe in easy plug-and-play prompts – some examples below:

We Talk A Lot and We Listen Even More

With good data at hand, the job of ETF research also calls for context.

If successful ETFs are born of a problem-solving mindset, understanding what problems investors are trying to solve is imperative for any useful research. We tackle that task in two main ways – one “behind doors”, and one in the public eye.

First, we are engaging with advisors one-on-one on a regular basis. We are talking about good old-fashioned phone call conversations between our portfolio managers and advisors out there. The conversations center on challenges advisors are facing, problem-solving, and how ETFs may (or may not) be able to help. This one-on-one type of due diligence approach was how the ETF Think Tank was originally born – as a custom research solution to custom client problems.

We expanded that original level of individual commitment to a broader audience, engaging much more openly in conversations, interviews, dialog with folks from various industries who think like we do and who disagree with us completely. We explore everything from macro views to structural innovation to behavioral insights – all in an effort to expand our understanding of the world.

We share all that learning and expertise through written content – weekly research and weekly industry KPIs – as well as through our social media and Youtube shows. This constantly growing library of knowledge is accessible – freely – to everyone at www.etfthinktank.com:

You can also find our research in its various forms, such as full and short video shows, a weekly happy hour, and much more here:

- X: https://www.x.com/etfthinktank

- Linkedin: https://www.linkedin.com/the-etf-industry-think-tank-innovation-lab

- YouTube: https://www.youtube.com/@etfthinktank

Watch: What is the ETF Think Tank

Industry Nod We are Excited to Share

We’ve long been committed to ETF research, and there’s a reason we are known on the street as ETF Nerds. We love this space.

This year, the ETF Think Tank earned a special distinction – we found ourselves among the nominees for “Best ETF Educators of the Year” in the ETF.com Awards, which take place in NYC on April 17.

We landed in a category packed with expert heavyweights: Vanguard, Fidelity, NYSE-affiliated ETF Institute and E-Toro. Stiff competition, to say the least.

What’s exciting beyond the recognition is the acknowledgment that ETF research – education – is critical to good investing because the best investment decisions are the well-informed ones. It’s worthy of an Award category.

We are thrilled to share this achievement with you – our advisor friends and partners as well as investors who’ve entrusted us with your challenging ETF questions. We are learning from you as much as we are teaching you what we know. And if you don’t know us, we invite you to get to know the ETF Think Tank. We work hard to be your best source of ETF ideas.

We can’t wait to see what April 17 brings. If you are so inclined, we’d love some extra fingers crossed for the ETF Nerds. Either way, ETF research is already a winner, so a toast to that.

Disclosure

All investments involve risk, including possible loss of principal.

The material provided here is for informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision.

All expressions of opinion are subject to change without notice in reaction to shifting market conditions. Data contained herein from third-party providers is obtained from what are considered reliable sources. However, its accuracy, completeness, or reliability cannot be guaranteed.

Examples provided are for illustrative purposes only and not intended to be reflective of results you can expect to achieve.

The value of investments and the income from them can go down as well as up and investors may not get back the amounts originally invested, and can be affected by changes in interest rates, exchange rates, general market conditions, political, social, and economic developments, and other variable factors. Investment involves risks including but not limited to, possible delays in payments and loss of income or capital. Neither Tidal nor any of its affiliates guarantees any rate of return or the return of capital invested. This commentary material is available for informational purposes only and nothing herein constitutes an offer to sell or a solicitation of an offer to buy any security and nothing herein should be construed as such. All investment strategies and investments involve risk of loss, including the possible loss of all amounts invested, and nothing herein should be construed as a guarantee of any specific outcome or profit. While we have gathered the information presented herein from sources that we believe to be reliable, we cannot guarantee the accuracy or completeness of the information presented and the information presented should not be relied upon as such. Any opinions expressed herein are our opinions and are current only as of the date of distribution, and are subject to change without notice. We disclaim any obligation to provide revised opinions in the event of changed circumstances.

The information in this material is confidential and proprietary and may not be used other than by the intended user. Neither Tidal nor its affiliates or any of their officers or employees of Tidal accepts any liability whatsoever for any loss arising from any use of this material or its contents. This material may not be reproduced, distributed, or published without prior written permission from Tidal. Distribution of this material may be restricted in certain jurisdictions. Any persons coming into possession of this material should seek advice for details of and observe such restrictions (if any).